PROTECTED SOURCE SCRIPT

Puell Multiple

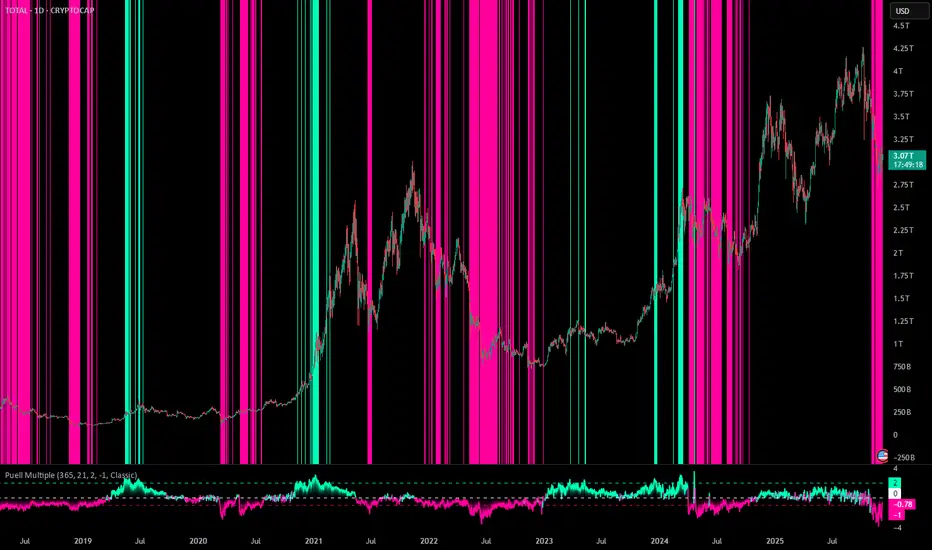

Puell Multiple

The Puell Multiple is calculated by dividing the total USD value of Bitcoin issued today (newly mined coins × BTC price) by the 365-day moving average of that daily issuance value. It shows how today's miner revenue compares to the past year's average.

Features

This script offers several customizable inputs, enabling traders to tailor the indicator to their preferences. Traders can adjust the thresholds to define the sensitivity of overbought and oversold conditions.

It has 10 available color schemes to choose from and the background coloring on the chart can be toggled on and off.

Practical Applications

This indicator is designed for traders who focus on identifying cycle extremes and potential mean reversion opportunities.

Detecting Overbought and Oversold Conditions: The indicator measures how far the price has deviated from its norm, allowing traders to identify overbought or oversold conditions with precision.

Timing Market Reversals: The indicator provides early signals of potential market reversals by highlighting when the price has moved too far away from its average, helping traders anticipate reversion opportunities.

The Puell Multiple is calculated by dividing the total USD value of Bitcoin issued today (newly mined coins × BTC price) by the 365-day moving average of that daily issuance value. It shows how today's miner revenue compares to the past year's average.

Features

This script offers several customizable inputs, enabling traders to tailor the indicator to their preferences. Traders can adjust the thresholds to define the sensitivity of overbought and oversold conditions.

It has 10 available color schemes to choose from and the background coloring on the chart can be toggled on and off.

Practical Applications

This indicator is designed for traders who focus on identifying cycle extremes and potential mean reversion opportunities.

Detecting Overbought and Oversold Conditions: The indicator measures how far the price has deviated from its norm, allowing traders to identify overbought or oversold conditions with precision.

Timing Market Reversals: The indicator provides early signals of potential market reversals by highlighting when the price has moved too far away from its average, helping traders anticipate reversion opportunities.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

Protected script

This script is published as closed-source. However, you can use it freely and without any limitations – learn more here.

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.