OPEN-SOURCE SCRIPT

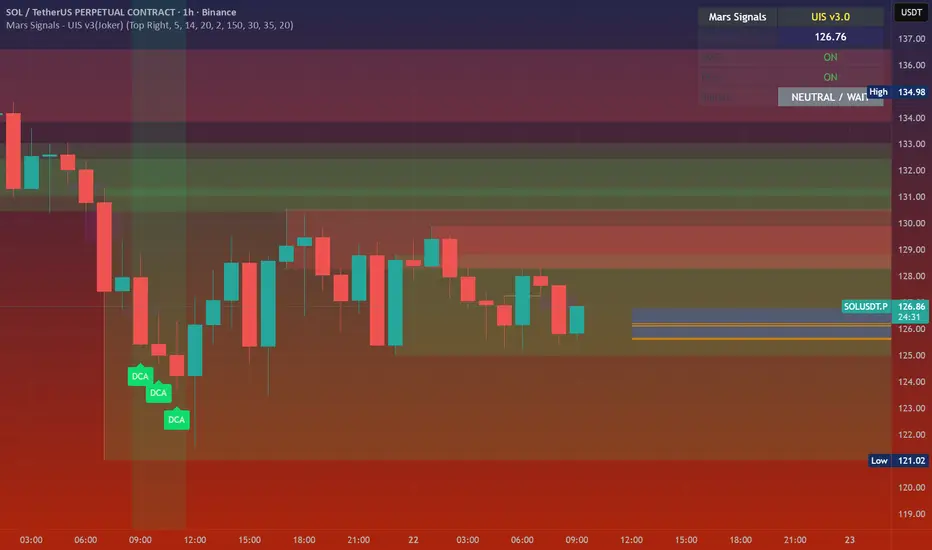

Mars Signals - Ultimate Institutional Suite v3.0(Joker)

Comprehensive Trading Manual

Mars Signals – Ultimate Institutional Suite v3.0 (Joker)

## Chapter 1 – Philosophy & System Architecture

This script is not a simple “buy/sell” indicator.

Mars Signals – UIS v3.0 (Joker) is designed as an institutional-style analytical assistant that layers several methodologies into a single, coherent framework.

The system is built on four core pillars:

1. Smart Money Concepts (SMC)

2. Smart DCA Strategy

3. Volume Profile (Visible Range Simulation)

4. Wyckoff Helper – Spring

All four pillars feed into a Confluence Engine (Scoring System).

The final output is presented in the Dashboard, with a clear, human-readable signal:

This allows the trader to see *how many* and *which* layers of the system support a bullish or bearish bias at any given time.

## Chapter 2 – Settings Overview

### 2.1 General & Dashboard Group

- Show Dashboard Panel (`show_dash`)

Turns the dashboard table in the corner of the chart ON/OFF.

- Show Signal Recommendation (`show_rec`)

- Dashboard Position (`dash_pos`)

Determines where the dashboard appears on the chart:

### 2.2 Smart Money (SMC) Group

- Enable SMC Strategy (`show_smc`)

Globally enables or disables the Order Block and FVG logic.

- Order Block Pivot Lookback (`ob_period`)

Main parameter for detecting key pivot highs/lows (swing points).

- Default value: 5

- Concept:

A bar is considered a pivot low if its low is lower than the lows of the previous 5 and the next 5 bars.

Similarly, a pivot high has a high higher than the previous 5 and the next 5 bars.

These pivots are used as anchors for Order Blocks.

- Increasing `ob_period`:

- Fewer levels.

- But levels tend to be more significant and reliable.

- In highly volatile markets (major news, war events, FOMC, etc.),

using values 7–10 is recommended to filter out weak levels.

- Show Fair Value Gaps (`show_fvg`)

Enables/disables the drawing of FVG zones (imbalances).

- Bullish OB Color (`c_ob_bull`)

- Color of Bullish Order Blocks (Demand Zones).

- Default: semi-transparent green (transparency ≈ 80).

- Bearish OB Color (`c_ob_bear`)

- Color of Bearish Order Blocks (Supply Zones).

- Default: semi-transparent red.

- Bullish FVG Color (`c_fvg_bull`)

- Color of Bullish FVG (upward imbalance), typically yellow.

- Bearish FVG Color (`c_fvg_bear`)

- Color of Bearish FVG (downward imbalance), typically purple.

### 2.3 Smart DCA Strategy Group

- Enable DCA Zones (`show_dca`)

Enables the Smart DCA logic and visual labels.

- RSI Length (`rsi_len`)

Lookback period for RSI (default: 14).

- Shorter → more sensitive, more noise.

- Longer → fewer signals, higher reliability.

- Bollinger Bands Length (`bb_len`)

Moving average period for Bollinger Bands (default: 20).

- BB Multiplier (`bb_mult`)

Standard deviation multiplier for Bollinger Bands (default: 2.0).

- For extremely volatile markets, values like 2.5–3.0 can be used so that only extreme deviations trigger a DCA signal.

### 2.4 Volume Profile (Visible Range Sim) Group

- Show Volume Profile (`show_vp`)

Enables the simulated Volume Profile bars on the right side of the chart.

- Volume Lookback Bars (`vp_lookback`)

Number of bars used to compute the Volume Profile (default: 150).

- Higher values → broader historical context, heavier computation.

- Row Count (`vp_rows`)

Number of vertical price segments (rows) to divide the total price range into (default: 30).

- Width (%) (`vp_width`)

Relative width of each volume bar as a percentage.

In the code, bar widths are scaled relative to the row with the maximum volume.

> Technical note: Volume Profile calculations are executed only on the last bar (`barstate.islast`) to keep the script performant even on higher timeframes.

### 2.5 Wyckoff Helper Group

- Show Wyckoff Events (`show_wyc`)

Enables detection and plotting of Wyckoff Spring events.

- Volume MA Length (`vol_ma_len`)

Length of the moving average on volume.

A bar is considered to have Ultra Volume if its volume is more than 2× the volume MA.

## Chapter 3 – Smart Money Strategy (Order Blocks & FVG)

### 3.1 What Is an Order Block?

An Order Block (OB) represents the footprint of large institutional orders:

- Bullish Order Block (Demand Zone)

The last selling region (bearish candle/cluster) before a strong upward move.

- Bearish Order Block (Supply Zone)

The last buying region (bullish candle/cluster) before a strong downward move.

Institutions and large players place heavy orders in these regions. Typical price behavior:

- Price moves away from the zone.

- Later returns to the same zone to fill unfilled orders.

- Then continues the larger trend.

In the script:

- If `pl` (pivot low) forms → a Bullish OB is created.

- If `ph` (pivot high) forms → a Bearish OB is created.

The box is drawn:

- From `bar_index[ob_period]` to `bar_index`.

- Between `low[ob_period]` and `high[ob_period]`.

- `extend=extend.right` extends the OB into the future, so it acts as a dynamic support/resistance zone.

- Only the last 4 OB boxes are kept to avoid clutter.

### 3.2 Order Block Color Guide

- Semi-transparent Green (`c_ob_bull`)

- Represents a Bullish Order Block (Demand Zone).

- Interpretation: a price region with a high probability of bullish reaction.

- Semi-transparent Red (`c_ob_bear`)

- Represents a Bearish Order Block (Supply Zone).

- Interpretation: a price region with a high probability of bearish reaction.

Overlap (Multiple OBs in the Same Area)

When two or more Order Blocks overlap:

- The shared area appears visually denser/stronger.

- This suggests higher order density.

- Such zones can be treated as high-priority levels for entries, exits, and stop-loss placement.

### 3.3 Demand/Supply Logic in the Scoring Engine

Pine Script®

- If current price is near the lowest lows of the last 20 bars, it is considered in a Demand Zone → positive impact on score.

- If current price is near the highest highs of the last 20 bars, it is considered in a Supply Zone → negative impact on score.

This logic complements Order Blocks and helps the Dashboard distinguish whether:

- Market is currently in a statistically cheap (long-friendly) area, or

- In a statistically expensive (short-friendly) area.

### 3.4 Fair Value Gaps (FVG)

#### Concept

When the market moves aggressively:

- Some price levels are skipped and never traded.

- A gap between wicks/shadows of consecutive candles appears.

- These regions are called Fair Value Gaps (FVGs) or Imbalances.

The market generally “dislikes” imbalance and often:

- Returns to these zones in the future.

- Fills the gap (rebalance).

- Then resumes its dominant direction.

#### Implementation in the Code

Bullish FVG (Yellow)

Pine Script®

Core condition:

`low > high[2]` → the current low is above the high of two bars ago; the space between them is an untraded gap.

Bearish FVG (Purple)

fvg_bear_cond = show_smc and show_fvg and high < low[2] and close[1] < low[2]

if fvg_bear_cond

box.new(bar_index[2], low[2], bar_index, high, ...)

Core condition:

`high < low[2]` → the current high is below the low of two bars ago; again a price gap exists.

#### FVG Color Guide

- Transparent Yellow (`c_fvg_bull`) – Bullish FVG

Often acts like a magnet for price:

- Price tends to retrace into this zone,

- Fill the imbalance,

- And then continue higher.

- Transparent Purple (`c_fvg_bear`) – Bearish FVG

Price tends to:

- Retrace upward into the purple area,

- Fill the imbalance,

- And then resume downward movement.

#### Trading with FVGs

- FVGs are *not* standalone entry signals.

They are best used as:

- Targets (take-profit zones), or

- Reaction areas where you expect a pause or reversal.

Examples:

- If you are long, a bearish FVG above is often an excellent take-profit zone.

- If you are short, a bullish FVG below is often a good cover/exit zone.

### 3.5 Core SMC Trading Templates

#### Reversal Long

1. Price trades down into a green Order Block (Demand Zone).

2. A bullish confirmation candle (Close > Open) forms inside or just above the OB.

3. If this zone is close to or aligned with a bullish FVG (yellow), the signal is reinforced.

4. Entry:

- At the close of the confirmation candle, or

- Using a limit order near the upper boundary of the OB.

5. Stop-loss:

- Slightly below the OB.

- If the OB is broken decisively and price consolidates below it, the zone loses validity.

6. Targets:

- The next FVG,

- Or the next red Order Block (Supply Zone) above.

#### Reversal Short

The mirror scenario:

- Price rallies into a red Order Block (Supply).

- A bearish confirmation candle forms (Close < Open).

- FVG/premium structure above can act as a confluence.

- Stop-loss goes above the OB.

- Targets: lower FVGs or subsequent green OBs below.

## Chapter 4 – Smart DCA Strategy (RSI + Bollinger Bands)

### 4.1 Smart DCA Concept

- Classic DCA = buying at fixed time intervals regardless of price.

- Smart DCA = scaling in only when:

- Price is statistically cheaper than usual, and

- The market is in a clear oversold condition.

Code logic:

Pine Script®

Conditions:

- DCA Buy – Smart Scale-In Zone

- RSI < 30 → oversold.

- Close < lower Bollinger Band → price has broken below its typical volatility envelope.

- DCA Sell – Overbought/Distribution Zone

- RSI > 70 → overbought.

- Close > upper Bollinger Band → price is extended far above the mean.

### 4.2 Visual Representation on the Chart

- Green “DCA” Label Below Candle

- Shape: `labelup`.

- Color: lime background, white text.

- Meaning: statistically attractive level for laddered spot entries or short exits.

- Red “SELL” Label Above Candle

- Warning that the market is in an extended, overbought condition.

- Suitable for profit-taking on longs or considering short entries (with proper confluence and risk management).

- Light Green Background (`bgcolor`)

- When `dca_buy` is true, the candle background turns very light green (high transparency).

- This helps visually identify DCA Zones across the chart at a glance.

### 4.3 Practical Use in Trading

#### Spot Trading

Used to build a better average entry price:

- Every time a DCA label appears, allocate a fixed portion of capital (e.g., 2–5%).

- Combining DCA signals with:

- Green OBs (Demand Zones), and/or

- The Volume Profile POC

makes the zone structurally more important.

#### Futures Trading

- Longs

- Use DCA Buy signals as low-risk zones for opening or adding to longs when:

- Price is inside a green OB, or

- The Dashboard already leans LONG.

- Shorts

- Use DCA Sell signals as:

- Exit zones for longs, or

- Areas to initiate shorts with stops above structural highs.

## Chapter 5 – Volume Profile (Visible Range Simulation)

### 5.1 Concept

Traditional volume (histogram under the chart) shows volume over time.

Volume Profile shows volume by price level:

- At which prices has the highest trading activity occurred?

- Where did buyers and sellers agree the most (High Volume Nodes – HVNs)?

- Where did price move quickly due to low participation (Low Volume Nodes – LVNs)?

### 5.2 Implementation in the Script

Executed only when `show_vp` is enabled and on the last bar:

1. The last `vp_lookback` bars (default 150) are processed.

2. The minimum low and maximum high over this window define the price range.

3. This price range is divided into `vp_rows` segments (e.g., 30 rows).

4. For each row:

- All bars are scanned.

- If the mid-price `(high[j] + low[j]) / 2` falls inside a row, that bar’s volume is added to the row total.

5. The row with the greatest volume is stored as `max_vol_idx` (the POC row).

6. For each row, a volume box is drawn on the right side of the chart.

### 5.3 Color Scheme

- Semi-transparent Orange

- The row with the maximum volume – the Point of Control (POC).

- Represents the strongest support/resistance level from a volume perspective.

- Semi-transparent Blue

- Other volume rows.

- The taller the bar → the higher the volume → the stronger the interest at that price band.

### 5.4 Trading Applications

- If price is above POC and retraces back into it:

→ POC often acts as support, suitable for long setups.

- If price is below POC and rallies into it:

→ POC often acts as resistance, suitable for short setups or profit-taking.

HVNs (Tall Blue Bars)

- Represent areas of equilibrium where the market has spent time and traded heavily.

- Price tends to consolidate here before choosing a direction.

LVNs (Short or Nearly Empty Bars)

- Represent low participation zones.

- Price often moves quickly through these areas – useful for targeting fast moves.

## Chapter 6 – Wyckoff Helper – Spring

### 6.1 Spring Concept

In the Wyckoff framework:

- A Spring is a false break of support.

- The market briefly trades below a well-defined support level, triggers stop losses,

then sharply reverses upward as institutional buyers absorb liquidity.

This movement:

### 6.2 Code Logic

Conditions for a Spring:

1. The current low is lower than the lowest low of the previous 50 bars

→ apparent break of a long-standing support.

2. The bar closes bullish (Close > Open)

→ the breakdown was rejected.

3. Volume is significantly elevated:

→ `volume > 2 × volume_MA` (Ultra Volume).

When all conditions are met and `show_wyc` is enabled:

- A pink diamond is plotted below the bar,

- With the label “Spring” – one of the strongest long signals in this system.

### 6.3 Trading Use

- After a valid Spring, markets frequently enter a meaningful bullish phase.

- The highest quality setups occur when:

- The Spring forms inside a green Order Block, and

- Near or on the Volume Profile POC.

Entries:

- At the close of the Spring bar, or

- On the first pullback into the mid-range of the Spring candle.

Stop-loss:

- Slightly below the Spring’s lowest point (wick low plus a small buffer).

## Chapter 7 – Confluence Engine & Dashboard

### 7.1 Scoring Logic

For each bar, the script:

1. Resets `score` to 0.

2. Adjusts the score based on different signals.

SMC Contribution

Pine Script®

- Being in Demand → `+1`

- Being in Supply → `-1`

DCA Contribution

Pine Script®

- DCA Buy → `+2` (strong, statistically driven long signal)

- DCA Sell → `-2`

Wyckoff Spring Contribution

Pine Script®

- Spring → `+2` (entry of strong money)

### 7.2 Mapping Score to Dashboard Signal

### 7.3 Dashboard Structure

The dashboard is a two-column table:

- Row 0

- Row 1

- Row 2

- Column 0: `"SMC:"`

- Column 1:

- Row 3

- Column 0: `"DCA:"`

- Column 1:

- Row 4

## Chapter 8 – Visual Legend (Colors, Shapes & Actions)

For quick reading inside TradingView, the visual elements are described line by line instead of a table.

Chart Element: Green Box

Color / Shape: Transparent green rectangle

Core Meaning: Bullish Order Block (Demand Zone)

Suggested Trader Response: Look for longs, Smart DCA adds, closing or reducing shorts.

Chart Element: Red Box

Color / Shape: Transparent red rectangle

Core Meaning: Bearish Order Block (Supply Zone)

Suggested Trader Response: Look for shorts, or take profit on existing longs.

Chart Element: Yellow Area

Color / Shape: Transparent yellow zone

Core Meaning: Bullish FVG / upside imbalance

Suggested Trader Response: Short take-profit zone or expected rebalance area.

Chart Element: Purple Area

Color / Shape: Transparent purple zone

Core Meaning: Bearish FVG / downside imbalance

Suggested Trader Response: Long take-profit zone or temporary supply region.

Chart Element: Green "DCA" Label

Color / Shape: Green label with white text, plotted below the candle

Core Meaning: Smart ladder-in buy zone, DCA buy opportunity

Suggested Trader Response: Spot DCA entry, partial short exit.

Chart Element: Red "SELL" Label

Color / Shape: Red label with white text, plotted above the candle

Core Meaning: Overbought / distribution zone

Suggested Trader Response: Take profit on longs, consider initiating shorts.

Chart Element: Light Green Background (bgcolor)

Color / Shape: Very transparent light-green background behind bars

Core Meaning: Active DCA Buy zone

Suggested Trader Response: Treat as a discount zone on the chart.

Chart Element: Orange Bar on Right

Color / Shape: Transparent orange horizontal bar in the volume profile

Core Meaning: POC – price with highest traded volume

Suggested Trader Response: Strong support or resistance; key reference level.

Chart Element: Blue Bars on Right

Color / Shape: Transparent blue horizontal bars in the volume profile

Core Meaning: Other volume levels, showing high-volume and low-volume nodes

Suggested Trader Response: Use to identify balance zones (HVN) and fast-move corridors (LVN).

Chart Element: Pink "Spring" Diamond

Color / Shape: Pink diamond with white text below the candle

Core Meaning: Wyckoff Spring – liquidity grab and potential major bullish reversal

Suggested Trader Response: One of the strongest long signals in the suite; look for high-quality long setups with tight risk.

Chart Element: STRONG LONG in Dashboard

Color / Shape: Green background, white text in the Signal row

Core Meaning: Multiple bullish layers in confluence

Suggested Trader Response: Consider initiating or increasing longs with strict risk management.

Chart Element: STRONG SHORT in Dashboard

Color / Shape: Red background, white text in the Signal row

Core Meaning: Multiple bearish layers in confluence

Suggested Trader Response: Consider initiating or increasing shorts with a logical, well-placed stop.

## Chapter 9 – Timeframe-Based Trading Playbook

### 9.1 Timeframe Selection

- Scalping

- Day Trading

- Swing Trading & Position Investing

### 9.2 Scenario A – Scalping Long

Example: 5-Minute Chart

1. Price is declining into a green OB (Bullish Demand).

2. A candle with a long lower wick and bullish close (Pin Bar / Rejection) forms inside the OB.

3. A Spring diamond appears below the same candle → very strong confluence.

4. The Dashboard shows at least WEAK LONG ↗, ideally STRONG LONG 🚀.

5. Entry:

6. Stop-loss:

7. Targets:

### 9.3 Scenario B – Day-Trading Short

Recommended Timeframes: 1H or 4H

1. The market completes a strong impulsive move upward.

2. Price enters a red Order Block (Supply).

3. In the same zone, a purple FVG appears or remains unfilled.

4. On a lower timeframe (e.g., 15M), RSI enters overbought territory and a DCA Sell signal appears.

5. The main timeframe Dashboard (1H) shows WEAK SHORT ↘ or STRONG SHORT 🩸.

Trade Plan

- Open a short near the upper boundary of the red OB.

- Place the stop above the OB or above the last swing high.

- Targets:

### 9.4 Scenario C – Swing / Investment with Smart DCA

Timeframes: Daily / Weekly

1. On the daily or weekly chart, each time a green “DCA” label appears:

2. Check whether this DCA zone aligns with the orange POC of the Volume Profile:

3. If the DCA signal sits inside a daily green OB, the probability of a medium-term bottom increases.

4. Always build the position laddered, never all-in at a single price.

Exits for investors:

### 9.5 Case Study 1 – BTCUSDT (15-Minute)

Plan

### 9.6 Case Study 2 – Meme Coin (PEPE – 4H)

Plan

## Chapter 10 – Risk Management, Psychology & Advanced Tuning

### 10.1 Risk Management

No signal, regardless of its strength, replaces risk control.

Recommendations:

- In futures, do not expose more than 1–3% of account equity to risk per trade.

- Adjust leverage to the volatility of the instrument (lower leverage for highly volatile altcoins).

- Place stop-losses in zones where the idea is clearly invalidated:

- Below/above the relevant Order Block or Spring, not randomly in the middle of the structure.

### 10.2 Market-Specific Parameter Tuning

- Calmer Markets (e.g., major FX pairs)

- Highly Volatile Markets (Crypto, news-driven assets)

### 10.3 Trading Psychology

- STRONG LONG 🚀 does not mean “risk-free”.

It means the probability of a successful long, given the model’s logic, is higher than average.

- Treat Mars Signals as a confirmation and context system, not a full replacement for your own decision-making.

- Example of disciplined thinking:

## Chapter 11 – Technical Notes & FAQ

### 11.1 Does the Script Repaint?

- Order Blocks and Springs are based on completed pivot structures and confirmed candles.

- Until a pivot is confirmed, an OB does not exist; after confirmation, behavior is stable under classic SMC assumptions.

- The script is designed to be structurally consistent rather than repainting signals arbitrarily.

### 11.2 Computational Load of Volume Profile

- On the last bar, the script processes up to `vp_lookback` bars × `vp_rows` rows.

- On very low timeframes with heavy zooming, this can become demanding.

- If you experience performance issues:

- Reduce `vp_lookback` or `vp_rows`, or

- Temporarily disable Volume Profile (`show_vp = false`).

### 11.3 Multi-Timeframe Behavior

- This version of the script is not internally multi-timeframe.

All logic (OB, DCA, Spring, Volume Profile) is computed on the active timeframe only.

- Practical workflow:

## Conclusion

Mars Signals – Ultimate Institutional Suite v3.0 (Joker) is a multi-layer trading framework that unifies:

into a single, coherent system driven by a transparent Confluence Scoring Engine.

The final output is presented in clear, actionable language:

The system is designed to support professional decision-making, not to replace it.

Used together with strict risk management and disciplined execution,

Mars Signals – UIS v3.0 (Joker) can serve as a central reference manual and operational guide

for your trading workflow, from scalping to swing and investment positioning.

Mars Signals – Ultimate Institutional Suite v3.0 (Joker)

## Chapter 1 – Philosophy & System Architecture

This script is not a simple “buy/sell” indicator.

Mars Signals – UIS v3.0 (Joker) is designed as an institutional-style analytical assistant that layers several methodologies into a single, coherent framework.

The system is built on four core pillars:

1. Smart Money Concepts (SMC)

- - Detection of Order Blocks (professional demand/supply zones).

- - Detection of Fair Value Gaps (FVGs) (price imbalances).

2. Smart DCA Strategy

- - Combination of RSI and Bollinger Bands

- - Identifies statistically discounted zones for scaling into spot positions or exiting shorts.

3. Volume Profile (Visible Range Simulation)

- - Distribution of volume by price, not by time.

- - Identification of POC (Point of Control) and high-/low-volume areas.

4. Wyckoff Helper – Spring

- - Detection of bear traps, liquidity grabs, and sharp bullish reversals.

All four pillars feed into a Confluence Engine (Scoring System).

The final output is presented in the Dashboard, with a clear, human-readable signal:

- - STRONG LONG 🚀

- - WEAK LONG ↗

- - NEUTRAL / WAIT

- - WEAK SHORT ↘

- - STRONG SHORT 🩸

This allows the trader to see *how many* and *which* layers of the system support a bullish or bearish bias at any given time.

## Chapter 2 – Settings Overview

### 2.1 General & Dashboard Group

- Show Dashboard Panel (`show_dash`)

Turns the dashboard table in the corner of the chart ON/OFF.

- Show Signal Recommendation (`show_rec`)

- - If enabled, the textual signal (STRONG LONG, WEAK SHORT, etc.) is displayed.

- - If disabled, you only see feature status (ON/OFF) and the current price.

- Dashboard Position (`dash_pos`)

Determines where the dashboard appears on the chart:

- - `Top Right`

- - `Bottom Right`

- - `Top Left`

### 2.2 Smart Money (SMC) Group

- Enable SMC Strategy (`show_smc`)

Globally enables or disables the Order Block and FVG logic.

- Order Block Pivot Lookback (`ob_period`)

Main parameter for detecting key pivot highs/lows (swing points).

- Default value: 5

- Concept:

A bar is considered a pivot low if its low is lower than the lows of the previous 5 and the next 5 bars.

Similarly, a pivot high has a high higher than the previous 5 and the next 5 bars.

These pivots are used as anchors for Order Blocks.

- Increasing `ob_period`:

- Fewer levels.

- But levels tend to be more significant and reliable.

- In highly volatile markets (major news, war events, FOMC, etc.),

using values 7–10 is recommended to filter out weak levels.

- Show Fair Value Gaps (`show_fvg`)

Enables/disables the drawing of FVG zones (imbalances).

- Bullish OB Color (`c_ob_bull`)

- Color of Bullish Order Blocks (Demand Zones).

- Default: semi-transparent green (transparency ≈ 80).

- Bearish OB Color (`c_ob_bear`)

- Color of Bearish Order Blocks (Supply Zones).

- Default: semi-transparent red.

- Bullish FVG Color (`c_fvg_bull`)

- Color of Bullish FVG (upward imbalance), typically yellow.

- Bearish FVG Color (`c_fvg_bear`)

- Color of Bearish FVG (downward imbalance), typically purple.

### 2.3 Smart DCA Strategy Group

- Enable DCA Zones (`show_dca`)

Enables the Smart DCA logic and visual labels.

- RSI Length (`rsi_len`)

Lookback period for RSI (default: 14).

- Shorter → more sensitive, more noise.

- Longer → fewer signals, higher reliability.

- Bollinger Bands Length (`bb_len`)

Moving average period for Bollinger Bands (default: 20).

- BB Multiplier (`bb_mult`)

Standard deviation multiplier for Bollinger Bands (default: 2.0).

- For extremely volatile markets, values like 2.5–3.0 can be used so that only extreme deviations trigger a DCA signal.

### 2.4 Volume Profile (Visible Range Sim) Group

- Show Volume Profile (`show_vp`)

Enables the simulated Volume Profile bars on the right side of the chart.

- Volume Lookback Bars (`vp_lookback`)

Number of bars used to compute the Volume Profile (default: 150).

- Higher values → broader historical context, heavier computation.

- Row Count (`vp_rows`)

Number of vertical price segments (rows) to divide the total price range into (default: 30).

- Width (%) (`vp_width`)

Relative width of each volume bar as a percentage.

In the code, bar widths are scaled relative to the row with the maximum volume.

> Technical note: Volume Profile calculations are executed only on the last bar (`barstate.islast`) to keep the script performant even on higher timeframes.

### 2.5 Wyckoff Helper Group

- Show Wyckoff Events (`show_wyc`)

Enables detection and plotting of Wyckoff Spring events.

- Volume MA Length (`vol_ma_len`)

Length of the moving average on volume.

A bar is considered to have Ultra Volume if its volume is more than 2× the volume MA.

## Chapter 3 – Smart Money Strategy (Order Blocks & FVG)

### 3.1 What Is an Order Block?

An Order Block (OB) represents the footprint of large institutional orders:

- Bullish Order Block (Demand Zone)

The last selling region (bearish candle/cluster) before a strong upward move.

- Bearish Order Block (Supply Zone)

The last buying region (bullish candle/cluster) before a strong downward move.

Institutions and large players place heavy orders in these regions. Typical price behavior:

- Price moves away from the zone.

- Later returns to the same zone to fill unfilled orders.

- Then continues the larger trend.

In the script:

- If `pl` (pivot low) forms → a Bullish OB is created.

- If `ph` (pivot high) forms → a Bearish OB is created.

The box is drawn:

- From `bar_index[ob_period]` to `bar_index`.

- Between `low[ob_period]` and `high[ob_period]`.

- `extend=extend.right` extends the OB into the future, so it acts as a dynamic support/resistance zone.

- Only the last 4 OB boxes are kept to avoid clutter.

### 3.2 Order Block Color Guide

- Semi-transparent Green (`c_ob_bull`)

- Represents a Bullish Order Block (Demand Zone).

- Interpretation: a price region with a high probability of bullish reaction.

- Semi-transparent Red (`c_ob_bear`)

- Represents a Bearish Order Block (Supply Zone).

- Interpretation: a price region with a high probability of bearish reaction.

Overlap (Multiple OBs in the Same Area)

When two or more Order Blocks overlap:

- The shared area appears visually denser/stronger.

- This suggests higher order density.

- Such zones can be treated as high-priority levels for entries, exits, and stop-loss placement.

### 3.3 Demand/Supply Logic in the Scoring Engine

is_in_demand = low <= ta.lowest(low, 20)[1]

is_in_supply = high >= ta.highest(high, 20)[1]

- If current price is near the lowest lows of the last 20 bars, it is considered in a Demand Zone → positive impact on score.

- If current price is near the highest highs of the last 20 bars, it is considered in a Supply Zone → negative impact on score.

This logic complements Order Blocks and helps the Dashboard distinguish whether:

- Market is currently in a statistically cheap (long-friendly) area, or

- In a statistically expensive (short-friendly) area.

### 3.4 Fair Value Gaps (FVG)

#### Concept

When the market moves aggressively:

- Some price levels are skipped and never traded.

- A gap between wicks/shadows of consecutive candles appears.

- These regions are called Fair Value Gaps (FVGs) or Imbalances.

The market generally “dislikes” imbalance and often:

- Returns to these zones in the future.

- Fills the gap (rebalance).

- Then resumes its dominant direction.

#### Implementation in the Code

Bullish FVG (Yellow)

fvg_bull_cond = show_smc and show_fvg and low > high[2] and close[1] > high[2]

if fvg_bull_cond

box.new(bar_index[2], high[2], bar_index, low, ...)

Core condition:

`low > high[2]` → the current low is above the high of two bars ago; the space between them is an untraded gap.

Bearish FVG (Purple)

fvg_bear_cond = show_smc and show_fvg and high < low[2] and close[1] < low[2]

if fvg_bear_cond

box.new(bar_index[2], low[2], bar_index, high, ...)

Core condition:

`high < low[2]` → the current high is below the low of two bars ago; again a price gap exists.

#### FVG Color Guide

- Transparent Yellow (`c_fvg_bull`) – Bullish FVG

Often acts like a magnet for price:

- Price tends to retrace into this zone,

- Fill the imbalance,

- And then continue higher.

- Transparent Purple (`c_fvg_bear`) – Bearish FVG

Price tends to:

- Retrace upward into the purple area,

- Fill the imbalance,

- And then resume downward movement.

#### Trading with FVGs

- FVGs are *not* standalone entry signals.

They are best used as:

- Targets (take-profit zones), or

- Reaction areas where you expect a pause or reversal.

Examples:

- If you are long, a bearish FVG above is often an excellent take-profit zone.

- If you are short, a bullish FVG below is often a good cover/exit zone.

### 3.5 Core SMC Trading Templates

#### Reversal Long

1. Price trades down into a green Order Block (Demand Zone).

2. A bullish confirmation candle (Close > Open) forms inside or just above the OB.

3. If this zone is close to or aligned with a bullish FVG (yellow), the signal is reinforced.

4. Entry:

- At the close of the confirmation candle, or

- Using a limit order near the upper boundary of the OB.

5. Stop-loss:

- Slightly below the OB.

- If the OB is broken decisively and price consolidates below it, the zone loses validity.

6. Targets:

- The next FVG,

- Or the next red Order Block (Supply Zone) above.

#### Reversal Short

The mirror scenario:

- Price rallies into a red Order Block (Supply).

- A bearish confirmation candle forms (Close < Open).

- FVG/premium structure above can act as a confluence.

- Stop-loss goes above the OB.

- Targets: lower FVGs or subsequent green OBs below.

## Chapter 4 – Smart DCA Strategy (RSI + Bollinger Bands)

### 4.1 Smart DCA Concept

- Classic DCA = buying at fixed time intervals regardless of price.

- Smart DCA = scaling in only when:

- Price is statistically cheaper than usual, and

- The market is in a clear oversold condition.

Code logic:

rsi_val = ta.rsi(close, rsi_len)

[bb_mid, bb_upper, bb_lower] = ta.bb(close, bb_len, bb_mult)

dca_buy = show_dca and rsi_val < 30 and close < bb_lower

dca_sell = show_dca and rsi_val > 70 and close > bb_upper

Conditions:

- DCA Buy – Smart Scale-In Zone

- RSI < 30 → oversold.

- Close < lower Bollinger Band → price has broken below its typical volatility envelope.

- DCA Sell – Overbought/Distribution Zone

- RSI > 70 → overbought.

- Close > upper Bollinger Band → price is extended far above the mean.

### 4.2 Visual Representation on the Chart

- Green “DCA” Label Below Candle

- Shape: `labelup`.

- Color: lime background, white text.

- Meaning: statistically attractive level for laddered spot entries or short exits.

- Red “SELL” Label Above Candle

- Warning that the market is in an extended, overbought condition.

- Suitable for profit-taking on longs or considering short entries (with proper confluence and risk management).

- Light Green Background (`bgcolor`)

- When `dca_buy` is true, the candle background turns very light green (high transparency).

- This helps visually identify DCA Zones across the chart at a glance.

### 4.3 Practical Use in Trading

#### Spot Trading

Used to build a better average entry price:

- Every time a DCA label appears, allocate a fixed portion of capital (e.g., 2–5%).

- Combining DCA signals with:

- Green OBs (Demand Zones), and/or

- The Volume Profile POC

makes the zone structurally more important.

#### Futures Trading

- Longs

- Use DCA Buy signals as low-risk zones for opening or adding to longs when:

- Price is inside a green OB, or

- The Dashboard already leans LONG.

- Shorts

- Use DCA Sell signals as:

- Exit zones for longs, or

- Areas to initiate shorts with stops above structural highs.

## Chapter 5 – Volume Profile (Visible Range Simulation)

### 5.1 Concept

Traditional volume (histogram under the chart) shows volume over time.

Volume Profile shows volume by price level:

- At which prices has the highest trading activity occurred?

- Where did buyers and sellers agree the most (High Volume Nodes – HVNs)?

- Where did price move quickly due to low participation (Low Volume Nodes – LVNs)?

### 5.2 Implementation in the Script

Executed only when `show_vp` is enabled and on the last bar:

1. The last `vp_lookback` bars (default 150) are processed.

2. The minimum low and maximum high over this window define the price range.

3. This price range is divided into `vp_rows` segments (e.g., 30 rows).

4. For each row:

- All bars are scanned.

- If the mid-price `(high[j] + low[j]) / 2` falls inside a row, that bar’s volume is added to the row total.

5. The row with the greatest volume is stored as `max_vol_idx` (the POC row).

6. For each row, a volume box is drawn on the right side of the chart.

### 5.3 Color Scheme

- Semi-transparent Orange

- The row with the maximum volume – the Point of Control (POC).

- Represents the strongest support/resistance level from a volume perspective.

- Semi-transparent Blue

- Other volume rows.

- The taller the bar → the higher the volume → the stronger the interest at that price band.

### 5.4 Trading Applications

- If price is above POC and retraces back into it:

→ POC often acts as support, suitable for long setups.

- If price is below POC and rallies into it:

→ POC often acts as resistance, suitable for short setups or profit-taking.

HVNs (Tall Blue Bars)

- Represent areas of equilibrium where the market has spent time and traded heavily.

- Price tends to consolidate here before choosing a direction.

LVNs (Short or Nearly Empty Bars)

- Represent low participation zones.

- Price often moves quickly through these areas – useful for targeting fast moves.

## Chapter 6 – Wyckoff Helper – Spring

### 6.1 Spring Concept

In the Wyckoff framework:

- A Spring is a false break of support.

- The market briefly trades below a well-defined support level, triggers stop losses,

then sharply reverses upward as institutional buyers absorb liquidity.

This movement:

- - Clears out weak hands (retail sellers).

- - Provides large players with liquidity to enter long positions.

- - Often initiates a new uptrend.

### 6.2 Code Logic

Conditions for a Spring:

1. The current low is lower than the lowest low of the previous 50 bars

→ apparent break of a long-standing support.

2. The bar closes bullish (Close > Open)

→ the breakdown was rejected.

3. Volume is significantly elevated:

→ `volume > 2 × volume_MA` (Ultra Volume).

When all conditions are met and `show_wyc` is enabled:

- A pink diamond is plotted below the bar,

- With the label “Spring” – one of the strongest long signals in this system.

### 6.3 Trading Use

- After a valid Spring, markets frequently enter a meaningful bullish phase.

- The highest quality setups occur when:

- The Spring forms inside a green Order Block, and

- Near or on the Volume Profile POC.

Entries:

- At the close of the Spring bar, or

- On the first pullback into the mid-range of the Spring candle.

Stop-loss:

- Slightly below the Spring’s lowest point (wick low plus a small buffer).

## Chapter 7 – Confluence Engine & Dashboard

### 7.1 Scoring Logic

For each bar, the script:

1. Resets `score` to 0.

2. Adjusts the score based on different signals.

SMC Contribution

if show_smc

if is_in_demand

score += 1

if is_in_supply

score -= 1

- Being in Demand → `+1`

- Being in Supply → `-1`

DCA Contribution

if show_dca

if dca_buy

score += 2

if dca_sell

score -= 2

- DCA Buy → `+2` (strong, statistically driven long signal)

- DCA Sell → `-2`

Wyckoff Spring Contribution

if show_wyc

if wyc_spring

score += 2

- Spring → `+2` (entry of strong money)

### 7.2 Mapping Score to Dashboard Signal

- - score ≥ 2 → STRONG LONG 🚀

- Multiple bullish conditions aligned.

- - score = 1 → WEAK LONG ↗

- Some bullish bias, but only one layer clearly positive.

- - score = 0 → NEUTRAL / WAIT

- Rough balance between buying and selling forces; staying flat is usually preferable.

- - score = -1 → WEAK SHORT ↘

- Mild bearish bias, suited for cautious or short-term plays.

- - score ≤ -2 → STRONG SHORT 🩸

- Convergence of several bearish signals.

### 7.3 Dashboard Structure

The dashboard is a two-column table:

- Row 0

- - Column 0: `"Mars Signals"` – black background, white text.

- - Column 1: `"UIS v3.0"` – black background, yellow text.

- Row 1

- - Column 0: `"Price:"` (light grey background).

- - Column 1: current closing price (`close`) with a semi-transparent blue background.

- Row 2

- Column 0: `"SMC:"`

- Column 1:

- - `"ON"` (green) if `show_smc = true`

- - `"OFF"` (grey) otherwise.

- Row 3

- Column 0: `"DCA:"`

- Column 1:

- - `"ON"` (green) if `show_dca = true`

- - `"OFF"` (grey) otherwise.

- Row 4

- - Column 0: `"Signal:"`

- - Column 1: signal text (`status_txt`) with background color `status_col`

- (green, red, teal, maroon, etc.)

- - If `show_rec = false`, these cells are cleared.

## Chapter 8 – Visual Legend (Colors, Shapes & Actions)

For quick reading inside TradingView, the visual elements are described line by line instead of a table.

Chart Element: Green Box

Color / Shape: Transparent green rectangle

Core Meaning: Bullish Order Block (Demand Zone)

Suggested Trader Response: Look for longs, Smart DCA adds, closing or reducing shorts.

Chart Element: Red Box

Color / Shape: Transparent red rectangle

Core Meaning: Bearish Order Block (Supply Zone)

Suggested Trader Response: Look for shorts, or take profit on existing longs.

Chart Element: Yellow Area

Color / Shape: Transparent yellow zone

Core Meaning: Bullish FVG / upside imbalance

Suggested Trader Response: Short take-profit zone or expected rebalance area.

Chart Element: Purple Area

Color / Shape: Transparent purple zone

Core Meaning: Bearish FVG / downside imbalance

Suggested Trader Response: Long take-profit zone or temporary supply region.

Chart Element: Green "DCA" Label

Color / Shape: Green label with white text, plotted below the candle

Core Meaning: Smart ladder-in buy zone, DCA buy opportunity

Suggested Trader Response: Spot DCA entry, partial short exit.

Chart Element: Red "SELL" Label

Color / Shape: Red label with white text, plotted above the candle

Core Meaning: Overbought / distribution zone

Suggested Trader Response: Take profit on longs, consider initiating shorts.

Chart Element: Light Green Background (bgcolor)

Color / Shape: Very transparent light-green background behind bars

Core Meaning: Active DCA Buy zone

Suggested Trader Response: Treat as a discount zone on the chart.

Chart Element: Orange Bar on Right

Color / Shape: Transparent orange horizontal bar in the volume profile

Core Meaning: POC – price with highest traded volume

Suggested Trader Response: Strong support or resistance; key reference level.

Chart Element: Blue Bars on Right

Color / Shape: Transparent blue horizontal bars in the volume profile

Core Meaning: Other volume levels, showing high-volume and low-volume nodes

Suggested Trader Response: Use to identify balance zones (HVN) and fast-move corridors (LVN).

Chart Element: Pink "Spring" Diamond

Color / Shape: Pink diamond with white text below the candle

Core Meaning: Wyckoff Spring – liquidity grab and potential major bullish reversal

Suggested Trader Response: One of the strongest long signals in the suite; look for high-quality long setups with tight risk.

Chart Element: STRONG LONG in Dashboard

Color / Shape: Green background, white text in the Signal row

Core Meaning: Multiple bullish layers in confluence

Suggested Trader Response: Consider initiating or increasing longs with strict risk management.

Chart Element: STRONG SHORT in Dashboard

Color / Shape: Red background, white text in the Signal row

Core Meaning: Multiple bearish layers in confluence

Suggested Trader Response: Consider initiating or increasing shorts with a logical, well-placed stop.

## Chapter 9 – Timeframe-Based Trading Playbook

### 9.1 Timeframe Selection

- Scalping

- - Timeframes: 1M, 5M, 15M

- - Objective: fast intraday moves (minutes to a few hours).

- - Recommendation: focus on SMC + Wyckoff.

- Smart DCA on very low timeframes may introduce excessive noise.

- Day Trading

- - Timeframes: 15M, 1H, 4H

- - Provides a good balance between signal quality and frequency.

- - Recommendation: use the full stack – SMC + DCA + Volume Profile + Wyckoff + Dashboard.

- Swing Trading & Position Investing

- - Timeframes: Daily, Weekly

- - Emphasis on Smart DCA + Volume Profile.

- - SMC and Wyckoff are used mainly to fine-tune swing entries within larger trends.

### 9.2 Scenario A – Scalping Long

Example: 5-Minute Chart

1. Price is declining into a green OB (Bullish Demand).

2. A candle with a long lower wick and bullish close (Pin Bar / Rejection) forms inside the OB.

3. A Spring diamond appears below the same candle → very strong confluence.

4. The Dashboard shows at least WEAK LONG ↗, ideally STRONG LONG 🚀.

5. Entry:

- - On the close of the confirmation candle, or

- - On the first pullback into the mid-range of that candle.

6. Stop-loss:

- - Slightly below the OB.

7. Targets:

- - Nearby bearish FVG above, and/or

- - The next red OB.

### 9.3 Scenario B – Day-Trading Short

Recommended Timeframes: 1H or 4H

1. The market completes a strong impulsive move upward.

2. Price enters a red Order Block (Supply).

3. In the same zone, a purple FVG appears or remains unfilled.

4. On a lower timeframe (e.g., 15M), RSI enters overbought territory and a DCA Sell signal appears.

5. The main timeframe Dashboard (1H) shows WEAK SHORT ↘ or STRONG SHORT 🩸.

Trade Plan

- Open a short near the upper boundary of the red OB.

- Place the stop above the OB or above the last swing high.

- Targets:

- - A yellow FVG lower on the chart, and/or

- - The next green OB (Demand) below.

### 9.4 Scenario C – Swing / Investment with Smart DCA

Timeframes: Daily / Weekly

1. On the daily or weekly chart, each time a green “DCA” label appears:

- - Allocate a fixed fraction of your capital (e.g., 3–5%) to that asset.

2. Check whether this DCA zone aligns with the orange POC of the Volume Profile:

- - If yes → the quality of the entry zone is significantly higher.

3. If the DCA signal sits inside a daily green OB, the probability of a medium-term bottom increases.

4. Always build the position laddered, never all-in at a single price.

Exits for investors:

- - Near weekly red OBs or large purple FVG zones.

- - Ideally via partial profit-taking rather than closing 100% at once.

### 9.5 Case Study 1 – BTCUSDT (15-Minute)

- - Context: Price has sold off down towards 65,000 USD.

- - A green OB had previously formed at that level.

- - Near the lower boundary of this OB, a partially filled yellow FVG is present.

- - As price returns to this region, a Spring appears.

- - The Dashboard shifts from NEUTRAL / WAIT to WEAK LONG ↗.

Plan

- - Enter a long near the OB low.

- - Place stop below the Spring low.

- - First target: a purple FVG around 66,200.

- - Second (optional) target: the first red OB above that level.

### 9.6 Case Study 2 – Meme Coin (PEPE – 4H)

- - After a strong pump, price enters a corrective phase.

- - On the 4H chart, RSI drops below 30; price breaks below the lower Bollinger Band → a DCA label prints.

- - The Volume Profile shows the POC at approximately the same level.

- - The Dashboard displays STRONG LONG 🚀.

Plan

- - Execute laddered buys in the combined DCA + POC zone.

- - Place a protective stop below the last significant swing low.

- - Target: an expected 20–30% upside move towards the next red OB or purple FVG.

## Chapter 10 – Risk Management, Psychology & Advanced Tuning

### 10.1 Risk Management

No signal, regardless of its strength, replaces risk control.

Recommendations:

- In futures, do not expose more than 1–3% of account equity to risk per trade.

- Adjust leverage to the volatility of the instrument (lower leverage for highly volatile altcoins).

- Place stop-losses in zones where the idea is clearly invalidated:

- Below/above the relevant Order Block or Spring, not randomly in the middle of the structure.

### 10.2 Market-Specific Parameter Tuning

- Calmer Markets (e.g., major FX pairs)

- - `ob_period`: 3–5.

- - `bb_mult`: 2.0 is usually sufficient.

- Highly Volatile Markets (Crypto, news-driven assets)

- - `ob_period`: 7–10 to highlight only the most robust OBs.

- - `bb_mult`: 2.5–3.0 so that only extreme deviations trigger DCA.

- - `vol_ma_len`: increase (e.g., to ~30) so that Spring triggers only on truly exceptional

### 10.3 Trading Psychology

- STRONG LONG 🚀 does not mean “risk-free”.

It means the probability of a successful long, given the model’s logic, is higher than average.

- Treat Mars Signals as a confirmation and context system, not a full replacement for your own decision-making.

- Example of disciplined thinking:

- - The Dashboard prints STRONG LONG,

- - But price is simultaneously testing a multi-month macro resistance or a major negative news event is imminent,

- - In such cases, trade smaller, widen stops appropriately, or skip the trade.

## Chapter 11 – Technical Notes & FAQ

### 11.1 Does the Script Repaint?

- Order Blocks and Springs are based on completed pivot structures and confirmed candles.

- Until a pivot is confirmed, an OB does not exist; after confirmation, behavior is stable under classic SMC assumptions.

- The script is designed to be structurally consistent rather than repainting signals arbitrarily.

### 11.2 Computational Load of Volume Profile

- On the last bar, the script processes up to `vp_lookback` bars × `vp_rows` rows.

- On very low timeframes with heavy zooming, this can become demanding.

- If you experience performance issues:

- Reduce `vp_lookback` or `vp_rows`, or

- Temporarily disable Volume Profile (`show_vp = false`).

### 11.3 Multi-Timeframe Behavior

- This version of the script is not internally multi-timeframe.

All logic (OB, DCA, Spring, Volume Profile) is computed on the active timeframe only.

- Practical workflow:

- - Analyze overall structure and key zones on higher timeframes (4H / Daily).

- - Use lower timeframes (15M / 1H) with the same tool for timing entries and exits.

## Conclusion

Mars Signals – Ultimate Institutional Suite v3.0 (Joker) is a multi-layer trading framework that unifies:

- - Price structure (Order Blocks & FVG),

- - Statistical behavior (Smart DCA via RSI + Bollinger),

- - Volume distribution by price (Volume Profile with POC, HVN, LVN),

- - Liquidity events (Wyckoff Spring),

into a single, coherent system driven by a transparent Confluence Scoring Engine.

The final output is presented in clear, actionable language:

> STRONG LONG / WEAK LONG / NEUTRAL / WEAK SHORT / STRONG SHORT

The system is designed to support professional decision-making, not to replace it.

Used together with strict risk management and disciplined execution,

Mars Signals – UIS v3.0 (Joker) can serve as a central reference manual and operational guide

for your trading workflow, from scalping to swing and investment positioning.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.