[Camarilla Pivots] Signal Clean Up Analysis with Backtest (TSO)Camarilla Pivots NEW GEN Indicator!

This is a full-cycle trading system indicator, which uses Camarilla Pivots for generating signals using a custom developed algorithm, TP (Take Profit) and SL (Stop Loss) levels. There are 3 SOURCES for signals (each can be used separately or in combination or all 3 can be used at the same time, each signal SOURCE is using Camarilla Pivots levels to open optimal trade direction) with chained (NOTE: There are many potential profitable setups available, by combining clean up features availabe in the indicator settings!) signal cleanup and analysis approach with scheduling and alerting capabilities. Works best with shorter timeframes: 1M, 5M, 15M, 1H.

NOTE: Every calculation is done on a confirmed closed candle bar state, so the indicator will never repaint!

NOTE: At position open - there will be calculated Take-Profit and Stop-Loss targets, however each target is considered hit, when candle bar closes breaking that target, so Take-Profit and Stop-Loss when hit will slightly differ then what you see at position open!

===========================================================================

Explanation of all the Features | Configuration Guide | Indicator Settings | Signal Cleanup Analysis

---------------------------------------------------------------------------

>>> Customizable Backtesting for a specific date range, results via TradingView strategy, which includes “Deep Backtesting” for largest amounts of data on trading results.

>>> Trading Schedule with customizable trading daily time range, automatic closing/alert trades before Power Hour or right before market closes or leave it open until next day.

>>> 3 Trading Systems.

>>> Multiple Signal SOURCEs for opening trades, either SOURCE can be used or both at the same time!

>>> Static/Dynamic Stop-Loss setups (HIGHLIGHT: Stop-Loss will be moved to Entry after TP1 is taken, which minimizes risk).

>>> Single or Multiple profit targets (up to 5).

>>> Take-Profit customizable offset feature (set your Take-Profit targets slightly before everyone is expecting it!).

>>> Candle bar signal analysis (matching candle color, skip opposite structured and/or doji candle uncertain signals).

>>> Additional analysis of VWAP/EMA/ATR/EWO (Elliot Wave Oscillator)/Divergence MACD+RSI/Volume signal confirmation (clean up your chart with indicator showing only the best potential signals!).

>>> Advanced Alerts setup, which can be potentially setup with a trading bot over TradingView Webhook (NOTE: This will require advanced programming knowledge).

===========================================================================

Labels, plots, colors explanations:

---------------------------------------------------------------------------

>>>>> LONG open: green "house" looking arrow below candle bar.

>>>>> SHORT open: red "house" looking arrow above candle bar.

>>>>> LONG/SHORT take-profit target: green/red circles (multi-profit > TP2/3/4/5 smaller circles).

>>>>> LONG/SHORT stop-loss target: green/red + crosses.

>>>>> LONG/SHORT take-profit hits: green/red diamonds.

>>>>> LONG/SHORT stop-loss hits: green/red X-crosses.

>>>>> LONG/SHORT EOD (End of Day | Intraday style) close (profitable trade): green/red squares.

>>>>> LONG/SHORT EOD (End of Day | Intraday style) close (loss trade): green/red PLUS(+)-crosses.

===========================================================================

Date Range and Trading Schedule Settings

---------------------------------------------------------------------------

>>>>> Date Range: Select your start and/or end dates (uncheck “End” for indicator to show results up to the very moment and to use for LIVE trading) for backtesting results, if not using backtesting – uncheck “Start”/“End” to turn it off.

>>>>> Use TradingView “Strategy Tester” to see backtesting results

NOTE: If Strategy Tester does not show any results with Date Ranged fully unchecked, there may be an issue where a script opens a trade, but there is not enough TradingView power to set the Take-Profit and Stop-Loss and somehow an open trade gets stuck and never closes, so there are “no trades present”. In such case you will need to manually check “Start”/“End” dates or use “Depp Backtesting” feature!

>>>>> Trading Schedule: This is where you can setup Intraday Session or any custom session schedule you wish. Turn it ON. Select trading hours. Select EOD (End of Day) setting (NOTE: If it will be OFF, the indicator will assume you are holding your position open until next day!). Please note the EOD trade closure times with the 2 different Intraday close settings when turned on:

At Market Close:

1/3/5min > will close at 15:55pm ET

15min > will close at 15:45pm ET

30min > will close at 15:30pm ET

45min > will close at 15:45pm ET

60min > will close at 15:00pm ET

Before Power Hour:

1/3/5min > will close at 15:00pm ET

15min > will close at 15:00pm ET

30min > will close at 15:00pm ET

45min > will close at 15:00pm ET

60min > will close at 15:00pm ET

>>> Trading Systems: 1) "Open Until Closed by TP or SL": the signal will only open a trade if no trades are currently open/trunning, a trade can only be closed by Take Profit, Stop Loss or End of Day close (if turned on) | 2) "Open Until Closed by TP or SL + OCA": Same as 1), but if there is an opposite signal to the trade which is currently open > it will immediately be closed with new trade open or End of Day close (if turned on) | 3) "OCA (no TP or SL)": There are is Take Profit or Stop Loss, only an opposite signal will close current trade and open an opposite one or End of Day close (if turned on).

>>> Position Open sources:

>>>>> Position Open - SOURCE1 | LONG: S3, SL: S4, TP1: R3, TP2: R4, TP3: R5, TP4/5: Smart Formula | SHORT: R3, SL: R4, TP1: S3, TP2: S4, TP3: S5, TP4/5: Smart Formula

>>>>> Position Open - SOURCE2 | LONG: R4, SL: R3, TP1: R5, TP2/3/4/5: Smart Formula | SHORT: S4, SL: S3, TP1: S5, TP2/3/4/5: Smart Formula

>>>>> Position Open - SOURCE3 | LONG: R5, SL: R4, TP1/2/3/4/5: Smart Formula | SHORT: S5, SL: S4, TP1/2/3/4/5: Smart Formula

>>> Turn On/Off: Current Position SL + Opposite Position Open Signal on the same closing candle bar (If current trade hits Stop-Loss and at that same closing candle bar there is a signal for an opposite direction trade > indicator will close current position as Stop-Loss and immediately open an opposite position). NOTE: With this option turned on, there will be more trades, but not necessarily better results, since after Stop-Loss is hit, it may make sense to wait a little before opening an opposite trade, even if it matches the condition at the same time when Stop-Loss is hit, but sometimes it shows great results, so this setting/feature is included.

>>> Turn On/Off: Turn On/Off: Current Position REGULAR SL | Only the SL + Opposite Position Open will trigger if turned on, IF NOT - THERE WILL BE NO STOP-LOSS AT ALL!!! NOTE: It is very dangerous to trade without Stop-Loss!

>>>>> Signal Candle Bar consuming Take-Profits - position/trade signal candle bar is big enought to "consume"/close ahead the first TP setting > the signal can either be skipped, or all Take-Profit areas pushed ahead using smart formula)

>>>>> MULTIPROFIT | TP (Take-Profit) System: Once the trade is open, all Take-Profit target(s) are immediately calculated and set for the trade > once the target(s) is hit > trade will be partially closed (if candle bar closes beyond several Take-Profit targets > trade will be reduced accordingly to the amount of how many Take-Profit targets were hit)

>>>>> MULTIPROFIT | SL (Stop-Loss) System: 1) Static – Once the trade is open, Stop-Loss is calculated and set for the remaining of the trade ||| 2) Dynamic – At trade open, Stop-Loss is calculated and set the same way, however once 1st Take-Profit is taken > Stop-Loss is moved to Entry, reducing the risk.

>>>>> # of TPs (number of take profit targets): Just like it is named, this is where you select the number of Take-Profit targets for your trading system (NOTE: If "OCA (no TP or SL)" Trading System is selected, this setting won’t do anything, since there are no TP or SLs for that system).

>>>>> TP(s) offset: This is a special feature for all Take-Profit targets, where you can turn on a customizable offset, so that if the price is almost hitting the Take-Profit target, but never actually touches it > you will capture it. This is good to use with HHLL (Highest High Lowest Low), which is pretty much a Support/Resistance as often the price will nearly touch these strong areas and turn around…

===========================================================================

Signal Analysis and Cleanup Settings

---------------------------------------------------------------------------

>>>>> Candle Analysis | Candle Color signal confirmation: If closed candle bar color does not match the signal direction > no trade will be open.

>>>>> Candle Analysis | Skip opposite candle signals: If closed candle bar color will match the signal direction, but candle structure will be opposite (for example: bearish green hammer, long high stick on top of a small green square) > no trade will be open.

>>>>> Candle Analysis | Skip doji candle signals: If closed candle bar will be the uncertain doji > no trade will be open.

>>>>> Divergence/Oscillator Analysis | EWO (Elliot Wave Oscillator) signal confirmation: LONG will only be open if at signal, EWO is green or will be at bullish slope (you can select which setting you desire), SHORT if EWO is red or will be at bearish slope.

>>>>> Divergence/Oscillator Analysis | VWAP signal confirmation: LONG will only be open if at signal, the price will be above VWAP, SHORT if below.

>>>>> Divergence/Oscillator Analysis | Moving Average signal confirmation: LONG will only be open if at signal, the price will be above selected Moving Average, SHORT if below.

>>>>> Divergence/Oscillator Analysis | ATR signal confirmation: LONG will only be open if at signal, the price will be above ATR, SHORT if below.

>>>>> Divergence/Oscillator Analysis | RSI + MACD signal confirmation: LONG will only be open if at signal, RSI + MACD will be bullish, SHORT if RSI + MACD will be bearish.

>>>>> Volume signal confirmation: LONG/SHORT will only be opened with strong Volume matching the signal direction, by default, strong Volume percentage is set to 150% and weak to 50%, but you can change it as you desire.

===========================================================================

||||||||||||||||||||||||||||||||||| *** ||||||||||||||||||||||||||||||||||| *** |||||||||||||||||||||||||||||||||||

||||||||||||||||||||||||||||||||||| *** ||||||||||||||||||||||||||||||||||| *** |||||||||||||||||||||||||||||||||||

TP System - VERY IMPORTANT INFO!

-------------------------------------------------------------------------------------------------------------------

"TP PERCENTAGE" - amount by which current trade/position needs to be reduced/partially closed/sold.

-------------------------------------------------------------------------------------------------------------------

TP System: Dynamic

"TP PERCENTAGE" - will always be the same amount (trade/position size divided by the # of take-profit(TP) targets) and percentage to be closed will always be of the ORIGINAL trade/position.

-------------------------------------------------------------------------------------------------------------------

TP System: Static

"TP PERCENTAGE" - will always be the same amount IF take-profit(TP) targets are hit 1-by-1 (TP1 > TP2 > TP3 > TP4 > TP5), otherwise it will vary and unless it is a 1st take-profit(TP1), the REMAINING trade/position size will always be smaller than original and therefore the percentage to be closed will always be of the REMAINING trade/position and NOT the original one!

-------------------------------------------------------------------------------------------------------------------

"TP PERCENTAGE" CheatSheet (these are the only percentages you may see)

-----------------------------------------------------------------------

TP PERCENTAGE---Close/Sell Amount-------------Example (trade size: 50 stocks)

20%-------------trade size * 0.2--------------50 * 0.2 = 10 stocks

25%-------------trade size * 0.25-------------50 * 0.25 = 12.5(~13) stocks

34%-------------trade size * 0.34-------------50 * 0.34 = 17 stocks

40%-------------trade size * 0.4--------------50 * 0.4 = 20 stocks

50%-------------trade size * 0.5--------------50 * 0.5 = 25 stocks

60%-------------trade size * 0.6--------------50 * 0.6 = 30 stocks

66%-------------trade size * 0.66-------------50 * 0.66 = 33 stocks

75%-------------trade size * 0.75-------------50 * 0.75 = 37.5(~38) stocks

80%-------------trade size * 0.8--------------50 * 0.8 = 40 stocks

100%------------trade size--------------------50 = 50 stocks

-----------------------------------------------------------------------

If for any reason a portion of the current/remaining trade closed at such occurrence was slightly wrong, it is not an issue. Such occurrences are rare and with slight difference in partial TP closed is not significant to overall performance of our algorithms.

||||||||||||||||||||||||||||||||||| *** ||||||||||||||||||||||||||||||||||| *** |||||||||||||||||||||||||||||||||||

||||||||||||||||||||||||||||||||||| *** ||||||||||||||||||||||||||||||||||| *** |||||||||||||||||||||||||||||||||||

Alert Settings (you don’t have to touch this section unless you will be using TradingView alerts through a Webhook to use with trading bot)

---------------------------------------------------------------------------

Here is how a LONG OPEN alert looks like.

NOTE: Each label , , etc. is customizable, you can change the text of it within indicator Input settings.

ALERT >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

COIN: BTCUSD

TIMEFRAME: 15M

LONG: OPEN

ENTRY: 20000

TP1: 20500

TP2: 21000

TP3: 21500

TP4: 22500

TP5: 23500

SL: 19000

Leverage: 0

---------------------------------------------------------------------------

Here is how a TP1 alert will look with 5 TPs breakdown of the trade.

NOTE1: Next to TP1 taken it will show at which price it was triggered.

NOTE2: Next to "TP Percentage" it shows how much of the CURRENT/ACTIVE/REMAINING trade needs to be closed.

NOTE2: If TP2/3/4/5 comes before TP1 - the alert will tell you exactly how many percent of the trade needs to be closed!

ALERT >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

COIN: BTCUSD

TIMEFRAME: 15M

LONG: TP1

TP1: 20500

TP Percentage: 20%

---------------------------------------------------------------------------

Here is how an alert will look for LONG - STOP-LOSS.

ALERT >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

COIN: BTCUSD

TIMEFRAME: 15M

ENTRY: 20000

LONG: SL

SL: 19000

---------------------------------------------------------------------------

Here is how an alert will look for LONG - EOD (End of Day) In Profit close.

ALERT >>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>>

COIN: BTCUSD

TIMEFRAME: 15M

LONG: EOD-Close (profit)

ENTRY: 20000

EOD-Close: 21900

===========================================================================

Adding Alerts in TradngView

---------------------------------------------------------------------------

-Add indicator to chart and make sure it is configured (check back-testing results)

-Right-click anywhere on the TradingView chart

-Click on Add alert

-Condition: Select this indicator by it’s name

-Alert name: Whatever you want

-Hit “Create”

-Note: If you change ANY Settings within the indicator – you must DELETE the current alert and create a new one per steps above, otherwise it will continue triggering alerts per old Settings!

===========================================================================

If you have any questions or issues with the indicator, please message me directly via TradingView.

---------------------------------------------------------------------------

Good Luck! (NOTE: Trading is very risky, past performance is not necessarily indicative of future results, so please trade responsibly!)

---------------------------------------------------------------------------

NOTE: There seems to be a strange glitch when strategy is running live, it will show "double-take" take-profits labels on the chart. This is not affecting the script logic and backtesting results, if you will remove/re-add the script afterwards, it will no longer show the duplicate orders... this must be some sort of a glitch as every alert was thoroughly tested to make sure everything is working!

Tìm kiếm tập lệnh với "backtest"

[SMA Cross + HHLL] Signal Clean Up Analysis with Backtest (TSO) This is a DEMO indicator with a simple 2 SMAs cross for signals + HHLL for TP/SL. It mainly demonstrates chained (NOTE: You can select several or ALL of the features, this is not limited to either one) signal cleanup and analysis approach with scheduling and alerting capabilities. Works with most popular timeframes: 1M, 5M, 15M, 1H, 4H, D.

===========================================================================

Here are some pre-set examples with nice Backtesting results (try em out!):

---------------------------------------------------------------------------

>>> Indexes – SPY (INTRADAY SETUP ): Timeframe: 5M | Trading Schedule: ON, 10:00-15:45 ET, EOD: At Market Close | Trading System: Open Until Closed by TP or SL | MULTIPROFIT: TP (take profit) System: Dynamic | MULTIPROFIT: SL (stop loss) System (This is only for “Dynamic” TP System ONLY!!!): Dynamic | # of TPs: 5 | Skip opposite candle types in signals, which are opposite to direction of candle color (for example: bearish green hammer) | Everything else: Default

>>> Bitcoin – BTCUSD (24/7 SETUP): Timeframe: 1H | Trading Schedule: OFF, End of Day (EOD): OFF | Trading System: Open Until Closed by TP or SL | MULTIPROFIT: TP (take profit) System: Dynamic | MULTIPROFIT: SL (stop loss) System (This is only for “Dynamic” TP System ONLY!!!): Dynamic | # of TPs: 3 | TP(s) Offset: on, TP(s) offset amount: 50 | ATR confirmation | Everything else: Default

===========================================================================

Explanation of all the Features | Configuration Guide | Indicator Settings

---------------------------------------------------------------------------

---------------------------------------------------------------------------

Signal cleanup analysis:

---------------------------------------------------------------------------

>>> Customizable Backtesting for a specific date range, results via TradingView strategy, which includes “Deep Backtesting” for largest amounts of data on trading results.

>>> Trading Schedule with customizable trading daily time range, automatic closing/alert trades before Power Hour or right before market closes or leave it open until next day.

>>> 3 Trading Systems.

>>> Static/Dynamic Take-Profit setups (HILIGHT: momentum catch dynamic Take-Profit approach).

>>> Static/Dynamic Stop-Loss setups (HIGHLIGHT: smart trailing Stop-Loss which minimizes risk).

>>> Single or Multiple profit targets (up to 5).

>>> Take-Profit customizable offset feature (set your Take-Profit targets slightly before everyone is expecting it!).

>>> Candle bar signal analysis (skip opposite structured and/or doji candle uncertain signals).

>>> Additional analysis of VWAP/EMA/ATR/EWO (Elliot Wave Oscillator)/Divergence MACD+RSI signal confirmation (clean up your chart with indicator showing only the best potential signals!).

>>> Advanced Alerts setup, which can be potentially setup with a trading bot over TradingView Webhook (NOTE: This will require advanced programming knowledge).

>>> Customize your signal SOURCE and your Take-Profit/Stop-Loss SOURCES as you desire.

===========================================================================

Labels, plots, colors explanations:

---------------------------------------------------------------------------

>>>>> Signal SOURCE: SMA crossings (green and red BIG circles) .

>>>>> Take-profit/Stop-loss SOURCE: HHLL (Highest High Lowest Low) .

>>>>> LONG open: green arrow below candle bar.

>>>>> SHORT open: red arrow above candle bar.

>>>>> LONG/SHORT take-profit target: green/red circles (multi-profit > TP2/3/4/5 smaller circles).

>>>>> LONG/SHORT take-profit hits: green/red diamonds.

>>>>> LONG/SHORT stop-loss target: green/red + crosses.

>>>>> LONG/SHORT stop-loss hits: green/red X-crosses.

>>>>> LONG/SHORT EOD close (profitable trade): green/red squares.

>>>>> LONG/SHORT EOD close (loss trade): green/red PLUS(+)-crosses.

===========================================================================

Date Range and Trading Schedule Settings

---------------------------------------------------------------------------

>>>>> Date Range: Select your start and/or end dates (uncheck “End” for indicator to show results up to the very moment and to use for LIVE trading) for backtesting results, if not using backtesting – uncheck “Start”/“End” to turn it off.

---------------------------------------------------------------------------

>>>>> Use TradingView “Strategy Tester” to see backtesting results

---------------------------------------------------------------------------

NOTE: If Strategy Tester does not show any results with Date Ranged fully unchecked, there may be an issue where a script opens a trade, but there is not enough TradingView power to set the Take-Profit and Stop-Loss and somehow an open trade gets stuck and never closes, so there are “no trades present”. In such case you will need to manually check “Start”/“End” dates or use “Depp Backtesting” feature!

---------------------------------------------------------------------------

>>>>> Trading Schedule: This is where you can setup Intraday Session or any custom session schedule you wish. Turn it ON. Select trading hours. Select EOD (End of Day) setting (NOTE: If it will be OFF, the indicator will assume you are holding your position open until next day!).

>>>>> Trading System: 1) Open Until Closed by TP or SL – once the trade is open, it can only be closed by Take-Profit, Stop-Loss or at EOD (if turned on) ||| 2) OCA – Opposite Trade will Open Closing Current Trade – Same as 1), except that when and if an OPPOSITE signal is received > indicator will close current trade immediately (profit or loss) and open a new one(NOTE: This will only happen with an OPPOSITE direction trade!) ||| 3) Open Until Opposite Signal or EOD (if turned on) – This approach is the simplest one, there are no Take-Profits or Stop-Losses, the trade is open until an OPPOSITE signal is received or until EOD (if turned on).

Take-Profit, Stop-Loss and Multi-Profit Settings

>>>>> MULTIPROFIT | TP (Take-Profit) System: 1) Static – Once the trade is open, all Take-Profit target(s) are immediately calculated and set for the trade > once the target(s) is hit > trade will be partially closed (if candle bar closes beyond several Take-Profit targets > trade will be reduced accordingly to the amount of how many Take-Profit targets were hit) ||| 2) Dynamic – Once the trade is open, only the 1st Take-Profit target is calculated, once the 1st Take-Profit is hit > next Take-Profit distance is calculated based on the distance from trade Entry to where 1st Take-Profit was taken, once 2nd Take-Profit is taken > 3rd Take-Profit is calculated per same logic, these are good for price momentum as with price speeding up – profits increase as well!

NOTE: Below 2 settings, each correspond to only 1 setting of the TP (Take-Profit) System, please pay attention to the above TP system setting before changing SL settings!

>>>>> MULTIPROFIT | SL (Stop-Loss) System : 1) Static – Once the trade is open, Stop-Loss is calculated and set for the remaining of the trade ||| 2) Dynamic – At trade open, Stop-Loss is calculated and set the same way, however once 1st Take-Profit is taken > Stop-Loss is moved to Entry, reducing the risk.

>>>>> MULTIPROFIT | SL (Stop-Loss) System : 1) Static - Once the trade is open, Stop-Loss is calculated and set for the remaining of the trade ||| 2) Dynamic – At trade open, Stop-Loss is calculated and set the same way, however with each Take-Profit taken, Stop-Loss will be moved to previous Take-Profit (TP1 taken > SL:Entry | TP2 taken > SL:TP1 | TP3 taken > SL:TP2 | TP4 taken > SL:TP3 | TP5 taken > trade closed), this is basically a smart Stop-Loss trailing system!

>>>>> # of TPs (number of take profit targets): Just like it is named, this is where you select the number of Take-Profit targets for your trading system (NOTE: If “3) Open Until Opposite Signal or EOD (if turned on)” Trading System is selected, this setting won’t do anything, since there are no TP or SLs for that system).

>>>>> TP(s) offset: This is a special feature for all Take-Profit targets, where you can turn on a customizable offset, so that if the price is almost hitting the Take-Profit target, but never actually touches it > you will capture it. This is good to use with HHLL (Highest High Lowest Low), which is pretty much a Support/Resistance as often the price will nearly touch these strong areas and turn around…

---------------------------------------------------------------------------

Dynamic/Static Take-Profit and Stop-Loss visual examples:

1) Fully Dynamic Take-Profit and Stop-Loss setup for BTCUSD

See how Take-Profit distances increase with price momentum and how Stop-Loss is following the trade reducing the risk!

2) Static/Dynamic, Static Take-Profit and Dynamic Stop-Loss setup for SPY (S&P500 ETF TRUST)

You can see a static Take-Profit set at position open, while Stop-Loss is semi-dynamic adjusting to Entry once TP1 target is taken!

3) Fully Static Take-Profit and Stop-Loss setup for SPY (S&P500 ETF TRUST)

This one is a fully static setup for both Take-Profit and Stop-Loss, you can also observe how trade is closed right before the Power Hour (trade can be closed right before Power Hour or right before Market Closes or left overnight as you desire).

---------------------------------------------------------------------------

Trade Analysis and Cleanup Settings

>>>>> Candle Analysis | Candle Color signal confirmation: If closed candle bar color does not match the signal direction > no trade will be open.

>>>>> Candle Analysis | Skip opposite candle signals: If closed candle bar color will match the signal direction, but candle structure will be opposite (for example: bearish green hammer, long high stick on top of a small green square) > no trade will be open.

>>>>> Candle Analysis | Skip doji candle signals: If closed candle bar will be the uncertain doji > no trade will be open.

>>>>> Divergence/Oscillator Analysis | EWO (Elliot Wave Oscillator) signal confirmation: LONG will only be open if at signal, EWO is green or will be at bullish slope (you can select which setting you desire), SHORT if EWO is red or will be at bearish slope.

>>>>> Divergence/Oscillator Analysis | VWAP signal confirmation: LONG will only be open if at signal, the price will be above VWAP, SHORT if below.

>>>>> Divergence/Oscillator Analysis | Moving Average signal confirmation: LONG will only be open if at signal, the price will be above selected Moving Average, SHORT if below.

>>>>> Divergence/Oscillator Analysis | ATR signal confirmation: LONG will only be open if at signal, the price will be above ATR, SHORT if below.

>>>>> Divergence/Oscillator Analysis | RSI + MACD signal confirmation: LONG will only be open if at signal, RSI + MACD will be bullish, SHORT if RSI + MACD will be bearish.

===========================================================================

Alert Settings (you don’t have to touch this section unless you will be using TradingView alerts through a Webhook to use with trading bot)

---------------------------------------------------------------------------

Here is how a LONG OPEN alert looks like (each label is customizable + I can add up more items/labels if needed):

COIN: BTCUSD

TIMEFRAME: 15M

LONG: OPEN

ENTRY: 20000

TP1: 20500

TP2: 21000

TP3: 21500

SL: 19000

Leverage: 0

===========================================================================

Trade Open Signal SOURCE + Take-Profit/Stop-Loss SOURCE

---------------------------------------------------------------------------

>>> Customize your signal SOURCE, Take-Profit and Stop-Loss SOURCE as desired (NOTE: These are pre-configured and should be usable on majority of markets, however feel free to play around with these settings as there is nearly an infinite amount of setups out there!

===========================================================================

Adding Alerts in TradngView

---------------------------------------------------------------------------

-Right-click anywhere on the TradingView chart

-Click on Add alert

-Condition: Select this indicator by it’s name

-Alert name: Whatever you want

-Hit “Create”

-Note: If you change ANY Settings within the indicator – you must DELETE the current alert and create a new one per steps above, otherwise it will continue triggering alerts per old Settings!

===========================================================================

If you have any questions or issues with the indicator, please message me directly via TradingView.

---------------------------------------------------------------------------

Good Luck! (NOTE: Trading is very risky, so please trade responsibly!)

Trend Movement S1-TMIdea:

This script combines: Moving Average (MA), Directional Movement (DMI), MACD

When condition of long or short position from all mentioned indicator are met script opens position. Once trend changes, it closes the position.

Then add some filter conditions to avoid noise.

Concept:

(Note that we take the close to get the closing price)

-Using only cross up down with MA will give a reversal point, but the downside is that it can be noisy.

-MACD will show the current trend detected by cross point.

-Then the +DI , -DI , ADX values are taken into account to confirm the price direction and movement strength.

-This strategy solves this problem by combining 2 more moving averages called 2 trend lines 1 long and 1 short. When the short line crosses up, it will show that the price trend is increasing (at this time the background between these 2 lines will be green) and vice versa (red). To determine if the current trend is bullish or bearish . This will avoid buying when price tend to go down.

-However, there will be many points where some more complex logic is needed. It will add conditions and calculate the probabilities before triggering the signals (You can see them through the item symbols B1, B2, ... ).

How it works:

1. The thin line is stand for short term moving average, and the thick line is stand for long term moving average.

If thin lines cross the thick lines, their color and background will turn green, the price is tend to go up (Uptrend).

If thin lines cross down thick lines, their color and background will turn red, the price is tend to go down (Downtrend).

2. Ability to check the checkbox in setting to show the Golden/De*ath cross.

The yellow symbol "+" is the Golden cross.

The black symbol "+" is the De*th cross.

3. Buy and Sell are show clearly on strategy as the buy and sell point. The default source from bar is CLOSE

4. Setting "Buy only" it using for spot market.

5. When "Not buy in down trend" is checked, it will not trigger buy when in down trend (thin lines cross down thick lines like description in 1.)

6. Setting High spread will call Close buy when it match the High spread bar with the High spread % value

7. It provides setting "Back test From date/To date" for backtest feature. You can set "BacktestFrom date" as the begin of test period. If check box "Using To Date" is check: "Backtest To Date" will be the end of test period.

Suitable time frames:

4h, 1D, 1W

* Please note that this logic does not attempt to predict future prices or 100% accurate signal; Strategy Tester are available to test the profitability of this strategy.

(INVITE ONLY indicator. Please direct message or visit website to try it out)

Hope you guys enjoy!

Examples:

BTCUSD 4H

TSLA 4H

Miyagi (VWAP) + DCA BacktestVWAP has been the main condition for entry for our trading community when using the Wick Hunter bot for quite some time now; however using VWAP alone can lead to poor entries and bags.

Miyagi adds filtering conditions which can then be used to improve entries as opposed to simply using VWAP alone.

Miyagi: The attempt at mastering something for the best results.

Miyagi indicators combine multiple trigger conditions and place them in one toolbox for traders to easily use, produce alerts, backtest, reduce risk and increase profitability.

Miyagi (VWAP) + DCA Backtest allows you to backtest your VWAP settings across each pair.

VWAP + Backtest starts with the user selectable take profit and stoploss, both in percent.

Backtesting can be done in any trend direction: Long, Short, or both.

First we start with the VWAP Settings for entry.

The VWAP Settings are based off the original VWAP Indicator found here:

VWAP Timeframe can be adjusted to chart timeframe, or to another timeframe of choice.

VWAP Period is adjustable and should be set to your current period setting.

VWAP Lower Line (Long) is the Percentage Below VWAP = Long Entry.

VWAP Upper Line (Short) is the Percentage Above VWAP = Short Entry.

Once your VWAP Settings are now configured for your current trading settings, you can move onto the DCA and Backtest Settings.

Select DCA to allow and backtest DCA.

Equity %: allows you to select what percent of Equity you will use.

Leverage: Set the leverage you will trade at, from 1-100X.

DCA Start %: This is the percent that your DCA Starts at, in % away from initial entry.

Entry Order Size %: This is the entry order size, in percent of your account, that is used for entry.

DCA Order Size %: This is the DCA order size, in percent of your account, that is used for the first DCA.

DCA Order Size Scale %: This is the DCA size scaling, in %, that is applied to all DCA's after the first.

DCA % from Avg: This is the % away from Average DCA setting.

Step Size Scale %: This is the step size scale setting in percent, that is placed away from your first DCA.

DCA Buy Count: How many DCAs in total that can be used.

Properties Tab includes generic backtest settings including capital amount, base currency, order size, commission, slippage and margin.

Happy Trading!

Anaconda Backtest VersionThis is the Anaconda strategy backtest version, no alerts. It will execute orders up to current_date - 2 days.

This is a LONG only strategy.

Anaconda waits for some thresholds to enter long. Once it enters long, it will setup profit and stoploss targets. These targets are updated if some conditions are met. The position is closed when the price hits profit or stoploss targets or when a certain bearish threshold is met.

No portfolio management is integrated. Positions are supposed to be entered with 100% equity and closed at 100%.

The strategy works better for large timeframes : 1h, 2h, 3h, 4h, 1D ...

You can apply the strategy to any symbol supported by TardingView and fine-tune the settings for the selected market/timeframe.

The strategy is supposed to be used on regular candles.

security() function has not been used. No special candles have been used (heikin ashi, renko etc.). Trailing stop (trail_* variables) have not been used.

==================

EXAMPLE SETTINGS

==================

These are the example settings for some assets that make the strategy perform well in the backtest mode.

Settings are listed in order of appearance in the strategy settings dialog in TradingView.

Please note that exaggerated profits for some symbols may come from the fact that the minimum ticker size of that symbol has been increased (from 0.0001 to 0.001 for example) between the start date and end date of the backtest. So you will see some trades closing outside the candle's ohlc range. Unfortunately, this is a limitation in TV and can't do much about it.

BNB/USDT (4h) : 11,5,1,3,10,4,1,4,5,200,6,2,19 (rsi threshold = 50)

FTM/USDT (1h) : 11,8,3,4,5,5,1,5,7,400,5,3,20 (rsi threshold=50)

ETH/USDT (4h) : 11,5,1,3,2,5,1,4,3,200,4,3,20 (rsi threshold = 68)

MATIC/USDT (1h) : 9,10,3,4,6,7,1,6,7,200,2,5,18 (rsi threshold = 70)

DASH/USDT (4h) : 8,8,3,3,4,4,1,7,5,200,3,2,21 (no rsi)

BAT/USDT (4h) : 8,8,3,3,7,7,1,8,6,200,3,2,21 (rsi threshold = 40)

BAT/USDT (1h) : 9,9,3,6,6,7,1,7,7,300,6,4,21 (no rsi)

DOGE/USDT (1h) : 11,8,3,4,4,9,1,4,6,200,3,2,18 (rsi thresold = 70)

NKN/USDT (1h) : 6,7,3,4,2,8,3,5,8,200,6,3,15 (rsi threshold = 50)

BTC/USDT (4h) : 6,5,3,4,7,6,5,5,6,200,2,3,15 (no rsi)

BTC/USDT (3h) : 6,5,3,4,7,5,1,6,4,300,2,2,17 (no rsi)

HFT Divergence Hunter BacktesterDefault Settings are meant to be used in BTC /USDT chart on 5 min time frame on Binance Futures . If you want to use for another asset on another time frame YOU MUST CHANGE THE SETTINGS

This is a divergence finding strategy developed by HFT Research. It is a highly customizable strategy and provides endless opportunities to find profitable trades in the market.

Default Settings are meant to be used in BTC /USDT chart on 5 min time frame on Binance Futures . If you want to use for another asset on another time frame YOU MUST CHANGE THE SETTINGS

This is a divergence finding indicator developed by HFT Research. It is a highly customizable indicator and provides endless opportunities to find profitable trades in the market.

Use Envelope , this is the main decision maker in this strategy. The idea behind is that you choose the length of the moving average and set an offset % to create an upper and lower band. If you click on “display envelope” you will be able to visually see the band you have created. This way, you get to scalp the market as the price is diverging and moving away from the moving average. As the famous saying goes, moving averages act like magnets and prices always visits them back. Using this ideology, we aim to capitilize on the price swings that move away from the chosen moving average by x%.

STARC Bands ;

These are two bands that are applied above and below a simple moving average of an asset’s price. The upper band is created by adding the value of the average true range (ATR) or a multiple of i. The lower band is created by subtracting the value of the ATR from the SMA . The channel can provide traders with ideas on when to buy or sell. During an overall uptrend, buying near the lower band and selling near the top band is favorable. However, from our testing results it does fairly poorly in crypto markets while it does pretty well in traditional markets.

Use RSI ;

One of the most commonly used indicators in the trading world. The idea is simple, buy when its oversold and sell when its overbought. You can use RSI as a secondary confirmation of the dips. It can be turned on and off.

Use MFI

MFI stands for Money Flow Index and it is an oscillator like RSI . However, it does track the price in a different fashion than RSI providing a reliable option. It uses the price and volume data for identifying overbought and oversold signals in an asset.

Use Fisher Transform

Even though, it has a funny name, Fisher is actually a very decent and reliable indicator. It converts the prices into a Gaussian normal distribution channel. Therefore, the indicator detects when the prices have moved to an extreme, based on recent price action.

Use VWAP

VWAP stands for volume weighted average price . It is an extremely useful indicator when trading intra-day. It does reset every trading session which is at 00:00 UTC . Instead of looking at x number of candles and providing an average price, it will take into consideration the volume that’s traded at a certain price and weigh it accordingly. It will NOT give entry signals but act as a filter. If the price is above VWAP will filter out the shorts and other way around for longs.

Use ADX

Average directional index is a powerful indicator when one is assessing the strength of a trend as well as measuring the volatility in the market. Unfortunately, the worst market condition for this strategy is sideways market. ADX becomes a useful tool since it can detect trend. If the volatility is low and there is no real price movement, ADX will pick that up and will not let you get in trades during a sideways market. It will allow you to enter trades only when the market is trending.

Use Super trend Filter

The indicator works well in a trending market but can give false signals when a market is trading in a range.

It uses the ATR ( average true range ) as part of its calculation which takes into account the volatility of the market. The ATR is adjusted using the multiplier setting which determines how sensitive the indicator is.

Use MA Filter

Lookback: It is an option to look back x number of candles to validate the price crossing. If the market is choppy and the price keeps crossing up and down the moving average you have chosen, it will generate a lot of “noisy” signals. This option allows you to confirm the cross by selecting how many candles the price needs to stay above or below the moving average. Setting it 0 will turn it off.

MA Filter Type: There is a selection of moving averages that is available on TradingView currently. You can choose from 14 different moving average types to detect the trend as accurate as possible.

Filter Length: You can select the length of your moving average. Most commonly used length being 50,100 and 200.

Filter Type: This is our propriety smoothing method in order to make the moving averages lag less and influence the way they are calculated slightly. Type 1 being the normal calculation and type 2 being the secret sauce .

Reverse MA Filter: This option allows you to use the moving average in reverse. For example, the strategy will go long when the price is above the moving average. However, if you use the reserve MA Filter, you will go short when the price is above the moving average. This method works best in sideways market where price usually retraces back to the moving average. So, in an anticipation of price reverting back to the moving average, it is a useful piece of option to use during sideway markets.

Use MACD Filter

MACD here will act as a filter rather than an entry signal generator. There are a few different ways to use this MACD filter. You can click on the Use MACD filter and it will use filter out the shorts generated in a bullish territory and longs generated in the bearish territory. It will greatly reduce the number of trades the strategy will trade because MACD is a lagging indicator. By the time MACD turns bullish or bearish , most of the other indicators will have already generated the signals. Therefore, resulting in less trades. You can use MACD filter as MA oscillator meaning that it will only look at the MA lines in MACD to filter out trades. Alternatively, you can use it with the histogram (Signal lines) meaning that it will only look at the histogram whether its below or above the zero line in order to filter out the trades.

TP (%)

Place your desired take profit percentage here. Default is 1.5%

Move SL At Entry x% Profit

This is when the strategy will move your SL to the entry point if the position reaches x% profit. It can also generate a signal which can be automated to adjust the SL on the exchange.

SL (%)

Place your desired stop loss percentage here. Default is 1%

The backtester assumes the following;

- 1000$ capital

- 0.06% commission based on binance

- 1% risk meaning 100% equity on cross leverage

- Backtest results are starting from 2020

If you want to get access to this indicator please DM me or visit our website.

HFT Fibonacci Bands BacktesterDefault Settings are meant to be used in XBT/USD chart on 15 min time frame. If you want to use for another asset on another time frame YOU MUST CHANGE THE SETTINGS

This is a Fibonacci bands based trading strategy developed by HFT Research. It is a highly customizable strategy and provides endless opportunities to find profitable trades in the market.

Use Fib BB

This is the main decision maker of the strategy. Tuning the settings of this portion of the strategy will change the outcome the most. We have provided default settings. However, they are only good for 15min chart on Bitcoin . Please adjust accordingly.

Fib BB Length: This setting adjusts the middle line of your Fibonacci Bands. It is the moving average that you take it as base for your Fibonacci bands. Default value is currently 20.

Fib Level to Use for Entry: Here, you adjust which one of the Fibonacci Ratio levels you would like to use for your entry. You can only choose one of the following options.

Fibonacci Ratio 1

This is your Fib ratio level 1 and you can put any number here you would like

Fibonacci Ratio 2

This is your Fib ratio level 2 and you can put any number here you would like

Fibonacci Ratio 3

This is your Fib ratio level 3 and you can put any number here you would like

Please keep in mind that Ratio 1 should be higher than Ratio 2 and Ratio 2 should be higher than Ratio 3.

Use RSI

You can also turn on and off the RSI as well. Alternatively, there is an option to use RSI on a different time frame than you are currently on. For example, if you are looking at the 5min chart to use Bollinger bands but you would like to look at the RSI value on the 15min chart. You can do so by selecting the custom RSI timeframe as well as adjusting the Oversold and Overbought value.

Use CCI

Commodity Channel Index is an indicator developed by Donald Lambert. It is a momentum-based oscillator used to help determine when an investment vehicle is reaching conditions of being overbought or oversold. It also used to asses price trend direction and strength. Default settings are usually the safest and the best fit.

Use VWAP

VWAP stands for volume weighted average price . It is an extremely useful indicator when trading intra-day. It does reset every trading session which is at 00:00 UTC . Instead of looking at x number of candles and providing an average price, it will take into consideration volume that’s traded at a certain price and weigh it accordingly.

Use ADX

ADX stands for average directional index . It is an indicator that measures volatility in the market. Unfortunately, the worst market condition for this strategy is sideways market. ADX becomes a useful tool since it can detect trend. If the volatility is low and there is no real price movement, ADX will pick that up and will not let you get in trades during a sideways market. It will allow you to enter trades only when the market is trending.

Use MA Filters

Lookback: It is an option to look back x number of candles to validate the price crossing. If the market is choppy and the price keeps crossing up and down the moving average you have chosen, it will generate a lot of “noisy” signals. This option allows you to confirm the cross by selecting how many candles the price needs to stay above or below the moving average. Setting it 0 will turn it off.

MA Filter Type: There is a selection of moving averages that is available on TradingView currently. You can choose from 14 different moving average types to detect the trend as accurate as possible.

Filter Length: You can select the length of your moving average. Most commonly used length being 50,100 and 200.

Filter Type: This is our propriety smoothing method in order to make the moving averages lag less and influence the way they are calculated slightly. Type 1 being the normal calculation and type 2 being the secret sauce

Reverse MA Filter: This option allows you to use the moving average in reverse. For example, the strategy will go long when the price is above the moving average. However, if you use the reserve MA Filter, you will go short when the price is above the moving average. This method works best in sideways market where price usually retraces back to the moving average. So, in an anticipation of price reverting back to the moving average, it is a useful piece of option to use during sideway markets.

The backtester assumes the following;

- 1000$ capital

- 0.06% commission based on binance

- 1% risk meaning 100% equity on cross leverage

- Backtest results are starting from 2020

If you want to get access to this indicator please DM me or visit our website.

HFT The Ultimate Trend BacktesterThis is a trend following based strategy developed by HFT Research.

It works on Stocks, Forex and Cryptocurrency markets

This indicator comes fine tuned out of the box. It works on best on 15min, 1 hour and 4 hour time frames. It provides 3 separate entries for each of the time frames, providing you 12 different entry options.

Each time frame has the following options to choose from

You can use 1 hour settings on 15min chart however, it may not work the best.

Moderate entry will give you the modest amount of trades with modest amount of risk

Aggressive entry will give you wild entries and lots of action, if you are willing to babysit the trades, it might be an option for you

Conservative entry are best for those who want to automate the strategy or for those that don't have the time to trade the alerts actively

The backtester assumes the following;

- 1000$ capital

- 0.06% commission based on binance

- 1% risk meaning 100% equity on cross leverage

- Backtest results are starting from 2020

Candle Crawler V1 [Moon]Candle Crawler is designed to crawl back through candle and bar data to retrieve specific values of interest.

The first implementation shows

Total bars or candles on any specific time frame or asset to the beginning of the chart. This can be used for backtesting or looking for specific assets / time frames that have a lot of backtest data.

- *usually* More backtest data = More accurate strategy implementation or live testing.

Crawls back and counts Red vs Green candles in a defined period (the max is 4999 total bars).

Use this to identify bearish or bullish trends and assets.

- *hint* if an asset through time is leaning heavily one way, a long-only or short-only strategy may be worth investigating.

Plots days of the week on each candle within it's specific day (turned off by default).

Default view of Total Candles + R/G (note if you want to turn off the labels go to the "Style" tab and just uncheck "Labels" at the bottom).

Works on any asset or timeframe including stocks and forex.

Easily filter days on or off to identify specific patterns or trends (check the "days of the week" box for ON|OFF) or head to the "style" tab to customize days or colors.

Most precise on the Daily (D) timeframe, but applicable on any.

If interested send me a DM.

[STRATEGY] Moving Average CrossoverThis is a backtester for the Moving Average Crossover indicator.

This tool allows you to backtest 4096 combinations of different MA types x customizable periods x customizable take-profits and stop-losses = almost limitless possibilities.

Study version can be found here:

Make Moving Averages Great Again!

Real Candles Heikin Ashi (HA) Candle functionsThis script plots both real and HA candles regardless or which are used on the chart in TV settings.

(and has the functions for you to use.)

Lots of people seem to misunderstand backtesting (or scam people) based on HA candles.

Backtesting with HA candles leads to impossible trades. ALWAYS backtest with real candles.

That doesn't mean you might not want to look at HA candle values to make trading decisions.

Add the code below to calculate HA candles from real and use that in your HA trading algo,

but test it on real charts.

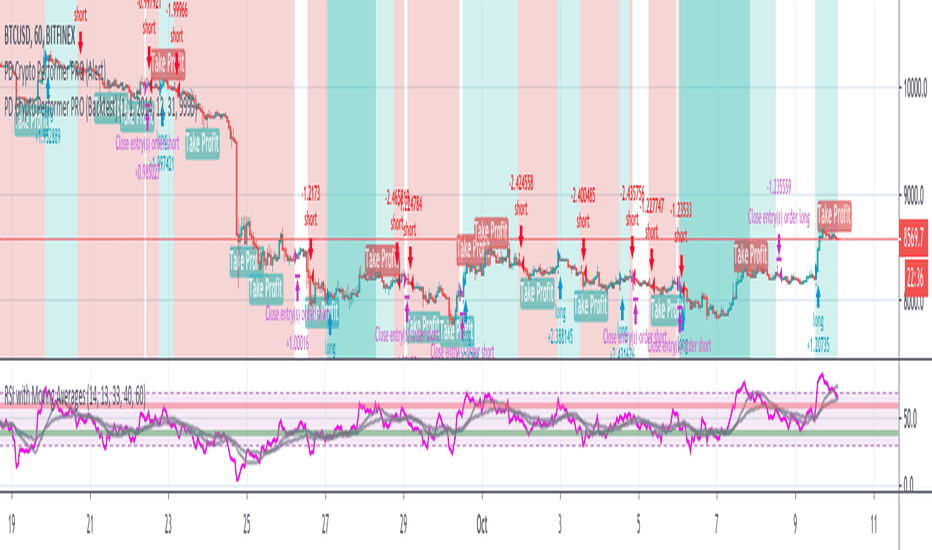

PD Crypto Performer PRO (Backtest)Description:

This is the backtesting version of the PD Crypto Performer Pro (Alert) . You can choose to backtest either one of the two strategies included, a trend-identifying swing strategy and a low risk scalping strategy. Both strategies assume the same capital amount invested ($10,000) each trade. You can also see how your capital grows over time by enabling the reinvesting proceeds option. For details, please check out this tutorial .

The backtesting results could be easily improved in live trading by utilizing the “Take Profit” signals and following the recommended methods of use below.

To assist the decision-making process, the code currently references BTCUSD. As a result, it is only suitable for crypto traders. However, we are working on the stock and forex versions, and the Performer will have these compatibilities soon.

Most importantly, our signals DO NOT REPAINT !

Recommended Use:

- Time Frame: 1HR

- Asset: Large cap crypto assets.

For lower risk tolerance, we recommend using the indicator on ETHUSD. For maximizing profits, we recommend using the indicator on BCHUSD.

- Always set stop loss according to your own risk tolerance

- Take profits along the way. Check out this video tutorial for when to reenter after our take profit signals.

Recommended Use for Advanced Traders:

- Position sizing:

Larger position if the 1HR signal is in the same direction compared to the 4HR trend.

Smaller position if the 1HR signal is in the opposite direction compared to the 4HR trend.

- Better entry/exit points:

Track the 1HR signal for the asset you are trading on other exchanges along with the BTCUSD 1HR signal. Sometimes, the signals from different exchanges occur with a 1-2 hour difference. You could use these earlier signals along with a lower time frame (eg. 15min) entry confirmation from your own exchange for better entry / exit points.

- Use “Take Profit” signals for counter trend scalps. Recover at the reentering opportunities . This works best with candlestick pattern confirmations.

Never use this if you suspect a flag / inverted flag pattern is forming.

Go to www.phi-deltalytics.com and sign up for a FREE trial today!

Let us know if you have any questions or recommendations. We are here for your success!

Disclaimer:

It should not be assumed that the methods, techniques, or indicators presented will be profitable or that they will not result in losses. Past results are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell.

Kashikoi [BACKTEST]🔰 Kashikoi Anaraiza BACKTEST

📌This indicator is a tool to backtest the Kashikoi Anaraiza indicator which has the alerts. To see which custom strategies, indicators, settings, TP/SL performed in backtest.

📌Can test any combination of indicators and settings

🔹Trend Analyzer - Trend Reversals

🔹RyuKumo - BULL / BEAR

🔹EMAs / MAs

🔹Ichimoku - Breakouts / TK Crosses

🔹Breakouts S/R

🔹Pullbacks

🔹MACD

🔹RSI

🔹Stoch RSI

🔹Custom TP/SL %

🔹Trailing Stoploss

🔹Will add more features in future updates and as requested

📌Note: This is a tool to test various settings, to find optimal timeframes, TP/SL %, strategy parameters and testing. Which can save time from tediously manually testing. Past performance is not indicative of future results.

RSC Trend Trading Strategy v1.0Ready Set Crypto Trend Trading Back-testing Strategy v1.0

This is a backtesting strategy for those who are familiar with Doc Severson's (Ready Set Crypto) Trend Trading Class offered at Ready Set Crypto . It is published with permission.

I highly recommend that you attend the class to understand this strategy and use this to your advantage. There is way more than just some indicators to utilise this trading strategy successfully.

Please also see the matching indicator for this strategy: Ready Set Crypto Trend Trading Indicator .

Buy and Sell Calls are based on the following:

An Upper Donchian Channel of 20 days (default) or more, used to indicate buy signals

A Lower Donchian Channel of 10 days (default) or more, used to indicate exit signals

A 50 day Simple Moving Average (for entry filtering)

A 200 day Simple Moving Average (for entry filtering)

How to do back-testing with this:

Once you add this strategy to your chart, go to the " Strategy Tester " section at the bottom of the screen to see it's performance.

You will need to configure the strategy (just like you'd configure any indicator) to tailor it to your specific scenarios.

Note following:

TradingView does not support BTC, ETH, etc as currencies, so BTC and other trading pairs are not available for back-testing; You will have to use USD pairs

The backtesting will apply to your chart's time frame (candle times) - use daily time candles as the starting point

You will need to tailor the " Input " and " Properties " options (click on the little gear icon) to adjust to suit your needs/scenarios

The default settings are as follows:

Backtest the current chart/ticker for the period of 2016 to 2020,

With a single position of US$1000 and a 0.1% commission (no pyramiding, i.e. multiple buy entries),

By entering a single position (buy) when the price is above SMA 50 and 200 and a candle high touches DC 20,

And exiting the position when a candle low touches DC 10.

Look under the " Strategy Tester " pane for the back-testing overview, performance and list of trades. Or if you are looking at the Published Idea , the back-testing results are displayed at the bottom of the page.

Please like, Share and Comment, if you like this indicator.

Warning

The Buy and Sell calls are meaningless and must not be auctioned without a thorough understanding of this trading strategy and the full consideration of the entry and exit conditions.

Please use this indicator at your own risk. The publisher does not accept any responsibility for its performance or any implications.

Intellitrader - Buy Random BACKTESTERI created a little backtester that it combines some of what we need to backtest to finetune a good strategy for Intellitrader.

RSI

STOCH

STOCHRSI

CCI

Price Change

[Volume Profile] Signal Clean Up Analysis with Backtest (TSO) This is a full-cycle trading system indicator, which uses Volume Profile for generating signals using a custom developed algorithm, TP (Take Profit) and SL (Stop Loss) levels. There are 2 SOURCES for signals (each can be used separately or both can be used at the same time, each signal SOURCE is using Volume Profile levels to open optimal trade direction) with chained (NOTE: You can select several or ALL of the features, this is not limited to either one) signal cleanup and analysis approach with scheduling and alerting capabilities. Works with most popular timeframes: 1M, 5M, 15M, 1H, 4H, D, great for intraday trading!

NOTE: Every calculation is done on a confirmed closed candle bar state, so the indicator will never repaint!

===========================================================================

Explanation of all the Features | Configuration Guide | Indicator Settings | Signal Cleanup Analysis

---------------------------------------------------------------------------

>>> Customizable Backtesting for a specific date range, results via TradingView strategy, which includes “Deep Backtesting” for largest amounts of data on trading results.

>>> Trading Schedule with customizable trading daily time range, automatic closing/alert trades before Power Hour or right before market closes or leave it open until next day.

>>> 3 Trading Systems.

>>> Multiple Signal SOURCEs for opening trades, either SOURCE can be used or both at the same time!

>>> Static/Dynamic Stop-Loss setups (HIGHLIGHT: Stop-Loss will be moved to Entry after TP1 is taken, which minimizes risk).

>>> Single or Multiple profit targets (up to 3).

>>> Take-Profit customizable offset feature (set your Take-Profit targets slightly before everyone is expecting it!).

>>> Candle bar signal analysis (matching candle color, skip opposite structured and/or doji candle uncertain signals).

>>> Additional analysis of VWAP/EMA/ATR/EWO (Elliot Wave Oscillator)/Divergence MACD+RSI/Volume signal confirmation (clean up your chart with indicator showing only the best potential signals!).

>>> Advanced Alerts setup, which can be potentially setup with a trading bot over TradingView Webhook (NOTE: This will require advanced programming knowledge).

===========================================================================

Labels, plots, colors explanations:

---------------------------------------------------------------------------

>>>>> Signal SOURCE(s): Green/Red arrows, which will be shown unconditionally, outside of trade engine and can be hidden if desired.

>>>>> LONG open: green "house" looking arrow below candle bar.

>>>>> SHORT open: red "house" looking arrow above candle bar.

>>>>> LONG/SHORT take-profit target: green/red circles (multi-profit > TP2/3/4/5 smaller circles).

>>>>> LONG/SHORT take-profit hits: green/red diamonds.

>>>>> LONG/SHORT stop-loss target: green/red + crosses.

>>>>> LONG/SHORT stop-loss hits: green/red X-crosses.

>>>>> LONG/SHORT EOD close (profitable trade): green/red squares.

>>>>> LONG/SHORT EOD close (loss trade): green/red PLUS(+)-crosses.

===========================================================================

Date Range and Trading Schedule Settings

---------------------------------------------------------------------------

>>>>> Date Range: Select your start and/or end dates (uncheck “End” for indicator to show results up to the very moment and to use for LIVE trading) for backtesting results, if not using backtesting – uncheck “Start”/“End” to turn it off.

>>>>> Use TradingView “Strategy Tester” to see backtesting results

NOTE: If Strategy Tester does not show any results with Date Ranged fully unchecked, there may be an issue where a script opens a trade, but there is not enough TradingView power to set the Take-Profit and Stop-Loss and somehow an open trade gets stuck and never closes, so there are “no trades present”. In such case you will need to manually check “Start”/“End” dates or use “Depp Backtesting” feature!

>>>>> Trading Schedule: This is where you can setup Intraday Session or any custom session schedule you wish. Turn it ON. Select trading hours. Select EOD (End of Day) setting (NOTE: If it will be OFF, the indicator will assume you are holding your position open until next day!).

>>> Trading Systems: 1) "Open Until Closed by TP or SL": the signal will only open a trade if no trades are currently open/trunning, a trade can only be closed by Take Profit, Stop Loss or End of Day close (if turned on) | 2) "Open Until Closed by TP or SL + OCA": Same as 1), but if there is an opposite signal to the trade which is currently open > it will immediately be closed with new trade open or End of Day close (if turned on) | 3) "OCA (no TP or SL)": There are is Take Profit or Stop Loss, only an opposite signal will close current trade and open an opposite one or End of Day close (if turned on)

>>>>> MULTIPROFIT | TP (Take-Profit) System: Once the trade is open, all Take-Profit target(s) are immediately calculated and set for the trade > once the target(s) is hit > trade will be partially closed (if candle bar closes beyond several Take-Profit targets > trade will be reduced accordingly to the amount of how many Take-Profit targets were hit)

>>>>> MULTIPROFIT | SL (Stop-Loss) System: 1) Static – Once the trade is open, Stop-Loss is calculated and set for the remaining of the trade ||| 2) Dynamic – At trade open, Stop-Loss is calculated and set the same way, however once 1st Take-Profit is taken > Stop-Loss is moved to Entry, reducing the risk.

>>>>> # of TPs (number of take profit targets): Just like it is named, this is where you select the number of Take-Profit targets for your trading system (NOTE: If "OCA (no TP or SL)" Trading System is selected, this setting won’t do anything, since there are no TP or SLs for that system).

>>>>> TP(s) offset: This is a special feature for all Take-Profit targets, where you can turn on a customizable offset, so that if the price is almost hitting the Take-Profit target, but never actually touches it > you will capture it. This is good to use with HHLL (Highest High Lowest Low), which is pretty much a Support/Resistance as often the price will nearly touch these strong areas and turn around…

===========================================================================

Take-Profit and Stop-Loss visual example:

---------------------------------------------------------------------------

1) A simply nice intraday trading day for SPY (S&P500 ETF TRUST) with a single Take-Profit target on each trade.

See how Take-Profit distances increase with price momentum and how Stop-Loss is following the trade reducing the risk!

2) Same intraday trading day for SPY (S&P500 ETF TRUST) with 3 Take-Profit targets with static Stop-Loss.

3) Same intraday trading day for SPY (S&P500 ETF TRUST) with 3 Take-Profit targets with dynamic Stop-Loss.

You can see how Stop-Loss was moved once TP1 is taken!

===========================================================================

Trade Analysis and Cleanup Settings

---------------------------------------------------------------------------

>>>>> Candle Analysis | Candle Color signal confirmation: If closed candle bar color does not match the signal direction > no trade will be open.

>>>>> Candle Analysis | Skip opposite candle signals: If closed candle bar color will match the signal direction, but candle structure will be opposite (for example: bearish green hammer, long high stick on top of a small green square) > no trade will be open.

>>>>> Candle Analysis | Skip doji candle signals: If closed candle bar will be the uncertain doji > no trade will be open.

>>>>> Divergence/Oscillator Analysis | EWO (Elliot Wave Oscillator) signal confirmation: LONG will only be open if at signal, EWO is green or will be at bullish slope (you can select which setting you desire), SHORT if EWO is red or will be at bearish slope.

>>>>> Divergence/Oscillator Analysis | VWAP signal confirmation: LONG will only be open if at signal, the price will be above VWAP, SHORT if below.

>>>>> Divergence/Oscillator Analysis | Moving Average signal confirmation: LONG will only be open if at signal, the price will be above selected Moving Average, SHORT if below.

>>>>> Divergence/Oscillator Analysis | ATR signal confirmation: LONG will only be open if at signal, the price will be above ATR, SHORT if below.

>>>>> Divergence/Oscillator Analysis | RSI + MACD signal confirmation: LONG will only be open if at signal, RSI + MACD will be bullish, SHORT if RSI + MACD will be bearish.

>>>>> Volume signal confirmation: LONG/SHORT will only be open if closing candle volume is 150% above average Volume based on the Volume Length.

===========================================================================

Alert Settings (you don’t have to touch this section unless you will be using TradingView alerts through a Webhook to use with trading bot)

---------------------------------------------------------------------------

Here is how a LONG OPEN alert looks like (each label is customizable + I can add up more items/labels if needed):

COIN: BTCUSD

TIMEFRAME: 15M

LONG: OPEN

ENTRY: 20000

TP1: 20500

TP2: 21000

TP3: 21500

SL: 19000

Leverage: 0

===========================================================================

Adding Alerts in TradngView

---------------------------------------------------------------------------

-Right-click anywhere on the TradingView chart

-Click on Add alert

-Condition: Select this indicator by it’s name

-Alert name: Whatever you want

-Hit “Create”

-Note: If you change ANY Settings within the indicator – you must DELETE the current alert and create a new one per steps above, otherwise it will continue triggering alerts per old Settings!

===========================================================================

If you have any questions or issues with the indicator, please message me directly via TradingView.

---------------------------------------------------------------------------

Good Luck! (NOTE: Trading is very risky, past performance is not necessarily indicative of future results, so please trade responsibly!)

Price Legs: Time & Distance. Measuring moves in time & price-Tool to measure price legs in terms of both time and price; gives an idea of frequency of market movements and their typical extent and duration.

-Written for backtesting: seeing times of day where setups are most likely to unfold dynamically; getting an idea of typical and minimum sizes of small/large legs.

-Two sets of editable lookback numbers to measure both small and large legs independently.

-Works across timeframes and assets (units = mins/hours/days dependent on timeframe; units = '$' for indices & futures, 'pips' for FX).

~toggle on/off each set of bull/bear boxes.

~choose lookback/forward length for each set. Increase number for larger legs, decrease for smaller legs.

(for assets outside of the big Indices and FX, you may want to edit the multiplier, pMult, on lines 23-24)

small legs

large legs

Divergence BacktesterThere is n number of possible ways in which we can backtest divergence and this is just a start :)

In this script, we are trying to count how many times the pivots made HH, HL, LH, LL after a particular divergence state.

An example of using data is as below:

The script keeps track of each pivot sentiment and resulting next pivot state. As mentioned in the chart snapshot, we can look at two of the previous pivot states and collect stats on how each of these state impacted price action.

As mentioned before, this is just tip of iceberg. Further combinations for which we can do backtest are:

1. m X n combinations of last pivot and last to last pivot divergence state

2. divergence combined with double divergence state.

Only issue to explore further is lack of space on the chart as tables can take up huge space.

PS: As you can see based on historical stats, probability of divergence impacting the change of trend is very low in most cases.

Crodl Pump & DumpThe reason why this indicator is called Pump and Dump is because it is based on volume.

The indicator focuses on volume levels to see if there is an increase in volume before deciding if it is worth entering a Position.

Long example = This will use ATR and price averages to trend Bullish and once the trend favours the upside it will then look at the Volume candles and if a candle is bigger then the average volume and the trend (ATR) is above a certain level it will then Give us a long entry if those conditions are true. We can have more than one long after one another since it will give us a position every-time the conditions are true and after TP(take profit) 1 or a Stop Loss was hit.

Short example = If the trend based on average price is trending downwards and we can see an increase of volume it will wait till we break a certain level breaks when we get the average price from the highs and Lows, then once the trend has met the bearish conditions it will wait for increase in volume and trigger a Sell. The sell will close once TP(take profit) 1 or a Stop Loss is hit.

In the inputs you can adjust the MA (moving average length. This helps to decide if the Trend is bearish or bullish. Higher moving averages will give you less entries and a lower moving average will give you more entries ,since price crosses lower MA's more it will change the trend more often.

Sensitivity is a divider of the MA values is so the higher the Sensitivity the lower the more trades you get since the trend is changing faster.

You will see that there is a backtesting panel on your chart when you look in the inputs there will be a statistics tab which will have 1. Simple 2. Mobile 3. Hide options

1. Simple is designed when you are using a PC or Laptop

2.Can be used when you are using your mobile it will show less data but won't be in your way

3.This will hide the backtesting panel on your screen.

Exit strategy.

there are 3 Types of exits for this indicator.

1 .CrodlExit which is ATR indicator based Exit with a divider.

2 . fIxed SL , this works in % so 1 = 1% market move.

3 .Reverse exits = Longs exit shorts and shorts exit longs.

there are 4 take profit targets and all of them are adjustable.

1= 0.5% by default

2=1% by default

3=1.5% by default

4=2% by default

on the Back tester you will find the following information :

Timeframe of your chart and then the Symbol or pair you are trading.

First trade = when the back tester starts to read data.

Total trade = Total buy and total sell signals and then total trades are buy + sell signals.

total win = total buys hit take profit 1 and total sells that hit take profit 1 and then total buy + total sells that hit take profit 1.

total loss = total buys that hit which ever exit mode you selected in the inputs by default it is crodl exit and total sells that hit which ever exit mode you selected in the inputs by default it is crodl exit and then you will get total buy losses + total sell losses to get total loss.

TP1= the % difference between total trades won and lost for the 1st take profit target and your stop loss method you chose.

TP2= the % difference between total trades won and lost for the 2nd take profit target and your stop loss method you chose.

TP3= the % difference between total trades won and lost for the 3rd take profit target and your stop loss method you chose.

TP4= the % difference between total trades won and lost for the 4th take profit target and your stop loss method you chose.

average win streak give you the average of how many winning trades you had every time before hitting a stop loss.

average loss streak is how many stop loss you hit on average before take profit one has been reached.

longest win streak give you the amount of winning trades you had without hitting a stop lossl that is selected in your inputs.

longest loss streak give you the amount of losing trades you had one after the other before hitting take profit 1.

Inverse Fisher Transform ScreenerThis is a Screener for Inverse Fisher Transform on multiple oscillators

This tool is intended to aid you to visually analyse reasonable buy and sell IFT-signal thresholds across multiple tokens and different sources. It will help you speed up the tedious and manual work of trying out different IFT-settings when you're able to review the chart visually to find which values are present the most often and the location of that signal on the chart.

What does it bring to the table, why is it useful?

- Invese Fisher Transform on multiple oscillators such as RSI, MFI, CCI, Stochastic

- Combine multiple sources into one signal, select how it's calculated

- Visually review the chart for good IFT-settings

- 4 dynamic buy labels with different thresholds

- 4 dynamic sell labels with different thresholds

- Buy and sell on signal reversal

- Create your own trade alerts for automation

- Backtester compatible (plots 1 and 2 for buy and sell signals)

- A dynamic table counting amount of signals for each setting

- The labels are automatically updated when you change the values in the settings

How to use?

1. Change signal source and method

2. Change buy and sell thresholds

3. Show/hide additional labels

4. Review chart

5. Change trade settings

6. Backtest

7. Create alerts

Description

With this indicator you're able to visually review the signal strength of one or multiple oscillators processed with Inverse Fisher Transform ( IFT ), combine them and choose the method of calculation when they are combined. This produces a signal which strongly fluctuates between -1 and +1 instead of the more common 0-100 most oscillators uses. The intention is to make the decision making clearer and easier when you decide when to enter or exit a trade. This aims to help you remove the feelings from your trading.

Inverse Fisher Transform was first presented by John Ehlers in Stocks & Commodities V. 22:5 where he proposes to process RSI with the formula for hyperbolic tangent, tanh (x). This transforms the oscillator into a smoother and more compressed version with quicker oscillations.