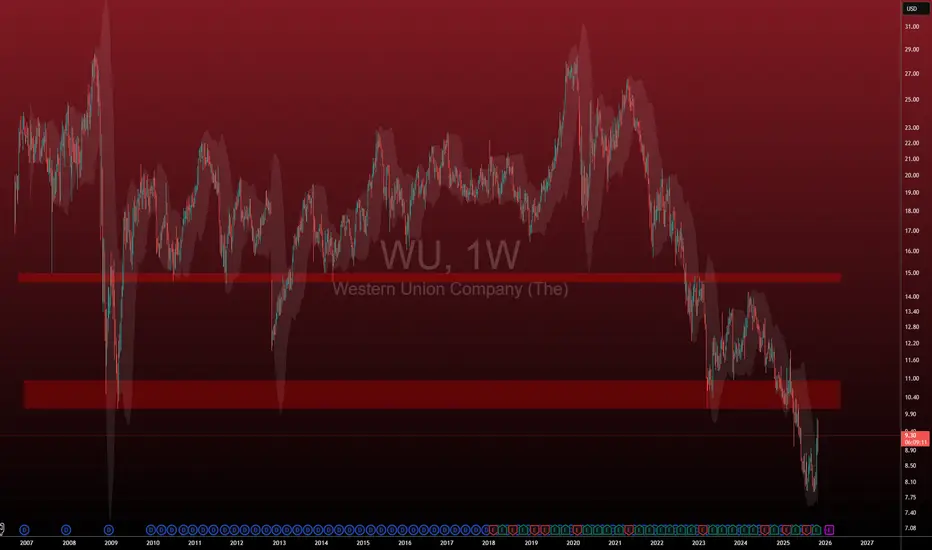

Chart is beaten up. At all time lows. Is it deserved?

Western Union presents a compelling value investment case. The company's valuation metrics appear deeply disconnected from its fundamental performance, trading at a P/E ratio of 3.86 and P/S ratio of 0.86 that would typically suggest severe distress, yet the company maintains exceptional profitability with a 22.2% net income margin and staggering 96.4% return on equity.

The investment thought is strengthened by the company's aggressive capital return program, which has driven 63% EPS growth through an 8.3% reduction in share count. This shareholder friendly approach is complemented by a substantial 8.9% dividend yield, providing both income and growth components to the investment case. While the company faces headwinds including negative revenue growth (-3.4%) and cash flow volatility, these concerns appear adequately discounted at current valuation levels.

From a technical perspective, the stock shows emerging momentum from oversold conditions with RSI at 63, suggesting room for continued recovery within the established $7.85-$11.95 trading range. The combination of deeply discounted valuation, strong profitability, aggressive capital returns, and improving technical positioning creates a compelling risk-reward profile that justifies a BUY recommendation with high conviction.

Western Union presents a compelling value investment case. The company's valuation metrics appear deeply disconnected from its fundamental performance, trading at a P/E ratio of 3.86 and P/S ratio of 0.86 that would typically suggest severe distress, yet the company maintains exceptional profitability with a 22.2% net income margin and staggering 96.4% return on equity.

The investment thought is strengthened by the company's aggressive capital return program, which has driven 63% EPS growth through an 8.3% reduction in share count. This shareholder friendly approach is complemented by a substantial 8.9% dividend yield, providing both income and growth components to the investment case. While the company faces headwinds including negative revenue growth (-3.4%) and cash flow volatility, these concerns appear adequately discounted at current valuation levels.

From a technical perspective, the stock shows emerging momentum from oversold conditions with RSI at 63, suggesting room for continued recovery within the established $7.85-$11.95 trading range. The combination of deeply discounted valuation, strong profitability, aggressive capital returns, and improving technical positioning creates a compelling risk-reward profile that justifies a BUY recommendation with high conviction.

CE - BitDoctor

Access our private indicators and join our Premium Room: bitdoctor.org

Beware of scams - I'll never DM you asking for funds.

Access our private indicators and join our Premium Room: bitdoctor.org

Beware of scams - I'll never DM you asking for funds.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

CE - BitDoctor

Access our private indicators and join our Premium Room: bitdoctor.org

Beware of scams - I'll never DM you asking for funds.

Access our private indicators and join our Premium Room: bitdoctor.org

Beware of scams - I'll never DM you asking for funds.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.