PROTECTED SOURCE SCRIPT

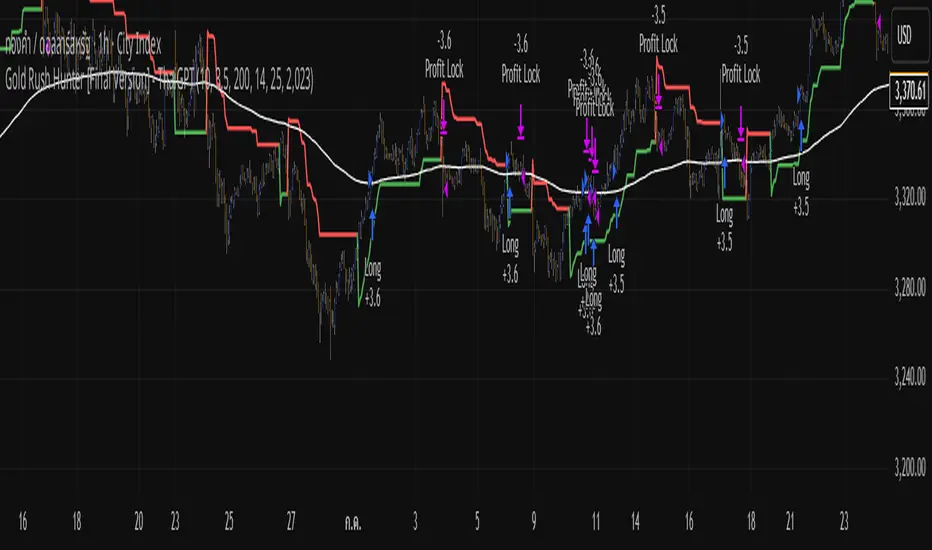

Gold Rush Hunter [Final Version] - ThaiGPT

English Translation — Core Principles of the “Supertrend Hunter: Long-Only Trend System”

1. The “Go With the Flow” Principle (Trend Following Bias)

Tools: EMA 200 + Long-Only Mode

Concept:

Gold (and assets like Bitcoin) naturally trend upward in the long run because they are inflationary assets.

Shorting against the long-term trend is like swimming upstream — exhausting and dangerous.

How it works in the code:

The system is strictly instructed to never open Sell positions.

→ This eliminates the risk of getting trapped in deep pullbacks that could wipe out 50% of an account.

Trades are taken only when price > EMA 200.

→ We buy only in confirmed bull conditions.

→ “Buy high to sell even higher.”

2. The “False Signal Filter” Principle (Volatility Filtering)

Tools: Supertrend (Factor 3.5) + ADX (> 25)

Concept:

The number one killer of traders is the sideways market — price moves inconsistently, up after you Sell and down after you Buy.

How it works in the code:

ADX > 25

→ Checks whether the market has real strength (momentum).

→ If ADX is low, the market is choppy → the system stays flat (“sit on your hands”).

Supertrend Factor 3.5

→ Higher than the standard 3.0 to widen the buffer.

→ Makes the system more resistant to market noise, preventing premature exits and stop-outs.

3. The “Let Profits Run” Principle

Tool: Supertrend Trailing Stop

Concept:

Most traders panic and close too early (“selling the piglet”), taking tiny profits out of fear.

This system is designed to catch the biggest possible moves.

How it works in the code:

There is no fixed Take Profit.

When price climbs, the system automatically lifts the Stop Loss upward using the Supertrend line.

As long as the trend holds, the system refuses to close the position.

Only when the trend genuinely reverses will the trade exit.

This allows the system to capture huge moves — sometimes 10,000+ points from a single entry.

4. The “Mathematics of Getting Rich” Principle (Asymmetric Risk/Reward)

Tools: Statistical structure (Win Rate vs Reward Ratio)

Concept:

You don’t need to win often — you just need to win big enough.

Your account statistics:

Win Rate: ~36%

→ You lose 6 trades, win only 4 trades (looks bad at first glance).

Reward Ratio: ~3.3R

→ Lose 1 unit, win 3.3 units.

Result:

10 trades →

Losses: −6

Wins: +13.2

Net profit: +7.2 units

This is why your account keeps growing despite losing more often than winning.

⚠️ Important Mindset Notes

Now that you understand the mechanics, you need to prepare for the realities:

• Boredom

The system may not trade for days or even weeks if:

ADX is too low

Price is below EMA 200

You must be patient.

• Losing streaks (Drawdowns)

With a 35% win rate, it is perfectly normal to hit 3–5 consecutive Stop Losses.

Do NOT modify the code or abandon the system during losing streaks.

Because big trends usually appear right after losing periods, and one large winning trade can recover every loss and add profit on top.

This is what a real “money-making system” looks like.

Not flashy. Not hyperactive.

But stable, scalable, and sustainable 🚀

1. The “Go With the Flow” Principle (Trend Following Bias)

Tools: EMA 200 + Long-Only Mode

Concept:

Gold (and assets like Bitcoin) naturally trend upward in the long run because they are inflationary assets.

Shorting against the long-term trend is like swimming upstream — exhausting and dangerous.

How it works in the code:

The system is strictly instructed to never open Sell positions.

→ This eliminates the risk of getting trapped in deep pullbacks that could wipe out 50% of an account.

Trades are taken only when price > EMA 200.

→ We buy only in confirmed bull conditions.

→ “Buy high to sell even higher.”

2. The “False Signal Filter” Principle (Volatility Filtering)

Tools: Supertrend (Factor 3.5) + ADX (> 25)

Concept:

The number one killer of traders is the sideways market — price moves inconsistently, up after you Sell and down after you Buy.

How it works in the code:

ADX > 25

→ Checks whether the market has real strength (momentum).

→ If ADX is low, the market is choppy → the system stays flat (“sit on your hands”).

Supertrend Factor 3.5

→ Higher than the standard 3.0 to widen the buffer.

→ Makes the system more resistant to market noise, preventing premature exits and stop-outs.

3. The “Let Profits Run” Principle

Tool: Supertrend Trailing Stop

Concept:

Most traders panic and close too early (“selling the piglet”), taking tiny profits out of fear.

This system is designed to catch the biggest possible moves.

How it works in the code:

There is no fixed Take Profit.

When price climbs, the system automatically lifts the Stop Loss upward using the Supertrend line.

As long as the trend holds, the system refuses to close the position.

Only when the trend genuinely reverses will the trade exit.

This allows the system to capture huge moves — sometimes 10,000+ points from a single entry.

4. The “Mathematics of Getting Rich” Principle (Asymmetric Risk/Reward)

Tools: Statistical structure (Win Rate vs Reward Ratio)

Concept:

You don’t need to win often — you just need to win big enough.

Your account statistics:

Win Rate: ~36%

→ You lose 6 trades, win only 4 trades (looks bad at first glance).

Reward Ratio: ~3.3R

→ Lose 1 unit, win 3.3 units.

Result:

10 trades →

Losses: −6

Wins: +13.2

Net profit: +7.2 units

This is why your account keeps growing despite losing more often than winning.

⚠️ Important Mindset Notes

Now that you understand the mechanics, you need to prepare for the realities:

• Boredom

The system may not trade for days or even weeks if:

ADX is too low

Price is below EMA 200

You must be patient.

• Losing streaks (Drawdowns)

With a 35% win rate, it is perfectly normal to hit 3–5 consecutive Stop Losses.

Do NOT modify the code or abandon the system during losing streaks.

Because big trends usually appear right after losing periods, and one large winning trade can recover every loss and add profit on top.

This is what a real “money-making system” looks like.

Not flashy. Not hyperactive.

But stable, scalable, and sustainable 🚀

Mã được bảo vệ

Tập lệnh này được đăng dưới dạng mã nguồn đóng. Tuy nhiên, bạn có thể sử dụng tự do và không giới hạn – tìm hiểu thêm tại đây.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã được bảo vệ

Tập lệnh này được đăng dưới dạng mã nguồn đóng. Tuy nhiên, bạn có thể sử dụng tự do và không giới hạn – tìm hiểu thêm tại đây.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.