Hello Traders!

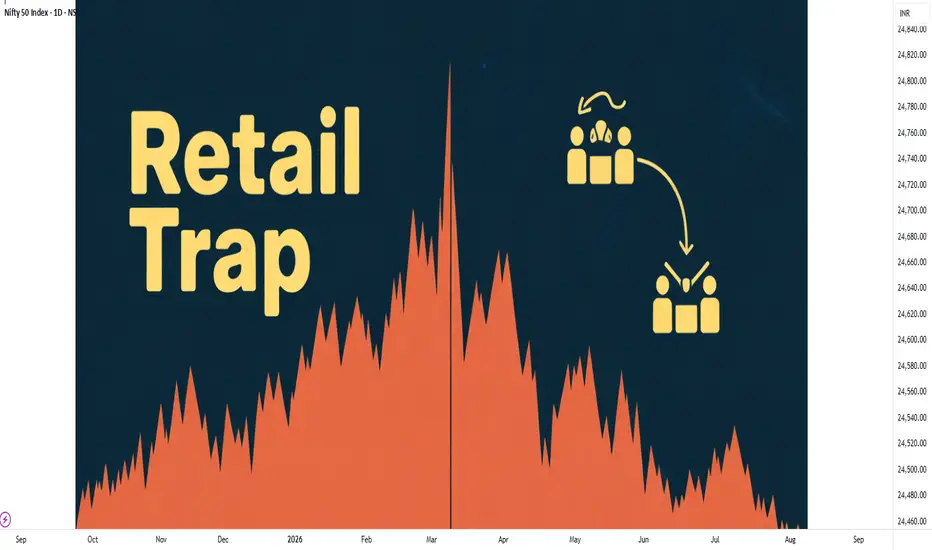

Most retail investors often struggle with timing the market. They end up buying when prices are high and panic-selling when markets fall. Let’s break down why this happens and how you can avoid it.

The Psychology Behind the Mistake

How to Avoid This Trap

Rahul’s Tip:

Smart investing is not about predicting the exact top or bottom. It’s about consistency, discipline, and managing risk. If you can keep emotions out of your decision-making, you’ll already be ahead of most retail investors.

Conclusion

Buying at the top and selling at the bottom is not a market problem, it’s a mindset problem. Once you fix the psychology, your investment journey becomes much smoother.

If this helped, like/follow/comment.

Most retail investors often struggle with timing the market. They end up buying when prices are high and panic-selling when markets fall. Let’s break down why this happens and how you can avoid it.

The Psychology Behind the Mistake

- Fear of Missing Out (FOMO): When stocks rally, people feel they might miss the opportunity. This pushes them to buy at high levels.

- Panic and Fear: During corrections or crashes, emotions take over. Instead of holding, many sell in fear of further losses.

- Herd Mentality: Most investors follow the crowd. If everyone is buying, they buy. If everyone is selling, they sell too.

How to Avoid This Trap

- Have a Clear Plan: Define your entry and exit strategy before investing. Don’t act on impulse.

- Focus on Fundamentals: Long-term value creation comes from fundamentals, not short-term price moves.

- Use SIP or Staggered Buying: Instead of putting all your money at once, invest gradually to avoid catching tops.

- Control Emotions: Discipline and patience are your biggest strengths as an investor.

Rahul’s Tip:

Smart investing is not about predicting the exact top or bottom. It’s about consistency, discipline, and managing risk. If you can keep emotions out of your decision-making, you’ll already be ahead of most retail investors.

Conclusion

Buying at the top and selling at the bottom is not a market problem, it’s a mindset problem. Once you fix the psychology, your investment journey becomes much smoother.

If this helped, like/follow/comment.

Premium Signals: 77% accuracy in Intraday & Positional trades for Stocks, Nifty, Bank Nifty, Gold, Silver & Crypto. Take demo & decide — most traders don’t leave after joining.

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Premium Signals: 77% accuracy in Intraday & Positional trades for Stocks, Nifty, Bank Nifty, Gold, Silver & Crypto. Take demo & decide — most traders don’t leave after joining.

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Free Demo: wa.me/919560602464

Free Telegram: spf.bio/c1lkb

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.