OPEN-SOURCE SCRIPT

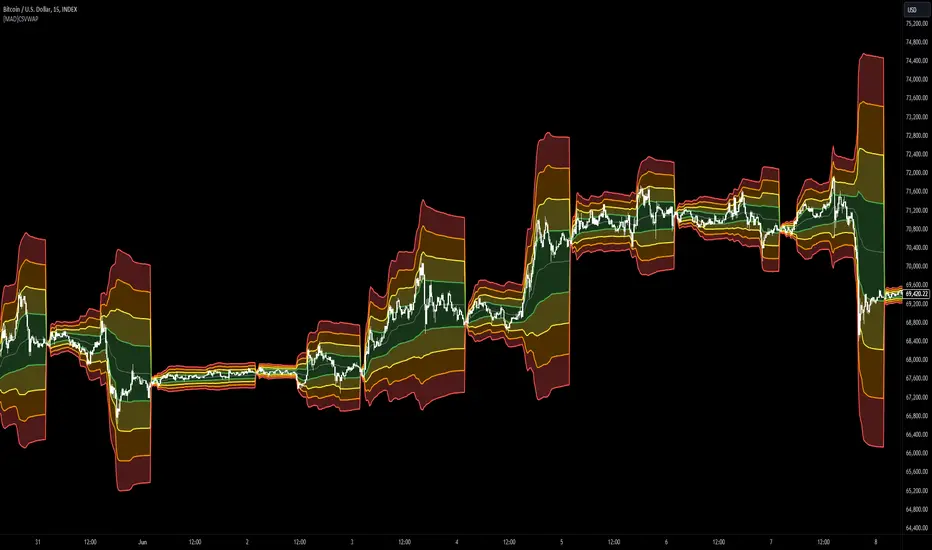

[MAD] Custom Session VWAP Bands

Overview

This indicator helps visualize the Volume Weighted Average Price (VWAP) and its associated standard deviation bands over specified time periods, providing traders with a clear understanding of price trends, volatility, and potential support/resistance levels.

Inputs

Deviation

Custom Vwap session reset settings

Many different options are considered when a session is going to be reset.

Plot and Fill Options

How to Use the Indicator

Adding the Indicator

Add the indicator to your chart through your trading platform's indicator menu.

Configuring the VWAP Reset

Specify reset intervals based on time, days of the week, or specific dates.

Adjust the time zone if necessary.

Customizing Standard Deviation Bands

Set the multipliers for the standard deviation bands.

Choose line width for better visualization.

Enabling Plots and Fills

Select which bands to display.

Enable or disable fills between the bands.

Practical Application of VWAP Bands

Understanding VWAP

VWAP is a trading benchmark that calculates the average price a security has traded at throughout the day based on volume and price. It is primarily used for intraday trading but can also offer insights during end-of-day reviews.

Using VWAP for Trading

Intraday Trading

Entry and Exit Points: VWAP can help identify optimal buy and sell points. Buy when the price is above VWAP and sell when it's below.

Support and Resistance: VWAP often acts as a dynamic support/resistance level. Prices tend to revert to VWAP, making it a crucial level for intraday traders.

Trend Confirmation

Uptrends and Downtrends: In an uptrend, the price will generally stay above VWAP. Conversely, in a downtrend, it will stay below. Use this to confirm market direction.

Combining with Other Indicators

Moving Averages and Bollinger Bands: Combining VWAP with these indicators can provide a more robust trading signal, confirming trends and potential reversals.

Setting Stop-Loss and Profit Targets

Conservative Stop Orders: Place stop orders at recent lows for pullback trades.

Profit Targets: Use daily highs or Fibonacci extension levels to set profit targets.

Strategies for Using VWAP

Pullback Strategy

Buy during pullbacks to VWAP in an uptrend, and sell during rallies to VWAP in a downtrend.

Breakout Strategy

Look for breakouts above/below VWAP after the market open to capitalize on new trends.

Momentum Trading

Use VWAP to confirm the strength of a trend. Buy when the price is consistently above VWAP and sell when it's consistently below.

Institutional Strategies

Institutional traders use VWAP to execute large orders without causing significant market impact, ensuring trades are made around the average price.

By incorporating these strategies, traders can better understand market dynamics, make informed trading decisions, and manage their risk effectively.

Some setup possibilities

This indicator helps visualize the Volume Weighted Average Price (VWAP) and its associated standard deviation bands over specified time periods, providing traders with a clear understanding of price trends, volatility, and potential support/resistance levels.

Inputs

Deviation

- StDev mult 1: Multiplier for the first standard deviation band (Default: 1.0)

- StDev mult 2: Multiplier for the second standard deviation band (Default: 2.0)

- StDev mult 3: Multiplier for the third standard deviation band (Default: 3.0)

- StDev mult 4: Multiplier for the fourth standard deviation band (Default: 4.0)

- Line width: Width of the lines for the bands (Default: 2)

Custom Vwap session reset settings

Many different options are considered when a session is going to be reset.

Plot and Fill Options

- Enable Fills: Enable/disable filling between bands.

- Plot +4: Enable/disable plotting the +4 standard deviation band.

- Plot +3: Enable/disable plotting the +3 standard deviation band.

- Plot +2: Enable/disable plotting the +2 standard deviation band.

- Plot +1: Enable/disable plotting the +1 standard deviation band.

- Plot VWAP: Enable/disable plotting the VWAP line.

- Plot -1: Enable/disable plotting the -1 standard deviation band.

- Plot -2: Enable/disable plotting the -2 standard deviation band.

- Plot -3: Enable/disable plotting the -3 standard deviation band.

- Plot -4: Enable/disable plotting the -4 standard deviation band.

How to Use the Indicator

Adding the Indicator

Add the indicator to your chart through your trading platform's indicator menu.

Configuring the VWAP Reset

Specify reset intervals based on time, days of the week, or specific dates.

Adjust the time zone if necessary.

Customizing Standard Deviation Bands

Set the multipliers for the standard deviation bands.

Choose line width for better visualization.

Enabling Plots and Fills

Select which bands to display.

Enable or disable fills between the bands.

Practical Application of VWAP Bands

Understanding VWAP

VWAP is a trading benchmark that calculates the average price a security has traded at throughout the day based on volume and price. It is primarily used for intraday trading but can also offer insights during end-of-day reviews.

Using VWAP for Trading

Intraday Trading

Entry and Exit Points: VWAP can help identify optimal buy and sell points. Buy when the price is above VWAP and sell when it's below.

Support and Resistance: VWAP often acts as a dynamic support/resistance level. Prices tend to revert to VWAP, making it a crucial level for intraday traders.

Trend Confirmation

Uptrends and Downtrends: In an uptrend, the price will generally stay above VWAP. Conversely, in a downtrend, it will stay below. Use this to confirm market direction.

Combining with Other Indicators

Moving Averages and Bollinger Bands: Combining VWAP with these indicators can provide a more robust trading signal, confirming trends and potential reversals.

Setting Stop-Loss and Profit Targets

Conservative Stop Orders: Place stop orders at recent lows for pullback trades.

Profit Targets: Use daily highs or Fibonacci extension levels to set profit targets.

Strategies for Using VWAP

Pullback Strategy

Buy during pullbacks to VWAP in an uptrend, and sell during rallies to VWAP in a downtrend.

Breakout Strategy

Look for breakouts above/below VWAP after the market open to capitalize on new trends.

Momentum Trading

Use VWAP to confirm the strength of a trend. Buy when the price is consistently above VWAP and sell when it's consistently below.

Institutional Strategies

Institutional traders use VWAP to execute large orders without causing significant market impact, ensuring trades are made around the average price.

By incorporating these strategies, traders can better understand market dynamics, make informed trading decisions, and manage their risk effectively.

Some setup possibilities

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.