PROTECTED SOURCE SCRIPT

Cập nhật Apex Squeeze Breakout Strategy (v1.0 by SKC)

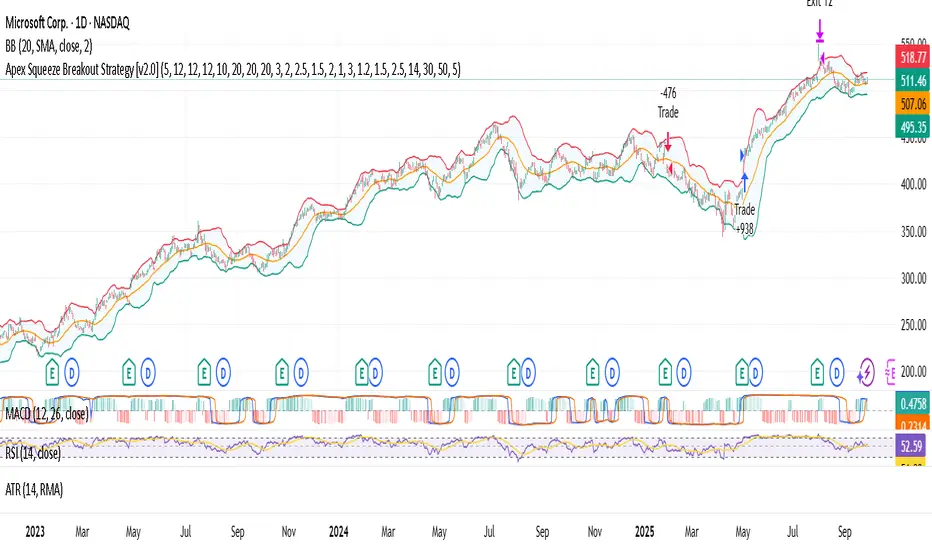

The Apex Squeeze Breakout Strategy is a powerful momentum-based system designed to capture explosive price moves following periods of low volatility compression (squeeze). It combines five key conditions to validate high-probability breakouts:

🔵 TTM Squeeze Detection using Bollinger Bands and Keltner Channels

🔊 Volume Spike Confirmation relative to a moving average

📈 Breakout Trigger above/below a recent high/low range

💪 Momentum Acceleration using percentage change over time

♻️ RSI Recovery / Overbought Logic to confirm shift in strength

The strategy includes:

Configurable swing/day trading modes

Dynamic ATR-based Stop Loss and TP1/TP2 system

Modular input structure for easy customization

Clear entry/exit visual markers and trade zones

It’s designed for disciplined traders who want to catch high-energy moves after consolidation, suitable for both intraday and swing setups.

🔵 TTM Squeeze Detection using Bollinger Bands and Keltner Channels

🔊 Volume Spike Confirmation relative to a moving average

📈 Breakout Trigger above/below a recent high/low range

💪 Momentum Acceleration using percentage change over time

♻️ RSI Recovery / Overbought Logic to confirm shift in strength

The strategy includes:

Configurable swing/day trading modes

Dynamic ATR-based Stop Loss and TP1/TP2 system

Modular input structure for easy customization

Clear entry/exit visual markers and trade zones

It’s designed for disciplined traders who want to catch high-energy moves after consolidation, suitable for both intraday and swing setups.

Phát hành các Ghi chú

This strategy detects squeeze breakouts using volume spikes, volatility compression, and momentum filters.It auto-manages entries, stop-loss, and targets, while plotting clean horizontal trade lines only during active trades.

Works on both day trading (5m/15m) and swing trading (4H/D).

Use with backtesting and forward-testing before applying live.

⚠️ Educational only. Not financial advice.

Phát hành các Ghi chú

his strategy detects squeeze breakouts using volume spikes, volatility compression, and momentum filters.It auto-manages entries, stop-loss, and targets, while plotting clean horizontal trade lines only during active trades.

Works on both day trading (5m/15m) and swing trading (4H/D).

Use with backtesting and forward-testing before applying live.

⚠️ Educational only. Not financial advice.

Phát hành các Ghi chú

Apex Squeeze Breakout Strategy (v1.0) — Strategy Version of the Official IndicatorThis is the official strategy version of the Apex Squeeze Breakout Trading System (v2.5 by SKC) indicator.

🔍 This script replicates the exact logic and trade behavior of the indicator, including:

Multi-factor scoring system (volume spike, squeeze, RSI recovery, momentum breakout, gap)

Supertrend-based trend bias and override logic

ATR-based dynamic SL/TP

Breakeven stop-loss shift after T1 hit

Trade logic works for both swing and day trading styles via a toggle

📈 Settings:

Use isDayTrading = true for 5m/15m charts

Use isDayTrading = false for 1H–Daily swing setups

⚠️ This strategy does not use repainting or offset entries. Backtest results are directly aligned with real-time signals from the original indicator.

✅ Use this strategy to backtest ticker performance, identify high-confidence symbols, and create forward trade plans based on proven edge.

Mã được bảo vệ

Tập lệnh này được đăng dưới dạng mã nguồn đóng. Tuy nhiên, bạn có thể sử dụng tự do và không giới hạn – tìm hiểu thêm tại đây.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.

Mã được bảo vệ

Tập lệnh này được đăng dưới dạng mã nguồn đóng. Tuy nhiên, bạn có thể sử dụng tự do và không giới hạn – tìm hiểu thêm tại đây.

Thông báo miễn trừ trách nhiệm

Thông tin và các ấn phẩm này không nhằm mục đích, và không cấu thành, lời khuyên hoặc khuyến nghị về tài chính, đầu tư, giao dịch hay các loại khác do TradingView cung cấp hoặc xác nhận. Đọc thêm tại Điều khoản Sử dụng.