Why Backtest Trading Strategies?

The idea of strategy backtesting is to view the performance of a trading strategy in past circumstances. This is an important point in building a profitable trading system. There are various techniques to change the performance of a strategy that affects the final results. A backtest shows the overall profitability of a trading method and compares different trading parameters to find out what may work better than others.

Backtesting on historical data increases trader's confidence and reduces emotional trading, because the series of losing and profitable trades is already known. If a trader has not backtested a strategy, he or she cannot know if the strategy is really profitable. It may be that the strategy used by the trader does not work in the new market conditions, thus destroying the trading psychology. Therefore, if the backtest gives unprofitable results, it is necessary to either change the settings or abandon the strategy.

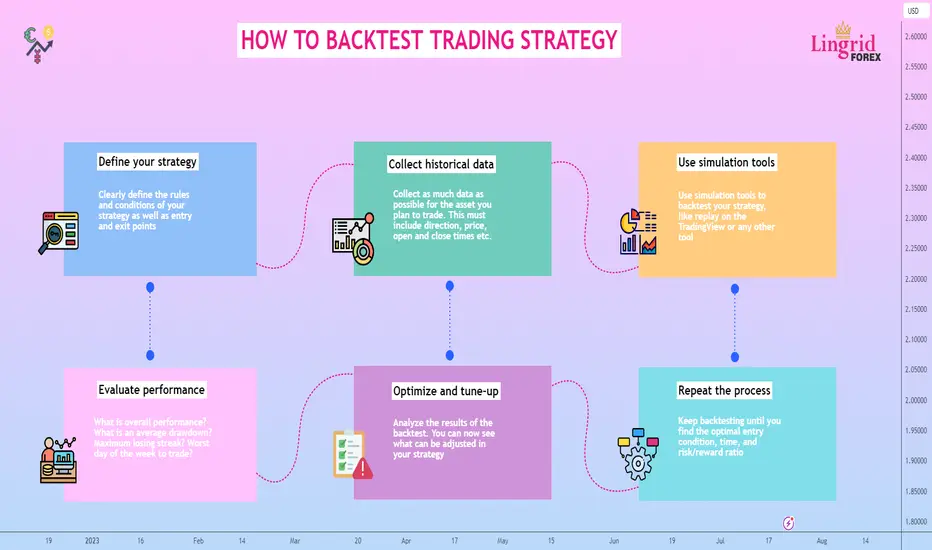

Steps of Manual Backtesting:

1. Identify Your Trading Strategy: Clearly define the rules and conditions of your strategy as well as entry and exit points.

2. Historical Data: Collect as much data as possible for the asset you plan to trade. This must include direction, price, open and close times, stop losses, market conditions, etc.

3. Set Up Your Backtesting Tool: Once you have the data, you will need to set up the backtesting tool. Use simulation tools to backtest your strategy, like replay on the TradingView or any other tool.

4. Evaluate strategy performance. Evaluate your collected data. What is overall performance? What is an average drawdown? Maximum losing streak? Worst day of the week to trade? What session bring most profit or loss?

5. Optimize and tune up. Analyze the results of the backtest. You can now see what can be adjusted in your strategy. For example, it could be certain hours of the day that bring the most losses, and once you eliminate these hours, your strategy's performance will significantly improve.

6. Do it again. Keep backtesting until you find the optimal entry condition, time, and risk/reward ratio.

Tips For Testing Strategies

Conclusion

Backtesting is a key moment in trading. It is almost one of the main tools that helps traders with trading psychology. Most traders open impulsive trades that lead to capital loss because they do not know when and where to open trades. If you have a trading plan but it does not include a backtested strategy, this plan is basically worthless. In fact, most successful traders spend more time backtesting than trading the real markets. Once you have a backtested strategy, you can now build rules around it and create a solid trading plan. And you are one step closer to being a consistently profitable trader.

The idea of strategy backtesting is to view the performance of a trading strategy in past circumstances. This is an important point in building a profitable trading system. There are various techniques to change the performance of a strategy that affects the final results. A backtest shows the overall profitability of a trading method and compares different trading parameters to find out what may work better than others.

Backtesting on historical data increases trader's confidence and reduces emotional trading, because the series of losing and profitable trades is already known. If a trader has not backtested a strategy, he or she cannot know if the strategy is really profitable. It may be that the strategy used by the trader does not work in the new market conditions, thus destroying the trading psychology. Therefore, if the backtest gives unprofitable results, it is necessary to either change the settings or abandon the strategy.

Steps of Manual Backtesting:

1. Identify Your Trading Strategy: Clearly define the rules and conditions of your strategy as well as entry and exit points.

2. Historical Data: Collect as much data as possible for the asset you plan to trade. This must include direction, price, open and close times, stop losses, market conditions, etc.

3. Set Up Your Backtesting Tool: Once you have the data, you will need to set up the backtesting tool. Use simulation tools to backtest your strategy, like replay on the TradingView or any other tool.

4. Evaluate strategy performance. Evaluate your collected data. What is overall performance? What is an average drawdown? Maximum losing streak? Worst day of the week to trade? What session bring most profit or loss?

5. Optimize and tune up. Analyze the results of the backtest. You can now see what can be adjusted in your strategy. For example, it could be certain hours of the day that bring the most losses, and once you eliminate these hours, your strategy's performance will significantly improve.

6. Do it again. Keep backtesting until you find the optimal entry condition, time, and risk/reward ratio.

Tips For Testing Strategies

- Be realistic, don't look only for profitable trades. On the contrary, look for as many bad trades as possible to get the reason for losses and to avoid them in the future.

- Evaluate the result, taking into account a large number of trades.

- The minimum number of trades is 100, or 5 years of data. What comes first.

- Test your strategy under different market conditions. In trending market and a flat market.

- Don't forget that after the backtest, you should switch to the forward test.

Conclusion

Backtesting is a key moment in trading. It is almost one of the main tools that helps traders with trading psychology. Most traders open impulsive trades that lead to capital loss because they do not know when and where to open trades. If you have a trading plan but it does not include a backtested strategy, this plan is basically worthless. In fact, most successful traders spend more time backtesting than trading the real markets. Once you have a backtested strategy, you can now build rules around it and create a solid trading plan. And you are one step closer to being a consistently profitable trader.

💰FREE FOREX signals in Telegram: bit.ly/3F4mrMi

🚀FREE CRYPTO signals in Telegram: t.me/cryptolingrid

🌎WebSite: lingrid.org

🚀FREE CRYPTO signals in Telegram: t.me/cryptolingrid

🌎WebSite: lingrid.org

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.

💰FREE FOREX signals in Telegram: bit.ly/3F4mrMi

🚀FREE CRYPTO signals in Telegram: t.me/cryptolingrid

🌎WebSite: lingrid.org

🚀FREE CRYPTO signals in Telegram: t.me/cryptolingrid

🌎WebSite: lingrid.org

Thông báo miễn trừ trách nhiệm

Thông tin và ấn phẩm không có nghĩa là và không cấu thành, tài chính, đầu tư, kinh doanh, hoặc các loại lời khuyên hoặc khuyến nghị khác được cung cấp hoặc xác nhận bởi TradingView. Đọc thêm trong Điều khoản sử dụng.