Historically, when U.S. interest rates

The difference today is the sovereign bid. Since 2022, central banks have been buying over 1,000 tonnes annually, creating a structural floor that didn’t exist in past cycles. Any weakness is likely to be bought aggressively, producing a V‑shaped recovery rather than a drawn‑out bear market.

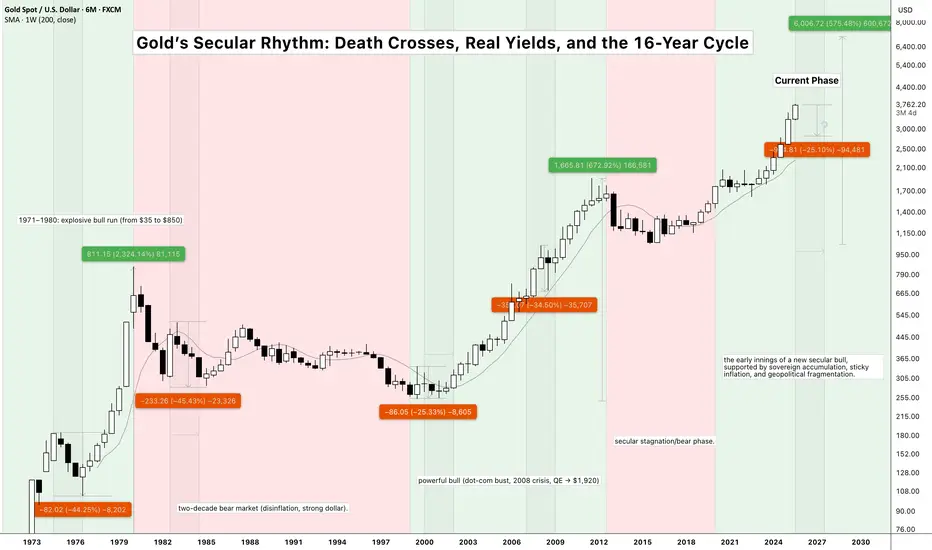

Meanwhile, the 10‑Year Real Interest Rate is hovering around 1.5–1.7%, still artificially high. History shows that when real yields inevitably turn negative (likely by 2026), gold tends to explode higher regardless of crisis timing.

Layer this onto the 16‑year secular cycle thesis and the central bank accumulation story, and the setup is compelling: gold may still face sharp but temporary corrections, yet the long‑term trajectory remains firmly higher. The key question is whether sovereign demand can fully absorb potential Western ETF liquidation during the next bout of financial stress.

Disclaimer: This analysis is for educational purposes only and should not be considered financial advice. Past performance does not guarantee future results. Always conduct your own research and consult with financial professionals before making investment decisions.

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.