OFA - Order Flow AnalysisThe script analyzes order flow based on fractal structure breaks. Every time there is a fractal breakout in the opposite direction of the dominant side in control a new leg ( bullish or bearish ) forms. This script comes with the added value of displaying the velocity and the magnitude of each leg/cycle.

Order flow leaves a trail of the future market intentions via the ability or lack thereof of the aggregated flow to keep consuming liquidity provided by market makers and find or not equilibrium in price. The proper reading of order flow can provide information advantage. Flows can be read via two main venues:

1 - Magnitude: A major clue that will help determine the health of a trend is the type of progress by the dominant side in control of the trend. We need to ask the following question: Are the new legs in the active buy-sell side campaign as identified by the script increasing or decreasing in magnitude?

2. Velocity: When it comes to the distance the price moves, the magnitude is only ½ the equation. The other ½ has to do with the velocity of the move or the speed. Was the new leg created after a fast and impulsive move? Or did price make a new low or high with the movement being sluggish, compressive and taking too long to form? A good rule of thumb is to count the number of candles it took to achieve a new leg.

Chỉ báo Bill Williams

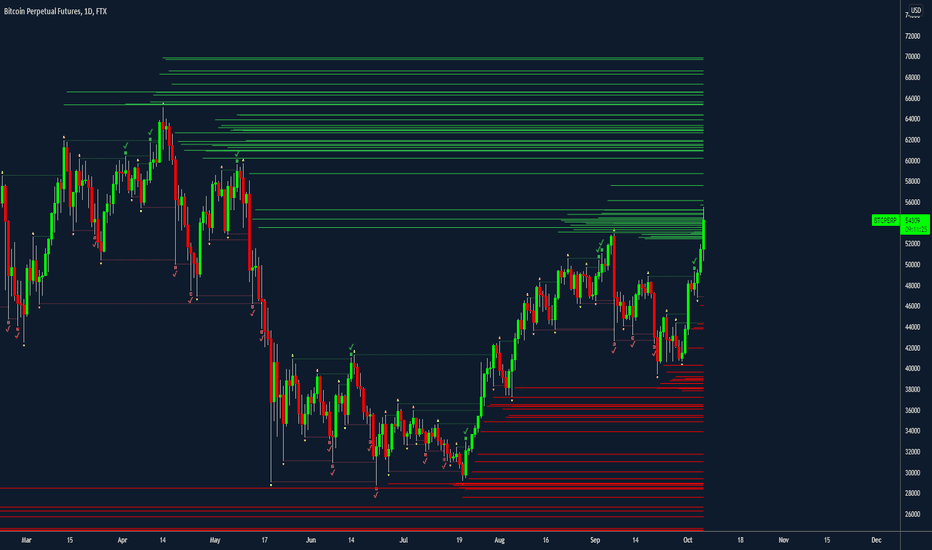

Fractals (Expo)

Fractals (Expo) make use of fractals to identify trends and reversals. The indicator is designed to adapt smoothly and quickly to significant price moves in order to identify trend reversals as well as filtering out noise in an established trend. The indicator is simple to use and understand therefore valuable to all trading styles.

The user has the ability to enable a custom input source which gives the user great flexibility and full control over what the calculations should be based on. The default input source is fractals from the swing points of the market.

Real-Time Trend Alerts

No Repainting

Works on any market and in any timeframe

HOW TO USE

Use the indicator to gain insights into trends and trend reversals.

Identify Trends

Identify Trend reversals

Use it as a Trend filter

INDICATOR IN ACTION

Daily Chart

I hope you find this indicator useful , and please comment or contact me if you like the script or have any questions/suggestions for future improvements. Thanks!

I will continually work on this indicator, so please share your experience and feedback as it will enable me to make even better improvements. Thanks to everyone that has already contacted me regarding my scripts. Your feedback is valuable for future developments!

-----------------

Disclaimer

Copyright by Zeiierman.

The information contained in my scripts/indicators/ideas does not constitute financial advice or a solicitation to buy or sell any securities of any type. I will not accept liability for any loss or damage, including without limitation any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

All investments involve risk, and the past performance of a security, industry, sector, market, financial product, trading strategy, or individual’s trading does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs.

My scripts/indicators/strategies/ideas are only for educational purposes!

ACCESS THE INDICATOR

• Contact me on TradingView or use the links below

Fractal ConvergenceThis is an indicator, ideally for use with the 15M charts, will mark out both buy and sell signals based on Fractal Convergence. If based on the direction and layout of the EMA (8/20 from 60 min) it determines the market to be sell biased it will look for a higher low fractal to the preceding low fractal. For a Buy biased market it will look for a lower high fractal to the preceding high fractal. The indicator will mark out the entry, stop-loss, and take profit, based on the convergence it sees. You should manage your risk as per your trading plan. A further extension to this Indicator is the ability to look for confluence with the higher timeframe i.e. H4(240M). With this it will require the EMAs for the 1 hour and 4 hour to be pointing in the right direction before looking for fractal convergence.

There is a balance to be met, and a decision to be made around whether to seek confluence with HTFs or not. In some market conditions waiting will mean fewer opportunities, but at the same time, it is supposed to be a higher probability move. At the same time if you are looking for higher risk to reward opportunities you will want to be looking to get in as soon after the crossover as possible. This will "likely" give you the run up to when the higher timeframe catches up (but not always).

As with any indicator it carries the risk that it may not always work in all conditions. One should test it out and be comfortable with the likeliness of the indicator use resulting in a loss as well as a win.

To further help you get in on those early entries the indicator has an alert condition that can alert you to the first signal after the EMA cross. Please use trader discretion when deciding to take this first signal i.e. presence of horizontal, trend and direction, any fundamentals (eg. avoid trading within 2 hours of news).

One might choose to incorporate other indicators to help in decision making. One such idea would be to combine it with pivot points and maybe using them for advanced stop loss placement, or ATR for deciding if the stop placement is too close for current market conditions, Stochastic for determining if there is likely going to be a pull back(overbought/oversold), RSI to determine if the market is in an established trend (above/below 50 and inside 70/30 respectively). Lots can be done - but it is just an idea and you must decide if the entry looks good for you and you are comfortable with the risk.

EOD TraderMy EOD (End of Day) system for trading on the daily timeframe with minimum stress. Just pair the built-in alerts with the bot of your choice and then let the indicator do the rest. It'll determine the current trend, filter out as much noise as possible and then take you from long to short.

There are options to toggle the following:

Auto fibonacci levels with alerts for the look-back period of your choosing

Auto support and resistance with alerts

Alerts for the price closing above/below the 50MA

A coloured background to show the trend direction (green = up, red = down)

The fib and support levels can be handy when trying to determine when best to take profit or even exit the trade entirely.

Important: I personally use Heikin Ashi candles with this script to further filter entries. An option is available within the script settings to toggle this on/off should you wish to do the same.

This is a premium script. Please DM me for access.

Zalligator - Zero-Lag Alligator IndicatorI applied the zero-lag moving average theory to the Alligator Indicator. It seems like some different rules would would be required versus the traditional Alligator. Let me know what you think!

Multi StrategyDuring the course of a trade, we can find ourselves changing strategies depending on the market. Instead of using many different templates, I have a simple indicator that clearly says "Buy", "Sell" or "Stay Out". The great thing about this approach, is we instantly observe the majority are in agreement and that decides which way to place our trade.

This indicator includes the following strategies:

- QQE

- Ichimoku using much faster settings.

- Parabolic SAR

- Supertrend

- TTM Oscillator

- The Squeeze strategy

- The Alligator Strategy

Using this indicator is simple, if the lines are mainly green then buy, if mainly red then sell OR don't trade. So...

Green Line - This strategy is in a buy position

Orange or Black Line - This strategy is undecided

Red Line - This strategy is in a sell position

There are also some green and red circles for reference that appear showing when that bar has broken through the Ichimoku cloud.

The trader's approach is simple, when all indicators are green or red, then take the trade. As soon as one indicator changes, then re-evaluate using your normal process, such as price action, to determine whether to close the trade or continue.

I can customise this further or add other strategies, please message me.

FX Social Entry FinderThis can be applied to Forex, Stocks and Crypto.

Understanding it

When the buy or sell signal align with the wave, it means the price is heading in the direction of alignment.

This indicator is intended to be used as a confirmation indicator for other algorithms for best result.

Indicators with specifically tested and chosen settings that have shown to work on a number of timeframes.

How to use on a buy

When you receive a buy signal if it's within the wave or above the wave, its an indication the market about to continue that direction. You could aim for 20-50 pips depending on the pair.

When to sell

When you receive a sell signal if it's within the wave or below the wave, its an indication the market about to continue that direction. You could aim for 20-50 pips depending on the pair.

When to exit

You can set our indicator to alert you when its a good time to exit the trade.

How to Access

Gain access to FX Social Entry Finder for your TradingView account by being a active member of FX Social.

[SCL] Bitcoin Hashrate Dips (Miner Capitulation)Gives long-term buy signals for Bitcoin from dips and recoveries in the hashrate (the "miner capitulation" theory). It has an overlay and a standalone mode and is fully configurable. It uses Williams Lows and ATR instead of moving averages.

Features that might be interesting for Pinescripters:

+ Automatic (as far as is possible currently) adjustment of plots for overlay and standalone display modes.

+ A neat label function for debugging floats

+ Fully commented

+ The debug that I used to overcome problems in developing it is left in

+ Ideas for how to deal with a wildly oscillating and exponentially increasing data source

You need to run this indicator on the Bitcoin daily chart for it to make any sense. The best is a BTC/USD chart with a long history, such as BNC:BLX.

Trend LineBasic Trend Line base on fractals (v0.1)

Can not draw a line on the future X axis, So just a line segment but not a ray.

I don't have a better idea to upgrade...

Williams Fractals with Alerts by MrTuanDoanCustom William Fractals for alerts and educational purpose.

Added custom alerts for Williams Fractals.

Also added filter to show less fractals on chart.

The simple idea how I use fractals in Binary Option is to determine temporary resistance and support.

Simple strategy:

- Mark Resistance/Support on higher time frame (e.g. 5M)

- Set an alert for new fractal

- Whenever a new fractal that appears close to your marked Resistance/Support, go to lower time frame (e.g. 1M)

- Wait for rejection at the level that lower than new down fractal (or higher than new up fractal).

- Enter with the same expiry of lower time frame.

Good luck and happy trading. :-)

Williams Fractals, A simpler scriptA simpler script to filter fractals and support large range parameter.

Deep_Fractal_Signals_and_Rubber_Band_TradesThis indicator is based on Williams Fractals and the TopDog Trading "Rubber Band Trade"

The Deep Fractal Signals are triangles that indicate the price is forming a pattern of decreasing lows in a down trend (orange) or, increasing highs in an up trend (green).

The triangles are placed above or below the last bar of the pattern, unlike Fractals which are drawn 2 candles prior to the current candle, and are re-painted on the chart.

When the triangle is indicated above the moving average in a down trend (blue), or below the moving average in an up trend (yellow), this is a Rubber Band Trade.

When the slope of the moving average is less than the Gain set by the user, or are counter-trend, the triangles are plotted in silver.

When used in conjunction with the Power Analyzer indicator, a signal to the long side should be taken when the Power Analyzer momentum indicator is at a cycle low. Similarly, a signal to the short side should be taken when the indicator is at a cycle high.

The first, second or third signal in a new trend have the highest probability of a follow through.

The indicator sometimes gives a false signal at the very end of the trend, just before the market reverses. This is an attempt by the Market Makers to persuade traders that the trend will continue.

Please leave a comment and "Like" this indicator if you find it useful.

FX Engineering

Heikin Ashi Buy Sell by JPTrades Description

I use this script a lot to know the trend of a stock, cryptocurrency, forex.

This script is based on an EMA study. Which tells us the trend of a stock.

How to use

You can see the trend of a stock if it goes up it says buy and if it goes down it says sell. It is recommended that you put it with the heinki ashi table. It can help you much more.

How to access the script

Send me a message to the private

Observations

This advice is NOT financial advice.

We do not provide personal investment advice and we are not a licensed and qualified investment advisor.

All information found here, including ideas, opinions, views, predictions, forecasts, comments, suggestions, or action selections, expressed or implied in this document, are for informational, entertainment, or educational purposes only and should not be be construed as personal investment advice.

We will not and will not be responsible for any action you take as a result of what you read here.

We only provide this information to help you make a better decision.

While the information provided is believed to be accurate, it may include errors or inaccuracies.

Buy and sell signal by JPTradesDescripcion:

The 10/20 MA Strategy is the best I know. It's easy, it's elegant, it's effective.

It's particularly effective in markets that trend on the daily. You may lose some money when markets are choppy, but your loss will be more than compensated when you're aboard during the big moves at the beginning of a trend or after retraces. There's that, and you nearly eliminate the risk of losing your profit in the long run.

The results are good throughout most assets, and at their best when an asset is making new all-time highs.

Caracteristicas:

It uses two simple moving averages: the 10 MA (Buy), and the 20 MA (Sell). Now here's the great thing. This script does not change your regular candles into heikin-ashi ones, which would have been annoying; instead, it subtly prints either a Buy or a Sell around your normal candles, indicating a heikin-ashi change from red to green, or from green to red, respectively. This way, you get both regular and heikin ashi "candles" on your chart.

How to Use:

Go LONG in case of ALL of the below:

A tab appeared with buy under the last daily candle (meaning the heikin-ashi is now "green").

The blue MA-line is above the red MA-line.

Price has recently breached the blue MA-line upwards, and is now above.

Cover when one or more of the above is no longer the case. This is very important. You want to keep your profit.

Go SHORT in case of ALL of the below:

A red tab with Sell above the last daily candle (meaning the heikin-ashi is now "red").

The red MA-line is above the blue MA-line.

Price has recently breached the blue MA-line downwards, and is now below.

Again, cover when one or more of the above is no longer the case. This is what gives you your edge.

How to get access to the script:

Send us a message if you would like to try!!

Awesome Oscillator_VTX

Abbreviations:

AO - Awesome Oscillator

AC - Accelerator Oscillator

TP - TimePeriod (1m,2m,5m,1h....)

TP Steps - 1m,3m,12m,1h,5h,D (This steps i use)

Use-case:

Awesome Oscillator best used to find Divergence/Convergence what results in Weakening of Momentum and Price reversals.

This script calculates and plots AO/AC with minute precision, removing GAPS when projecting Higher Period AO/AC.

So you can accommodate all important information on one chart with best precision.

Made for Intraday Perioads.

Best used for DayTrading, when you need to make quick and efficient decisions.

Calculation = Preferred resolution * Length / Present resolution.

As Additional Function, this Awesome Oscillator has AC built in.

Settings:

Resolution - Most used TP included, plus some exclusive paid plans (1m, 2m, 3m, 5m, 12m, 15m, 1h, 4h, 5h, Daily). Default set to 1h

Use AO - You can switch between EMA and SMA for FastMA/SlowMA calculation. Default set to EMA

FastMA - standard function. Default set to 5

SlowMA - standard function. Default set to 34

Signal Line - Plots MA to show Momentum. Uses EMA/SMA based on "Use AO" selection. Default set to 5

Use AC - You can switch between EMA and SMA for AC calculation. Default set to SMA

Offset - standard function. Default set to 0

Accelerator - AC length. Default set to 5

Source - standard function. Default set to hlc3

Why to use it ?

Yes, i know that variable TP is standard now in TradingView. But there are some limitations, especially for DayTraders.

Problem:

Imagine you are trading/scalping on 1m.. 5m.. 15.. charts and you want to see where are your on Higher TP.

-- You can change to 1h and check it, but you will loose the picture from smaller TP.

-- You can use Standard TP function, but your data will update every 15m, 1h (depends on TP). And in result you have Gaps between bars.

Solution:

This script help to solve this problem, by breaking information down to 1m and building from there.

So whatever Intraday TP you choose to trade, your AO/AC will be updated with minute precision.

Limitations:

Sadly nothing without limitations.

1. For Best performance use only Higher TP dividable By Yours (ex. You use 3m chart, then you can plot 12m, 15m, 1h / You use 5m chart, then you can plot 15m, 1h. 12m will already have 3m of information lost using 5m Chart )

MarketStructureBreakThe Script is called a MSB/MarketStructureBreak

This script is meant to teach you on how the 2 candles are responsible for the breakout and shows you patience

The best way to use this indicator is by putting the "SMA 50 SMA 200" settings helps filter out the false calls

As well, if you use this in a bigger time frame like 1 HOUR, 4 HOUR, Daily, and Weekly it will call the best buy and sell Signals

Liquidity and SFPThis tool prints fractal high & lows (triangles) illustrating probably points of liquidity & Williams method.

If the liquidity points have been run, there will be a line print, when they have not been run there will still be a single triangle print without a line.

If the liquidity is run and then the candle closes above we print a checkmark to demo that it is likely that this was a stop run to generate liquidity for bigger market participants. This can help with entry identification if this is a method you deploy.

This indicator is available as part of membership at at decentrader.com

Two Fractals TrendlinesThis study draws a trend line for the last two Bill Williams up-fractals and down-fractals.

Trend line break signals and alerts can optionally be added.

Normal FractalsNormal size fractal

For those who like Charts as clean as possible, I modified build in fractals in smaller size clean chart pollution

CAMZONEAdded Fractals which establishes high and low based on Bill Williams definition. Added one type of Pinbar (where the open and close is near extreme of the range and with long shadow that is at least 80% of the range). It is a powerful reversal pattern especially on the daily charts. These bars are identified with the character P. Also included dots below momentum candles.

FRACTAL-TREND-MTF-GRIDFractal Trend - Multi Time Frame

Toggle time frame 3 on/off (When on, time frame 3 is set to the chart time frame)

Toggle ticker selection on/off

Toggle time frame header on/off

To configure grid see grid instructions below (the indicator in the gif is the SMT but same concept applies)

***** Make sure all instances of the indicator are pinned to the same scale *****

gifyu.com

Jackrabbit.modulus.Williams%RThis is the Williams %R for the Jackrabbit suite and modulus framework.

This indicator supports differential timeframe analysis and confirmational bias. Dynamic timeframes are supported.

This is an updated view of %R and supports traditional overbought/sold boundaries and cross over regions.

The main indicatior and the confirmational indicator can both be individually tuned for the length and smoothing, with 30 different moving average types:

SMA, Double SMA, Triple SMA,

EMA, Double EMA, Triple EMA,

RMA, Double RMA, Triple RMA

WMA, Double WMA, Triple WMA,

VWMA, Double VWMA, Triple VWMA,

Hull, Double Hull, Triple Hull,

ZLEMA, Double ZLEMA, Triple ZLEMA,

SWMA, Double SWMA, Triple SWMA,

SSMA, Double SSMA, Triple SSMA,

SMMA,Double SMMA, Triple SMMA

The Jackrabbit modulus framework is a plug in play paradigm built to operate through TradingView's indicator on indicatior (IoI) functionality. As such, this script receives a signal line from the previous script in the IoI chain, and evaluates the buy/sell signals appropriate to the current analysis. The results are either combined with the signal line, or used as confirmation to the signal line. A new signal line is generated for the next script in the link.

This script is not designed or meant to function outside my framework.

By default, the signal line is visible and the charts are turned off. Signal line visibility is controlled by the Style tab, and the charts display is controlled by the indicator settings tab.

This script is by invitation only. To learn more about accessing this script, please see my signature or send me a PM. Thank you.