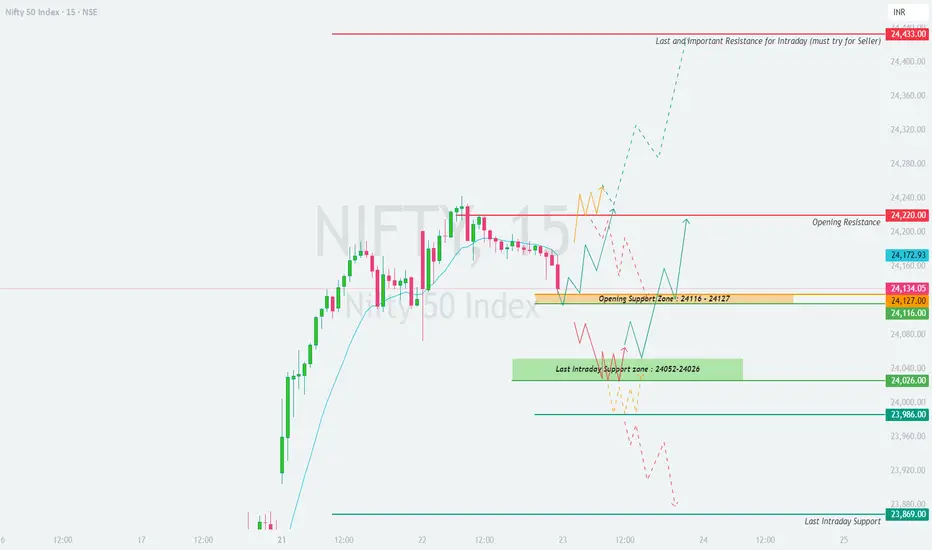

📊 NIFTY Intraday Trading Plan – 23-Apr-2025

Timeframe: 15-minute

Previous Close: 24,134.05

📌 Key Zones Marked on the Chart:

🟥 Opening Resistance: 24,220

🔴 Major Resistance Zone (Short opportunity): 24,433

🟧 Opening Support Zone: 24,116 – 24,127

🟩 Last Intraday Support Zone: 24,052 – 24,026

🔵 Final Intraday Support: 23,869

🟥 Scenario 1: Gap-Up Opening (Above 24,234 – i.e. +100 points)

If Nifty opens above 24,234, it will be above the immediate resistance zone of 24,220. This brings it closer to the 24,433 level — a last-resort intraday resistance that’s a key zone for aggressive short sellers.

💡 Educational Note: Strong opening gaps tend to invite profit booking near supply zones. Always wait for price confirmation before entering.

🟨 Scenario 2: Flat Opening (Between 24,127 – 24,220)

This scenario keeps Nifty in a neutral yet sensitive range between the support and resistance levels. Traders should be patient and wait for breakout or breakdown confirmation.

💡 Educational Note: In flat openings, the first 3 candles of the day often decide direction. Focus on volume and price range contraction or expansion for clues.

🟩 Scenario 3: Gap-Down Opening (Below 24,034 – i.e. -100 points)

A gap-down below 24,034 will place Nifty directly into the Last Intraday Support Zone: 24,052 – 24,026. This is a critical area for reversal setups or further breakdown.

💡 Educational Note: A gap-down into a known support zone creates high emotion. Don’t be tempted to buy blindly – always wait for support-holding confirmation.

🛡️ Options Trading Risk Management Tips

📘 Summary & Conclusion

📍 Important Levels:

🔺 Resistance: 24,220 | 24,433

⚠️ Opening Support: 24,116 – 24,127

🔻 Lower Supports: 24,052 | 24,026 | 23,986 | 23,869

🎯 On 23-Apr-2025, observe the first 15-minute candle carefully for structure. Trade only on confirmed breakout/breakdown from defined zones.

Use well-hedged strategies when near volatile support/resistance levels. Keep emotions in check and stay adaptive.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is shared purely for educational purposes. Please consult your financial advisor before making any trading decisions.

Timeframe: 15-minute

Previous Close: 24,134.05

📌 Key Zones Marked on the Chart:

🟥 Opening Resistance: 24,220

🔴 Major Resistance Zone (Short opportunity): 24,433

🟧 Opening Support Zone: 24,116 – 24,127

🟩 Last Intraday Support Zone: 24,052 – 24,026

🔵 Final Intraday Support: 23,869

🟥 Scenario 1: Gap-Up Opening (Above 24,234 – i.e. +100 points)

If Nifty opens above 24,234, it will be above the immediate resistance zone of 24,220. This brings it closer to the 24,433 level — a last-resort intraday resistance that’s a key zone for aggressive short sellers.

- []Watch for price behavior near 24,433. If Nifty gives wick rejections or bearish engulfing candles, this is a low-risk shorting opportunity.

[]Targets on downside would be 24,220 and 24,127, with a stop loss above 24,470. - If price consolidates above 24,433 for more than 30 minutes, expect a breakout toward 24,500+. Use a bull call spread instead of naked options to control risk.

💡 Educational Note: Strong opening gaps tend to invite profit booking near supply zones. Always wait for price confirmation before entering.

🟨 Scenario 2: Flat Opening (Between 24,127 – 24,220)

This scenario keeps Nifty in a neutral yet sensitive range between the support and resistance levels. Traders should be patient and wait for breakout or breakdown confirmation.

- []If Nifty breaks above 24,220 with volume, it may attempt 24,300–24,433. Buy with a tight SL of 24,170.

[]If Nifty sustains below 24,116, price may drift towards 24,052 – 24,026. Consider puts or bear spreads below 24,116. - Avoid initiating trades in the first 15 minutes. Let the market structure itself after opening volatility.

💡 Educational Note: In flat openings, the first 3 candles of the day often decide direction. Focus on volume and price range contraction or expansion for clues.

🟩 Scenario 3: Gap-Down Opening (Below 24,034 – i.e. -100 points)

A gap-down below 24,034 will place Nifty directly into the Last Intraday Support Zone: 24,052 – 24,026. This is a critical area for reversal setups or further breakdown.

- []If this zone holds and we see a bullish hammer or strong green engulfing candle, a counter-trend bounce toward 24,116 is possible.

[]If Nifty breaks below 24,026 and sustains, watch for a fall to 23,986 or even 23,869. This is a bearish momentum zone. - Avoid long trades until the price forms a base above 24,026 again.

💡 Educational Note: A gap-down into a known support zone creates high emotion. Don’t be tempted to buy blindly – always wait for support-holding confirmation.

🛡️ Options Trading Risk Management Tips

- []Always use defined SL (stop loss) while trading directional options.

[]Avoid trading OTM options alone on Wednesdays and Thursdays due to higher theta decay.

[]Use spreads like Bull Call / Bear Put to reduce cost and hedge risk.

[]Do not take trades based on bias. Let price structure guide your decision. - Never risk more than 2–3% of your capital per trade, especially in volatile conditions.

📘 Summary & Conclusion

📍 Important Levels:

🔺 Resistance: 24,220 | 24,433

⚠️ Opening Support: 24,116 – 24,127

🔻 Lower Supports: 24,052 | 24,026 | 23,986 | 23,869

🎯 On 23-Apr-2025, observe the first 15-minute candle carefully for structure. Trade only on confirmed breakout/breakdown from defined zones.

Use well-hedged strategies when near volatile support/resistance levels. Keep emotions in check and stay adaptive.

⚠️ Disclaimer: I am not a SEBI-registered analyst. This trading plan is shared purely for educational purposes. Please consult your financial advisor before making any trading decisions.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.