Cano Health to Become Publicly Traded via Merger with JWS

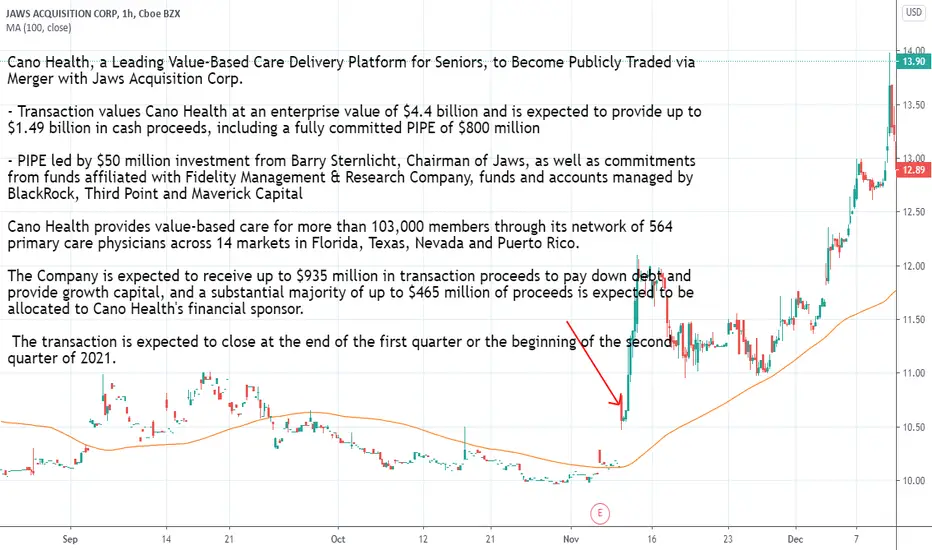

Cano Health, a Leading Value-Based Care Delivery Platform for Seniors, to Become Publicly Traded via Merger with Jaws Acquisition Corp.

- Transaction values Cano Health at an enterprise value of $4.4 billion and is expected to provide up to $1.49 billion in cash proceeds, including a fully committed PIPE of $800 million

- PIPE led by $50 million investment from Barry Sternlicht, Chairman of Jaws, as well as commitments from funds affiliated with Fidelity Management & Research Company, funds and accounts managed by BlackRock, Third Point and Maverick Capital

Cano Health provides value-based care for more than 103,000 members through its network of 564 primary care physicians across 14 markets in Florida, Texas, Nevada and Puerto Rico.

The Company is expected to receive up to $935 million in transaction proceeds to pay down debt and provide growth capital, and a substantial majority of up to $465 million of proceeds is expected to be allocated to Cano Health's financial sponsor.

The transaction is expected to close at the end of the first quarter or the beginning of the second quarter of 2021.

finance.yahoo.com/news/cano-health-leading-value-based-110000860.html

- Transaction values Cano Health at an enterprise value of $4.4 billion and is expected to provide up to $1.49 billion in cash proceeds, including a fully committed PIPE of $800 million

- PIPE led by $50 million investment from Barry Sternlicht, Chairman of Jaws, as well as commitments from funds affiliated with Fidelity Management & Research Company, funds and accounts managed by BlackRock, Third Point and Maverick Capital

Cano Health provides value-based care for more than 103,000 members through its network of 564 primary care physicians across 14 markets in Florida, Texas, Nevada and Puerto Rico.

The Company is expected to receive up to $935 million in transaction proceeds to pay down debt and provide growth capital, and a substantial majority of up to $465 million of proceeds is expected to be allocated to Cano Health's financial sponsor.

The transaction is expected to close at the end of the first quarter or the beginning of the second quarter of 2021.

finance.yahoo.com/news/cano-health-leading-value-based-110000860.html

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.