Statistical Trailing Stop [LuxAlgo]The Statistical Trailing Stop tool offers traders a way to lock in profits in trending markets with four statistical levels based on the log-normal distribution of volatility.

The indicator also features a dashboard with statistics of all detected signals.

🔶 USAGE

The tool works out of the box, traders can adjust the data used with two parameters: data & distribution length.

By default, the tool takes volatility measures of groups of 10 candles, and statistical measures of the last 100 of these groups then traders can adjust the base level to use as trailing, the larger the level, the more resistant the tool will be to moves against the trend.

🔹 Base Levels

Traders can choose up to 4 different levels of trailing, all based on the statistical distribution of volatility.

As we can see in the chart above, each higher level is more resistant to market movements, so level 0 is the most reactive and level 3 the least.

It is up to the trader to determine the best level for each underlying, time frame and market conditions.

🔹 Dashboard

The tool provides a dashboard with the statistics of all trades, making it very easy to assess the performance of the parameters used for any given market.

As we can see on the chart, all Daily BTC signals with default parameters but different base levels, level 2 is the best performing of all four, giving a positive expectation of $2435 per trade, taking into account all long and short trades.

Of note are the long trades with a win rate of 76.47% and a risk-to-reward of 3.34, giving a positive expectation of $4839 per trade, with winners having an average duration of 210 days and losers 32 days.

This, compared to short trades with negative expectation, speaks to the uptrend bias of this particular market.

🔶 SETTINGS

Data Length: Select how many bars to use per data point

Distribution Length: Select how many data points the distribution will have

Base Level: Choose between 4 different trailing levels

🔹 Dashboard

Show Statistics: Enable/disable dashboard

Position: Select dashboard position

Size: Select dashboard size

Distribution

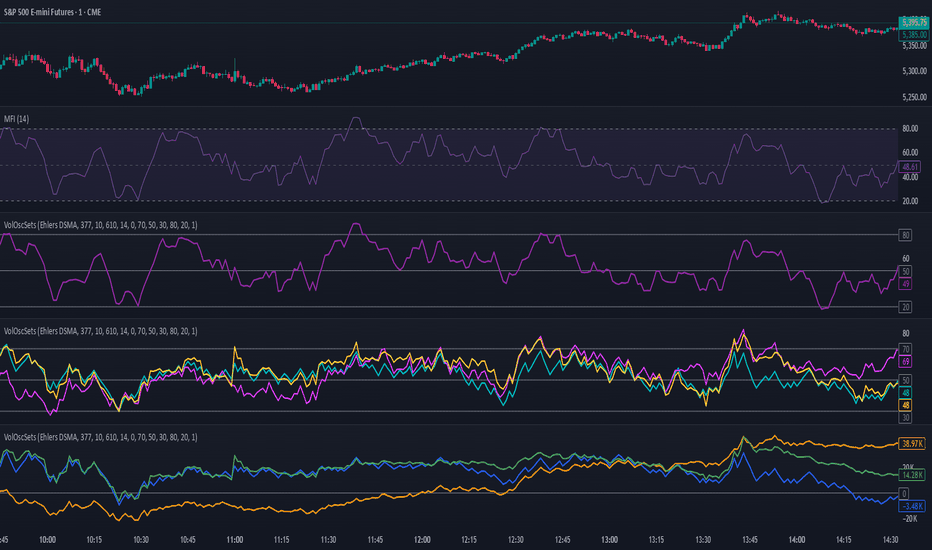

OBV & AD Oscillators with Dual Smoothing OptionsOn Balance Volume and Accumulation/Distribution

Overlaid into 1 and then some,

Now it is an oscillator!

3 customizable moving average types

- Ehlers Deviation Scaled Moving Average

- Volatility Dynamic Moving Average

- Simple Moving Average

Each with customizable periods

And with the ability to overlay a second set too

Default Settings have a longer period MA of 377 using Ehlers DSMA to better capture the standard view of OBV and A/D.

An extra overlay of a shorter period using a Volatility DMA uses Average True Range with its own custom settings, seeks to act more as an RSI

RSI Accumulation/Distribution [M]Hello everyone,

After my long tests, I observed that the rate of change of direction of the price was high after the periods when the RSI spent a long time outside the band. As a result of my observations, I prepared this indicator.

This indicator shows you the accumulation and distribution areas that occur outside the rsi band.

There are 3 different levels available.

Level 1 = 5 Bars

Level 2 = 7 Bars

Level 3 = 9 Bars

For example, if the RSI spends more than 9 bars below the 30 level or above the 70 level, it will paint that area red. Levels can be changed from the indicator settings. The rsi is smoothed with simple moving average to reduce fake signals.

Using the RSI A/D indicator with different indicators or patterns will increase your success rate.

Examples:

Elastic Volume-Weighted Student-T TensionOverview

The Elastic Volume-Weighted Student-T Tension Bands indicator dynamically adapts to market conditions using an advanced statistical model based on the Student-T distribution. Unlike traditional Bollinger Bands or Keltner Channels, this indicator leverages elastic volume-weighted averaging to compute real-time dispersion and location parameters, making it highly responsive to volatility changes while maintaining robustness against price fluctuations.

This methodology is inspired by incremental calculation techniques for weighted mean and variance, as outlined in the paper by Tony Finch:

📄 "Incremental Calculation of Weighted Mean and Variance" .

Key Features

✅ Adaptive Volatility Estimation – Uses an exponentially weighted Student-T model to dynamically adjust band width.

✅ Volume-Weighted Mean & Dispersion – Incorporates real-time volume weighting, ensuring a more accurate representation of market sentiment.

✅ High-Timeframe Volume Normalization – Provides an option to smooth volume impact by referencing a higher timeframe’s cumulative volume, reducing noise from high-variability bars.

✅ Customizable Tension Parameters – Configurable standard deviation multipliers (σ) allow for fine-tuned volatility sensitivity.

✅ %B-Like Oscillator for Relative Price Positioning – The main indicator is in form of a dedicated oscillator pane that normalizes price position within the sigma ranges, helping identify overbought/oversold conditions and potential momentum shifts.

✅ Robust Statistical Foundation – Utilizes kurtosis-based degree-of-freedom estimation, enhancing responsiveness across different market conditions.

How It Works

Volume-Weighted Elastic Mean (eμ) – Computes a dynamic mean price using an elastic weighted moving average approach, influenced by trade volume, if not volume detected in series, study takes true range as replacement.

Dispersion (eσ) via Student-T Distribution – Instead of assuming a fixed normal distribution, the bands adapt to heavy-tailed distributions using kurtosis-driven degrees of freedom.

Incremental Calculation of Variance – The indicator applies Tony Finch’s incremental method for computing weighted variance instead of arithmetic sum's of fixed bar window or arrays, improving efficiency and numerical stability.

Tension Calculation – There are 2 dispersion custom "zones" that are computed based on the weighted mean and dynamically adjusted standard student-t deviation.

%B-Like Oscillator Calculation – The oscillator normalizes the price within the band structure, with values between 0 and 1:

* 0.00 → Price is at the lower band (-2σ).

* 0.50 → Price is at the volume-weighted mean (eμ).

* 1.00 → Price is at the upper band (+2σ).

* Readings above 1.00 or below 0.00 suggest extreme movements or possible breakouts.

Recommended Usage

For scalping in lower timeframes, it is recommended to use the fixed α Decay Factor, it is in raw format for better control, but you can easily make a like of transformation to N-bar size window like in EMA-1 bar dividing 2 / decayFactor or like an RMA dividing 1 / decayFactor.

The HTF selector catch quite well Higher Time Frame analysis, for example using a Daily chart and using as HTF the 200-day timeframe, weekly or monthly.

Suitable for trend confirmation, breakout detection, and mean reversion plays.

The %B-like oscillator helps gauge momentum strength and detect divergences in price action if user prefer a clean chart without bands, this thanks to pineScript v6 force overlay feature.

Ideal for markets with volume-driven momentum shifts (e.g., futures, forex, crypto).

Customization Parameters

Fixed α Decay Factor – Controls the rate of volume weighting influence for an approximation EWMA approach instead of using sum of series or arrays, making the code lightweight & computing fast O(1).

HTF Volume Smoothing – Instead of a fixed denominator for computing α , a volume sum of the last 2 higher timeframe closed candles are used as denominator for our α weight factor. This is useful to review mayor trends like in daily, weekly, monthly.

Tension Multipliers (±σ) – Adjusts sensitivity to dispersion sigma parameter (volatility).

Oscillator Zone Fills – Visual cues for price positioning within the cloud range.

Posible Interpretations

As market within indicators relay on each individual edge, this are just some key ideas to glimpse how the indicator could be interpreted by the user:

📌 Price inside bands – Market is considered somehow "stable"; price is like resting from tension or "charging batteries" for volume spike moves.

📌 Price breaking outer bands – Potential breakout or extreme movement; watch for reversals or continuation from strong moves. Market is already in tension or generating it.

📌 Narrowing Bands – Decreasing volatility; expect contraction before expansion.

📌 Widening Bands – Increased volatility; prepare for high probability pull-back moves, specially to the center location of the bands (the mean) or the other side of them.

📌 Oscillator is just the interpretation of the price normalized across the Student-T distribution fitting "curve" using the location parameter, our Elastic Volume weighted mean (eμ) fixed at 0.5 value.

Final Thoughts

The Elastic Volume-Weighted Student-T Tension indicator provides a powerful, volume-sensitive alternative to traditional volatility bands. By integrating real-time volume analysis with an adaptive statistical model, incremental variance computation, in a relative price oscillator that can be overlayed in the chart as bands, it offers traders an edge in identifying momentum shifts, trend strength, and breakout potential. Think of the distribution as a relative "tension" rubber band in which price never leave so far alone.

DISCLAIMER:

The Following indicator/code IS NOT intended to be a formal investment advice or recommendation by the author, nor should be construed as such. Users will be fully responsible by their use regarding their own trading vehicles/assets.

The following indicator was made for NON LUCRATIVE ACTIVITIES and must remain as is, following TradingView's regulations. Use of indicator and their code are published for work and knowledge sharing. All access granted over it, their use, copy or re-use should mention authorship(s) and origin(s).

WARNING NOTICE!

THE INCLUDED FUNCTION MUST BE CONSIDERED FOR TESTING. The models included in the indicator have been taken from open sources on the web and some of them has been modified by the author, problems could occur at diverse data sceneries, compiler version, or any other externality.

Wyckoff Event Detection [Alpha Extract]Wyckoff Event Detection

A powerful and intelligent indicator designed to detect key Wyckoff events in real time, helping traders analyze market structure and anticipate potential trend shifts. Using volume and price action, this script automatically identifies distribution and accumulation phases, providing traders with valuable insights into market behavior.

🔶 Phase-Based Detection

Utilizes a phase detection algorithm that evaluates price and volume conditions to identify accumulation (bullish) and distribution (bearish) events. This method ensures the script effectively captures major market turning points and avoids noise.

🔶 Multi-Factor Event Recognition

Incorporates multiple event conditions, including upthrusts, selling climaxes, and springs, to detect high-probability entry and exit points. Each event is filtered through customizable sensitivity settings, ensuring precise detection aligned with different trading styles.

🔶 Customizable Parameters

Fine-tune event detection with adjustable thresholds for volume, price movement, trend strength, and event spacing. These inputs allow traders to personalize the script to match their strategy and risk tolerance.

// === USER INPUTS ===

i_volLen = input.int(20, "Volume MA Length", minval=1)

i_priceLookback = input.int(20, "Price Pattern Lookback", minval=5)

i_lineLength = input.int(15, "Line Length", minval=5)

i_labelSpacing = input.int(5, "Minimum Label Spacing (bars)", minval=1, maxval=20)

❓How It Works

🔶 Event Identification

The script scans for key Wyckoff events by analyzing volume spikes, price deviations, and trend shifts within a user-defined lookback period. It categorizes events into bullish (accumulation) or bearish (distribution) structures and plots them directly on the chart.

// === EVENT DETECTION ===

volMA = ta.sma(volume, i_volLen)

highestHigh = ta.highest(high, i_priceLookback)

lowestLow = ta.lowest(low, i_priceLookback)

🔶 Automatic Filtering & Cleanup

Unconfirmed or weak signals are filtered out using customizable strength multipliers and volume thresholds. Events that do not meet the minimum conditions are discarded to keep the chart clean and informative.

🔶 Phase Strength Analysis

The script continuously tracks bullish and bearish event counts to determine whether the market is currently in an accumulation, distribution, or neutral phase. This allows traders to align their strategies accordingly.

🔶 Visual Alerts & Labels

Detects and labels key Wyckoff events directly on the chart, providing immediate insights into market conditions:

- PSY (Preliminary Supply) and UT (Upthrust) for distribution phases.

- PS (Preliminary Support) and SC (Selling Climax) for accumulation phases.

- Labels adjust dynamically to avoid chart clutter and improve readability.

🔶 Entry & Exit Optimization

By highlighting supply and demand imbalances, the script assists traders in identifying optimal entry and exit points. Wyckoff concepts such as springs and upthrusts provide clear trade signals based on market structure.

🔶 Trend Confirmation & Risk Management

Observing how price reacts to detected events helps confirm trend direction and potential reversals. Traders can place stop-loss and take-profit levels based on Wyckoff phase analysis, ensuring strategic trade execution.

🔶 Table-Based Market Analysis (Table)

A built-in table summarizes:

- Market Phase: Accumulation, Distribution, or Neutral.

- Strength of Phase: Weak, Moderate, or Strong.

- Price Positioning: Whether price is near support, resistance, or in a trading range.

- Supply/Demand State: Identifies whether the market is supply or demand dominant.

🔶 Why Choose Wyckoff Market Phases - Alpha Extract?

This indicator offers a systematic approach to understanding market mechanics through the lens of Wyckoff's time-tested principles. By providing clear and actionable insights into market phases, it empowers traders to make informed decisions, enhancing both confidence and performance in various trading environments.

Accurate Bollinger Bands mcbw_ [True Volatility Distribution]The Bollinger Bands have become a very important technical tool for discretionary and algorithmic traders alike over the last decades. It was designed to give traders an edge on the markets by setting probabilistic values to different levels of volatility. However, some of the assumptions that go into its calculations make it unusable for traders who want to get a correct understanding of the volatility that the bands are trying to be used for. Let's go through what the Bollinger Bands are said to show, how their calculations work, the problems in the calculations, and how the current indicator I am presenting today fixes these.

--> If you just want to know how the settings work then skip straight to the end or click on the little (i) symbol next to the values in the indicator settings window when its on your chart <--

--------------------------- What Are Bollinger Bands ---------------------------

The Bollinger Bands were formed in the 1980's, a time when many retail traders interacted with their symbols via physically printed charts and computer memory for personal computer memory was measured in Kb (about a factor of 1 million smaller than today). Bollinger Bands are designed to help a trader or algorithm see the likelihood of price expanding outside of its typical range, the further the lines are from the current price implies the less often they will get hit. With a hands on understanding many strategies use these levels for designated levels of breakout trades or to assist in defining price ranges.

--------------------------- How Bollinger Bands Work ---------------------------

The calculations that go into Bollinger Bands are rather simple. There is a moving average that centers the indicator and an equidistant top band and bottom band are drawn at a fixed width away. The moving average is just a typical moving average (or common variant) that tracks the price action, while the distance to the top and bottom bands is a direct function of recent price volatility. The way that the distance to the bands is calculated is inspired by formulas from statistics. The standard deviation is taken from the candles that go into the moving average and then this is multiplied by a user defined value to set the bands position, I will call this value 'the multiple'. When discussing Bollinger Bands, that trading community at large normally discusses 'the multiple' as a multiplier of the standard deviation as it applies to a normal distribution (gaußian probability). On a normal distribution the number of standard deviations away (which trades directly use as 'the multiple') you are directly corresponds to how likely/unlikely something is to happen:

1 standard deviation equals 68.3%, meaning that the price should stay inside the 1 standard deviation 68.3% of the time and be outside of it 31.7% of the time;

2 standard deviation equals 95.5%, meaning that the price should stay inside the 2 standard deviation 95.5% of the time and be outside of it 4.5% of the time;

3 standard deviation equals 99.7%, meaning that the price should stay inside the 3 standard deviation 99.7% of the time and be outside of it 0.3% of the time.

Therefore when traders set 'the multiple' to 2, they interpret this as meaning that price will not reach there 95.5% of the time.

---------------- The Problem With The Math of Bollinger Bands ----------------

In and of themselves the Bollinger Bands are a great tool, but they have become misconstrued with some incorrect sense of statistical meaning, when they should really just be taken at face value without any further interpretation or implication.

In order to explain this it is going to get a bit technical so I will give a little math background and try to simplify things. First let's review some statistics topics (distributions, percentiles, standard deviations) and then with that understanding explore the incorrect logic of how Bollinger Bands have been interpreted/employed.

---------------- Quick Stats Review ----------------

.

(If you are comfortable with statistics feel free to skip ahead to the next section)

.

-------- I: Probability distributions --------

When you have a lot of data it is helpful to see how many times different results appear in your dataset. To visualize this people use "histograms", which just shows how many times each element appears in the dataset by stacking each of the same elements on top of each other to form a graph. You may be familiar with the bell curve (also called the "normal distribution", which we will be calling it by). The normal distribution histogram looks like a big hump around zero and then drops off super quickly the further you get from it. This shape (the bell curve) is very nice because it has a lot of very nifty mathematical properties and seems to show up in nature all the time. Since it pops up in so many places, society has developed many different shortcuts related to it that speed up all kinds of calculations, including the shortcut that 1 standard deviation = 68.3%, 2 standard deviations = 95.5%, and 3 standard deviations = 99.7% (these only apply to the normal distribution). Despite how handy the normal distribution is and all the shortcuts we have for it are, and how much it shows up in the natural world, there is nothing that forces your specific dataset to look like it. In fact, your data can actually have any possible shape. As we will explore later, economic and financial datasets *rarely* follow the normal distribution.

-------- II: Percentiles --------

After you have made the histogram of your dataset you have built the "probability distribution" of your own dataset that is specific to all the data you have collected. There is a whole complicated framework for how to accurately calculate percentiles but we will dramatically simplify it for our use. The 'percentile' in our case is just the number of data points we are away from the "middle" of the data set (normally just 0). Lets say I took the difference of the daily close of a symbol for the last two weeks, green candles would be positive and red would be negative. In this example my dataset of day by day closing price difference is:

week 1:

week 2:

sorting all of these value into a single dataset I have:

I can separate the positive and negative returns and explore their distributions separately:

negative return distribution =

positive return distribution =

Taking the 25th% percentile of these would just be taking the value that is 25% towards the end of the end of these returns. Or akin the 100%th percentile would just be taking the vale that is 100% at the end of those:

negative return distribution (50%) = -5

positive return distribution (50%) = +4

negative return distribution (100%) = -10

positive return distribution (100%) = +20

Or instead of separating the positive and negative returns we can also look at all of the differences in the daily close as just pure price movement and not account for the direction, in this case we would pool all of the data together by ignoring the negative signs of the negative reruns

combined return distribution =

In this case the 50%th and 100%th percentile of the combined return distribution would be:

combined return distribution (50%) = 4

combined return distribution (100%) = 10

Sometimes taking the positive and negative distributions separately is better than pooling them into a combined distribution for some purposes. Other times the combined distribution is better.

Most financial data has very different distributions for negative returns and positive returns. This is encapsulated in sayings like "Price takes the stairs up and the elevator down".

-------- III: Standard Deviation --------

The formula for the standard deviation (refereed to here by its shorthand 'STDEV') can be intimidating, but going through each of its elements will illuminate what it does. The formula for STDEV is equal to:

square root ( (sum ) / N )

Going back the the dataset that you might have, the variables in the formula above are:

'mean' is the average of your entire dataset

'x' is just representative of a single point in your dataset (one point at a time)

'N' is the total number of things in your dataset.

Going back to the STDEV formula above we can see how each part of it works. Starting with the '(x - mean)' part. What this does is it takes every single point of the dataset and measure how far away it is from the mean of the entire dataset. Taking this value to the power of two: '(x - mean) ^ 2', means that points that are very far away from the dataset mean get 'penalized' twice as much. Points that are very close to the dataset mean are not impacted as much. In practice, this would mean that if your dataset had a bunch of values that were in a wide range but always stayed in that range, this value ('(x - mean) ^ 2') would end up being small. On the other hand, if your dataset was full of the exact same number, but had a couple outliers very far away, this would have a much larger value since the square par of '(x - mean) ^ 2' make them grow massive. Now including the sum part of 'sum ', this just adds up all the of the squared distanced from the dataset mean. Then this is divided by the number of values in the dataset ('N'), and then the square root of that value is taken.

There is nothing inherently special or definitive about the STDEV formula, it is just a tool with extremely widespread use and adoption. As we saw here, all the STDEV formula is really doing is measuring the intensity of the outliers.

--------------------------- Flaws of Bollinger Bands ---------------------------

The largest problem with Bollinger Bands is the assumption that price has a normal distribution. This is assumption is massively incorrect for many reasons that I will try to encapsulate into two points:

Price return do not follow a normal distribution, every single symbol on every single timeframe has is own unique distribution that is specific to only itself. Therefore all the tools, shortcuts, and ideas that we use for normal distributions do not apply to price returns, and since they do not apply here they should not be used. A more general approach is needed that allows each specific symbol on every specific timeframe to be treated uniquely.

The distributions of price returns on the positive and negative side are almost never the same. A more general approach is needed that allows positive and negative returns to be calculated separately.

In addition to the issues of the normal distribution assumption, the standard deviation formula (as shown above in the quick stats review) is essentially just a tame measurement of outliers (a more aggressive form of outlier measurement might be taking the differences to the power of 3 rather than 2). Despite this being a bit of a philosophical question, does the measurement of outlier intensity as defined by the STDEV formula really measure what we want to know as traders when we're experiencing volatility? Or would adjustments to that formula better reflect what we *experience* as volatility when we are actively trading? This is an open ended question that I will leave here, but I wanted to pose this question because it is a key part of what how the Bollinger Bands work that we all assume as a given.

Circling back on the normal distribution assumption, the standard deviation formula used in the calculation of the bands only encompasses the deviation of the candles that go into the moving average and have no knowledge of the historical price action. Therefore the level of the bands may not really reflect how the price action behaves over a longer period of time.

------------ Delivering Factually Accurate Data That Traders Need------------

In light of the problems identified above, this indicator fixes all of these issue and delivers statistically correct information that discretionary and algorithmic traders can use, with truly accurate probabilities. It takes the price action of the last 2,000 candles and builds a huge dataset of distributions that you can directly select your percentiles from. It also allows you to have the positive and negative distributions calculated separately, or if you would like, you can pool all of them together in a combined distribution. In addition to this, there is a wide selection of moving averages directly available in the indicator to choose from.

Hedge funds, quant shops, algo prop firms, and advanced mechanical groups all employ the true return distributions in their work. Now you have access to the same type of data with this indicator, wherein it's doing all the lifting for you.

------------------------------ Indicator Settings ------------------------------

.

---- Moving average ----

Select the type of moving average you would like and its length

---- Bands ----

The percentiles that you enter here will be pulled directly from the return distribution of the last 2,000 candles. With the typical Bollinger Bands, traders would select 2 standard deviations and incorrectly think that the levels it highlights are the 95.5% levels. Now, if you want the true 95.5% level, you can just enter 95.5 into the percentile value here. Each of the three available bands takes the true percentile you enter here.

---- Separate Positive & Negative Distributions----

If this box is checked the positive and negative distributions are treated indecently, completely separate from each other. You will see that the width of the top and bottom bands will be different for each of the percentiles you enter.

If this box is unchecked then all the negative and positive distributions are pooled together. You will notice that the width of the top and bottom bands will be the exact same.

---- Distribution Size ----

This is the number of candles that the price return is calculated over. EG: to collect the price return over the last 33 candles, the difference of price from now to 33 candles ago is calculated for the last 2,000 candles, to build a return distribution of 2000 points of price differences over 33 candles.

NEGATIVE NUMBERS(<0) == exact number of candles to include;

EG: setting this value to -20 will always collect volatility distributions of 20 candles

POSITIVE NUMBERS(>0) == number of candles to include as a multiple of the Moving Average Length value set above;

EG: if the Moving Average Length value is set to 22, setting this value to 2 will use the last 22*2 = 44 candles for the collection of volatility distributions

MORE candles being include will generally make the bands WIDER and their size will change SLOWER over time.

I wish you focus, dedication, and earnest success on your journey.

Happy trading :)

Edufx AMD~Accumulation, Manipulation, DistributionEdufx AMD Indicator

This indicator visualizes the market cycles using distinct phases: Accumulation, Manipulation, Distribution, and Reversal. It is designed to assist traders in identifying potential entry points and understanding price behavior during these phases.

Key Features:

1. Phases and Logic:

-Accumulation Phase: Highlights the price range where market accumulation occurs.

-Manipulation Phase:

- If the price sweeps below the accumulation low, it signals a potential "Buy Zone."

- If the price sweeps above the accumulation high, it signals a potential "Sell Zone."

-Distribution Phase: Highlights where price is expected to expand and establish trends.

-Reversal Phase: Marks areas where the price may either continue or reverse.

2. Weekly and Daily Cycles:

- Toggle the visibility of Weekly Cycles and Daily Cycles independently through the settings.

- These cycles are predefined with precise timings for each phase, based on your selected on UTC-5 timezone.

3. Customizable Appearance:

- Adjust the colors for each phase directly in the settings to suit your preferences.

- The indicator uses semi-transparent boxes to represent the phases, allowing easy visualization without obstructing the chart.

4. Static Boxes:

- Boxes representing the phases are drawn only once for the visible chart range and do not dynamically delete, ensuring important consistent reference points.

XAMD/AMDX ICT 01 [TradingFinder] SMC Quarterly Theory Cycles🔵 Introduction

The XAMD/AMDX strategy, combined with the Quarterly Theory, forms the foundation of a powerful market structure analysis. This indicator builds upon the principles of the Power of 3 strategy introduced by ICT, enhancing its application by incorporating an additional phase.

By extending the logic of Power of 3, the XAMD/AMDX tool provides a more detailed and comprehensive view of daily market behavior, offering traders greater precision in identifying key movements and opportunities

This approach divides the trading day into four distinct phases : Accumulation (19:00 - 01:00 EST), Manipulation (01:00 - 07:00 EST), Distribution (07:00 - 13:00 EST), and Continuation or Reversal (13:00 - 19:00 EST), collectively known as AMDX.

Each phase reflects a specific market behavior, providing a structured lens to interpret price action. Building on the fractal nature of time in financial markets, the Quarterly Theory introduces the Four Quarters Method, where a currency pair’s price range is divided into quarters.

These divisions, known as quarter points, highlight critical levels for analyzing and predicting market dynamics. Together, these principles allow traders to align their strategies with institutional trading patterns, offering deeper insights into market trends

🔵 How to Use

The AMDX framework provides a structured approach to understanding market behavior throughout the trading day. Each phase has its own characteristics and trading opportunities, allowing traders to align their strategies effectively. To get the most out of this tool, understanding the dynamics of each phase is essential.

🟣 Accumulation

During the Accumulation phase (19:00 - 01:00 EST), the market is typically quiet, with price movements confined to a narrow range. This phase is where institutional players accumulate their positions, setting the stage for future price movements.

Traders should use this time to study price patterns and prepare for the next phases. It’s a great opportunity to mark key support and resistance zones and set alerts for potential breakouts, as the low volatility makes immediate trading less attractive.

🟣 Manipulation

The Manipulation phase (01:00 - 07:00 EST) is often marked by sharp and deceptive price movements. Institutions create false breakouts to trigger stop-losses and trap retail traders into the wrong direction. Traders should remain cautious during this phase, focusing on identifying the areas of liquidity where these traps occur.

Watching for price reversals after these false moves can provide excellent entry opportunities, but patience and confirmation are crucial to avoid getting caught in the manipulation.

🟣 Distribution

The Distribution phase (07:00 - 13:00 EST) is where the day’s dominant trend typically emerges. Institutions execute large trades, resulting in significant price movements. This phase is ideal for trading with the trend, as the market provides clearer directional signals.

Traders should focus on identifying breakouts or strong momentum in the direction of the trend established during this period. This phase is also where traders can capitalize on setups identified earlier, aligning their entries with the market’s broader sentiment.

🟣 Continuation or Reversal

Finally, the Continuation or Reversal phase (13:00 - 19:00 EST) offers a critical juncture to assess the market’s direction. This phase can either reinforce the established trend or signal a reversal as institutions adjust their positions.

Traders should observe price behavior closely during this time, looking for patterns that confirm whether the trend is likely to continue or reverse. This phase is particularly useful for adjusting open positions or initiating new trades based on emerging signals.

🔵 Settings

Show or Hide Phases.

Adjust the session times for each phase :

Accumulation: 19:00-01:00 EST

Manipulation: 01:00-07:00 EST

Distribution: 07:00-13:00 EST

Continuation or Reversal: 13:00-19:00 EST

Modify Visualization : Customize how the indicator looks by changing settings like colors and transparency.

🔵 Conclusion

AMDX provides traders with a practical method to analyze daily market behavior by dividing the trading day into four key phases: Accumulation, Manipulation, Distribution, and Continuation or Reversal. Each phase highlights specific market dynamics, offering insights into how institutional activity shapes price movements.

From the quiet buildup in the Accumulation phase to the decisive trends of the Distribution phase, and the critical transitions in Continuation or Reversal, this approach equips traders with the tools to anticipate movements and make informed decisions.

By recognizing the significance of each phase, traders can avoid common traps during Manipulation, capitalize on clear trends during Distribution, and adapt to changes in the final phase of the day.

The structured visualization of market phases simplifies decision-making for traders of all levels. By incorporating these principles into your trading strategy, you can enhance your ability to align with market trends, optimize entry and exit points, and achieve more consistent results in your trading journey.

Power Of 3 ICT 01 [TradingFinder] AMD ICT & SMC Accumulations🔵 Introduction

The ICT Power of 3 (PO3) strategy, developed by Michael J. Huddleston, known as the Inner Circle Trader, is a structured approach to analyzing daily market activity. This strategy divides the trading day into three distinct phases: Accumulation, Manipulation, and Distribution.

Each phase represents a unique market behavior influenced by institutional traders, offering a clear framework for retail traders to align their strategies with market movements.

Accumulation (19:00 - 01:00 EST) takes place during low-volatility hours, as institutional traders accumulate orders. Manipulation (01:00 - 07:00 EST) involves false breakouts and liquidity traps designed to mislead retail traders. Finally, Distribution (07:00 - 13:00 EST) represents the active phase where significant market movements occur as institutions distribute their positions in line with the broader trend.

This indicator is built upon the Power of 3 principles to provide traders with a practical and visual tool for identifying these key phases. By using clear color coding and precise time zones, the indicator highlights critical price levels, such as highs and lows, helping traders to better understand market dynamics and make more informed trading decisions.

Incorporating the ICT AMD setup into daily analysis enables traders to anticipate market behavior, spot high-probability trade setups, and gain deeper insights into institutional trading strategies. With its focus on time-based price action, this indicator simplifies complex market structures, offering an effective tool for traders of all levels.

🔵 How to Use

The ICT Power of 3 (PO3) indicator is designed to help traders analyze daily market movements by visually identifying the three key phases: Accumulation, Manipulation, and Distribution.

Here's how traders can effectively use the indicator :

🟣 Accumulation Phase (19:00 - 01:00 EST)

Purpose : Identify the range-bound activity where institutional players accumulate orders.

Trading Insight : Avoid placing trades during this phase, as price movements are typically limited. Instead, use this time to prepare for the potential direction of the market in the next phases.

🟣 Manipulation Phase (01:00 - 07:00 EST)

Purpose : Spot false breakouts and liquidity traps that mislead retail traders.

Trading Insight : Observe the market for price spikes beyond key support or resistance levels. These moves often reverse quickly, offering high-probability entry points in the opposite direction of the initial breakout.

🟣 Distribution Phase (07:00 - 13:00 EST)

Purpose : Detect the main price movement of the day, driven by institutional distribution.

Trading Insight : Enter trades in the direction of the trend established during this phase. Look for confirmations such as breakouts or strong directional moves that align with broader market sentiment

🔵 Settings

Show or Hide Phases :mDecide whether to display Accumulation, Manipulation, or Distribution.

Adjust the session times for each phase :

Accumulation: 1900-0100 EST

Manipulation: 0100-0700 EST

Distribution: 0700-1300 EST

Modify Visualization : Customize how the indicator looks by changing settings like colors and transparency.

🔵 Conclusion

The ICT Power of 3 (PO3) indicator is a powerful tool for traders seeking to understand and leverage market structure based on time and price dynamics. By visually highlighting the three key phases—Accumulation, Manipulation, and Distribution—this indicator simplifies the complex movements of institutional trading strategies.

With its customizable settings and clear representation of market behavior, the indicator is suitable for traders at all levels, helping them anticipate market trends and make more informed decisions.

Whether you're identifying entry points in the Accumulation phase, navigating false moves during Manipulation, or capitalizing on trends in the Distribution phase, this tool provides valuable insights to enhance your trading performance.

By integrating this indicator into your analysis, you can better align your strategies with institutional movements and improve your overall trading outcomes.

Effective Volume (ADV) v3Effective Volume (ADV) v3: Enhanced Accumulation/Distribution Analysis Tool

This indicator is an updated version of the original script by cI8DH, now upgraded to Pine Script v5 with added functionality, including the Volume Multiple feature. The tool is designed for analyzing Accumulation/Distribution (A/D) volume, referred to here as "Effective Volume," which represents the volume impact in alignment with price direction, providing insights into bullish or bearish trends through volume.

Accumulation/Distribution Volume Analysis : The script calculates and visualizes Effective Volume (ADV), helping traders assess volume strength in relation to price action. By factoring in bullish or bearish alignment, Effective Volume highlights points where volume strongly supports price movements.

Volume Multiple Feature for Volume Multiplication : The Volume Multiple setting (default value 2) allows you to set a multiplier to identify bars where Effective Volume exceeds the previous bar’s volume by a specified factor. This feature aids in pinpointing significant shifts in volume intensity, often associated with potential trend changes.

Customizable Aggregation Types : Users can choose from three volume aggregation types:

Simple - Standard SMA (Simple Moving Average) for averaging Effective Volume

Smoothed - RMA (Recursive Moving Average) for a less volatile, smoother line

Cumulative - Accumulated Effective Volume for ongoing trend analysis

Volume Divisor : The “Divide Vol by” setting (default 1 million) scales down the Effective Volume value for easier readability. This allows Effective Volume data to be aligned with the scale of the price chart.

Visualization Elements

Effective Volume Columns : The Effective Volume bar plot changes color based on volume direction:

Green Bars : Bullish Effective Volume (volume aligns with price movement upwards)

Red Bars : Bearish Effective Volume (volume aligns with price movement downwards)

Moving Average Lines :

Volume Moving Average - A gray line representing the moving average of total volume.

A/D Moving Average - A blue line showing the moving average of Accumulation/Distribution (A/D) Effective Volume.

High ADV Indicator : A “^” symbol appears on bars where the Effective Volume meets or exceeds the Volume Multiple threshold, highlighting bars with significant volume increase.

How to Use

Analyze Accumulation/Distribution Trends : Use Effective Volume to observe if bullish or bearish volume aligns with price direction, offering insights into the strength and sustainability of trends.

Identify Volume Multipliers with Volume Multiple : Adjust Volume Multiple to track when Effective Volume has notably increased, signaling potential shifts or strengthening trends.

Adjust Volume Display : Use the volume divisor setting to scale Effective Volume for clarity, especially when viewing alongside price data on higher timeframes.

With customizable parameters, this script provides a flexible, enhanced perspective on Effective Volume for traders analyzing volume-based trends and reversals.

The Vet [TFO]In collaboration with @mickey1984 , "The Vet" was created to showcase various statistical measures of price.

The first core measurement utilizes the Defining Range (DR) concept on a weekly basis. For example, we might track the session from 09:30-10:30 on Mondays to get the DR high, DR low, IDR high, and IDR low. The DR high and low are the highest high and lowest low of the session, respectively, whereas the IDR high and low would be the highest candle body level (open or close) and lowest candle body level, respectively, during this window of time.

From this data, we use the IDR range (from IDR high to IDR low) to extrapolate several, custom projections of this range from its high and low so that we can collect data on how often these levels are hit, from the close of one DR session to the open of the next one.

This information is displayed in the Range Projection Table with a few main columns of information:

- The leftmost column indicates each level that is projected from the IDR range, where (+) indicates a projection above the range high, and (-) indicates a projection below the range low

- The "First Touch" column indicates how often price has reached these levels in the past at any point until the next weekly DR session

- The "Other Side Touch" column indicates how often price has reached a given level, then reversed to hit the opposing level of the same magnitude. For example, the above chart shows that if price hit the +1 projection, ~33% of instances also hit the -1 projection before the next weekly DR session. For this reason, the probabilities will be the same for projection levels of the same but opposite magnitude (+1 would be the same as -1, +3 would be the same as -3, etc.)

- The "Next Level Touch" column provides insight into how often price reaches the next greatest projection level. For example, in the above chart, the red box in the projection table is highlighting that once price hits the -2 projection, ~86% of instances reached the -3 projection before the next weekly DR session

- The last columns, "Within ADR" and "Within AWR" show if any of the projection levels are within the current Average Daily Range, or Average Weekly Range, respectively, which can both be enabled from the Average Range section

The next section, Distributions, primarily measures and displays the average price movements from specified intraday time windows. The option to Show Distribution Boxes will overlay a box showing each respective session's average range, while adjusting itself to encapsulate the price action of that session until the average range is met/exceeded. Users can choose to display the range average by Day of Week, or the Total average from all days. Values for average ranges can either be shown as point or percent values. We can also show a table to display this information about price's average ranges for each given session, and show labels displaying the current range vs its average.

The final section, Average Range, simply offers the ability to plot the Average Daily Range (ADR) and Average Weekly Range (AWR) of a specified length. An ADR of 10 for example would take the average of the last 10 days, from high to low, while an AWR of 10 would take the average of the last 10 weeks (if the current chart provides enough data to support this). Similarly, we can also show the Average Range Table to indicate what these ADR/AWR values are, what our current range is and how it compares to those values, as well as some simple statistics on how often these levels are hit. As an example, "Hit +/- ADR: 40%/35%" in this table would indicate that price has hit the upper ADR limit 40% of the time, and the lower limit 35% of the time, for the amount of data available on the current chart.

ICT Power Of Three | Flux Charts💎 GENERAL OVERVIEW

Introducing our new ICT Power Of Three Indicator! This indicator is built around the ICT's "Power Of Three" strategy. This strategy makes use of these 3 key smart money concepts : Accumulation, Manipulation and Distribution. Each step is explained in detail within this write-up. For more information about the process, check the "HOW DOES IT WORK" section.

Features of the new ICT Power Of Three Indicator :

Implementation of ICT's Power Of Three Strategy

Different Algorithm Modes

Customizable Execution Settings

Customizable Backtesting Dashboard

Alerts for Buy, Sell, TP & SL Signals

📌 HOW DOES IT WORK ?

The "Power Of Three" comes from these three keywords "Accumulation, Manipulation and Distribution". Here is a brief explanation of each keyword :

Accumulation -> Accumulation phase is when the smart money accumulate their positions in a fixed range. This phase indicates price stability, generally meaning that the price constantly switches between up & down trend between a low and a high pivot point. When the indicator detects an accumulation zone, the Power Of Three strategy begins.

Manipulation -> When the smart money needs to increase their position sizes, they need retail traders' positions for liquidity. So, they manipulate the market into the opposite direction of their intended direction. This will result in retail traders opening positions the way that the smart money intended them to do, creating liquidity. After this step, the real move that the smart money intended begins.

Distribution -> This is when the real intention of the smart money comes into action. With the new liquidity thanks to the manipulation phase, the smart money add their positions towards the opposite direction of the retail mindset. The purpose of this indicator is to detect the accumulation and manipulation phases, and help the trader move towards the same direction as the smart money for their trades.

Detection Methods Of The Indicator :

Accumulation -> The indicator detects accumulation zones as explained step-by-step :

1. Draw two lines from the lowest point and the highest point of the latest X bars.

2. If the (high line - low line) is lower than Average True Range (ATR) * accumulationConstant

3. After the condition is validated, an accumulation zone is detected. The accumulation zone will be invalidated and manipulation phase will begin when the range is broken.

Manipulation -> If the accumulation range is broken, check if the current bar closes / wicks above the (high line + ATR * manipulationConstant) or below the (low line - ATR * manipulationConstant). If the condition is met, the indicator detects a manipulation zone.

Distribution -> The purpose of this indicator is to try to foresee the distribution zone, so instead of a detection, after the manipulation zone is detected the indicator automatically create a "shadow" distribution zone towards the opposite direction of the freshly detected manipulation zone. This shadow distribution zone comes with a take-profit and stop-loss layout, customizable by the trader in the settings.

The X bars, accumulationConstant and manipulationConstant are subject to change with the "Algorithm Mode" setting. Read the "Settings" section for more information.

This indicator follows these steps and inform you step by step by plotting them in your chart.

🚩UNIQUENESS

This indicator is an all-in-one suite for the ICT's Power Of Three concept. It's capable of plotting the strategy, giving signals, a backtesting dashboard and alerts feature. Different and customizable algorithm modes will help the trader fine-tune the indicator for the asset they are currently trading. The backtesting dashboard allows you to see how your settings perform in the current ticker. You can also set up alerts to get informed when the strategy is executable for different tickers.

⚙️SETTINGS

1. General Configuration

Algorithm Mode -> The indicator offers 3 different detection algorithm modes according to your needs. Here is the explanation of each mode.

a) Small Manipulation

This mode has the default bar length for the accumulation detection, but a lower manipulation constant, meaning that slighter imbalances in the price action can be detected as manipulation. This setting can be useful on tickers that have lower liquidity, thus can be manipulated easier.

b) Big Manipulation

This mode has the default bar length for the accumulation detection, but a higher manipulation constant, meaning that heavier imbalances on the price action are required in order to detect manipulation zones. This setting can be useful on tickers that have higher liquidity, thus can be manipulated harder.

c) Short Accumulation

This mode has a ~70% lower bar length requirement for accumulation zone detection, and the default manipulation constant. This setting can be useful on tickers that are highly volatile and do not enter accumulation phases too often.

Breakout Method -> If "Close" is selected, bar close price will be taken into calculation when Accumulation & Manipulation zone invalidation. If "Wick" is selected, a wick will be enough to validate the corresponding zone.

2. TP / SL

TP / SL Method -> If "Fixed" is selected, you can adjust the TP / SL ratios from the settings below. If "Dynamic" is selected, the TP / SL zones will be auto-determined by the algorithm.

Risk -> The risk you're willing to take if "Dynamic" TP / SL Method is selected. Higher risk usually means a better winrate at the cost of losing more if the strategy fails. This setting is has a crucial effect on the performance of the indicator, as different tickers may have different volatility so the indicator may have increased performance when this setting is correctly adjusted.

3. Visuals

Show Zones -> Enables / Disables rendering of Accumulation (yellow) and Manipulation (red) zones.

Frequency and Volume ProfileFREQUENCY & VOLUME PROFILE

⚪ OVERVIEW

The Frequency and Volume Profile indicator plots a frequency or volume profile based on the visible bars on the chart, providing insights into price levels with significant trading activity.

⚪ USAGE

● Market Structure Analysis:

Identify key price levels where significant trading activity occurred, which can act as support and resistance zones.

● Volume Analysis:

Use the volume mode to understand where the highest trading volumes have occurred, helping to confirm strong price levels.

● Trend Confirmation:

Analyze the distribution of trading activity to confirm or refute trends, mark important levels as support and resistance, aiding in making more informed trading decisions.

● Frequency Distribution:

In statistics, a frequency distribution is a list of the values that a variable takes in a sample. It is usually a list. Displayed as a histogram.

⚪ SETTINGS

Source: Select the price data to use for the profile calculation (default: hl2).

Move Profile: Set the number of bars to offset the profile from the current bar (default: 100).

Mode: Choose between "Frequency" and "Volume" for the profile calculation.

Profile Color: Customize the color of the profile lines.

Lookback Period: Uses 5000 bars for daily and higher timeframes, otherwise 10000 bars.

The Frequency Profile indicator is a powerful tool for visualizing price levels with significant trading activity, whether in terms of frequency or volume. Its dynamic calculation and customizable settings make it a versatile addition to any trading strategy.

Global Net Liquidity (TG fork)Worldwide net liquidity, with trend coloring.

Global Net Liquidity attempts to represent worldwide net liquidity, and is defined as: Fed + Japan + China + UK + ECB - RRP - TGA , Where the first five components are central bank assets.

On TradingView, the indicator can be reproduced with the following equations: Global Net Liquidity = FRED:WALCL + FRED:JPNASSETS * FX_IDC:JPYUSD + CNCBBS * FX_IDC:CNYUSD + GBCBBS * FX:GBPUSD + ECBASSETSW * FX:EURUSD + RRPONTSYD + WTREGEN

However, this indicator adds a moving average cloud, and margin coloring, which eases historical trend assessment at a glance.

This indicator can be seen as an alternative representation of the accumulation/distribution indicator (and hence the same terms can be used in this description).

The Moving Average Cloud is simply the filling between the moving average (by default an EMA) and the current value. This feature was inspired by D7R ACC/DIST closed-source indicator, kudos to D7R for making such neat visual indicators.

Usage instructions:

Blue is more likely a phase of accumulation because the current value is above its historical price as defined by the moving average,

red is when this is more likely a phase of distribution.

Yellow is when the difference is below the margin, so we consider it is insignificant and that the trend is undecided. This can be disabled by setting the margin to 0.

While the color indicates if it's more likely an accumulation (blue) or distribution (red) phase or undecided (yellow), the cloud's vertical size allows to assess the strength of this tendency and the horizontal size the momentum, so that the bigger the cloud, the stronger the accumulation (if cloud is blue) or distribution (if cloud is red).

Why is that so? This is because the cloud represents the difference between the current tendency and the moving averaged past one, so a bigger cloud represents a bigger departure from recently observed tendencies. In practice, when there is accumulation, a pump in price can be expected soon, or if it already happened then it means it is indeed supported by volume, whereas if distribution, either a dump is to be expected soon, or if it already happened it means it's supported by volume.

Or maybe not necessarily a dump, but if there is a move upward in price, but the indicator indicates a strong distribution, then it means that the price movement is not supported and may not be sustainable (reversal may happen at anytime), whereas if price is going upward AND there is an accumulation (blue coloring) then it is more sustainable. This can be used to adapt strategies accordingly (risk on/risk off depending on whether there is concordance of both price and accumulation/distribution).

This indicator also includes sentiment signals that can be used to trigger alarms.

This indicator is a remix of Dharmatech's, who authored the first this Global Net Liquidity equation, kudos to them! Please show them some love if you like this indicator!

TTP Big Whale ExplorerThe Big Whale Explorer is an indicator that looks into the ratio of large wallets deposits vs withdrawals.

Whales tend to sale their holding when they transfer their holdings into exchanges and they tend to hold when they withdraw.

In this overlay indicator you'll be able to see in an oscillator format the moves of large wallets.

The moves above 1.5 turn into red symbolising that they are starting to distribute. This can eventually have an impact in the price by causing anything from a mild pullback to a considerable crash depending on how much is being actually sold into the market.

Moves below 0.5 mean that the large whales are heavily accumulating and withdrawing. During these periods price could still pullback or even crash but eventually the accumulation can take prices to new highs.

Instructions:

1) Load INDEX:BTCUSD or BNC:BLX to get the most historic data as possible

2) use the daily timeframe

3) load the indicator into the chart

NormInvTargetSeekerNormInvTargetSeeker

The NormInvTargetSeeker is a trading tool designed to aid traders in identifying and capitalizing on Distribution and Accumulation zones, highlighting specific price levels that could serve as targets for future price movements. Although the indicator itself is not multi-timeframe, an effective trading strategy might involve signal validation across multiple timeframes.

🔶 USAGE

The indicator identifies Distribution and Accumulation zones, providing potential targets for future price moves.

Traders are encouraged to use these zones as profit targets or potential reversal points.

Confluence Zones

These zones are identified as regions where various factors or levels converge, signaling an increased probability of price reaction.

They can be used to reinforce signals or identify levels where price might encounter significant resistance or support.

🔹 Trading Strategy

First, identify a signal on your primary trading timeframe.

Manually check higher timeframes to ensure the signal aligns with them.

Use the identified zones, whether Distribution or Accumulation, as target zones for your trades.

🔶 Order Blocks

The NormInvTargetSeeker identifies "Order Blocks" by examining a specified number of consecutive candles with a specific condition: the current candle must completely engulf the previous candle. This means that both the high and low of the current candle are higher and lower, respectively, than the high and low of the previous candle, signifying a dominant move in the direction of the current candle.

🔹 Trading Strategy

Target Confirmation: Order Blocks can serve to confirm target points, providing additional validation for identified levels.

Market Insight: They offer crucial insights into whether "big hands" or institutional players are positioned as buyers or sellers in the market.

Traders can use Order Blocks as a means to validate targets or key price levels, observing if the price reacts significantly upon reaching these blocks.

They can also provide insights into the general market direction or underlying market strength by identifying where the major market players are placing their orders.

🔶 SETTINGS

The indicator allows users to adjust various parameters to customize the display and logic of the tool to fit their needs.

🔹 Display Settings

Users can customize the colors and displays of various zones and labels to match their preferences.

🔶 LICENSE AND CREDITS

This work is licensed under Attribution-NonCommercial-ShareAlike 4.0 International (CC BY-NC-SA 4.0). More information here: creativecommons.org

This indicator utilizes a TypeScript implementation of the Normal Inverse function as a reference, which can be found here : github.com

Special thanks to the authors of the referenced code for providing a foundation upon which this indicator was built.

🔶 UPDATES

Current Version: 1.0.0

For future updates, please check the comment section.

🔶 CONTACT

For any questions or suggestions, please feel free to contact @RickSimpson on TradingView.

Position Cost DistributionThe Position Cost Distribution indicator (also known as the Market Position Overview, Chip Distribution, or CYQ Algorithm) provides an estimate of how shares are distributed across different price levels. Visually, it resembles the Volume Profile indicator, though they rely on distinct computational approaches.

🟠 Principle

The Position Cost Distribution algorithm is based on the principle that a security's total shares outstanding usually remains constant, except under conditions like stock splits, reverse splits, or new share issuance. It views all trading activity as simply exchanging share positions between holders at different price points.

By analyzing daily trade volume and the prior day's distribution, the algorithm infers the resulting share distribution after each day. By tracking these inferred transpositions over time, the indicator builds up an aggregate view of the estimated share concentration at each price level. This provides insights into potential buying and selling pressure zones that could form support or resistance areas.

Together with the Volume Profile, the Position Cost Distribution gives traders multiple lenses for examining market structure from both a volume and positional standpoint. Both can help identify meaningful technical price levels.

🟠 Algorithm

The algorithm initializes by allocating all shares to the price range encompassed by the first bar displayed on the chart. Preferably, the chart window should include the stock's IPO date, allowing the model to distribute shares specifically to the IPO price.

For subsequent trading sessions, the indicator performs the following calculations:

1. The daily turnover ratio is calculated by dividing the bar's trading volume by total outstanding shares.

2. For each price level (bucket), the number of shares is reduced by the turnover amount to represent shares transferring from existing holders.

3. The bar's total volume is then added to buckets corresponding to that period's price range.

Currently, the model assumes each share has an equal probability of being exchanged, regardless of how long ago it was acquired or at what price. Potential optimizations could incorporate factors like making shares held longer face a smaller chance of transfer compared to more recently purchased shares.

────────────────────────────────────────────

中文介绍:该指标为“筹码分布”的一个 TradingView 实现 :)

Paytience DistributionPaytience Distribution Indicator User Guide

Overview:

The Paytience Distribution indicator is designed to visualize the distribution of any chosen data source. By default, it visualizes the distribution of a built-in Relative Strength Index (RSI). This guide provides details on its functionality and settings.

Distribution Explanation:

A distribution in statistics and data analysis represents the way values or a set of data are spread out or distributed over a range. The distribution can show where values are concentrated, values are absent or infrequent, or any other patterns. Visualizing distributions helps users understand underlying patterns and tendencies in the data.

Settings and Parameters:

Main Settings:

Window Size

- Description: This dictates the amount of data used to calculate the distribution.

- Options: A whole number (integer).

- Tooltip: A window size of 0 means it uses all the available data.

Scale

- Description: Adjusts the height of the distribution visualization.

- Options: Any integer between 20 and 499.

Round Source

- Description: Rounds the chosen data source to a specified number of decimal places.

- Options: Any whole number (integer).

Minimum Value

- Description: Specifies the minimum value you wish to account for in the distribution.

- Options: Any integer from 0 to 100.

- Tooltip: 0 being the lowest and 100 being the highest.

Smoothing

- Description: Applies a smoothing function to the distribution visualization to simplify its appearance.

- Options: Any integer between 1 and 20.

Include 0

- Description: Dictates whether zero should be included in the distribution visualization.

- Options: True (include) or False (exclude).

Standard Deviation

- Description: Enables the visualization of standard deviation, which measures the amount of variation or dispersion in the chosen data set.

- Tooltip: This is best suited for a source that has a vaguely Gaussian (bell-curved) distribution.

- Options: True (enable) or False (disable).

Color Options

- High Color and Low Color: Specifies colors for high and low data points.

- Standard Deviation Color: Designates a color for the standard deviation lines.

Example Settings:

Example Usage RSI

- Description: Enables the use of RSI as the data source.

- Options: True (enable) or False (disable).

RSI Length

- Description: Determines the period over which the RSI is calculated.

- Options: Any integer greater than 1.

Using an External Source:

To visualize the distribution of an external source:

Select the "Move to" option in the dropdown menu for the Paytience Distribution indicator on your chart.

Set it to the existing panel where your external data source is placed.

Navigate to "Pin to Scale" and pin the indicator to the same scale as your external source.

Indicator Logic and Functions:

Sinc Function: Used in signal processing, the sinc function ensures the elimination of aliasing effects.

Sinc Filter: A filtering mechanism which uses sinc function to provide estimates on the data.

Weighted Mean & Standard Deviation: These are statistical measures used to capture the central tendency and variability in the data, respectively.

Output and Visualization:

The indicator visualizes the distribution as a series of colored boxes, with the intensity of the color indicating the frequency of the data points in that range. Additionally, lines representing the standard deviation from the mean can be displayed if the "Standard Deviation" setting is enabled.

The example RSI, if enabled, is plotted along with its common threshold lines at 70 (upper) and 30 (lower).

Understanding the Paytience Distribution Indicator

1. What is a Distribution?

A distribution represents the spread of data points across different values, showing how frequently each value occurs. For instance, if you're looking at a stock's closing prices over a month, you may find that the stock closed most frequently around $100, occasionally around $105, and rarely around $110. Graphically visualizing this distribution can help you see the central tendencies, variability, and shape of your data distribution. This visualization can be essential in determining key trading points, understanding volatility, and getting an overview of the market sentiment.

2. The Rounding Mechanism

Every asset and dataset is unique. Some assets, especially cryptocurrencies or forex pairs, might have values that go up to many decimal places. Rounding these values is essential to generate a more readable and manageable distribution.

Why is Rounding Needed? If every unique value from a high-precision dataset was treated distinctly, the resulting distribution would be sparse and less informative. By rounding off, the values are grouped, making the distribution more consolidated and understandable.

Adjusting Rounding: The `Round Source` input allows users to determine the number of decimal places they'd like to consider. If you're working with an asset with many decimal places, adjust this setting to get a meaningful distribution. If the rounding is set too low for high precision assets, the distribution could lose its utility.

3. Standard Deviation and Oscillators

Standard deviation is a measure of the amount of variation or dispersion of a set of values. In the context of this indicator:

Use with Oscillators: When using oscillators like RSI, the standard deviation can provide insights into the oscillator's range. This means you can determine how much the oscillator typically deviates from its average value.

Setting Bounds: By understanding this deviation, traders can better set reasonable upper and lower bounds, identifying overbought or oversold conditions in relation to the oscillator's historical behavior.

4. Resampling

Resampling is the process of adjusting the time frame or value buckets of your data. In the context of this indicator, resampling ensures that the distribution is manageable and visually informative.

Resample Size vs. Window Size: The `Resample Resolution` dictates the number of bins or buckets the distribution will be divided into. On the other hand, the `Window Size` determines how much of the recent data will be considered. It's crucial to ensure that the resample size is smaller than the window size, or else the distribution will not accurately reflect the data's behavior.

Why Use Resampling? Especially for price-based sources, setting the window size around 500 (instead of 0) ensures that the distribution doesn't become too overloaded with data. When set to 0, the window size uses all available data, which may not always provide an actionable insight.

5. Uneven Sample Bins and Gaps

You might notice that the width of sample bins in the distribution is not uniform, and there can be gaps.

Reason for Uneven Widths: This happens because the indicator uses a 'resampled' distribution. The width represents the range of values in each bin, which might not be constant across bins. Some value ranges might have more data points, while others might have fewer.

Gaps in Distribution: Sometimes, there might be no data points in certain value ranges, leading to gaps in the distribution. These gaps are not flaws but indicate ranges where no values were observed.

In conclusion, the Paytience Distribution indicator offers a robust mechanism to visualize the distribution of data from various sources. By understanding its intricacies, users can make better-informed trading decisions based on the distribution and behavior of their chosen data source.

SimilarityMeasuresLibrary "SimilarityMeasures"

Similarity measures are statistical methods used to quantify the distance between different data sets

or strings. There are various types of similarity measures, including those that compare:

- data points (SSD, Euclidean, Manhattan, Minkowski, Chebyshev, Correlation, Cosine, Camberra, MAE, MSE, Lorentzian, Intersection, Penrose Shape, Meehl),

- strings (Edit(Levenshtein), Lee, Hamming, Jaro),

- probability distributions (Mahalanobis, Fidelity, Bhattacharyya, Hellinger),

- sets (Kumar Hassebrook, Jaccard, Sorensen, Chi Square).

---

These measures are used in various fields such as data analysis, machine learning, and pattern recognition. They

help to compare and analyze similarities and differences between different data sets or strings, which

can be useful for making predictions, classifications, and decisions.

---

References:

en.wikipedia.org

cran.r-project.org

numerics.mathdotnet.com

github.com

github.com

github.com

Encyclopedia of Distances, doi.org

ssd(p, q)

Sum of squared difference for N dimensions.

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

Returns: Measure of distance that calculates the squared euclidean distance.

euclidean(p, q)

Euclidean distance for N dimensions.

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

Returns: Measure of distance that calculates the straight-line (or Euclidean).

manhattan(p, q)

Manhattan distance for N dimensions.

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

Returns: Measure of absolute differences between both points.

minkowski(p, q, p_value)

Minkowsky Distance for N dimensions.

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

p_value (float) : `float` P value, default=1.0(1: manhatan, 2: euclidean), does not support chebychev.

Returns: Measure of similarity in the normed vector space.

chebyshev(p, q)

Chebyshev distance for N dimensions.

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

Returns: Measure of maximum absolute difference.

correlation(p, q)

Correlation distance for N dimensions.

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

Returns: Measure of maximum absolute difference.

cosine(p, q)

Cosine distance between provided vectors.

Parameters:

p (float ) : `array` 1D Vector.

q (float ) : `array` 1D Vector.

Returns: The Cosine distance between vectors `p` and `q`.

---

angiogenesis.dkfz.de

camberra(p, q)

Camberra distance for N dimensions.

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

Returns: Weighted measure of absolute differences between both points.

mae(p, q)

Mean absolute error is a normalized version of the sum of absolute difference (manhattan).

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

Returns: Mean absolute error of vectors `p` and `q`.

mse(p, q)

Mean squared error is a normalized version of the sum of squared difference.

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

Returns: Mean squared error of vectors `p` and `q`.

lorentzian(p, q)

Lorentzian distance between provided vectors.

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

Returns: Lorentzian distance of vectors `p` and `q`.

---

angiogenesis.dkfz.de

intersection(p, q)

Intersection distance between provided vectors.

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

Returns: Intersection distance of vectors `p` and `q`.

---

angiogenesis.dkfz.de

penrose(p, q)

Penrose Shape distance between provided vectors.

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

Returns: Penrose shape distance of vectors `p` and `q`.

---

angiogenesis.dkfz.de

meehl(p, q)

Meehl distance between provided vectors.

Parameters:

p (float ) : `array` Vector with first numeric distribution.

q (float ) : `array` Vector with second numeric distribution.

Returns: Meehl distance of vectors `p` and `q`.

---

angiogenesis.dkfz.de

edit(x, y)

Edit (aka Levenshtein) distance for indexed strings.

Parameters:

x (int ) : `array` Indexed array.

y (int ) : `array` Indexed array.

Returns: Number of deletions, insertions, or substitutions required to transform source string into target string.

---

generated description:

The Edit distance is a measure of similarity used to compare two strings. It is defined as the minimum number of