🔹 Intro / Overview

Managing a position after entry is just as important as identifying the entry itself.

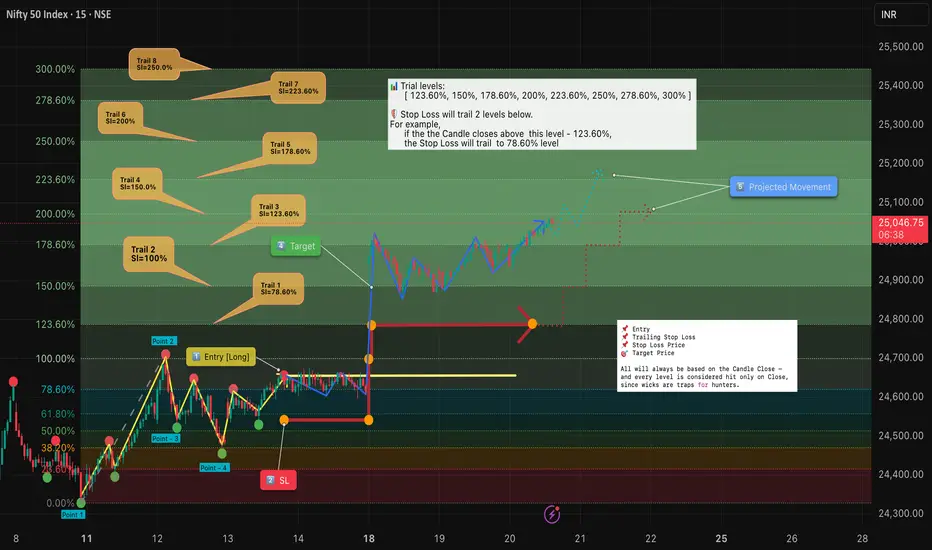

Here, we are specifically discussing trailing stops using Fibonacci retracements.

A well-structured trailing stop helps traders:

✅ Lock in profits

🛡️ Reduce risk

📊 Stay objective in the face of market noise

This idea shows how trailing stops can be applied in a structured way to complement Fibonacci retracements and trend management.

📖 Concept

📍 A trailing stop is a dynamic stop-loss that adjusts as price moves in your favor.

🔄 Instead of staying fixed, it “trails” price at a chosen distance — capturing more upside while capping downside.

🧩 Traders often trail stops using swing lows/highs, moving averages, or volatility measures like ATR.

📊 Chart Explanation (Step-by-Step)

1️⃣ Entry Criteria

✅ Successive closes above 78.6% confirm the long entry.

2️⃣ Stop Loss (SL)

📉 Placed at the previous swing low for structure-based protection.

⏩ SL adjustments move forward only with trailing rules — never backward.

3️⃣ Trailing Levels

👉 SL always trails two levels below the current trail level if the candle closes above it.

📈 Trail 1: 123.60% → SL moves to 78.60%

📈 Trail 2: 150.00% → SL moves to 100.00%

📈 Trail 3: 178.60% → SL moves to 123.60%

📈 Trail 4: 200.00% → SL moves to 150.00%

📈 Trail 5: 223.60% → SL moves to 178.60%

📈 Trail 6: 250.00% → SL moves to 200.00%

📈 Trail 7: 278.60% → SL moves to 223.60%

📈 Trail 8: 300.00% → SL moves to 250.00%

4️⃣ Target Points

🎯 At Target 1, book one lot to secure profits.

📊 Remaining positions can be trailed further with the next levels.

5️⃣ Projected Path

🔍 Dotted blue/red projections illustrate potential movement under this trailing system.

🔍 Observations

📌 Objective Entry: Requires successive closes above 78.6%, reducing false signals.

🎯 Partial Profit Booking: Taking one lot off at Target 1 ensures realized gains.

🔄 Two-Level Trailing: Locks in profits while leaving room for trend continuation.

📊 Rule-Based Framework: Clear Fibonacci-based progression keeps decisions mechanical and consistent.

✨ Why It Matters

✔ Prevents turning winning trades into losers.

✔ Builds confidence by removing emotions from exit decisions.

✔ Lets profits run while maintaining protection.

✅ Conclusion

Trailing stops are not about perfection — they’re about discipline.

By systematically adjusting stops as the market moves, traders:

🛡️ Protect capital

🚀 Let profits run

🤝 Remove emotions from decision-making

When combined with Fibonacci retracements, trailing stops provide a structured framework to manage trades effectively after entry.

⚠️ Disclaimer: For educational purposes only · Not SEBI registered · Not a buy/sell recommendation · No investment advice — purely a learning resource

Managing a position after entry is just as important as identifying the entry itself.

Here, we are specifically discussing trailing stops using Fibonacci retracements.

A well-structured trailing stop helps traders:

✅ Lock in profits

🛡️ Reduce risk

📊 Stay objective in the face of market noise

This idea shows how trailing stops can be applied in a structured way to complement Fibonacci retracements and trend management.

📖 Concept

📍 A trailing stop is a dynamic stop-loss that adjusts as price moves in your favor.

🔄 Instead of staying fixed, it “trails” price at a chosen distance — capturing more upside while capping downside.

🧩 Traders often trail stops using swing lows/highs, moving averages, or volatility measures like ATR.

📊 Chart Explanation (Step-by-Step)

1️⃣ Entry Criteria

✅ Successive closes above 78.6% confirm the long entry.

2️⃣ Stop Loss (SL)

📉 Placed at the previous swing low for structure-based protection.

⏩ SL adjustments move forward only with trailing rules — never backward.

3️⃣ Trailing Levels

👉 SL always trails two levels below the current trail level if the candle closes above it.

📈 Trail 1: 123.60% → SL moves to 78.60%

📈 Trail 2: 150.00% → SL moves to 100.00%

📈 Trail 3: 178.60% → SL moves to 123.60%

📈 Trail 4: 200.00% → SL moves to 150.00%

📈 Trail 5: 223.60% → SL moves to 178.60%

📈 Trail 6: 250.00% → SL moves to 200.00%

📈 Trail 7: 278.60% → SL moves to 223.60%

📈 Trail 8: 300.00% → SL moves to 250.00%

4️⃣ Target Points

🎯 At Target 1, book one lot to secure profits.

📊 Remaining positions can be trailed further with the next levels.

5️⃣ Projected Path

🔍 Dotted blue/red projections illustrate potential movement under this trailing system.

🔍 Observations

📌 Objective Entry: Requires successive closes above 78.6%, reducing false signals.

🎯 Partial Profit Booking: Taking one lot off at Target 1 ensures realized gains.

🔄 Two-Level Trailing: Locks in profits while leaving room for trend continuation.

📊 Rule-Based Framework: Clear Fibonacci-based progression keeps decisions mechanical and consistent.

✨ Why It Matters

✔ Prevents turning winning trades into losers.

✔ Builds confidence by removing emotions from exit decisions.

✔ Lets profits run while maintaining protection.

✅ Conclusion

Trailing stops are not about perfection — they’re about discipline.

By systematically adjusting stops as the market moves, traders:

🛡️ Protect capital

🚀 Let profits run

🤝 Remove emotions from decision-making

When combined with Fibonacci retracements, trailing stops provide a structured framework to manage trades effectively after entry.

⚠️ Disclaimer: For educational purposes only · Not SEBI registered · Not a buy/sell recommendation · No investment advice — purely a learning resource

Ghi chú

Update (22 Aug): After price reached the 200% Fibonacci extension, the trend shifted to bearish on closing below the 150% level. This highlights how the Fibonacci levels have worked so far for projection and trailing-stop purposes.

We now wait for a proper bearish confirmation before applying bearish Fibonacci zones.

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.