FinVolution Group (FINV) - A Quiet Giant on the Edge of Breakout

⚡ FinVolution Group (FINV) — A Quiet Giant on the Edge of Breakout

While everyone is chasing the inflated Big Tech bubble, a much quieter — and potentially far more explosive — opportunity is forming right now in the fintech and online lending space.

That opportunity is FinVolution Group (FINV) — a Chinese and Southeast Asian fintech player that looks ready to break through its 2021 highs. Once that breakout happens, the move could be massive.

🔸 Fundamentals

FinVolution has quietly turned a corner.

Recent quarters have been consistently profitable — both revenue and EPS are growing.

The most striking part?

The forward P/E ratio is just 0.7 — yes, less than one.

That’s an extraordinary valuation for a profitable fintech with expanding operations across multiple Asian markets.

It’s a risky play, no doubt, but these are exactly the kind of setups that tend to drive portfolio growth over time: low valuation, improving financials, and clear technical breakout potential.

🔸 Technical Picture

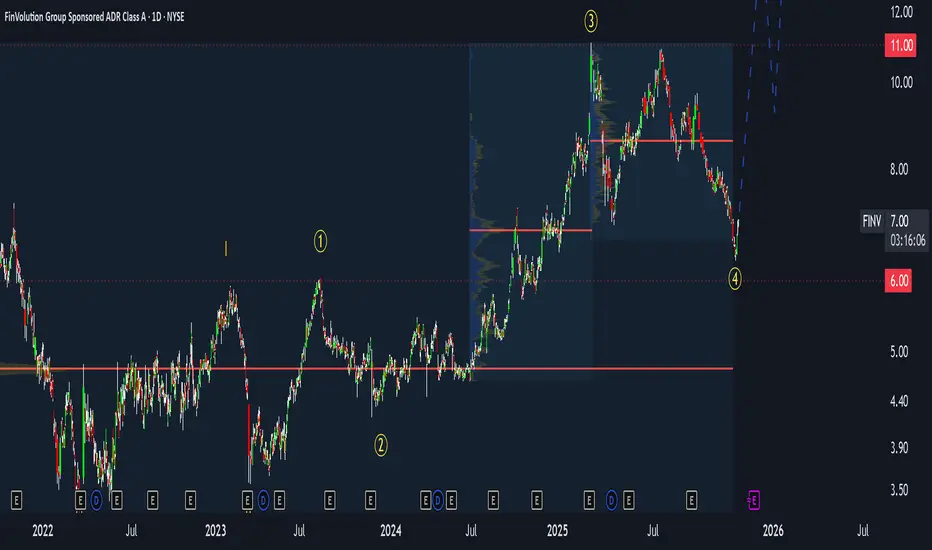

From a technical perspective, FINV is at the start of what looks like the third major wave of its long-term structure.

Since 2021, the price has been consolidating sideways — but that phase seems to be ending now.

If the price breaks below $6, the bullish scenario pauses — it doesn’t collapse, but likely extends the sideways phase.

That sets up a risk of roughly 10–15%, while the potential upside remains multiple times higher.

The risk/reward profile here is exceptionally strong.

🔸 My Strategy

I’m already positioned - entered near $7, with a stop-loss around $6.

Once we approach $11, I plan to take partial profits and watch for a breakout confirmation.

If we get a strong breakout above $11 with solid volume, that’s my next entry trigger.

Then I’ll look to add on pullbacks, applying my call stacking strategy - building exposure gradually as the trend confirms and accelerates.

🚀 Summary

FinVolution (FINV) shows a rare combination:

✅ Profitable growth

✅ Deep undervaluation

✅ Strong breakout setup

It’s one of those asymmetric opportunities — where the downside is limited, but the upside could multiply several times over.

If the $11 breakout confirms, this could easily become one of the most powerful fintech moves of the next few quarters.

⚡ Call to Action

If you like this type of setup - low-risk, high-upside plays - tap 🚀 to support the idea,

and drop a comment with tickers you’d like me to review next.

(Full technical breakdown and strategy details are discussed in my latest videos — available via my profile.)

While everyone is chasing the inflated Big Tech bubble, a much quieter — and potentially far more explosive — opportunity is forming right now in the fintech and online lending space.

That opportunity is FinVolution Group (FINV) — a Chinese and Southeast Asian fintech player that looks ready to break through its 2021 highs. Once that breakout happens, the move could be massive.

🔸 Fundamentals

FinVolution has quietly turned a corner.

Recent quarters have been consistently profitable — both revenue and EPS are growing.

The most striking part?

The forward P/E ratio is just 0.7 — yes, less than one.

That’s an extraordinary valuation for a profitable fintech with expanding operations across multiple Asian markets.

It’s a risky play, no doubt, but these are exactly the kind of setups that tend to drive portfolio growth over time: low valuation, improving financials, and clear technical breakout potential.

🔸 Technical Picture

From a technical perspective, FINV is at the start of what looks like the third major wave of its long-term structure.

Since 2021, the price has been consolidating sideways — but that phase seems to be ending now.

- Key resistance: $11

- Current price: around $7

- Breakout level: above $11 (with volume confirmation)

- First targets: $20 → $30 → $40

If the price breaks below $6, the bullish scenario pauses — it doesn’t collapse, but likely extends the sideways phase.

That sets up a risk of roughly 10–15%, while the potential upside remains multiple times higher.

The risk/reward profile here is exceptionally strong.

🔸 My Strategy

I’m already positioned - entered near $7, with a stop-loss around $6.

Once we approach $11, I plan to take partial profits and watch for a breakout confirmation.

If we get a strong breakout above $11 with solid volume, that’s my next entry trigger.

Then I’ll look to add on pullbacks, applying my call stacking strategy - building exposure gradually as the trend confirms and accelerates.

🚀 Summary

FinVolution (FINV) shows a rare combination:

✅ Profitable growth

✅ Deep undervaluation

✅ Strong breakout setup

It’s one of those asymmetric opportunities — where the downside is limited, but the upside could multiply several times over.

If the $11 breakout confirms, this could easily become one of the most powerful fintech moves of the next few quarters.

⚡ Call to Action

If you like this type of setup - low-risk, high-upside plays - tap 🚀 to support the idea,

and drop a comment with tickers you’d like me to review next.

(Full technical breakdown and strategy details are discussed in my latest videos — available via my profile.)

Giao dịch đang hoạt động

Right now, based on my wave count, I think we might be near the end of the decline — the selling climax — but I’m not entering yet.

I’m waiting for a proper bounce first, and then a test from top to bottom of the key level before I take a new position.

For now, I got stopped out and I’m completely out of the market.

The short-term target remains $11, and if we break that level, it would activate a cup-with-handle pattern, which points to a longer-term target around $50.

FREE Trading Hub

👉 sdk-trading.com/discord

Real-time entries, exits and Q&A. Clean mid–term & long–term analysis. Free to join.

More analysis / forecasts:

sdk-trading.com

👉 sdk-trading.com/discord

Real-time entries, exits and Q&A. Clean mid–term & long–term analysis. Free to join.

More analysis / forecasts:

sdk-trading.com

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

FREE Trading Hub

👉 sdk-trading.com/discord

Real-time entries, exits and Q&A. Clean mid–term & long–term analysis. Free to join.

More analysis / forecasts:

sdk-trading.com

👉 sdk-trading.com/discord

Real-time entries, exits and Q&A. Clean mid–term & long–term analysis. Free to join.

More analysis / forecasts:

sdk-trading.com

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.