OPEN-SOURCE SCRIPT

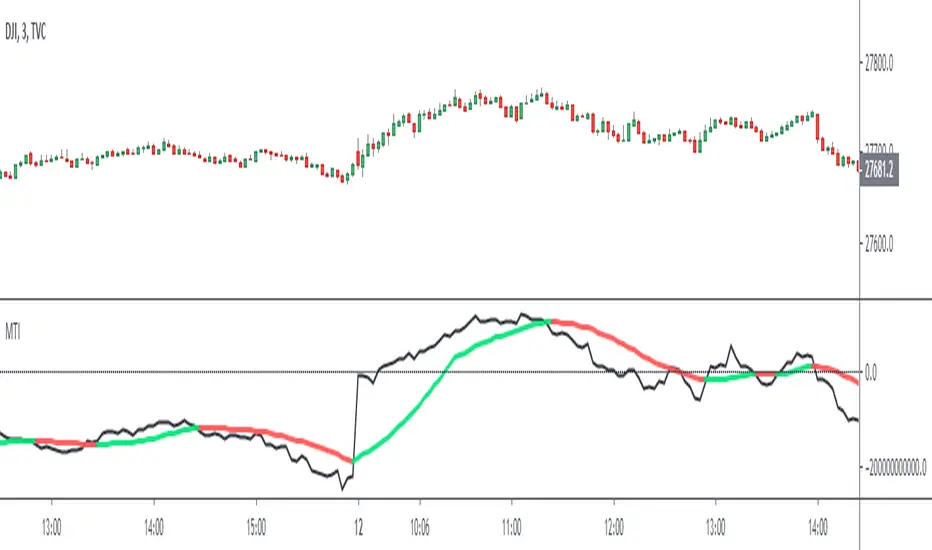

Market Thrust Indicator

The Market Thrust indicator is a powerful measure of the stock market's internal strength or weakness. There are four components to this indicator:

1-Advancing Issues on the New York Stock Exchange (NYSE) – AADV

2-Advancing Volume on the NYSE – UUVOL

3-Declining Issues on the NYSE – DDECL

4-Declining Volume on the NYSE – DDVOL

The formula for Market Thrust is given below:

(AADV x UUVOL)-(DDECL x DDVOL)

When used for day-trading, the trend of the Market Thrust indicator is what is most important.

Rising Market Thrust Indicator: Considered a bullish sign; can act as a confirmation signal when combined with a rising stock, index ETF, or stock index future's price.

Falling Market Thrust Indicator: Considered a bearish sign; can act as a confirmation signal of a decreasing market price.

The Market Thrust indicator could be used for detecting divergences in trends. Divergences occur when:

- Price is trending higher, but the Market Thrust indicator is not moving higher or is even going down.

- Price is trending lower, however, the Market Thrust technical analysis tool is not trending lower, it is either not trending or is trending higher.

Add a fully configurable trend line over MTI.

Read more at: commodity.com/technical-analysis/market-thrust/

1-Advancing Issues on the New York Stock Exchange (NYSE) – AADV

2-Advancing Volume on the NYSE – UUVOL

3-Declining Issues on the NYSE – DDECL

4-Declining Volume on the NYSE – DDVOL

The formula for Market Thrust is given below:

(AADV x UUVOL)-(DDECL x DDVOL)

When used for day-trading, the trend of the Market Thrust indicator is what is most important.

Rising Market Thrust Indicator: Considered a bullish sign; can act as a confirmation signal when combined with a rising stock, index ETF, or stock index future's price.

Falling Market Thrust Indicator: Considered a bearish sign; can act as a confirmation signal of a decreasing market price.

The Market Thrust indicator could be used for detecting divergences in trends. Divergences occur when:

- Price is trending higher, but the Market Thrust indicator is not moving higher or is even going down.

- Price is trending lower, however, the Market Thrust technical analysis tool is not trending lower, it is either not trending or is trending higher.

Add a fully configurable trend line over MTI.

Read more at: commodity.com/technical-analysis/market-thrust/

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.