OPEN-SOURCE SCRIPT

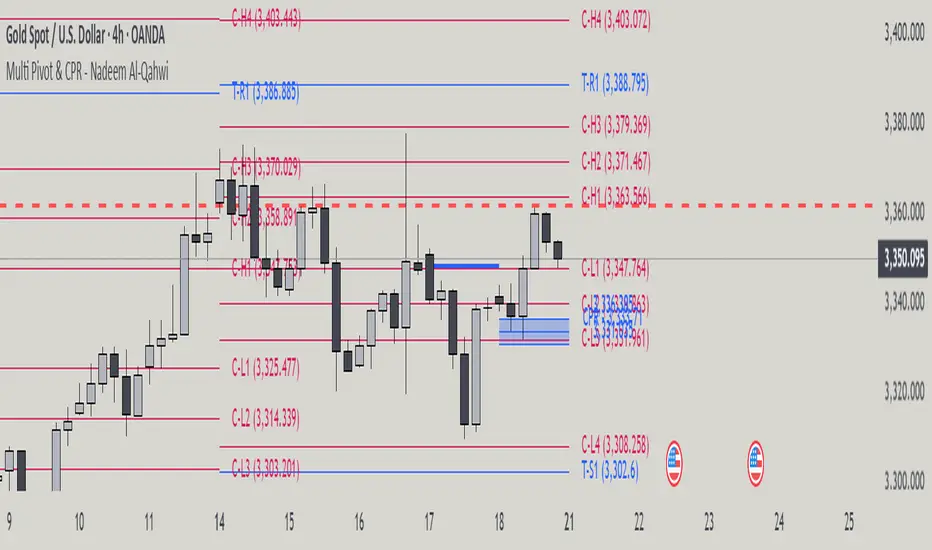

Multi Pivot Point & Central Pivot Range - Nadeem Al-Qahwi

This indicator combines four advanced trading modules into one flexible and easy-to-use script:

Traditional Pivot Points:

Calculates classic support and resistance levels (PP, R1–R5, S1–S5) based on previous session data. Ideal for identifying key turning points and mapping out the daily, weekly, or monthly structure.

Camarilla Levels:

Provides six upper and lower pivot levels (H1–H6, L1–L6) derived from volatility and closing price formulas. Especially effective for intraday reversal, mean reversion, and finding overbought/oversold extremes.

Central Pivot Range (CPR):

Plots the median, top, and bottom of the value area each session. CPR width instantly highlights whether the market is likely to trend (narrow CPR) or remain range-bound (wide CPR).

Developing CPR projects the evolving range for the current period—essential for real-time analysis and pre-market planning.

Dynamic Zone Levels (DZL):

Automatically detects and highlights clusters of pivots to reveal high-probability support/resistance zones, filtering out market “noise.”

DZL alerts notify you whenever price breaks or retests these key areas, making it easier to spot momentum trades and avoid false signals.

Key Features:

Multi-timeframe flexibility: Use with daily, weekly, monthly, yearly, or custom timeframes—even rare ones like biyearly and decennial.

Modular design: Activate or hide any system (Traditional, Camarilla, CPR, DZL) as you need.

Bilingual interface: Every setting and label is shown in both English and Arabic.

Full customization: Control visibility, color, style, and placement for every level and label.

Historical depth: Plot up to 5,000 pivot/zones back for deep analysis and backtesting.

Smart alerts: Get instant notifications on true S/R breakouts or retests (from DZL).

How to Use:

Trend Trading:

Watch for a very narrow CPR to identify potential trending days—trade in the breakout direction above/below the CPR.

Range Trading:

When CPR is wide, expect sideways movement. Fade reversals at R1/S1 or within the CPR boundaries.

Breakouts:

Use DZL alerts to capture momentum as price breaks or retests dynamic support/resistance zones.

Multi-Timeframe Confluence:

Combine CPR and pivot levels from multiple timeframes for higher-probability entries and exits.

All calculations and logic are fully open.

Traditional Pivot Points:

Calculates classic support and resistance levels (PP, R1–R5, S1–S5) based on previous session data. Ideal for identifying key turning points and mapping out the daily, weekly, or monthly structure.

Camarilla Levels:

Provides six upper and lower pivot levels (H1–H6, L1–L6) derived from volatility and closing price formulas. Especially effective for intraday reversal, mean reversion, and finding overbought/oversold extremes.

Central Pivot Range (CPR):

Plots the median, top, and bottom of the value area each session. CPR width instantly highlights whether the market is likely to trend (narrow CPR) or remain range-bound (wide CPR).

Developing CPR projects the evolving range for the current period—essential for real-time analysis and pre-market planning.

Dynamic Zone Levels (DZL):

Automatically detects and highlights clusters of pivots to reveal high-probability support/resistance zones, filtering out market “noise.”

DZL alerts notify you whenever price breaks or retests these key areas, making it easier to spot momentum trades and avoid false signals.

Key Features:

Multi-timeframe flexibility: Use with daily, weekly, monthly, yearly, or custom timeframes—even rare ones like biyearly and decennial.

Modular design: Activate or hide any system (Traditional, Camarilla, CPR, DZL) as you need.

Bilingual interface: Every setting and label is shown in both English and Arabic.

Full customization: Control visibility, color, style, and placement for every level and label.

Historical depth: Plot up to 5,000 pivot/zones back for deep analysis and backtesting.

Smart alerts: Get instant notifications on true S/R breakouts or retests (from DZL).

How to Use:

Trend Trading:

Watch for a very narrow CPR to identify potential trending days—trade in the breakout direction above/below the CPR.

Range Trading:

When CPR is wide, expect sideways movement. Fade reversals at R1/S1 or within the CPR boundaries.

Breakouts:

Use DZL alerts to capture momentum as price breaks or retests dynamic support/resistance zones.

Multi-Timeframe Confluence:

Combine CPR and pivot levels from multiple timeframes for higher-probability entries and exits.

All calculations and logic are fully open.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.