**Heading:** Strategic Analysis and Trading Recommendations for NIFTY

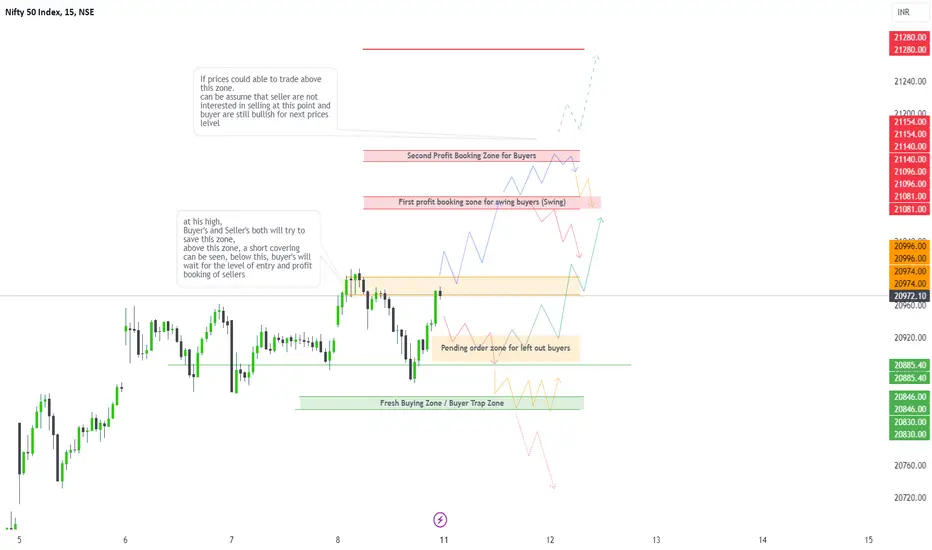

The recent performance of NIFTY indicates a potential bullish trend, with the index closing near an all-time high. However, a closer examination of the short-term timeframe reveals a consolidation phase around this peak. In preparation for Monday's market activity, it is crucial to monitor the price levels closely.

**Key Analysis:**

- *Bullish Scenario:* If prices manage to sustain and trade within the range of 21,000-20,996, an uptick move towards 21,081-21,150 is anticipated, followed by a consolidation phase in the vicinity of 21,150-21,100.

- *Flat to Negative Opening:* In the event of a flat to negative opening, prices may find support in the range of 20,920-20,885. This level could prompt a rebound, presenting an opportunity for initiating buying trades. The recommended stop loss is set at 25-30 points, targeting an upside range of 21,000-21,100.

**Trading Strategies:**

- *Short Positions:* Consider short-side trades only if prices sustain below 20,830. Otherwise, the recommended strategy is to focus on buying on dips at specified levels.

**Recommended Buying Levels:**

1. Sustaining Above: 20,996

2. Retracement Level: 20,920-20,900

3. Buyers Zone Level: 20,846-20,830

**Stop Loss:** Set a maximum of 25-30 points for risk management.

This analysis provides a comprehensive overview of potential market movements, offering strategic insights for traders to navigate the NIFTY index effectively.

The recent performance of NIFTY indicates a potential bullish trend, with the index closing near an all-time high. However, a closer examination of the short-term timeframe reveals a consolidation phase around this peak. In preparation for Monday's market activity, it is crucial to monitor the price levels closely.

**Key Analysis:**

- *Bullish Scenario:* If prices manage to sustain and trade within the range of 21,000-20,996, an uptick move towards 21,081-21,150 is anticipated, followed by a consolidation phase in the vicinity of 21,150-21,100.

- *Flat to Negative Opening:* In the event of a flat to negative opening, prices may find support in the range of 20,920-20,885. This level could prompt a rebound, presenting an opportunity for initiating buying trades. The recommended stop loss is set at 25-30 points, targeting an upside range of 21,000-21,100.

**Trading Strategies:**

- *Short Positions:* Consider short-side trades only if prices sustain below 20,830. Otherwise, the recommended strategy is to focus on buying on dips at specified levels.

**Recommended Buying Levels:**

1. Sustaining Above: 20,996

2. Retracement Level: 20,920-20,900

3. Buyers Zone Level: 20,846-20,830

**Stop Loss:** Set a maximum of 25-30 points for risk management.

This analysis provides a comprehensive overview of potential market movements, offering strategic insights for traders to navigate the NIFTY index effectively.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.