PROTECTED SOURCE SCRIPT

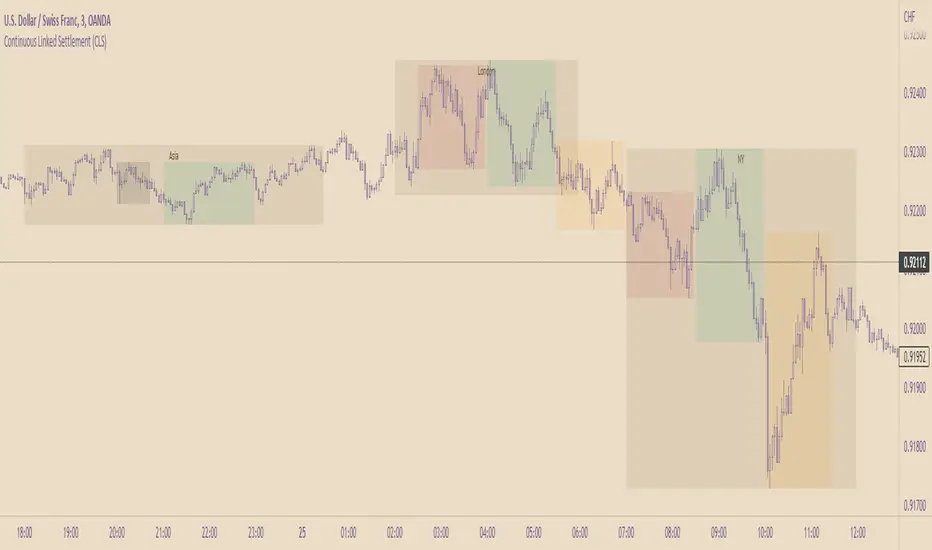

Continuous Linked Settlement (CLS)

Continuous Linked Settlement (CLS) is an international payment system which was launched in September 2002 for the settlement of foreign exchange transactions. In the conventional settlement of a foreign exchange transaction the exchange of the two currencies involved in the trade is not normally synchronous.

For one party to the trade there is therefore a risk that it will transfer the currency it has sold without receiving from the counterparty the currency it has bought (settlement risk). Even if a bank’s risk position vis-à-vis a counterparty is short-term, it may be many times greater than its capital. With CLS, an infrastructure has been created which eliminates settlement risk by means of a payment-versus-payment (PvP)2 mechanism.

For one party to the trade there is therefore a risk that it will transfer the currency it has sold without receiving from the counterparty the currency it has bought (settlement risk). Even if a bank’s risk position vis-à-vis a counterparty is short-term, it may be many times greater than its capital. With CLS, an infrastructure has been created which eliminates settlement risk by means of a payment-versus-payment (PvP)2 mechanism.

Mã được bảo vệ

Tập lệnh này được đăng dưới dạng mã nguồn đóng. Tuy nhiên, bạn có thể sử dụng tự do và không giới hạn – tìm hiểu thêm tại đây.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã được bảo vệ

Tập lệnh này được đăng dưới dạng mã nguồn đóng. Tuy nhiên, bạn có thể sử dụng tự do và không giới hạn – tìm hiểu thêm tại đây.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.