📘 NIFTY TRADING PLAN – 22-Apr-2025

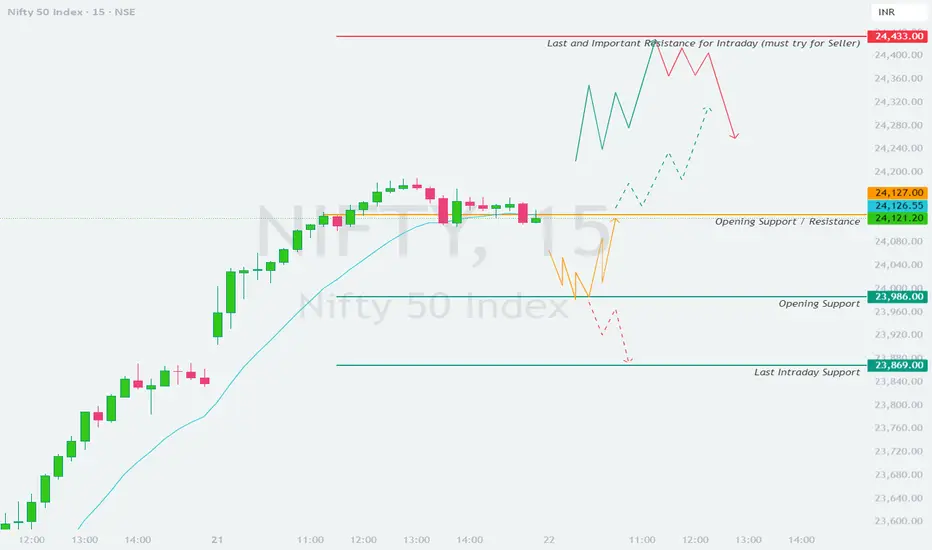

📊 Index Spot Close: 24,121.20 | ⏱ Timeframe: 15-Min | 🚪 Gap Opening Threshold: 100+ Points

🔼 Scenario 1: Gap-Up Opening (Above 24,221+)

A gap-up opening above 24,221 will push Nifty into a zone where sellers will likely get active. The chart highlights 24,433 as a "must try for sellers" level — this acts as the last important intraday resistance. Sustained movement beyond this level would be a bullish breakout, but chances of intraday reversal increase as price nears this resistance.

📌 Plan of Action:

💡 Educational Insight:

Gap-ups near major resistances are tricky — markets often use such openings for distribution. Watch price behavior at key levels instead of assuming breakout or reversal in advance.

⚖️ Scenario 2: Flat Opening (Between 24,020 – 24,221)

A flat opening within this range keeps Nifty in the current supply zone. The chart shows that 24,127 acts as a critical structure – previously both as resistance and a congestion area.

📌 Plan of Action:

💡 Educational Insight:

Flat openings near previous congestion levels often offer clean breakouts or breakdowns. Let the price action confirm direction – patience pays in such setups.

🔽 Scenario 3: Gap-Down Opening (Below 24,020–23,986)

A gap-down below the 23,986 support area would indicate potential profit booking or intraday reversal. The key support to monitor is 23,869 – labeled as "last intraday support" on your chart.

📌 Plan of Action:

💡 Educational Insight:

Gap-downs into key support zones often trap emotional sellers. Let price confirm breakdown — don’t assume it. Wait for candle confirmation before acting.

🛡️ Risk Management Tips for Options Traders 💼🧠

✅ Don’t trade first 15–30 minutes — let the market show intent.

✅ Use ITM or ATM options for better delta and less time decay.

✅ Position sizing is key — don’t risk more than 1–2% of capital on one trade.

✅ Avoid revenge trading — step back after a loss and reassess.

✅ Avoid averaging losers — have a clear SL and respect it.

✅ Don’t chase moves — especially after gaps; wait for retests.

✅ Maintain a trading journal — log entry/exit and reason behind trade.

✅ In volatile markets, hedge directional bets with spreads if needed.

🧾 Summary & Conclusion 🧠📊

📍 Gap-Up (Above 24,221): Sellers may get active near 24,433; watch for reversal signs.

📍 Flat Open (24,020–24,221): Critical level is 24,127 — breakout leads to 24,280, rejection leads to 23,986.

📍 Gap-Down (Below 24,020): Breakdown below 23,869 can trigger further fall; else, watch for bounce attempts.

📍 Zone to Monitor Closely: 24,127 and 23,986 — act as pivotal levels for intraday structure.

🧘♂️ Final Note: Trade levels, not emotions. Capital protection is the first job of a trader. Stick to your process and trust your risk management — opportunities will come.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. This trading plan is prepared purely for educational purposes only. Kindly consult with your financial advisor before making any investment or trading decisions. Markets involve risk — please use strict stop-loss and position sizing.

📊 Index Spot Close: 24,121.20 | ⏱ Timeframe: 15-Min | 🚪 Gap Opening Threshold: 100+ Points

🔼 Scenario 1: Gap-Up Opening (Above 24,221+)

A gap-up opening above 24,221 will push Nifty into a zone where sellers will likely get active. The chart highlights 24,433 as a "must try for sellers" level — this acts as the last important intraday resistance. Sustained movement beyond this level would be a bullish breakout, but chances of intraday reversal increase as price nears this resistance.

📌 Plan of Action:

- [] Wait for the first 15–30 minutes to settle the gap-up volatility. Don't chase the first green candle.

[] If price sustains above 24,221 and starts climbing toward 24,433, watch for a rejection wick or bearish engulfing candle near that level to plan shorts.

[] Ideal short opportunity arises if price touches 24,433 and then shows weakness — keep SL just above 24,460, target could be 24,280 → 24,127.

[] If price consolidates above 24,433 without signs of exhaustion, consider it a bullish continuation setup. In that case, adopt a breakout-retest strategy with SL below 24,400. - Aggressive buyers can look for retest around 24,221–24,280 zone for a possible long setup toward uncharted zones.

💡 Educational Insight:

Gap-ups near major resistances are tricky — markets often use such openings for distribution. Watch price behavior at key levels instead of assuming breakout or reversal in advance.

⚖️ Scenario 2: Flat Opening (Between 24,020 – 24,221)

A flat opening within this range keeps Nifty in the current supply zone. The chart shows that 24,127 acts as a critical structure – previously both as resistance and a congestion area.

📌 Plan of Action:

- [] Let the market settle. If price holds above 24,127 for 15–30 minutes, intraday strength may follow toward 24,221 → 24,280.

[] Longs can be initiated above 24,150 with tight SL below 24,120 and targets near 24,221.

[] On the flip side, if Nifty starts rejecting 24,127, consider intraday shorts with SL above 24,150. Target on downside could be 24,000 → 23,986.

[] Be cautious about trading within a choppy range of 24,050–24,127 – breakout or breakdown from this area will provide cleaner moves. - Wait for directional confirmation through volume and momentum indicators like RSI or VWAP reaction.

💡 Educational Insight:

Flat openings near previous congestion levels often offer clean breakouts or breakdowns. Let the price action confirm direction – patience pays in such setups.

🔽 Scenario 3: Gap-Down Opening (Below 24,020–23,986)

A gap-down below the 23,986 support area would indicate potential profit booking or intraday reversal. The key support to monitor is 23,869 – labeled as "last intraday support" on your chart.

📌 Plan of Action:

- [] Do not enter trades immediately on the gap-down. Let the price show its intent in the first 15–30 mins.

[] If price sustains below 23,986 and breaks 23,869, intraday weakness can accelerate with downside targets at 23,800 → 23,720.

[] Intraday shorts can be initiated on breakdowns below 23,869 with SL above 23,900.

[] If price bounces back and reclaims 23,986, avoid fresh shorts — this could be a trap for sellers. - Aggressive reversal traders can look for bullish price action near 23,869 — a hammer or bullish engulfing candle with volume might offer a low-risk bounce trade toward 24,000.

💡 Educational Insight:

Gap-downs into key support zones often trap emotional sellers. Let price confirm breakdown — don’t assume it. Wait for candle confirmation before acting.

🛡️ Risk Management Tips for Options Traders 💼🧠

✅ Don’t trade first 15–30 minutes — let the market show intent.

✅ Use ITM or ATM options for better delta and less time decay.

✅ Position sizing is key — don’t risk more than 1–2% of capital on one trade.

✅ Avoid revenge trading — step back after a loss and reassess.

✅ Avoid averaging losers — have a clear SL and respect it.

✅ Don’t chase moves — especially after gaps; wait for retests.

✅ Maintain a trading journal — log entry/exit and reason behind trade.

✅ In volatile markets, hedge directional bets with spreads if needed.

🧾 Summary & Conclusion 🧠📊

📍 Gap-Up (Above 24,221): Sellers may get active near 24,433; watch for reversal signs.

📍 Flat Open (24,020–24,221): Critical level is 24,127 — breakout leads to 24,280, rejection leads to 23,986.

📍 Gap-Down (Below 24,020): Breakdown below 23,869 can trigger further fall; else, watch for bounce attempts.

📍 Zone to Monitor Closely: 24,127 and 23,986 — act as pivotal levels for intraday structure.

🧘♂️ Final Note: Trade levels, not emotions. Capital protection is the first job of a trader. Stick to your process and trust your risk management — opportunities will come.

⚠️ Disclaimer:

I am not a SEBI-registered analyst. This trading plan is prepared purely for educational purposes only. Kindly consult with your financial advisor before making any investment or trading decisions. Markets involve risk — please use strict stop-loss and position sizing.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.