\📈 NIFTY TRADING PLAN – 26-Jun-2025\

📍 \Previous Close:\ 25,238

📏 \Gap Opening Consideration:\ ±100 points

🕒 \Chart Timeframe:\ 15-Minutes

🧩 \Strategy Focus:\ Zone-based reaction + Breakout/Breakdown with confirmation

---

\

📍 \Previous Close:\ 25,238

📏 \Gap Opening Consideration:\ ±100 points

🕒 \Chart Timeframe:\ 15-Minutes

🧩 \Strategy Focus:\ Zone-based reaction + Breakout/Breakdown with confirmation

---

\

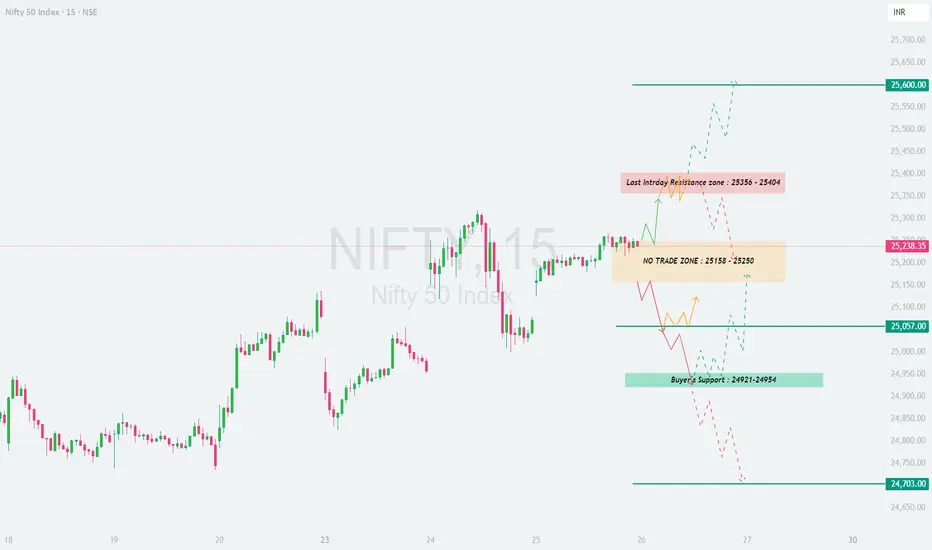

\[\*]\🚀 GAP-UP OPENING (Above 25,356):\

If Nifty opens 100+ points above and trades above \25,356\, it will directly enter the \Last Intraday Resistance Zone (25,356 – 25,404)\. Sustained strength above this zone could trigger a move toward the upper resistance at \25,600\.

✅ \Plan of Action:\

• Observe price reaction near 25,404 — look for rejection or breakout

• If breakout sustains with volume, trend continuation possible

• A rejection here might signal intraday reversal or consolidation

🎯 \Trade Setup:\

– Long above 25,404 with confirmation

– Target: 25,600

– SL: Below 25,356

– Short only if clear rejection occurs below 25,356 with volume

📘 \Pro Tip:\ Don’t jump into trades immediately post open — let the first 15-minute candle confirm the bias.

\[\*]\⚖️ FLAT OPENING (Between 25,158 – 25,250):\

This region is marked as \NO TRADE ZONE\, where indecision and false moves are more likely. Trapped buyers/sellers from previous sessions often create sideways or volatile price action here.

✅ \Plan of Action:\

• Avoid trading within this zone

• Wait for a breakout above 25,250 or a breakdown below 25,158

• Entry only after 15–30 minutes of trend confirmation

🎯 \Trade Setup:\

– Long above 25,250 → Target: 25,356

– Short below 25,158 → Target: 25,057

– SL: Outside of range boundary

📘 \Pro Tip:\ Protect your capital — “no trade” is also a strategy. Trade only when structure forms outside the zone.

\[\*]\📉 GAP-DOWN OPENING (Below 25,057):\

Opening below the \Opening Support (25,057)\ brings the \Buyer’s Support Zone (24,921 – 24,954)\ into focus. A reversal bounce or further breakdown will depend on early price action around this zone.

✅ \Plan of Action:\

• Look for bullish candles or wicks from 24,921 zone for potential intraday reversal

• If breakdown below 24,921 occurs, expect move toward \24,703\

• Be cautious during volatile flushes in first 5–10 mins

🎯 \Trade Setup:\

– Long only on strong reversal at 24,921–24,954

– Short below 24,921 with momentum

– Target: 24,703

– SL: Tight SL below support for longs or above resistance for shorts

📘 \Pro Tip:\ Lower supports attract buying interest — ideal for low-risk reversals, but only with confirmation.

---

\📊 KEY LEVELS TO WATCH:\

🟧 \NO TRADE ZONE:\ 25,158 – 25,250

🟥 \Resistance Zone:\ 25,356 – 25,404

🟢 \Opening Support:\ 25,057

🟦 \Buyer’s Support Zone:\ 24,921 – 24,954

🔻 \Breakdown Support:\ 24,703

---

\🛡️ OPTIONS TRADING & RISK MANAGEMENT TIPS:\

✅ Use \Bull Call Spreads\ above resistance to reduce premium decay risk

✅ In sideways zones, prefer \Iron Condors or Short Straddles\ (only if IV is high)

✅ Avoid naked OTM options inside no trade zone – theta kills premium

✅ Never chase after missed trades – wait for next setup

✅ SL should always be based on \15-min closing candles\

✅ Maintain risk per trade ≤ \2% of capital\

---

\📌 SUMMARY:\

• 🔼 \Bullish Above:\ 25,404 → Next stop: 25,600

• ⛔ \Avoid trading inside:\ 25,158 – 25,250

• 🔽 \Bearish Below:\ 25,057 → Watch 24,921

• 🧲 \Reversal or flush below:\ 24,921 → Can test 24,703

---

\⚠️ DISCLAIMER:\

I am not a SEBI-registered advisor. All trade setups shared are for educational purposes only. Always perform your own analysis or consult a financial expert before entering any trades. Use strict stop-loss and adhere to risk management at all times.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.