Good evening traders, Brian here with a fresh look at gold on the 2-hour chart.

Price is compressing in a broad sideways range, building energy for the next leg – the break from this structure will set the tone for the coming sessions.

Fundamental analysis

The core driver remains the Fed’s December decision. The market is effectively split on whether we see a cut or a delay:

A camp of institutions argues that rising unemployment and softer data could still justify a 25-basis-point cut in December, keeping pressure on the dollar and supporting gold on dips.

Others point out that the Fed is short of clean, up-to-date data and may prefer to wait until next year before committing to an easing cycle.

As a result, pricing for a December cut is roughly “fifty–fifty” and highly sensitive to the next run of labour-market and activity data.

In short: the macro backdrop is undecided, so intraday direction will be driven mainly by levels and liquidity until the next data catalyst hits.

Technical analysis

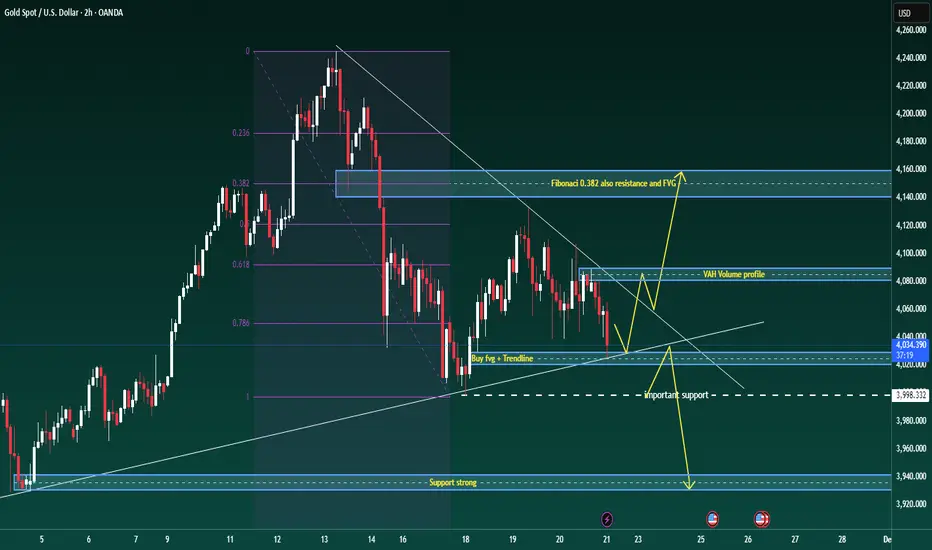

On the H2 chart, gold is in a broad consolidation after the recent sell-off:

Price is trading inside a descending structure, repeatedly respecting the short-term trendline from the recent high.

The Fibonacci retracement of the latest impulse shows the 0.382 level lining up with a prior fair-value gap and horizontal resistance – this forms a key rejection zone overhead.

Below price, there is a confluence of support where the rising trendline meets a small bullish FVG around 4027–4029, followed by a more important horizontal support band near 3998.

The volume profile highlights a Value Area High (VAH) around 4075–4080, which is likely to act as a reaction zone if price rotates back into it.

Until we break convincingly out of this structure, I treat it as a large accumulation range with a slight downside bias: sellers are still defending lower highs, but buyers are stepping in aggressively at trendline support.

Key levels

Resistance zones:

4080–4085 (VAH / short-term supply)

4135–4145 (Fibonacci 0.382 + FVG + structural resistance)

Support zones:

4027–4029 (trendline + FVG confluence buy area)

3995–4000 (important horizontal support)

3940 region (deeper support if the range finally breaks down)

Trade scenarios

1. Primary long – buy the trendline/FVG confluence

Entry: 4027–4029

Stop: 4023

Targets: 4035 – 4050 – 4068 – 4080

Idea: look for price to react at the rising trendline where it overlaps with the small FVG. A clean rejection candle or shift in intraday order flow from that zone sets up a rotation back towards the VAH and potentially the upper boundary of the range.

2. Break-and-retest short – if the trendline fails

Trigger: clear H1/H2 close below the rising trendline and the 4027 area

Plan: wait for price to retest the underside of the broken trendline / prior support

Entry: on rejection of that retest

Initial targets: 4000, then 3940 if momentum accelerates

This scenario treats any breakdown as a structural shift, using the retest as a lower-risk point to join the move rather than chasing the first leg.

3. Intraday scalp zones

These are discretionary, short-term opportunities for active traders:

Reaction sells: around 4085, and higher up if we spike into the 4135–4145 resistance band. Look for exhaustion or rejection patterns back into the range (potential targets 4060 then 4033).

Reaction buys: into 3998–4000 if we see a liquidity sweep below the current range, with tight stops and quick profit-taking back towards the mid-range.

Price is compressing in a broad sideways range, building energy for the next leg – the break from this structure will set the tone for the coming sessions.

Fundamental analysis

The core driver remains the Fed’s December decision. The market is effectively split on whether we see a cut or a delay:

A camp of institutions argues that rising unemployment and softer data could still justify a 25-basis-point cut in December, keeping pressure on the dollar and supporting gold on dips.

Others point out that the Fed is short of clean, up-to-date data and may prefer to wait until next year before committing to an easing cycle.

As a result, pricing for a December cut is roughly “fifty–fifty” and highly sensitive to the next run of labour-market and activity data.

In short: the macro backdrop is undecided, so intraday direction will be driven mainly by levels and liquidity until the next data catalyst hits.

Technical analysis

On the H2 chart, gold is in a broad consolidation after the recent sell-off:

Price is trading inside a descending structure, repeatedly respecting the short-term trendline from the recent high.

The Fibonacci retracement of the latest impulse shows the 0.382 level lining up with a prior fair-value gap and horizontal resistance – this forms a key rejection zone overhead.

Below price, there is a confluence of support where the rising trendline meets a small bullish FVG around 4027–4029, followed by a more important horizontal support band near 3998.

The volume profile highlights a Value Area High (VAH) around 4075–4080, which is likely to act as a reaction zone if price rotates back into it.

Until we break convincingly out of this structure, I treat it as a large accumulation range with a slight downside bias: sellers are still defending lower highs, but buyers are stepping in aggressively at trendline support.

Key levels

Resistance zones:

4080–4085 (VAH / short-term supply)

4135–4145 (Fibonacci 0.382 + FVG + structural resistance)

Support zones:

4027–4029 (trendline + FVG confluence buy area)

3995–4000 (important horizontal support)

3940 region (deeper support if the range finally breaks down)

Trade scenarios

1. Primary long – buy the trendline/FVG confluence

Entry: 4027–4029

Stop: 4023

Targets: 4035 – 4050 – 4068 – 4080

Idea: look for price to react at the rising trendline where it overlaps with the small FVG. A clean rejection candle or shift in intraday order flow from that zone sets up a rotation back towards the VAH and potentially the upper boundary of the range.

2. Break-and-retest short – if the trendline fails

Trigger: clear H1/H2 close below the rising trendline and the 4027 area

Plan: wait for price to retest the underside of the broken trendline / prior support

Entry: on rejection of that retest

Initial targets: 4000, then 3940 if momentum accelerates

This scenario treats any breakdown as a structural shift, using the retest as a lower-risk point to join the move rather than chasing the first leg.

3. Intraday scalp zones

These are discretionary, short-term opportunities for active traders:

Reaction sells: around 4085, and higher up if we spike into the 4135–4145 resistance band. Look for exhaustion or rejection patterns back into the range (potential targets 4060 then 4033).

Reaction buys: into 3998–4000 if we see a liquidity sweep below the current range, with tight stops and quick profit-taking back towards the mid-range.

🔥 BrianLionCapital – Where Top Traders Unite

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+-C-Pc_SOCPRjMmQ9

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+-C-Pc_SOCPRjMmQ9

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

🔥 BrianLionCapital – Where Top Traders Unite

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+-C-Pc_SOCPRjMmQ9

✅ Accurate signals & exclusive analysis: 10–15 signals daily with continuous market insights

⏳ Every minute you hesitate is a winning opportunity slipping away!

t.me/+-C-Pc_SOCPRjMmQ9

Bài đăng liên quan

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.