30 Second Futures Session Open RangeThis indicator displays 30 second opening ranges from Globex, Europe, and RTH sessions.

From the RTH session range, it also displays infinitely generating Price Targets based on a % of the opening range size.

I am retrieving the 30 second data using the new "request.security_lower_tf()" function.

The importance of these levels is based on the idea that when the market opens, algorithms establish their positions within the first 30 seconds.

These areas can also be seen as potential areas of support and resistance throughout the sessions.

Enjoy!

Futures

Failed Breakdown Detection'Failed Breakdowns' are a popular set up for long entries.

In short, the set up requires:

1) A significant low is made ('initial low')

2) Initial low is undercut with a new low

3) Price action then 'reclaims' the initial low by moving +8-10 points from the initial low

This script aims at detecting such set ups. It was coded with the ES Futures 15 minute chart in mind but may be useful on other instruments and time frames.

Business Logic:

1) Uses pivot lows to detect 'significant' initial lows

2) Uses amplitude threshold to detect a new low beneath the initial low; used /u/ben_zen script for this

3) Looks for a valid reclaim - a green candle that occurs within 10 bars of the new low

4) Price must reclaim at least 8 points for the set up to be valid

5) If a signal is detected, the initial low value (pivot low) is stored in array that prevents duplicate signals from being generated.

6) FBD Signal is plotted on the chart with "X"

7) Pivot low detection is plotted on the chart with "P" and a label

8) New lows are plotted on the chart with a blue triangle

Notes:

User input

- My preference is to use the defaults as is, but as always feel free to experiment

- Can modify pivot length but in my experience 10/10 work best for pivot lows

- New low detection - 55 bars and 0.05 amplitude work well based on visual checks of signals

- Can modify the number of points needed to reclaim a low, and the # of bars limit under which this must occur.

Alerts:

- Alerts are available for detection of new lows and detection of failed breakdowns

- Alerts are also available for these signals but only during 7:30PM-4PM EST - 'prime time' US trading hours

Limitations:

- Current version of the script only compares new lows to the most recent pivot low, does not look at anything prior to that

- Best used as a discretionary signal

Visit /u/ben_zen's Profile:

www.tradingview.com

Profile Link www.tradingview.com

Encounters Pro - Free versionThe Encounters Pro indicator is a general-purpose tool to improve the capacity of forecasting future market price moves.

This free version has one engine active and a second engine partially active between 15h and 17h UTC.

This indicator does not provide buy, sell or hold signals ; instead, it helps to determine the future direction of prices .

How to read it:

The engines must be tracked from bottom to the top. Red color is bearish or descending and green color is bullish or ascending. The upper engine (line) is the one that represents the immediate price direction, take it into consideration.

When two or more consecutive engines change, sequentially, from bottom to top, and they have, after this process, the same color, it may indicate that price is about to move in that direction. However, that is not enough, the trend must be already present or you must have a sound technical reason to validate the idea provided by the Encounters Pro indicator.

There are four examples on the image above.

Case 1 is a valid signal because the three upper engines changed from red to green, from bottom to top: firstly the third one, then the second one and, finally, the first one on top.

Case 2 would not be a valid singnal considering that the third engine was red before the first one turned green. However, it was a valid bullish signal because the fourth level was green before the second and the first.

Case 3 is not a valid signal because the first engine is green and the rest are red.

Case 4 is not a valid signal because the sequence goes from top to bottom and it is mandatory that the sequence goes from the bottom or lower engines to the ones on top.

Two engines switching color at the same time are valid. This is the only exception to the bottom to top rule.

The engines

The first one (the top one) leads the rest from the temporal perspective, but it is the weaker one. The sencond and rest of lines, to the bottom, reflect an increasing directional strength, and may represent deeper effects on market prices. You will have to carefully examine the chart, with historical data, and observe how price reacts as you spot different patterns among the engines of the Encounter Pro indicator.

On the main image above, the green arrows show a clear bullish tendency upon London Markets open time, for instance.

The slope and the engine position

The lines should be considered in terms of their slope and position. An ascending line is a bullish strength signal, even if a red color temporarily appears, specially if above the middle level of the engine. When the lines are on top, it means the engine is gauging the maximum possible bullish pressure, but if the line were falling at the same time, above the middle level, the bullish implication of that engine would be significantly lower.

Conversely, when lines are either stalling or close to the bottom, it is a signal of bearish increasing power.

mex_fundingScript for calculating Bitmex funding based on the Premium tickers Bitmex submits to Tradingview

Make sure you add the correct Bitmex Interest Base and Quote Symbols in the input settings

For example for www.bitmex.com the inputs are:

Chart ticker: XBTUSDPI8H

Input Settings

Interest Base: XBTBON8H

Interest Quote: USDBON8H

Session LiquidityThe “Session Liquidity” TradingView indicator by Infinity Trading creates dynamic horizontal lines at the high and low points of a specified time span within the trading day. This indicator gives the user control of three separate time spans so the user can dynamically see the highs and lows of their favorite daily time spans.

Purpose

This indicator is similar to my TradingView indicator “Futures Exchange Sessions 3.0”. In that indicator the user gets control of dynamic price boxes. For me, these boxes made it difficult to spot ICT’s Orderblocks. So instead of boxes I made independently controllable lines and now I can spot ICT Orderblocks and easily identify Liquidity Pools.

Inputs and Style

Everything about the three dynamic lines can but independently configured. Start & End Times, Line Color, Line Style, Line Width, Text Characters, Text Size, Text Color can all be adjusted. The high and low lines as well as their text labels can be individually toggled on or off for maximum control.

Timezone

All of the start and end times are in EST. Additionally, each time span line needs a specific start of each day. This is controlled by a setting called “Line Start Day Timezone” where the user sets a timezone that corresponds with the start time. In general if a timespan resides within a particular Session pick the corresponding timezone. If the users line fits in the Asian Session then choose Asia/Shanghai. If the line is within the London Session then choose Europe/London. And the same goes for the New York Session.

Special Notes

If the Line Start Time is within one candle of the Start Day Timezone in the Settings, then the line/box won’t display. So choose the previous timezone

Lines only display when the timeframe is <= 30 minute

Gallery

Z Score BandThis is a band based on Z Score. What is Z Score? In layman's terms it's a method of finding outliers within a sequence of numbers. It's highly effective to quantify pump and dumps in the crypto market.

The middle line is a simple Exponential Moving Average, you can configure this with whatever period you prefer. It comes default with a period of 247 to which I find suitable for my style of trading. The upper and lower bound are determined by the standard deviation you choose in the settings, it comes with a default of 1.69 although I've heard people saying 2.5 is a better number to really pinpoint outliers.

Trading with this indicator is like trading with any band based indicator. The main difference is that this indicator's sole purpose when I wrote it is to help me find shorting positions in the futures market. On the contrary though, longs are also achievable although I rarely long the futures market.

If prices hit the upper bound and get rejected, it's probably because the move was an outlier, it doesn't happen often and when it does usually it reveals crypto's nature of buying spot and hedging short in the futures market. When prices stay above the upper bound, switch to a higher timeframe until we can see that it's still have some ways upwards.

What's true about using this as a shorting tool is also true with longs. However, it might not be as effective, I'd like to be proven wrong.

Weekly Power 3Did you know there is a simple line you can place on your chart to immediately make the weeks price action more understandable? Its called the Weekly Open Line. And its the opening price of the trading week. It was created by The Inner Circle Trader (ICT) and incorporates another one of his concepts called Power 3.

The Weekly Power 3 indicator takes the idea of the Weekly Open Line and builds a suite of intelligent and dynamic tools around it that will immediately help the user to start understanding how price moves within the trading week context.

Features

Static Weekly Open Line

Intelligent Days of the Week Text

Dynamic Weekly High Line

Dynamic Weekly Low Line

Weekly High Candle Label (highest candle of the week)

Weekly Low Candle Label (lowest candle of the week)

Best Odds High of the Week Zone Line & Text

Best Odds Low of the Week Zone Line & Text

Components

The primary feature is a line that forms on the weekly open price and grows as the week progresses. Additionally, lines are created for the highest and lowest prices of the week so the weekly profile can be easily recognized. A dynamic label marks each weeks highest and lowest point. This will automatically move as prices expand throughout the week.

A very useful component of the Weekly Power 3 indicator is the Days of the Week text. Each Day of the Week text is displayed in the middle of each trading day and also the user can specify in the Settings whether to position the text at the high or low of the weeks price range. Additionally, there is a Buffer setting that allows the user to move the Days of the Week text up or down to prevent chart overlapping.

To help the user visualize the span of time with the best odds of forming the weekly highs or weekly lows, according to ICT, this indicator adds at static line and optional label into the charts future that projects the span from Tuesday’s London Open to Wednesday’s New York. Having a static line out in the future on your chart really helps to picture where price could be drawn to based solely around time of the week.

Premise

ICT says that the weekly open price is the most important level that price reacts to across the five days of a trading week. If the week profile is expected to be bullish then price many times goes below the weekly open line at the beginning of the week and above it later in the week (a.k.a Bullish Power 3). Consequently, if the week is anticipated to be a bearish week, price often times starts the week high and then goes lower throughout the week (a.k.a Bearish Power 3).

ICT always specifies that the weekly high or weekly low have the best odds of forming between the Tuesday’s London Open and Wednesday’s New York Open.

Inputs and Style

Like all scripts publish by Infinity Trading, everything in the indicator is customizable by the user. Every label, line, or text can be individually toggled ON or OFF so the user has complete control over the elements they want displayed on their chart. All of the lines can be individually adjusted by color, line style, or line width. The color and text color on the high and low of the week labels can be individually changed. The text in the chart (day of the week & best odds zones text) each have a “buffer” value. This allows the user to individually move the text up or down on the chart to declutter the chart. And lastly, the day of the week text can be positioned above or below the weeks price action and the text will dynamically move higher or lower as price expands throughout the week.

Previous weeks have all of the Weekly Power 3 markups so it's easy to study past price action and identify trends.

Gallery

View the weeks price action

View multiple weeks price action

Visualize future price action

SPY Targets to ESSPY Targets to ES is an indicator that draws lines on an ES / MES futures chart based of price targets given for SPY.

This is useful if given support/resistance levels or price targets for SPY and you like to see the converted value to ES / MES

This indicator also converts VWAP from SPY and adds it to the ES / MES chart.

Note that conversion is happening on price updates, and there are small conversion differences between ES and SPY as price moves. This is why lines are not perfectly straight. To counter this, smoothing is added which evens out the variations. Please give yourself up to 0.5-1 handle deviation from the line drawn on the futures chart.

Version 1.0 supports up to 30 price targets. More targets will be added in later version

SUPER GCOV5 MAPSCALP > MAPPING & SCALPING SUPER GCOV5 MAPSCALP indicator is built specifically for mapping/prediction measurement and fast trading i.e. scalping/intraday in the commodity market or cryptos market. It uses an indicator instrument consisting of ATR TRAILING STOP (ATR), EXPONENTIAL MOVING AVERAGE, PIVOT POINT, FIBONACCI KEY LEVEL, and LINEAR REGRESSION CHANNEL(LRC).

Rebuild of Instrument & Parameter

This indicator is also an upgraded instrument that is sourced from the previous indicator-FUTURES SCALPV2.This R&D of course makes trading activities more effective, and dynamic to increase the confidence of traders in current trading activities. The indicator has been upgraded in terms of parameters as well as additional instruments. Among them are;

1. ATR Trailing Stop

2. ATR BUY/SELL signal

3. Exponential Moving Average(EMA) – fastMA/slowMA Length

5. Breakout/breakdown signal

6. Pivot low/high level

7. Fibonacci extends & retracement

8. Linear Regression Channel(LRC)

9. Alert condition ( a dozen alerts )

> The best timeframe for entry is 3 minutes for FCPO and 15 minutes for other futures & cryptos.

> The best timeframe mapping/prediction is 1 hour & 4 hours.

>The candle/bars have been colored to make it easier for traders to see the price trends whether in bullish or bearish conditions.

Easier SOP of ENTRIES/POSITIONING:

1. entry by signal BUY/SELL after signal bar ( 2nd bar) for confirmation.

2. The best entries BUY at support(pivot low-Blue line) after price rebound then signal appears. The best buy also when the price is at lower

low pivot + fibo support level + lower trendline(LRC) + and the price went rebound.

3. The best entries SELL at resistance(pivot high-red line) after price pullback then signal appears.

The best buy also when the price is at a higher high pivot + fibo resistance level + upper trendline LRC + and the price went pullback.

4. Profit-taking areas are usually measured by support and resistance levels. Please refer to the bold line( support & resistance), fibo key level,

and trendline.

*To avoid false signals/wrong positions, you can use the EMA line as a guide and follow the trends, which are the buying weight when the price is above the 20/50 ema, and the selling weight when the price is below the 20/50 ema. EMA can be reset on the input setting.

STEPS of MAPPING/PROJECTION:

1. Use a bigger timeframe such as 4 hours or 1 hour

2. Use LRC to identify buy/sell weights when the price makes a zig-zag patent

3. Use monthly and weekly fibo levels to know support and resistance. This fibo is very important to see if the price will make an extension or

retracement based on the regression channel earlier. So here we can evaluate which area to buy/sell/take-profit/exit and the reversal of a

market price.

You can also create an ALERT CONDITION to help you get a reminder of signals and price trend changes

The original instrument has been retained but changed in terms of display & facelift features.

Hopefully, the new one will assist you in making analysis and strategy of trading activities successfully.

THIS IS NOT A BUY/SELL CALL, ONLY STUDY IDEAS AND ANALYSIS BASED ON MEASUREMENT TOOLS FOR EDUCATION AND GUIDANCE PURPOSES.PLEASE TAKE AT YOUR OWN RISK.

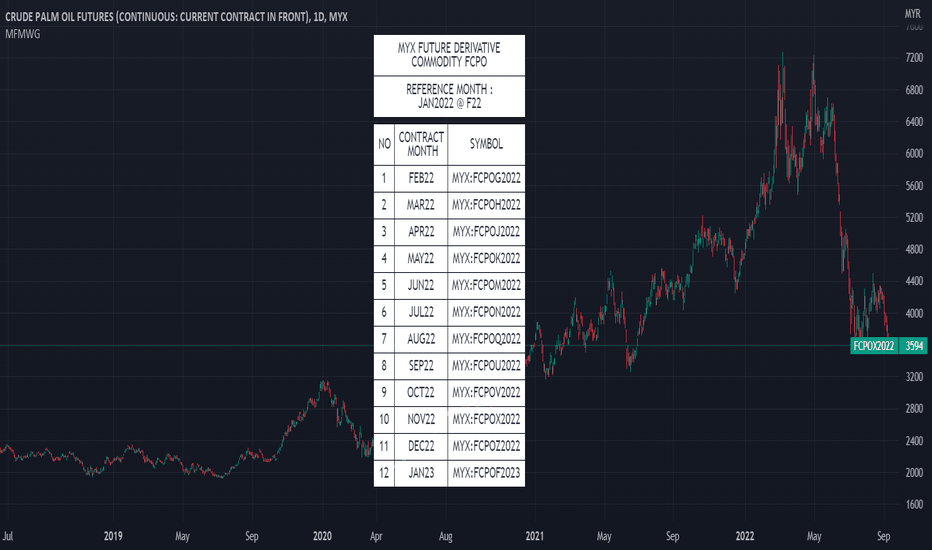

MYX Future Market Watchlist Generator█ OVERVIEW

This indicator listed all Future market in Malaysia and categorize them into Contract Month, Spread, Current Contract and Continuous Contract.

The indicator was developed to make user easier to make watchlist, suitable for beginners and experts in Malaysia Future Market.

This cover all Malaysia Future Markets as follows :

1. Commodity - FCPO, FPKO, FGLD, FTIN, FPOL and FUPO

2. Equity - FKLI and FM70

3. SSF - FCIM, FDRB, FGAM, FHAR, FINA, FMEG, FGEM, FGEN, FTEL and FTOP

4. Financial - FKB3, FMG3, FMG5 and FMGA

█ INSPIRATIONS

This indicator got inspirations from the previous indicators which I developed :

MYX Malaysia Bursa Futures Derivatives Auto Detect

FCPO Contract Month Table

█ CREDITS

I dedicated to known members in this industry especially who actively involved in Malaysia Future Market.

BURSATRENDBANDCHART

zhafrihandsome

XMODEUS

HAIDOJO_trading

datuksri

wrtech2020

FaizHebat

█ FEATURES

1. As mentioned in overview, main ability to categorize and export into watchlist.

2. Dark or light theme table including table position.

█ IMPORTANT NOTES

1. This indicator is one time usage only to generate watchlist through alert.

2. Use live chart to generate alert.

3. Set Alert Frequency to All.

4. Remove Alert once watchlist is done.

5. Usage method is similar to this video . (Sorry no audio provided)

█ EXAMPLE OF USAGE

Future's spread with base contract (MOEX)English:

Indicator calculates spread between future and it's theoretical price baased on base contract, number of days to expiration and central bank key rate.

I didn't find any means of getting base contract of security on chart so I hardcoded futures and corresponding base contracts.

Hardcoded futures are MOEX (Moscow Exchange) only and key rate used in script is Russian Central Bank's key rate from 2013, but I believe you can easily adapt it to any other key rate history. I can share source code of tiny C++20 utility for easy generation of get_rate(time) function from more human-readable date format rather then UNIX timestamp used in PineScript.

Only quarterly futures are supported. Only in "SIU2022" like notation. "SI1!" like aliases are not supported.

Русский:

Индикатор отображает спред фьючерса к его теоретической цене с учётом усыхания на каждый день.

Не нашёл, как определить базовый актив фьючерса средствами TradingView - поэтому это соответствие захардкожено вручную.

Поддерживаются только квартальные фьючерсы, только MOEX, только хардкор.

Поддерживается история ключевой ставки ЦБ РФ с 2013 года.

Используйте коды фьючерсов вида "SIU2022".

Не поддерживаются альясы вроде "SI1!", "EU1!".

EuroDollar Curve Implied 3M RateChart shows the Eurodollar futures prices latest prices from Sep 22 onwards. Display logic based on LongFiats code. This needs to be readjusted manually every 3 months whenever the front-month expires. Good tool to see where professional eurodollar futures think interest rates will be over the next few years. Check regularly as sentiment changes.

Futures Exchange Sessions 3.0Description

The ultimate conclusion to the Futures Exchange Sessions 2.0 indicator. In version 3.0 the user gets full control of the start and end times of three separate dynamic boxes and one horizontal line. If the user wants to visually keep track of killzones, lunches, or any other time span in a trading day, version 3.0 will dynamically expand and keep track of price within the time specified by the user.

Inputs and Style

Everything about the three dynamic boxes and one horizontal line can but independently configured. Color, style, border, width can all be adjusted. In the Settings each box has a text box so the user can give each one a unique name.

Timezone

All of the start and end times are in EST. Additionally, each box and line need a dependent start of each day. This is controlled by a setting where the user can specify a timezone called Start Day Timezone which would be midnight of the respective timezone. In general if a box or line resides within a particular Session pick the corresponding timezone. If the users box/line fits in the Asian Session then choose Asia/Shanghai. If the box/line is within the London Session then choose Europe/London. And the same goes for the New York Session.

Special Notes

If start time is within one period of the Start Day Timezone in the Settings, then the line/box won't display

Boxes and time lines only display when timeframe is <= 30 minute

To turn off box text label set opacity to 0%

Binance Futures Swap-Spot Basis LabelNote: This script will only work with Binance Futures Symbols

This script calculates the basis between the Binance Future and Binance Spot market for the coin you are currently viewing and paints a label on the chart which displays the percentage difference between future and spot. If the future is trading below the spot market the text will be red indicating backwardation and if the future is trading above spot, it will be green indicating contango. Please note this script will only work on Binance perps against Binance spot. The script will change based on what perp you are looking at, no inputs are required.

SPY to ES / MESSPY to ES is an indicator that converts SPY price targets to ES / MES futures price targets.

This indicator is helpful when you have price targets for SPY but trade ES or MES futures instead of SPY. It coverts the SPY price targets to ES / MES futures, and draws the SPY VWAP line on your ES / MES chart.

It supports the following lines

Bullish Above

Bearish Below

Long PT1

Long PT2

Long PT3

Short PT1

Short PT2

Short PT3

It also converts the SPY VWAP to it's current ES / MES value.

Note: The conversion do not work during pre and after market and the lines are only correct during market hours.

Binance Big Open Interest Delta Change v2 Note: This script will only work properly with Binance Futures symbols.

This script simply looks at the open interest for the symbol you are currently viewing and determines if a large change in open interest has occurred, which triggers a background color alert.

It does this by comparing the absolute value of the range of the current open interest bar with a simple average (length set by user) of the past x range. The user also determines what is considered a 'large' change in open interest by setting a multiplier with which the current range must exceed compared to the average range in order to trigger an alert.

If the change in open interest is an increase in OI, the alert is blue, and if the change in open interest is a decrease, the alert is orange.

The open interest ticker that is used for calculation is derived by adding the current ticker and "_OI" so that it auto changes each time you switch to a new Binance futures contract.

Candle Level of VWAP [By MUQWISHI]The " Price of Volume Weighted Average Price " (PVWAP) indicator calculates the VWAP standard deviation of bar price.

Features:

1. Ability to smooth the "Price of Volume Weighted Average Price" line.

2. Ability to choose the anchor period (timeframes).

Let me know if you have any questions.

Thanks.

Crude Oil: Backwardation Vs ContangoCrude Oil, CL

Plots Futures Curve: Futures contract prices over the next 3.5 years; to easily visualize Backwardation Vs Contango(carrying charge) markets.

Carrying charge (contract prices increasing into the future) = normal, representing the costs of carrying/storage of a commodity. When this is flipped to Backwardation(As the above; contract prices decreasing into the future): it's a bullish sign: Buyers want this commodity, and they want it NOW.

Note: indicator does not map to time axis in the same way as price; it simply plots the progression of contract months out into the future; left to right; so timeframe DOESN'T MATTER for this plot

TO UPDATE (every year or so): in REQUEST CONTRACTS section, delete old contracts (top) and add new ones (bottom). Then in PLOTTING section, Delete old contract labels (bottom); add new contract labels (top); adjust the X in 'bar_index-(X+_historical)' numbers accordingly

This is one of several similar Futures Curve indicators: Meats | Metals | Grains | VIX | Crude Oil

If you want to build from this; to work on other commodities; be aware that Tradingview limits the number of contract calls to 40 (hence the multiple indicators)

Tips:

-Right click and reset chart if you can't see the plot; or if you have trouble with the scaling.

-Right click and add to new scale if you prefer this not to overlay directly on price. Or move to new pane below.

-If this takes too long to load (due to so many security calls); comment out the more distant future half of the contracts; and their respective labels. Or comment out every other contract and every other label if you prefer.

--Added historical input: input days back in time; to see the historical shape of the Futures curve via selecting 'days back' snapshot

updated 20th June 2022

© twingall

VIX: Backwardation Vs ContangoVIX: Backwardation Vs Contango

Quickly visualize Contango vs Backwardation in the S&P 500 Volatility Index by plotting the prices of the futures contracts over the next 9 months

Note: indicator does not map to time axis in the same way as price; it simply plots the progression of contract months out into the future; left to right; so timeframe DOESN'T MATTER for this plot

TO UPDATE(every few months recommended): in REQUEST CONTRACTS section, delete old contracts (top) and add new ones (bottom). Then in PLOTTING section, Delete old contract labels (bottom); add new contract labels (top); adjust the X in 'bar_index-(X+_historical)' numbers accordingly

This is one of several similar indicators: Meats | Metals | Grains | VIX

Tips:

-Right click and reset chart if you can't see the plot; or if you have trouble with the scaling.

-Right click and pin to Scale A to plot on the same scale as price

--Added historical input: input days back in time; to see the historical shape of the Futures curve via selecting 'days back' snapshot

updated 15th June 2022

© twingall

unrealized pnl for btcusdt (or any linear perp)haven't seen this published, so i made it to watch my position while looking at my TV chart

right now, code works for just linear contracts (base currency margined, not quote currency) and i will have to add the code for inverse perps soon in the next update

very simple tool... not much to explain

just enter

long or short

average entry

position size (designed for btc since i'm a maxi, but entering the amount of any base currency should work)

take profit

then you'll get candles for your position and a line for your TP (and its amount)

next version will add a feature to plot inverse perps

(sorry TV if this doesn't abide by the House Rules exactly)

Metals:Backwardation/ContangoMETALS: Gold , Silver , Copper ( GC , SI, HG)

Quickly visualize carrying charge market vs backwardized market by comparing the price of the next 2 years of futures contracts.

Carrying charge (contract prices increasing into the future) = normal, representing the costs of carrying/storage of a commodity. When this is flipped to Backwardation (contract prices decreasing into the future): its a bullish sign: Buyers want this commodity, and they want it NOW.

Note: indicator does not map to time axis in the same way as price; it simply plots the progression of contract months out into the future; left to right; so timeframe DOESN'T MATTER for this plot

There's likely some more efficient way to write this; e.g. when plotting for Gold ( GC ); 21 of the security requests are redundant; but they are still made; and can make this slower to load

TO UPDATE(once a year will do): in REQUEST CONTRACTS section, delete old contracts (top) and add new ones (bottom). Then in PLOTTING section, Delete old contract labels (bottom); add new contract labels (top); adjust the X in 'bar_index-(X+_historical)' numbers accordingly

This is one of three similar indicators: Meats | Metals | Grains

-If you want to build from this; to work on other commodities ; be aware that Tradingview limits the number of contract calls to 40 (hence the 3 seperate indicators)

Tips:

-Right click and reset chart if you can't see the plot; or if you have trouble with the scaling.

-Right click and add to new scale if you prefer this not to overlay directly on price. Or move to new pane below.

--Added historical input: input days back in time; to see the historical shape of the Futures curve via selecting 'days back' snapshot

updated 15th June 2022

© twingall

Grains:Backwardation/ContangoGRAINS: Wheat , Soybeans , Corn (ZW, ZS, ZC )

Quickly visualize carrying charge market vs backwardized market by comparing the price of the next 2 years of futures contracts.

Carrying charge (contract prices increasing into the future) = normal, representing the costs of carrying/storage of a commodity. When this is flipped to Backwardation (contract prices decreasing into the future): its a bullish sign: Buyers want this commodity, and they want it NOW.

The above chart shows a nice example of backwardation.

Note: indicator does not map to time axis in the same way as price; it simply plots the progression of contract months out into the future; left to right; so timeframe DOESN'T MATTER for this plot

There's likely some more efficient way to write this; e.g. when plotting for Wheat (ZW); 15 of the security requests are redundant; but they are still made; and can make this slower to load

TO UPDATE(once a year will do): in REQUEST CONTRACTS section, delete old contracts (top) and add new ones (bottom). Then in PLOTTING section, Delete old contract labels (bottom); add new contract labels (top); adjust the X in 'bar_index-(X+_historical)' numbers accordingly

This is one of three similar indicators: Meats | Metals | Grains

-If you want to build from this; to work on other commodities ; be aware that Tradingview limits the number of contract calls to 40 (hence the 3 seperate indicators)

Tips:

-Right click and reset chart if you can't see the plot; or if you have trouble with the scaling.

-Right click and add to new scale if you prefer this not to overlay directly on price. Or move to new pane below.

--Added historical input: input days back in time; to see the historical shape of the Futures curve via selecting 'days back' snapshot

updated 15th June 2022

© twingall

Meats: Backwardation/CantangoMEATS: Live Cattle , Feeder Cattle, Lean Hogs (LE, GF , HE)

Quickly visualize carrying charge market vs backwardized market by comparing the price of the next 2 years of futures contracts.

Carrying charge (contract prices increasing into the future) = normal, representing the costs of carrying/storage of a commodity. When this is flipped to Backwardation (contract prices decreasing into the future): its a bullish sign: Buyers want this commodity, and they want it NOW.

Note: indicator does NOT map to time axis in the same way as price; it simply plots the progression of contract months out into the future; left to right; so timeframe DOESN'T MATTER for this plot

There's likely some more efficient way to write this; e.g. when plotting for Live Cattle (LE); 8 of the security requests are redundant; but they are still made; and can make this slower to load

TO UPDATE(once a year will do): in REQUEST CONTRACTS section, delete old contracts (top) and add new ones (bottom). Then in PLOTTING section, Delete old contract labels (bottom); add new contract labels (top); adjust the X in 'bar_index-(X+_historical)' numbers accordingly

This is one of three similar indicators: Meats | Metals | Grains

-If you want to build from this; to work on other commodities ; be aware that Tradingview limits the number of contract calls to 40 (hence the 3 seperate indicators)

Tips:

-Right click and reset chart if you can't see the plot; or if you have trouble with the scaling.

-Right click and add to new scale if you prefer this not to overlay directly on price. Or move to new pane below.

--Added historical input: input days back in time; to see the historical shape of the Futures curve via selecting 'days back' snapshot

updated 15th June 2022

© twingall