PROTECTED SOURCE SCRIPT

Cập nhật Relative Volume - Real-Time Volume [LevelUp]

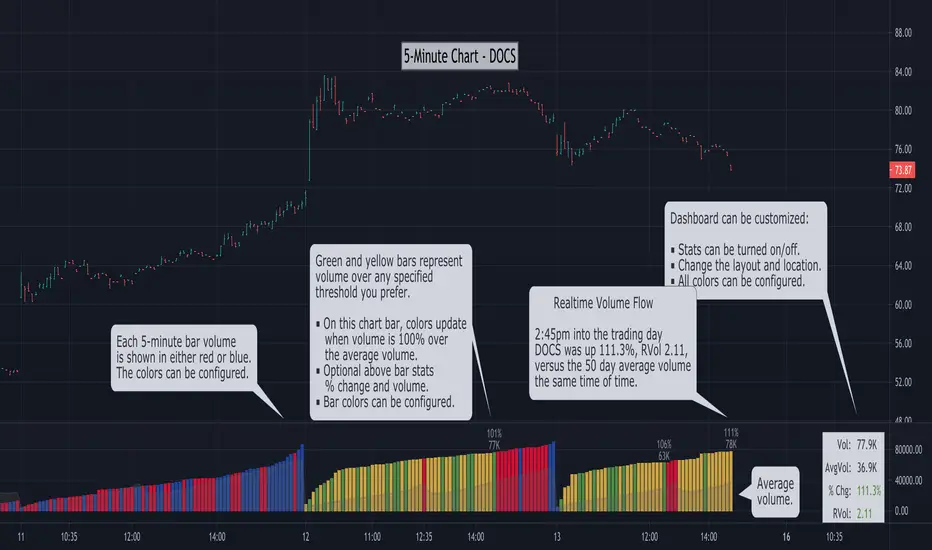

Relative volume compares the volume at a specific time in the trading day versus the prior volume at the same time of day over a specified range. This is an ideal way to gauge if there is significant volume driving a price move, either up or down.

What's Unique About this Relative Volume Indicator?

Many relative volume indicators simply divide the current volume by the average volume. Unfortunately, this calculation is not an accurate gauge of volume at a specific point in time and it will not account for typical spikes in volume that occur early and late in the day.

This indicator calculates relative volume on an intraday chart, looking at the volume for each bar in the current timeframe, over a range of days that is configured in Settings. For example, if the preferred lookback is set to 50 and you are on a 5-minute chart at 1:00pm, the indicator will determine the average of cumulative volume traded up to 1:00pm on each 5-minute bar, over the past 50 days. The result is an accurate representation of the "true" volume for a specific time in the day.

Relative Volume as Percentage or Ratio

Relative volume can be shown as a percentage change, a ratio or both. The calculations are the same, it's more about your preference.

For example, if a stock has traded 1M shares at 10:00am, yet the average over the past 50 days at 10:00am is 500k shares, the percentage increase is 100% and the ratio would be 2.0.

Intraday Charts

To accurately determine volume at a specific point during the trading day, as compared to the average at that same time of day, calculations need to be done on an intraday chart. This is your go-to chart to gauge realtime volume flow.

Daily, Weekly and Monthly Charts

Relative volume data is also shown on daily, weekly and monthly charts, however, it's important to note these values are based on the close of the respective timeframe.

Acknowledgement

Many thanks to LucF and @e2e4mfck for their excellent open source indicator, Relative Volume at Time, for TradingView. If you are interested to learn more about the details of relative volume, this is the definitive resource.

What's Unique About this Relative Volume Indicator?

Many relative volume indicators simply divide the current volume by the average volume. Unfortunately, this calculation is not an accurate gauge of volume at a specific point in time and it will not account for typical spikes in volume that occur early and late in the day.

This indicator calculates relative volume on an intraday chart, looking at the volume for each bar in the current timeframe, over a range of days that is configured in Settings. For example, if the preferred lookback is set to 50 and you are on a 5-minute chart at 1:00pm, the indicator will determine the average of cumulative volume traded up to 1:00pm on each 5-minute bar, over the past 50 days. The result is an accurate representation of the "true" volume for a specific time in the day.

Relative Volume as Percentage or Ratio

Relative volume can be shown as a percentage change, a ratio or both. The calculations are the same, it's more about your preference.

For example, if a stock has traded 1M shares at 10:00am, yet the average over the past 50 days at 10:00am is 500k shares, the percentage increase is 100% and the ratio would be 2.0.

Intraday Charts

To accurately determine volume at a specific point during the trading day, as compared to the average at that same time of day, calculations need to be done on an intraday chart. This is your go-to chart to gauge realtime volume flow.

Daily, Weekly and Monthly Charts

Relative volume data is also shown on daily, weekly and monthly charts, however, it's important to note these values are based on the close of the respective timeframe.

Acknowledgement

Many thanks to LucF and @e2e4mfck for their excellent open source indicator, Relative Volume at Time, for TradingView. If you are interested to learn more about the details of relative volume, this is the definitive resource.

Phát hành các Ghi chú

Version 2.0■ Additional volume data on daily charts, including U/D Volume Ratio and Average Daily Dollar Volume.

■ Customize all colors in the volume dashboard.

In addition to the realtime relative volume data on an intraday chart, there is a great deal of volume data shown on daily, weekly and monthly charts. For example, when viewing a daily chart, you can also view Up/Down Volume Ratio and Average Daily Dollar Volume.

■ Average Daily Dollar Volume is the average volume of shares traded over the past 50 days multiplied by the price. Stocks with a larger Average Daily Dollar Volume tend to be less volatile and have more liquidity.

A common approach is to set a preferred baseline, say $20M, and focus on stocks above that value. It's important to note, $20M is just a starting point to consider. The take away is that stocks with a lower Average Daily Dollar Volume may have more volatility and are often thinly traded.

■ Up/Down Volume Ratio compares volume on up days to volume on down days over a 50 day range. A value of 1 equates to equal volume on buying and selling.

Phát hành các Ghi chú

Version 3.0■ View volume stats in the Data Window.

Phát hành các Ghi chú

Version 4.0■ Volume bar colors can now be based on the previous close.

Phát hành các Ghi chú

Version 5.0■ Updated formatting of the volume scale on the right.

■ Current bar volume is now shown in the Data Window.

Phát hành các Ghi chú

Version 6.0■ Above bar stats updated to reduce overlapping of data.

■ Stats table and Data Window properly format output when there is no volume data available.

■ Formatting fixes for NaN values.

Phát hành các Ghi chú

Version 7.0■ Updates to table data and layout.

■ Enhancements to Settings and tooltips.

Phát hành các Ghi chú

Version 8.0■ Performance improvements on intraday calculations.

■ Minor updates to the Settings dialog.

Phát hành các Ghi chú

Version 9.0■ Add support for pocket pivots.

■ Show pocket pivots as an arrow and/or candle.

Pocket pivots can be helpful to look for potential early entries before a base is complete. Pocket pivots were created by Gil Morales and Dr. Chris Kacher, documented in their books Trade Like an O'Neil Disciple and In the Trading Cockpit with O'Neil Disciples.

Phát hành các Ghi chú

Version 10.0■ Add an option to configure which timeframes to show pocket pivots.

Phát hành các Ghi chú

Version 11.0■ Update Settings to clarify pocket pivot customization options.

Phát hành các Ghi chú

Version 12.0■ Add an option to choose the shape of the symbol that indicates a pocket pivot.

Mã được bảo vệ

Tập lệnh này được đăng dưới dạng mã nguồn đóng. Tuy nhiên, bạn có thể sử dụng tự do và không giới hạn – tìm hiểu thêm tại đây.

Join traders in over 40 countries and LevelUp!

tradingview.com/spaces/LevelUpTools/

tradingview.com/spaces/LevelUpTools/

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã được bảo vệ

Tập lệnh này được đăng dưới dạng mã nguồn đóng. Tuy nhiên, bạn có thể sử dụng tự do và không giới hạn – tìm hiểu thêm tại đây.

Join traders in over 40 countries and LevelUp!

tradingview.com/spaces/LevelUpTools/

tradingview.com/spaces/LevelUpTools/

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.