OPEN-SOURCE SCRIPT

VWAP Suite, Session Cloud Rev

Overview

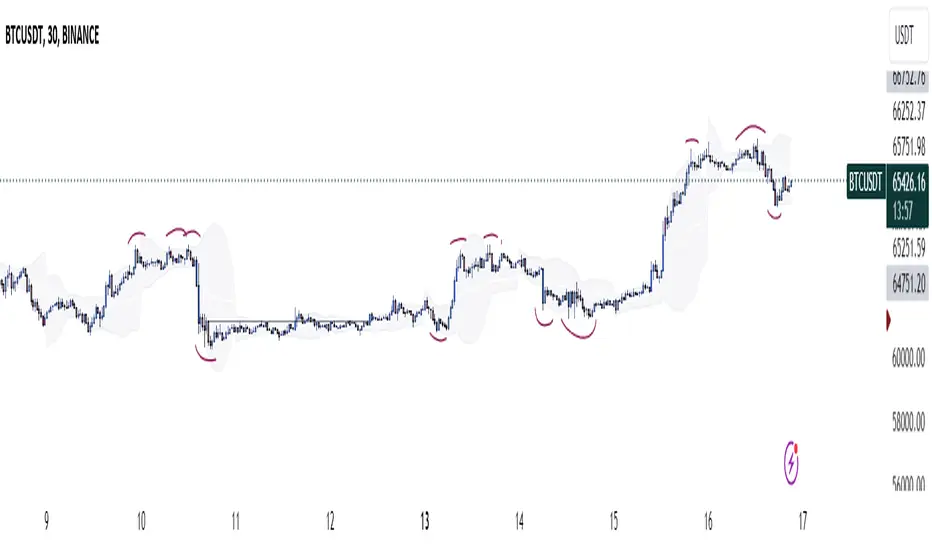

The VWAP Suite with Standard Deviation Strategy is a comprehensive indicator designed to help traders make informed trading decisions based on the Volume Weighted Average Price (VWAP) and its associated standard deviation bands. This indicator provides multiple VWAP calculations for different timeframes (Session, Day, Week, Month) and incorporates standard deviation bands to identify potential trade entry and exit points.

Components

VWAP Calculation:

Session VWAP: VWAP calculated based on the current trading session.

Day VWAP: VWAP calculated for the daily timeframe.

Week VWAP: VWAP calculated for the weekly timeframe.

Month VWAP: VWAP calculated for the monthly timeframe.

Standard Deviation Bands:

The indicator includes three standard deviation bands (StDev 1, StDev 2, and StDev 3) around the VWAP. These bands help identify the dispersion of price from the VWAP, providing insight into potential overbought or oversold conditions.

Additional VWAP Lines:

VWAP 2: An additional VWAP line with a customizable timeframe (Day, Week, Month).

VWAP 3: Another VWAP line for further analysis with a customizable timeframe (Day, Week, Month).

Strategy Description

The primary strategy implemented in this indicator revolves around the second standard deviation band (StDev 2). The key aspects of this strategy include:

Entry Points:

Long Entry: Consider entering a long position when the price moves below the lower StDev 2 band and then starts to revert back towards the VWAP. This indicates a potential oversold condition.

Short Entry: Consider entering a short position when the price moves above the upper StDev 2 band and then starts to revert back towards the VWAP. This indicates a potential overbought condition.

Exit Points:

Long Exit: Exit the long position when the price moves back up to the VWAP or the upper StDev 1 band, indicating a normalization of the price.

Short Exit: Exit the short position when the price moves back down to the VWAP or the lower StDev 1 band, indicating a normalization of the price.

Risk Management:

Set stop-loss levels slightly beyond the StDev 3 bands to protect against significant adverse price movements.

Use trailing stops to lock in profits as the price moves favorably.

Customization

The VWAP Suite allows for extensive customization, enabling traders to adjust the following settings:

VWAP Mode: Select the timeframe for the primary VWAP calculation (Session, Day, Week, Month).

Line Widths and Colors: Customize the line widths and colors for VWAP and standard deviation bands.

Fill Opacity: Adjust the opacity of the fill between standard deviation bands for better visual clarity.

Additional VWAPs: Enable and customize additional VWAP lines (VWAP 2 and VWAP 3) for further analysis.

The VWAP Suite with Standard Deviation Strategy is a comprehensive indicator designed to help traders make informed trading decisions based on the Volume Weighted Average Price (VWAP) and its associated standard deviation bands. This indicator provides multiple VWAP calculations for different timeframes (Session, Day, Week, Month) and incorporates standard deviation bands to identify potential trade entry and exit points.

Components

VWAP Calculation:

Session VWAP: VWAP calculated based on the current trading session.

Day VWAP: VWAP calculated for the daily timeframe.

Week VWAP: VWAP calculated for the weekly timeframe.

Month VWAP: VWAP calculated for the monthly timeframe.

Standard Deviation Bands:

The indicator includes three standard deviation bands (StDev 1, StDev 2, and StDev 3) around the VWAP. These bands help identify the dispersion of price from the VWAP, providing insight into potential overbought or oversold conditions.

Additional VWAP Lines:

VWAP 2: An additional VWAP line with a customizable timeframe (Day, Week, Month).

VWAP 3: Another VWAP line for further analysis with a customizable timeframe (Day, Week, Month).

Strategy Description

The primary strategy implemented in this indicator revolves around the second standard deviation band (StDev 2). The key aspects of this strategy include:

Entry Points:

Long Entry: Consider entering a long position when the price moves below the lower StDev 2 band and then starts to revert back towards the VWAP. This indicates a potential oversold condition.

Short Entry: Consider entering a short position when the price moves above the upper StDev 2 band and then starts to revert back towards the VWAP. This indicates a potential overbought condition.

Exit Points:

Long Exit: Exit the long position when the price moves back up to the VWAP or the upper StDev 1 band, indicating a normalization of the price.

Short Exit: Exit the short position when the price moves back down to the VWAP or the lower StDev 1 band, indicating a normalization of the price.

Risk Management:

Set stop-loss levels slightly beyond the StDev 3 bands to protect against significant adverse price movements.

Use trailing stops to lock in profits as the price moves favorably.

Customization

The VWAP Suite allows for extensive customization, enabling traders to adjust the following settings:

VWAP Mode: Select the timeframe for the primary VWAP calculation (Session, Day, Week, Month).

Line Widths and Colors: Customize the line widths and colors for VWAP and standard deviation bands.

Fill Opacity: Adjust the opacity of the fill between standard deviation bands for better visual clarity.

Additional VWAPs: Enable and customize additional VWAP lines (VWAP 2 and VWAP 3) for further analysis.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã nguồn mở

Theo đúng tinh thần TradingView, tác giả của tập lệnh này đã công bố nó dưới dạng mã nguồn mở, để các nhà giao dịch có thể xem xét và xác minh chức năng. Chúc mừng tác giả! Mặc dù bạn có thể sử dụng miễn phí, hãy nhớ rằng việc công bố lại mã phải tuân theo Nội quy.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.