PROTECTED SOURCE SCRIPT

Cập nhật ODSR - Open Driven Support and Resistance Levels

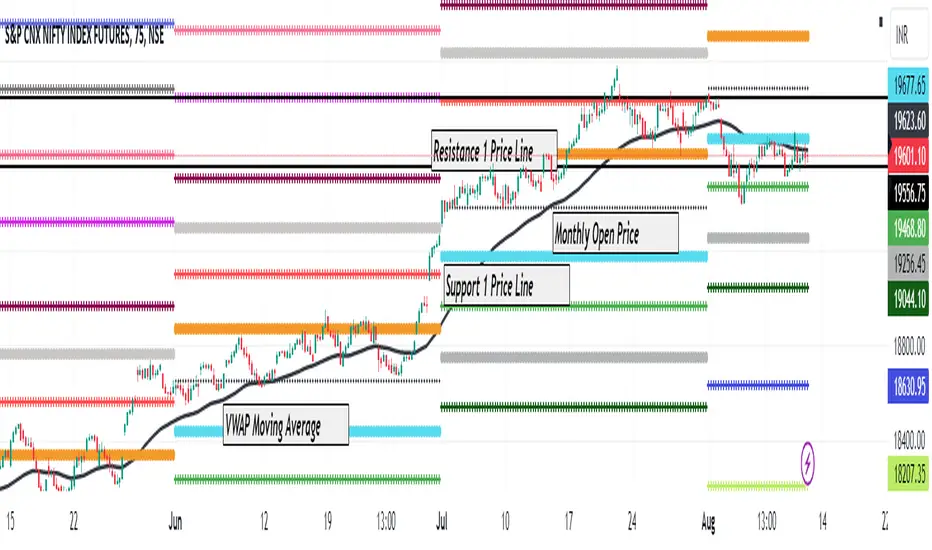

ODSR is a support and resistance levels generator indicator which uses Open of the Day, Week or Month (basis time frame selection by user) to calculate support and resistance levels and plot it on chart.

Background:

I have been using various indicators which could generate support and resistance levels using different data points available on chart. After analyzing multiple indicators I felt there is a need of an indicator which uses Open of the day, week or month as base data and then do further calculations and generate support and resistance levels.

Logic

This indicator takes open of day, week or month candle and then compare how far was the high and low from open. It then calculate the range and add it for analysis, it does same for all the candles declared in look back period of the indicator. Once it have all the data it calculates average difference of high and low from open price. It then compare how many times that average range has been exceeded by high or low made on specific day. If high or low has exceeded the average range it then calculate how by how many point new high or low has exceeded the average range. It then use that difference to predict next level of Support and Resistance. It then check if high or low has still exceeded the support or resistance range indicator predicted using points difference it found from when price exceeded initial average range. Indicator repeat the process till 7 levels of support and resistance has been generated by indicator.

Usage

As indicator use Open price data to generate support and resistance levels therefore once it has open price of the Day, Week or Month candle it will plot the levels on charts. Open price is plotted in thin black dot line, anything above it would be considered as resistance levels. Anything below dotted line would be considered as support levels. The far the level from open less possibility it will be tested by the price. Therefore if price breaks one level it may try to test next level or can return back to Open price as well.

Along with support and resistance indicator also calculate VWAP moving average which smoothen the normal VWAP line and allow use to identify long term trend on chart. Points table display the average difference between levels price has exceeded in past.

Please do share comments, feedback or questions if you have any. If you liked the indictor please do share it with others too.

Background:

I have been using various indicators which could generate support and resistance levels using different data points available on chart. After analyzing multiple indicators I felt there is a need of an indicator which uses Open of the day, week or month as base data and then do further calculations and generate support and resistance levels.

Logic

This indicator takes open of day, week or month candle and then compare how far was the high and low from open. It then calculate the range and add it for analysis, it does same for all the candles declared in look back period of the indicator. Once it have all the data it calculates average difference of high and low from open price. It then compare how many times that average range has been exceeded by high or low made on specific day. If high or low has exceeded the average range it then calculate how by how many point new high or low has exceeded the average range. It then use that difference to predict next level of Support and Resistance. It then check if high or low has still exceeded the support or resistance range indicator predicted using points difference it found from when price exceeded initial average range. Indicator repeat the process till 7 levels of support and resistance has been generated by indicator.

Usage

As indicator use Open price data to generate support and resistance levels therefore once it has open price of the Day, Week or Month candle it will plot the levels on charts. Open price is plotted in thin black dot line, anything above it would be considered as resistance levels. Anything below dotted line would be considered as support levels. The far the level from open less possibility it will be tested by the price. Therefore if price breaks one level it may try to test next level or can return back to Open price as well.

Along with support and resistance indicator also calculate VWAP moving average which smoothen the normal VWAP line and allow use to identify long term trend on chart. Points table display the average difference between levels price has exceeded in past.

Please do share comments, feedback or questions if you have any. If you liked the indictor please do share it with others too.

Phát hành các Ghi chú

Removed restriction on Time Frame Selection. For E.g: Now you can set lookback time frame to 1 year and plot forward looking levels for the rest of year.Mã được bảo vệ

Tập lệnh này được đăng dưới dạng mã nguồn đóng. Tuy nhiên, bạn có thể sử dụng tự do và không giới hạn – tìm hiểu thêm tại đây.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã được bảo vệ

Tập lệnh này được đăng dưới dạng mã nguồn đóng. Tuy nhiên, bạn có thể sử dụng tự do và không giới hạn – tìm hiểu thêm tại đây.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.