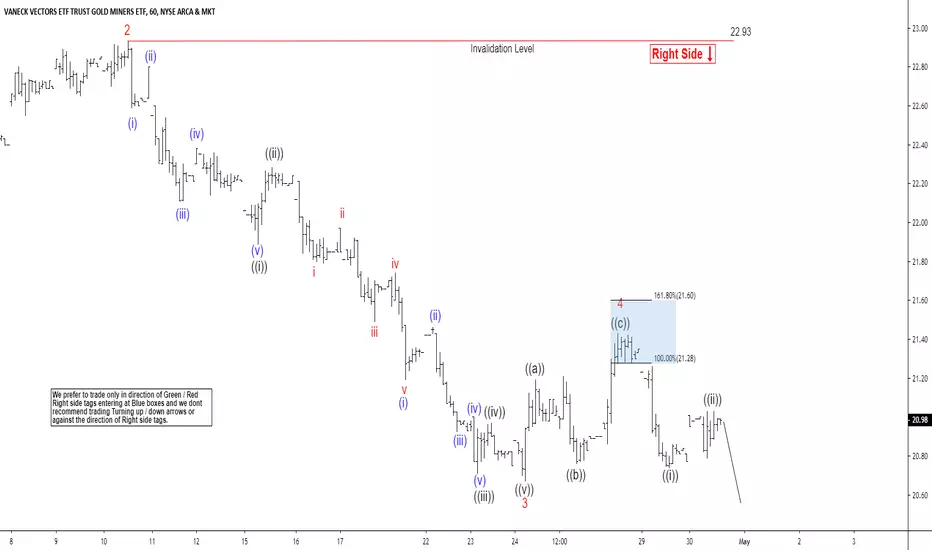

Elliott Wave view calls the decline in Gold Miners ETF (GDX) from March 27, 2019 high ($23.40) as an impulse structure. In the chart below, wave 2 of that impulse ended at $22.93. Down from there, wave 3 ended at $20.67 and wave 4 ended at $21.43. The miners still need to break below wave 3 at $20.67 to validate the view and avoid a double correction. The internal of wave 3 subdivides as an impulse Elliott Wave structure of lesser degree. Wave ((i)) of 3 ended at $21.89 and wave ((ii)) of 3 ended at $22.29. Down from there, wave ((iii)) of 3 ended at $20.71, wave ((iv)) of 3 ended at $20.97, and wave ((v)) of 3 ended at $20.67.

Wave 4 bounce unfolded as a zigzag Elliott Wave structure. Wave ((a)) ended at $21.19, wave ((b)) ended at $20.76, and wave ((c)) of 4 ended at $21.43. Near term, while bounce stays below $21.43, and more importantly below $22.93, expect the miners to extend lower. Potential target to the downside for wave 5 is $19.6 – $20, which is where wave 1 = wave 5.

Wave 4 bounce unfolded as a zigzag Elliott Wave structure. Wave ((a)) ended at $21.19, wave ((b)) ended at $20.76, and wave ((c)) of 4 ended at $21.43. Near term, while bounce stays below $21.43, and more importantly below $22.93, expect the miners to extend lower. Potential target to the downside for wave 5 is $19.6 – $20, which is where wave 1 = wave 5.

14 days trial --> elliottwave-forecast.com/plan-trial/ and get Accurate & timely Elliott Wave Forecasts of 78 instruments. Webinars, Chat Room, Stocks/Forex/Indices Signals & more.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

14 days trial --> elliottwave-forecast.com/plan-trial/ and get Accurate & timely Elliott Wave Forecasts of 78 instruments. Webinars, Chat Room, Stocks/Forex/Indices Signals & more.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.