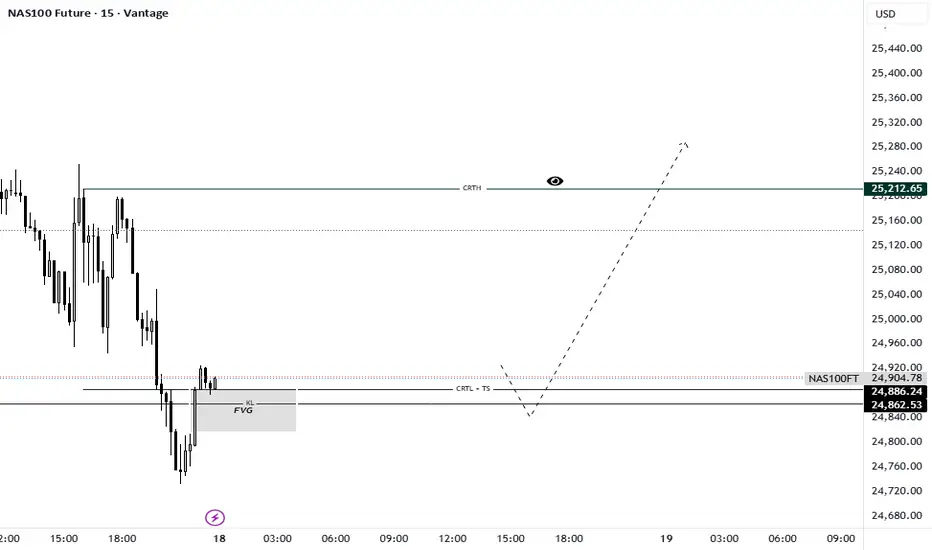

Timeframe: 15M | Model: CRT Model #1 / Turtle Soup Reversal

The Nasdaq Index is presenting a high-probability Candle Range Theory (CRT) setup after an aggressive drop. The price action perfectly encapsulates the Manipulation (Candle 2) phase and is setting up for the explosive Distribution (Candle 3) move.

The market has completed a textbook Turtle Soup (TS), aggressively pushing below the structural support to liquidate short-term positions. This hunt was contained by the confluence of the CRTL (Candle Range Theory Low) and a strong underlying Fair Value Gap (FVG).

Here’s the step-by-step breakdown (The CRT Checklist):

Liquidity Sweep: The deep wick confirms the Turtle Soup, clearing the stops below the previous support area around 24,862.53.

Confluence: The reversal attempt is happening right off the FVG area, giving high confidence to the long thesis, as outlined in the CRT Secrets Series (Episode 5: Key Levels).

The Trigger: We are now waiting for the final confirmation—the bullish Model #1 candle close. This candle must reverse the market structure and close decisively above the manipulation low (back into the range).

Targets:

Primary Objective (CRTH): The target is the CRTH (Candle Range Theory High) at 25,217.65, aiming to fill the liquidity above the initial range high.

Mindset: As the chart suggests, this reversal setup has the potential for a swift expansion move, seeking higher liquidity pools.

Discipline: Avoid the temptation to enter early. We must wait for the Model #1 candle to close and confirm the shift in control from sellers back to buyers. Trade what you see, not what you think!

Trade Smart. Trust the Candle Close.

Greetings,

MrYounity

The Nasdaq Index is presenting a high-probability Candle Range Theory (CRT) setup after an aggressive drop. The price action perfectly encapsulates the Manipulation (Candle 2) phase and is setting up for the explosive Distribution (Candle 3) move.

The market has completed a textbook Turtle Soup (TS), aggressively pushing below the structural support to liquidate short-term positions. This hunt was contained by the confluence of the CRTL (Candle Range Theory Low) and a strong underlying Fair Value Gap (FVG).

Here’s the step-by-step breakdown (The CRT Checklist):

Liquidity Sweep: The deep wick confirms the Turtle Soup, clearing the stops below the previous support area around 24,862.53.

Confluence: The reversal attempt is happening right off the FVG area, giving high confidence to the long thesis, as outlined in the CRT Secrets Series (Episode 5: Key Levels).

The Trigger: We are now waiting for the final confirmation—the bullish Model #1 candle close. This candle must reverse the market structure and close decisively above the manipulation low (back into the range).

Targets:

Primary Objective (CRTH): The target is the CRTH (Candle Range Theory High) at 25,217.65, aiming to fill the liquidity above the initial range high.

Mindset: As the chart suggests, this reversal setup has the potential for a swift expansion move, seeking higher liquidity pools.

Discipline: Avoid the temptation to enter early. We must wait for the Model #1 candle to close and confirm the shift in control from sellers back to buyers. Trade what you see, not what you think!

Trade Smart. Trust the Candle Close.

Greetings,

MrYounity

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.