OPEN-SOURCE SCRIPT

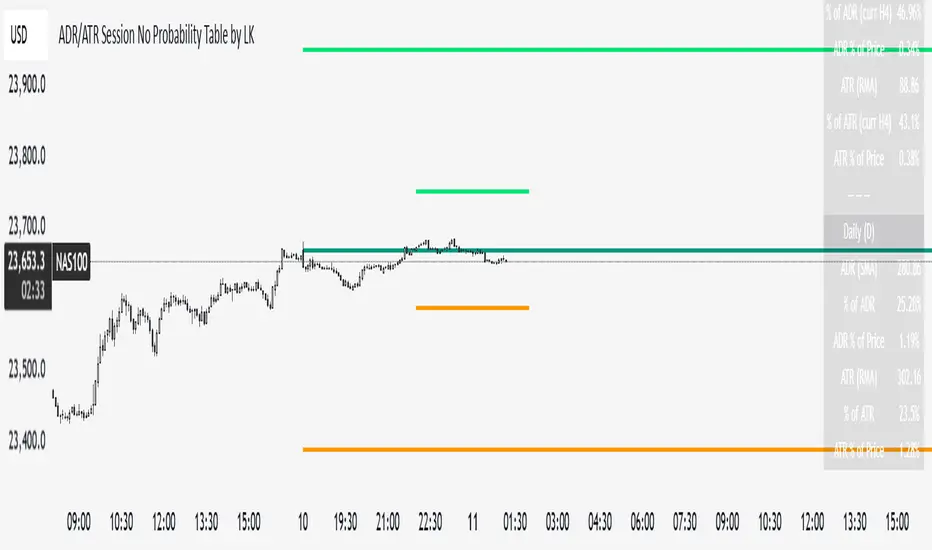

ADR/ATR Session No Probability Table by LK

Here you go—clear, English docs you can drop into your script’s description or share with teammates.

ADR/ATR Session by LK — Overview

This indicator summarizes Average Daily Range (ADR) and Average True Range (ATR) for two horizons:

• Session H4 (e.g., 06:00–13:00 on a 4‑hour chart)

• Daily (D)

It shows:

• Current ADR/ATR values (using your chosen smoothing method)

• How much of ADR/ATR today/this bar has already been consumed (% of ADR/ATR)

• ADR/ATR as a percent of price

• Optional probability blocks: likelihood that %ADR will exceed user‑defined thresholds over a lookback window

• Optional on‑chart lines for the current H4 and Daily candles: Open, ADR High, ADR Low

⸻

What the metrics mean

• ADR (H4 / D): Moving average of the bar range (high - low).

• ATR (H4 / D): Moving average of True Range (max(hi-lo, |hi-close[1]|, |lo-close[1]|)).

• % of ADR (curr H4): (H4 range of the current H4 bar) / ADR(H4) × 100. Updates live even if the current time is outside the session.

• % of ADR (Daily): (today’s intra‑day range) / ADR(D) × 100.

• % of ATR (curr H4 / Daily): TR / ATR × 100 for that horizon.

• ADR % of Price / ATR % of Price: ADR or ATR divided by current price × 100 (a quick “volatility vs. price” gauge).

Session logic (H4): ADR/ATR(H4) only update on bars that fall inside the configured session window; outside the window the values hold steady (no recalculation “bleed”).

Daily range tracking: The indicator tracks today’s high/low in real‑time and resets at the day change.

⸻

Inputs (quick reference)

Core

• Length (ADR/ATR): smoothing length for ADR/ATR (default 21).

• Wait for Higher TF Bar Close: if true, updates ADR/ATR only after the higher‑TF bar closes when using request.security.

Timeframes

• Session Timeframe (H4): default 240.

• Daily Timeframe: default D.

Session time

• Session Timezone: “Chart” (default) or a fixed timezone.

• Session Start Hour, End Hour (minutes are fixed to 0 in this version).

Smoothing methods

• H4 ADR Method / H4 ATR Method: SMA/EMA/RMA/WMA.

• Daily ADR Method / Daily ATR Method: SMA/EMA/RMA/WMA.

Table appearance

• Table BG, Table Text, Table Font Size.

Lines (optional)

• Show current H4 segments, Show current Daily segments

• Line colors for Open / ADR High / ADR Low

• Line width

Probability

• H4 Probability Lookback (bars): number of H4 bars to examine (e.g., 300).

• Daily Probability Lookback (days): number of D bars (e.g., 180).

• ADR thresholds (%): CSV list of thresholds (e.g., 25,50,55,60,65,70,75,80,85,90,95,100,125,150).

The table will show the % of lookback bars where %ADR ≥ threshold.

Tip: If you want probabilities only for session H4 bars (not every H4 bar), ask and I can add a toggle to filter by inSess.

⸻

How to read the table

H4 block

• ADR (method) / ATR (method): the session‑aware averages.

• % of ADR (curr H4): live progress of this H4 bar toward the session ADR.

• ADR % of Price: ADR(H4) relative to price.

• % of ATR (curr H4) and ATR % of Price: same idea for ATR.

H4 Probability (lookback N bars)

• Rows like “≥ 80% ADR” show the fraction (in %) of the last N H4 bars that reached at least 80% of ADR(H4).

Daily block

• Mirrors the H4 block, but for Daily.

Daily Probability (lookback M days)

• Rows like “≥ 100% ADR” show the fraction of the last M daily bars whose daily range reached at least 100% of ADR(D).

⸻

Practical usage

• Use % of ADR (curr H4 / Daily) to judge exhaustion or room left in the day/session.

E.g., if Daily %ADR is already 95%, be cautious with momentum continuation trades.

• The probability tables give a quick historical context:

If “≥ 125% ADR” is ~18%, the market rarely stretches that far; your trade sizing/targets can reflect that.

• ADR/ATR % of Price helps normalize volatility between instruments.

⸻

Troubleshooting

• If probability rows are blank: ensure lookback windows are large enough (and that the chart has enough history).

• If ADR/ATR show … (NA): usually you don’t have enough bars for the chosen length/TF yet.

• If line segments are missing: verify you’re on a chart with visible current H4/D bars and the toggles are enabled.

⸻

Notes & customization ideas

• Add a toggle to count only session bars in H4 probability.

• Add separate thresholds for H4 vs Daily.

• Let users pick minutes for session start/end if needed.

• Add alerts when %ADR crosses specified thresholds.

If you want me to bundle any of the “ideas” above into the code, say the word and I’ll ship a clean patch.

ADR/ATR Session by LK — Overview

This indicator summarizes Average Daily Range (ADR) and Average True Range (ATR) for two horizons:

• Session H4 (e.g., 06:00–13:00 on a 4‑hour chart)

• Daily (D)

It shows:

• Current ADR/ATR values (using your chosen smoothing method)

• How much of ADR/ATR today/this bar has already been consumed (% of ADR/ATR)

• ADR/ATR as a percent of price

• Optional probability blocks: likelihood that %ADR will exceed user‑defined thresholds over a lookback window

• Optional on‑chart lines for the current H4 and Daily candles: Open, ADR High, ADR Low

⸻

What the metrics mean

• ADR (H4 / D): Moving average of the bar range (high - low).

• ATR (H4 / D): Moving average of True Range (max(hi-lo, |hi-close[1]|, |lo-close[1]|)).

• % of ADR (curr H4): (H4 range of the current H4 bar) / ADR(H4) × 100. Updates live even if the current time is outside the session.

• % of ADR (Daily): (today’s intra‑day range) / ADR(D) × 100.

• % of ATR (curr H4 / Daily): TR / ATR × 100 for that horizon.

• ADR % of Price / ATR % of Price: ADR or ATR divided by current price × 100 (a quick “volatility vs. price” gauge).

Session logic (H4): ADR/ATR(H4) only update on bars that fall inside the configured session window; outside the window the values hold steady (no recalculation “bleed”).

Daily range tracking: The indicator tracks today’s high/low in real‑time and resets at the day change.

⸻

Inputs (quick reference)

Core

• Length (ADR/ATR): smoothing length for ADR/ATR (default 21).

• Wait for Higher TF Bar Close: if true, updates ADR/ATR only after the higher‑TF bar closes when using request.security.

Timeframes

• Session Timeframe (H4): default 240.

• Daily Timeframe: default D.

Session time

• Session Timezone: “Chart” (default) or a fixed timezone.

• Session Start Hour, End Hour (minutes are fixed to 0 in this version).

Smoothing methods

• H4 ADR Method / H4 ATR Method: SMA/EMA/RMA/WMA.

• Daily ADR Method / Daily ATR Method: SMA/EMA/RMA/WMA.

Table appearance

• Table BG, Table Text, Table Font Size.

Lines (optional)

• Show current H4 segments, Show current Daily segments

• Line colors for Open / ADR High / ADR Low

• Line width

Probability

• H4 Probability Lookback (bars): number of H4 bars to examine (e.g., 300).

• Daily Probability Lookback (days): number of D bars (e.g., 180).

• ADR thresholds (%): CSV list of thresholds (e.g., 25,50,55,60,65,70,75,80,85,90,95,100,125,150).

The table will show the % of lookback bars where %ADR ≥ threshold.

Tip: If you want probabilities only for session H4 bars (not every H4 bar), ask and I can add a toggle to filter by inSess.

⸻

How to read the table

H4 block

• ADR (method) / ATR (method): the session‑aware averages.

• % of ADR (curr H4): live progress of this H4 bar toward the session ADR.

• ADR % of Price: ADR(H4) relative to price.

• % of ATR (curr H4) and ATR % of Price: same idea for ATR.

H4 Probability (lookback N bars)

• Rows like “≥ 80% ADR” show the fraction (in %) of the last N H4 bars that reached at least 80% of ADR(H4).

Daily block

• Mirrors the H4 block, but for Daily.

Daily Probability (lookback M days)

• Rows like “≥ 100% ADR” show the fraction of the last M daily bars whose daily range reached at least 100% of ADR(D).

⸻

Practical usage

• Use % of ADR (curr H4 / Daily) to judge exhaustion or room left in the day/session.

E.g., if Daily %ADR is already 95%, be cautious with momentum continuation trades.

• The probability tables give a quick historical context:

If “≥ 125% ADR” is ~18%, the market rarely stretches that far; your trade sizing/targets can reflect that.

• ADR/ATR % of Price helps normalize volatility between instruments.

⸻

Troubleshooting

• If probability rows are blank: ensure lookback windows are large enough (and that the chart has enough history).

• If ADR/ATR show … (NA): usually you don’t have enough bars for the chosen length/TF yet.

• If line segments are missing: verify you’re on a chart with visible current H4/D bars and the toggles are enabled.

⸻

Notes & customization ideas

• Add a toggle to count only session bars in H4 probability.

• Add separate thresholds for H4 vs Daily.

• Let users pick minutes for session start/end if needed.

• Add alerts when %ADR crosses specified thresholds.

If you want me to bundle any of the “ideas” above into the code, say the word and I’ll ship a clean patch.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.