OPEN-SOURCE SCRIPT

Cập nhật Scalp Tool

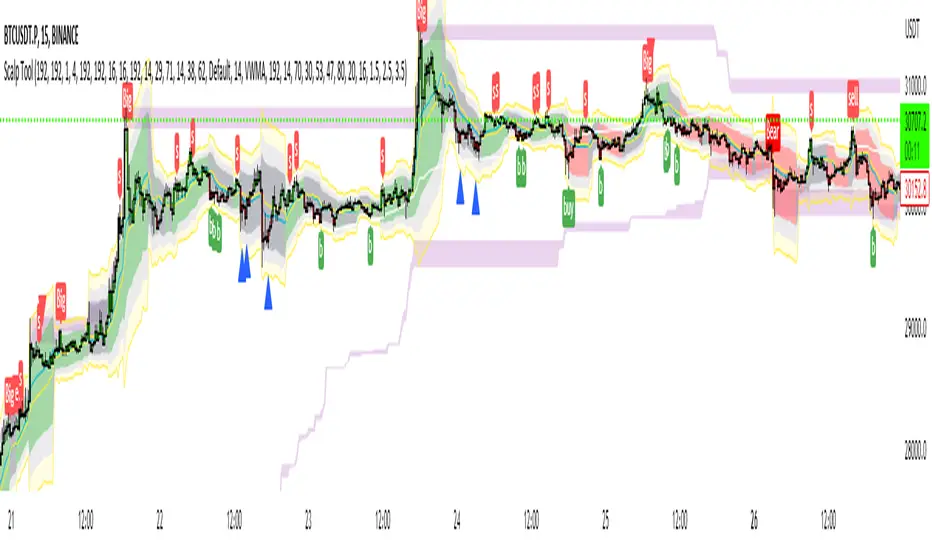

https://www.tradingview.com/x/RsHbdLR3/

This script is primarily intended as a scalping tool.

The theory of the tool is based on the fact that the price always returns to its mean.

Elements used:

1. VWMA as a moving average. VWMA is calculated once based on source close and once based on source open.

2. the bands are not calculated like the Bollinger Band, but only a settlement is calculated for the lower bands based on the Lows and for the upper bands based on the Highs. Thus the bands do not become thicker or thinner, but remain in the same measure to the mean value above or below the price.

3. a volume filter on simple calculation of a MA with deviation. Therefore, it can be identified if a volume breakout has occurred.

4. support and resistance zones which are calculated based on the highs and lows over a certain length.

5. RSI to determine oversold and overbought zones. It also tries to capture the momentum by using a moving average (variable selectable) to filter the signals. The theory is that in an uptrend the RSI does not go below 50 and in a downtrend it does not go above 50.

However, this can be very different depending on the financial instrument.

Explanation of the signals:

The main signal in this indicator Serves for pure short-term trading and is generated purely on the basis of the bands and the RSI.

Only the first bands are taken into account.

Buy signal is generated when the price opens below the lower band 1 and closes above the lower band 1 or the RSI crosses a value of 25 from bottom to top.

Sell signal is generated when the price opens above the Upper Band 1 and closes below the Upper Band 1 or the RSI crosses a value of 75 from top to bottom.

The position should be closed when the price hits the opposite band. Alternatively, it can also be closed at the mean.

Other side signals:

1. breakouts:

The indicator includes 2 support and resistance zones, which differ only in length. For the breakout signals, the short version of the R/S is used. A signal is generated when the price breaks through the zones with increased volume. It is then assumed that the price will continue to follow the breakout.

The values of the S/R are adjustable and marked with "BK".

The value under Threshold 2 defines the volume breakout. 4 is considered as the highest value. The smaller the value, the smaller the volume must be during a breakout.

2. bounce

If the price hits a S/R (here the long variant is used with the designation "Support" or "Resistance") and makes a wick with small volume, the script assumes a bounce and generates a Sell or Buy signal accordingly.

The volume can be defined under "Threshold".

The S/R according to the designation as well.

Combined signals:

If the value of the S/R BK and the S/R is the same and the bounce logic of the S/R BK applies and an RSI signal is also generated, a signal is also plotted.

Here the idea was to get very strong signals for possible swing entries.

4. RSI Signals

The script contains two RSI.

RSI 1:

Bullish signal is generated when the set value is crossed from the bottom to the top.

Bearish signal is generated when the set value is crossed from the top to the bottom.

RSI 2:

Bullish signal is generated when the set value is crossed from the top to the bottom.

Bearish signal is generated when the set value is crossed from bottom to top.

For RSI 2 the theory is taken into account according to the description under Used elements point 5

Optical trend filter:

Also an optical trend filter was generated which fills the bands accordingly.

For this the VWMA is used and the two average values of the band.

Color definition:

Gray = Neutral

Red = Bearish

Green = Bullish

If the mean value is above the VWMA and the mean value based on the closing price is above the mean value based on the open price, the band is colored green. It is a bullish trend

If the mean value is below the VWMA and the mean value based on the closing price is below the mean value based on the open price, the band is colored red.

The band is colored gray if the mean value is correspondingly opposite. A sideways phase is assumed.

The script was developed on the basis of the pair BTCUSD in the 15 minute chart and the settings were defined accordingly on it. The display of S/R for forex pairs does not work correctly and should be hidden. The logic works anyway.

When using the script, all options should first be set accordingly to the asset and tested before trading afterwards. It applies of course also here that there is no 100% guarantee.

Also, a strong breakout leads to false signals and overheating of the indicator.

This script is primarily intended as a scalping tool.

The theory of the tool is based on the fact that the price always returns to its mean.

Elements used:

1. VWMA as a moving average. VWMA is calculated once based on source close and once based on source open.

2. the bands are not calculated like the Bollinger Band, but only a settlement is calculated for the lower bands based on the Lows and for the upper bands based on the Highs. Thus the bands do not become thicker or thinner, but remain in the same measure to the mean value above or below the price.

3. a volume filter on simple calculation of a MA with deviation. Therefore, it can be identified if a volume breakout has occurred.

4. support and resistance zones which are calculated based on the highs and lows over a certain length.

5. RSI to determine oversold and overbought zones. It also tries to capture the momentum by using a moving average (variable selectable) to filter the signals. The theory is that in an uptrend the RSI does not go below 50 and in a downtrend it does not go above 50.

However, this can be very different depending on the financial instrument.

Explanation of the signals:

The main signal in this indicator Serves for pure short-term trading and is generated purely on the basis of the bands and the RSI.

Only the first bands are taken into account.

Buy signal is generated when the price opens below the lower band 1 and closes above the lower band 1 or the RSI crosses a value of 25 from bottom to top.

Sell signal is generated when the price opens above the Upper Band 1 and closes below the Upper Band 1 or the RSI crosses a value of 75 from top to bottom.

The position should be closed when the price hits the opposite band. Alternatively, it can also be closed at the mean.

Other side signals:

1. breakouts:

The indicator includes 2 support and resistance zones, which differ only in length. For the breakout signals, the short version of the R/S is used. A signal is generated when the price breaks through the zones with increased volume. It is then assumed that the price will continue to follow the breakout.

The values of the S/R are adjustable and marked with "BK".

The value under Threshold 2 defines the volume breakout. 4 is considered as the highest value. The smaller the value, the smaller the volume must be during a breakout.

2. bounce

If the price hits a S/R (here the long variant is used with the designation "Support" or "Resistance") and makes a wick with small volume, the script assumes a bounce and generates a Sell or Buy signal accordingly.

The volume can be defined under "Threshold".

The S/R according to the designation as well.

Combined signals:

If the value of the S/R BK and the S/R is the same and the bounce logic of the S/R BK applies and an RSI signal is also generated, a signal is also plotted.

Here the idea was to get very strong signals for possible swing entries.

4. RSI Signals

The script contains two RSI.

RSI 1:

Bullish signal is generated when the set value is crossed from the bottom to the top.

Bearish signal is generated when the set value is crossed from the top to the bottom.

RSI 2:

Bullish signal is generated when the set value is crossed from the top to the bottom.

Bearish signal is generated when the set value is crossed from bottom to top.

For RSI 2 the theory is taken into account according to the description under Used elements point 5

Optical trend filter:

Also an optical trend filter was generated which fills the bands accordingly.

For this the VWMA is used and the two average values of the band.

Color definition:

Gray = Neutral

Red = Bearish

Green = Bullish

If the mean value is above the VWMA and the mean value based on the closing price is above the mean value based on the open price, the band is colored green. It is a bullish trend

If the mean value is below the VWMA and the mean value based on the closing price is below the mean value based on the open price, the band is colored red.

The band is colored gray if the mean value is correspondingly opposite. A sideways phase is assumed.

The script was developed on the basis of the pair BTCUSD in the 15 minute chart and the settings were defined accordingly on it. The display of S/R for forex pairs does not work correctly and should be hidden. The logic works anyway.

When using the script, all options should first be set accordingly to the asset and tested before trading afterwards. It applies of course also here that there is no 100% guarantee.

Also, a strong breakout leads to false signals and overheating of the indicator.

Phát hành các Ghi chú

The calculation for the bands has been changed so that the ratio of the center to the upper and lower bands remains the same even if the timeframe is changed.Phát hành các Ghi chú

New functions:The Support and Resistance Zone is now also displayed as a zone. The area between Highest Close and Highest High as well as the area between Lowest Close and Lowest Low of the set period are marked.

The candles can now be colored on the basis of the RSI.

5 zones have been defined

Extreme Upper = RSI above 70

Upper = RSI above 55 but below 70

Middle = RSI between 45 and 55

Lower = RSI below 45 but above 30

Extreme Lower = RSI below 30

The theory

If the RSI is above 55, one assumes a bullish momentum.

An RSI above 70 is considered overbought and a market reversal is expected. However, there are also theories which say that a value above 70 speaks for an extreme bullish momentum.

Values between 45 and 55 are considered neutral (I prefer values between 47 and 53).

Values below 45 but above 30 indicate a bearish momentum.

Values below 30 indicate an oversold market and a reversal is expected. However, the opposite can also be considered here and an extremely bearish momentum can be assumed.

The values as well as bar colors are freely adjustable.

Phát hành các Ghi chú

Small change to the Devault settings and update of the chart imagePhát hành các Ghi chú

An error in the signal display has been corrected.Now the signals can be activated or deactivated directly in the settings. Since certain signals arise when a combination of other signals occurs, the deactivation of higher-level signals led to the fact that nothing was displayed. With the correction the signals are displayed if a higher prioritized signal is deactivated. The checkboxes were listed in the prioritization order. Top checkbox has Prio 5 Bottom = Prio 1

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.