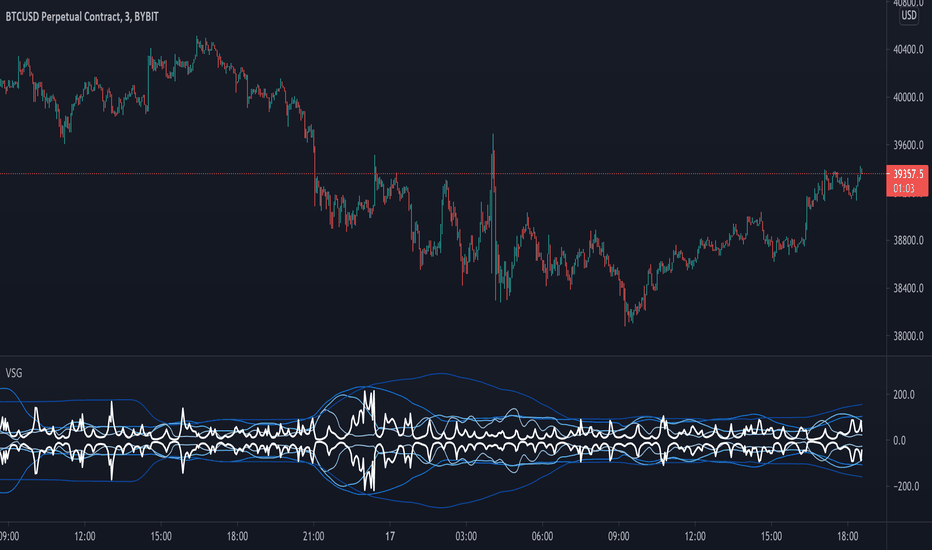

#1 Vishal Toora Buy/Sell Table#1 Vishal Toora Buy/Sell Table

A multi-range volume analysis tool that tracks Short, Medium, and Long-term volume activity directly from recent candles.

It calculates Buy and Sell volumes for each range, shows their Delta (difference), and generates a combined Signal (Buy / Sell / Neutral) based on all active ranges.

Each column and the Signal row can be switched ON/OFF for custom clarity.

🧠 What the Numbers Represent (Candle Connection)

Each number represents total volume from a group of candles:

The script looks back a certain number of candles in each range (e.g., 2–3 candles for Short, 10–20 for Medium, 50–100 for Long).

It measures how much volume occurred on bullish candles (Buy) vs bearish candles (Sell).

Buy Volume (Green Numbers):

Volume from candles where price closed higher than it opened → bullish pressure.

Sell Volume (Red Numbers):

Volume from candles where price closed lower than it opened → bearish pressure.

Delta (White or Yellow Numbers):

The difference between Buy and Sell volumes within that range.

Positive → More bullish volume.

Negative → More bearish volume.

Larger absolute values = stronger imbalance between buyers and sellers.

Signal Row:

Summarizes all ranges’ deltas:

🟢 Buy → majority of ranges show positive delta.

🔴 Sell → majority show negative delta.

⚪ Neutral → roughly balanced or mixed candle behavior.

🎯 In Simple Terms

Each number in the table is a summary of what recent candles did —

it converts multiple candles’ volume data into clean, readable signals,

so you instantly see who’s in control (buyers or sellers) across short, medium, and long perspectives.

© 2025 Vishal Toora — counting volumes so you don’t have to.

Buy or Sell... or just stare at the screen.

Making deltas speak louder than your ex. 💀

Disclaimer:

This indicator is for educational and informational purposes only.

It does not guarantee accuracy or performance.

You are solely responsible for your trading decisions.

Movement

First-Move-Wrong Toolkit [CHE] First-Move-Wrong Toolkit — Session-bound sweep rejection with structure confirmation

Summary

This indicator marks potential “first move wrong” reversals during a defined trading session. It looks for a quick sweep beyond the prior day high or low, or the opening range high or low, followed by rejection and a basic structure confirmation. Optional rules require a retest and a VWAP reclaim in the direction of the trade idea. The script renders session levels as right-extended lines, signals as labels, optional SL/TP guide lines for visualization, and background tints during sweep events. Pivots are confirmed using swing width, which reduces repaint risk compared to live swings.

Motivation: Why this design?

Intraday reversals often start with a liquidity sweep around obvious highs or lows. Acting on the sweep alone can be noisy, while waiting for structure break and a retest can be slow. This tool balances both by checking a sweep and rejection at session-relevant levels, then requiring a simple structure cue and, optionally, a retest and a VWAP filter. The goal is a clear, rule-based signal layer that is easy to audit on chart without hidden state.

What’s different vs. standard approaches?

Baseline reference: Simple sweep detectors or basic CHOCH markers that ignore session context and liquidity anchors.

Architecture differences:

Session-aware opening range tracking that finalizes after the chosen minutes from session start.

Daily previous high and low pulled without lookahead, then extended forward as visual anchors.

Confirmed pivot highs and lows to avoid repaint from live, unconfirmed swings.

Optional retest rule using crossover or crossunder at the trigger level.

Optional VWAP filter to demand reclaim in the intended direction.

Global label cooldown to prevent clusters of signals.

Practical effect: Fewer one-off flips around noisy levels, clearer alignment with session structure, and compact visual feedback through lines, labels, and tints.

How it works (technical)

Levels: During the defined session, the script builds an opening range high and low until the configured minute mark after session start, then freezes those levels for the day. It also fetches the previous day high and low from the daily timeframe without lookahead and extends them forward.

Sweep and rejection: A sweep is defined as price moving beyond a target level and then rejecting back inside on the same bar. The script checks this condition separately for highs and lows against opening range and previous-day levels.

Structure validation: Confirmed pivot highs and lows are computed using a symmetric swing width. A bearish idea requires a prior sweep of a high plus a break through the last confirmed swing low. A bullish idea requires a prior sweep of a low plus a break through the last confirmed swing high.

Optional retest: If enabled, a bearish signal needs a cross under the bearish trigger level; a bullish signal needs a cross over the bullish trigger level.

VWAP filter (optional): The script requires a reclaim of VWAP in the intended direction when enabled.

State handling: Opening range values, previous-day lines, and the label cooldown timestamp are stored in persistent variables. Lines are created once and updated each bar to extend forward.

Repaint considerations: Pivots confirm only after the specified swing width, reducing repaint. The daily level request is performed without lookahead. Signals use closed-bar checks implied by crossover and crossunder logic.

Parameter Guide

Session (local) — Defines the active trading window. Default nine to seventeen. Narrower windows focus on the main session drive.

Opening Range (min) — Minutes from session start to finalize OR levels. Default fifteen. Shorter values react faster; longer values stabilize levels.

Use PrevDay H/L levels — Toggle previous-day anchors. On by default.

Use OR H/L levels — Toggle opening range anchors. On by default.

Equal H/L tolerance (ticks) — Intended tolerance for equal highs or lows. Default one. (Unknown/Optional) in current signals.

Swing width — Bars on both sides for confirmed pivots. Default two. Larger values reduce noise but confirm later.

Require CHOCH after sweep — Enforces structure break after a sweep. On by default.

Prefer retest entries — Requires crossover or crossunder of the trigger level. On by default.

VWAP filter — Demands a reclaim of VWAP in signal direction. Off by default.

TP in R (guide) — Multiplier for visual TP guides. Default one. Visualization only.

Show levels / Show signals / Show R-guides — Rendering toggles. R-guides are visual aids, not orders.

Label cooldown (bars) — Minimum bars between labels. Default five. Higher values reduce clusters.

Palette inputs — Colors and transparencies for levels, labels, VWAP, and tints.

Reading & Interpretation

Lines: Dotted lines represent opening range high and low after the OR window completes. Dashed lines represent previous-day high and low.

Signals: “Long” labels appear after a low-side sweep with rejection and structure confirmation, subject to optional retest and VWAP rules. “Short” labels mirror this on the high side.

Background tints: Red-tinted bars indicate a high-side sweep and rejection. Green-tinted bars indicate a low-side sweep and rejection.

R-guides: Circles display a visual stop level at the bar extreme and a target guide based on the selected multiple. They are informational only.

Practical Workflows & Combinations

Session reversal scans: During the first hour, watch for sweeps around previous-day or opening range levels, then wait for structure confirmation and optional retest.

Trend following with filters: Combine signals with higher-timeframe structure or a moving average regime check. Ignore signals against the dominant regime.

Exits and stops: Use the visual stop as a reference near the sweep extreme; adapt the target guide to volatility and market conditions.

Multi-asset / Multi-TF: Works on intraday timeframes for liquid futures, indices, forex, and large-cap equities. Start with default settings and adjust swing width and OR minutes to instrument volatility.

Behavior, Constraints & Performance

Repaint/confirmation: Pivots confirm after the swing window completes. Signals occur only when conditions are met on closed bars.

security()/HTF: Daily previous-day levels are requested without lookahead to reduce repaint.

Resources: Uses persistent variables and line updates per bar; no heavy loops or arrays.

Known limits: Signals can arrive later when swing width is large. Gaps around session boundaries may distort OR levels. VWAP behavior may vary with partial sessions or illiquid assets.

Sensible Defaults & Quick Tuning

Starting point: Session nine to seventeen, opening range fifteen minutes, swing width two, CHOCH required, retest on, VWAP off, cooldown five bars.

Too many flips: Increase swing width, enable VWAP filter, or raise label cooldown.

Too sluggish: Reduce swing width or shorten the opening range window.

Too many session-level hits: Disable either previous-day levels or opening range levels to simplify context.

What this indicator is—and isn’t

This is a session-aware visualization and signal layer focused on sweep-plus-structure behavior. It is not a complete trading system and does not manage orders, risk, or portfolio exposure. Use it with market structure, risk limits, and execution rules that fit your process.

Disclaimer

The content provided, including all code and materials, is strictly for educational and informational purposes only. It is not intended as, and should not be interpreted as, financial advice, a recommendation to buy or sell any financial instrument, or an offer of any financial product or service. All strategies, tools, and examples discussed are provided for illustrative purposes to demonstrate coding techniques and the functionality of Pine Script within a trading context.

Any results from strategies or tools provided are hypothetical, and past performance is not indicative of future results. Trading and investing involve high risk, including the potential loss of principal, and may not be suitable for all individuals. Before making any trading decisions, please consult with a qualified financial professional to understand the risks involved.

By using this script, you acknowledge and agree that any trading decisions are made solely at your discretion and risk.

Do not use this indicator on Heikin-Ashi, Renko, Kagi, Point-and-Figure, or Range charts, as these chart types can produce unrealistic results for signal markers and alerts.

Best regards and happy trading

Chervolino

Average hourly move by @zeusbottradingThis Pine Script called "Average hourly move by @zeusbottrading" calculates and displays the average percentage price movement for each hour of the day using the full available historical data.

How the script works:

It tracks the high and low price within each full hour (e.g., 10:00–10:59).

It calculates the percentage move as the range between high and low relative to the average price during that hour.

For each hour of the day, it stores the total of all recorded moves and the count of occurrences across the full history.

At the end, the script computes the average move for each hour (0 to 23) and determines the minimum and maximum averages.

Using these values, it creates a color gradient, where the hours with the lowest average volatility are red and the highest are green.

It then displays a table in the top-right corner of the chart showing each hour and its average percentage move, color‑coded according to volatility.

What it can be used for:

Identifying when the market is historically most volatile or calm during the day.

Helping plan trade entries and exits based on expected volatility.

Comparing hourly volatility patterns across different markets or instruments.

Adjusting position size and risk management according to the anticipated volatility in a particular hour.

Using long-term historical data to understand recurring daily volatility patterns.

In short, this script is a useful tool for traders who want to fine‑tune their trading strategies and risk management by analyzing time‑based volatility profiles.

Briese CoT Movement IndexThis Briese CoT (Commitments of Traders) Movement Index histogram indicator was built based on the formula by Stephen Briese in his book "The Commitments of Traders Bible":

"...difference between the COT Index and its reading of one or several weeks prior. I use six." —Chapter 7, page 75.

The code is a bit of a remix of the "ICT Commitment of Traders°" indicator by toodegrees and is meant for use in a new pane below a Weekly Chart .

The upper and lower thresholds are +40/-40. Some context: "A ± 40 point surge in the COT Index within a six-week period frequently marks the end of a counter-trend price reaction"

40 Point CoT Surge Rules (Commercials) from page 76

"During a correction from a prevailing uptrend, a +40 point movement in the CoT Index within a six-week period often marks the end of a corrective pullback, and the resumption of the major uptrend."

"During a reaction in a prevailing downtrend, a -40 point movement in the CoT Index within a six-week period frequently marks the end of a price reaction, and the resumption of the established downtrend."

"The failure of a ± point CoT Movement Index signal to restart the prevailing trend is a tip-off to a major trend change"

I'd recommend reading Briese's book for examples on how to properly interpret this indictor.

This indicator can be used in conjunction with another one I've published called the "Williams x Briese Hybrid CoT Index" which can be found on my scripts page.

Sentiment OscillatorIn the complex world of trading, understanding market sentiment can be like reading the emotional pulse of financial markets. Our Sentiment Oscillator is designed to be your personal market mood translator, helping you navigate through the noise of price movements and market fluctuations.

Imagine having a sophisticated tool that goes beyond traditional price charts, diving deep into the underlying dynamics of market behavior. This indicator doesn't just show you numbers – it tells you a story about market sentiment, combining multiple financial signals to give you a comprehensive view of potential market directions.

The Sentiment Oscillator acts like a sophisticated emotional barometer for stocks, cryptocurrencies, or any tradable asset. It analyzes price changes, market volatility, trading volume, and long-term trends to generate a unique sentiment score. This score ranges from highly bullish to deeply bearish, providing traders with an intuitive visual representation of market mood.

Green zones indicate positive market sentiment, suggesting potential buying opportunities. Red zones signal caution, hinting at possible downward trends. The oscillator's gray neutral zone helps you identify periods of market uncertainty, allowing for more calculated trading decisions.

What sets this indicator apart is its ability to blend multiple market factors into a single, easy-to-understand indicator. It's not just about current price – it's about understanding the deeper currents moving beneath the surface of market prices.

Traders can use this oscillator to:

- Identify potential trend reversals

- Understand market sentiment beyond price movement

- Spot periods of market strength or weakness

- Complement other technical analysis tools

Whether you're a day trader, swing trader, or long-term investor, the Sentiment Oscillator provides an additional layer of insight to support your trading strategy. Remember, no indicator is a crystal ball, but this tool can help you make more informed decisions in the dynamic world of trading.

Six PillarsGeneral Overview

The "Six Pillars" indicator is a comprehensive trading tool that combines six different technical analysis methods to provide a holistic view of market conditions.

These six pillars are:

Trend

Momentum

Directional Movement (DM)

Stochastic

Fractal

On-Balance Volume (OBV)

The indicator calculates the state of each pillar and presents them in an easy-to-read table format. It also compares the current timeframe with a user-defined comparison timeframe to offer a multi-timeframe analysis.

A key feature of this indicator is the Confluence Strength meter. This unique metric quantifies the overall agreement between the six pillars across both timeframes, providing a score out of 100. A higher score indicates stronger agreement among the pillars, suggesting a more reliable trading signal.

I also included a visual cue in the form of candle coloring. When all six pillars agree on a bullish or bearish direction, the candle is colored green or red, respectively. This feature allows traders to quickly identify potential high-probability trade setups.

The Six Pillars indicator is designed to work across multiple timeframes, offering a comparison between the current timeframe and a user-defined comparison timeframe. This multi-timeframe analysis provides traders with a more comprehensive understanding of market dynamics.

Origin and Inspiration

The Six Pillars indicator was inspired by the work of Dr. Barry Burns, author of "Trend Trading for Dummies" and his concept of "5 energies." (Trend, Momentum, Cycle, Support/Resistance, Scale) I was intrigued by Dr. Burns' approach to analyzing market dynamics and decided to put my own twist upon his ideas.

Comparing the Six Pillars to Dr. Burns' 5 energies, you'll notice I kept Trend and Momentum, but I swapped out Cycle, Support/Resistance, and Scale for Directional Movement, Stochastic, Fractal, and On-Balance Volume. These changes give you a more dynamic view of market strength, potential reversals, and volume confirmation all in one package.

What Makes This Indicator Unique

The standout feature of the Six Pillars indicator is its Confluence Strength meter. This feature calculates the overall agreement between the six pillars, providing traders with a clear, numerical representation of signal strength.

The strength is calculated by considering the state of each pillar in both the current and comparison timeframes, resulting in a score out of 100.

Here's how it calculates the strength:

It considers the state of each pillar in both the current timeframe and the comparison timeframe.

For each pillar, the absolute value of its state is taken. This means that both strongly bullish (2) and strongly bearish (-2) states contribute equally to the strength.

The absolute values for all six pillars are summed up for both timeframes, resulting in two sums: current_sum and alternate_sum.

These sums are then added together to get a total_sum.

The total_sum is divided by 24 (the maximum possible sum if all pillars were at their strongest states in both timeframes) and multiplied by 100 to get a percentage.

The result is rounded to the nearest integer and capped at a minimum of 1.

This calculation method ensures that the Confluence Strength meter takes into account not only the current timeframe but also the comparison timeframe, providing a more robust measure of overall market sentiment. The resulting score, ranging from 1 to 100, gives traders a clear and intuitive measure of how strongly the pillars agree, with higher scores indicating stronger potential signals.

This approach to measuring signal strength is unique in that it doesn't just rely on a single aspect of price action or volume. Instead, it takes into account multiple factors, providing a more robust and reliable indication of potential market moves. The higher the Confluence Strength score, the more confident traders can be in the signal.

The Confluence Strength meter helps traders in several ways:

It provides a quick and easy way to gauge the overall market sentiment.

It helps prioritize potential trades by identifying the strongest signals.

It can be used as a filter to avoid weaker setups and focus on high-probability trades.

It offers an additional layer of confirmation for other trading strategies or indicators.

By combining the Six Pillars analysis with the Confluence Strength meter, I've created a powerful tool that not only identifies potential trading opportunities but also quantifies their strength, giving traders a significant edge in their decision-making process.

How the Pillars Work (What Determines Bullish or Bearish)

While developing this indicator, I selected and configured six key components that work together to provide a comprehensive view of market conditions. Each pillar is set up to complement the others, creating a synergistic effect that offers traders a more nuanced understanding of price action and volume.

Trend Pillar: Based on two Exponential Moving Averages (EMAs) - a fast EMA (8 period) and a slow EMA (21 period). It determines the trend by comparing these EMAs, with stronger trends indicated when the fast EMA is significantly above or below the slow EMA.

Directional Movement (DM) Pillar: Utilizes the Average Directional Index (ADX) with a default period of 14. It measures trend strength, with values above 25 indicating a strong trend. It also considers the Positive and Negative Directional Indicators (DI+ and DI-) to determine trend direction.

Momentum Pillar: Uses the Moving Average Convergence Divergence (MACD) with customizable fast (12), slow (26), and signal (9) lengths. It compares the MACD line to the signal line to determine momentum strength and direction.

Stochastic Pillar: Employs the Stochastic oscillator with a default period of 13. It identifies overbought conditions (above 80) and oversold conditions (below 20), with intermediate zones between 60-80 and 20-40.

Fractal Pillar: Uses Williams' Fractal indicator with a default period of 3. It identifies potential reversal points by looking for specific high and low patterns over the given period.

On-Balance Volume (OBV) Pillar: Incorporates On-Balance Volume with three EMAs - short (3), medium (13), and long (21) periods. It assesses volume trends by comparing these EMAs.

Each pillar outputs a state ranging from -2 (strongly bearish) to 2 (strongly bullish), with 0 indicating a neutral state. This standardized output allows for easy comparison and aggregation of signals across all pillars.

Users can customize various parameters for each pillar, allowing them to fine-tune the indicator to their specific trading style and market conditions. The multi-timeframe comparison feature also allows users to compare pillar states between the current timeframe and a user-defined comparison timeframe, providing additional context for decision-making.

Design

From a design standpoint, I've put considerable effort into making the Six Pillars indicator visually appealing and user-friendly. The clean and minimalistic design is a key feature that sets this indicator apart.

I've implemented a sleek table layout that displays all the essential information in a compact and organized manner. The use of a dark background (#030712) for the table creates a sleek look that's easy on the eyes, especially during extended trading sessions.

The overall design philosophy focuses on presenting complex information in a simple, intuitive format, allowing traders to make informed decisions quickly and efficiently.

The color scheme is carefully chosen to provide clear visual cues:

White text for headers ensures readability

Green (#22C55E) for bullish signals

Blue (#3B82F6) for neutral states

Red (#EF4444) for bearish signals

This color coding extends to the candle coloring, making it easy to spot when all pillars agree on a bullish or bearish outlook.

I've also incorporated intuitive symbols (↑↑, ↑, →, ↓, ↓↓) to represent the different states of each pillar, allowing for quick interpretation at a glance.

The table layout is thoughtfully organized, with clear sections for the current and comparison timeframes. The Confluence Strength meter is prominently displayed, providing traders with an immediate sense of signal strength.

To enhance usability, I've added tooltips to various elements, offering additional information and explanations when users hover over different parts of the indicator.

How to Use This Indicator

The Six Pillars indicator is a versatile tool that can be used for various trading strategies. Here are some general usage guidelines and specific scenarios:

General Usage Guidelines:

Pay attention to the Confluence Strength meter. Higher values indicate stronger agreement among the pillars and potentially more reliable signals.

Use the multi-timeframe comparison to confirm signals across different time horizons.

Look for alignment between the current timeframe and comparison timeframe pillars for stronger signals.

One of the strengths of this indicator is it can let you know when markets are sideways – so in general you can know to avoid entering when the Confluence Strength is low, indicating disagreement among the pillars.

Customization Options

The Six Pillars indicator offers a wide range of customization options, allowing traders to tailor the tool to their specific needs and trading style. Here are the key customizable elements:

Comparison Timeframe:

Users can select any timeframe for comparison with the current timeframe, providing flexibility in multi-timeframe analysis.

Trend Pillar:

Fast EMA Period: Adjustable for quicker or slower trend identification

Slow EMA Period: Can be modified to capture longer-term trends

Momentum Pillar:

MACD Fast Length

MACD Slow Length

MACD Signal Length These can be adjusted to fine-tune momentum sensitivity

DM Pillar:

ADX Period: Customizable to change the lookback period for trend strength measurement

ADX Threshold: Adjustable to define what constitutes a strong trend

Stochastic Pillar:

Stochastic Period: Can be modified to change the sensitivity of overbought/oversold readings

Fractal Pillar:

Fractal Period: Adjustable to identify potential reversal points over different timeframes

OBV Pillar:

Short OBV EMA

Medium OBV EMA

Long OBV EMA These periods can be customized to analyze volume trends over different timeframes

These customization options allow traders to experiment with different settings to find the optimal configuration for their trading strategy and market conditions. The flexibility of the Six Pillars indicator makes it adaptable to various trading styles and market environments.

Extension %This is a tracking tool to measure two different kinds of distances:

- Gaps, from the open/close or the high/low value to the nearest open/close or high/low value.

- Price extensions of one or two candles from a preferred starting point (open, high, low or close) to a final point (open, high, low or close). The two-candles mode includes an optional rectangle to help you visualize the first and the last point of the measurement.

The script will plot a label with a percentage when the extension reaches the value you set. Unless you choose to track the one-candle price extension, the label will always be displayed on the high/low value of the second candle.

Moving Average Gradient (MAG) The Moving Average Gradient Indicator uses multiple Moving Averages to create a gradient. It creates continually more faint MAs, filled upwards or downwards to the price at a certain opacity. It can be used efficiently for stocks, forex, crypto, and more. This indicator combines numerous Moving Averages of your choice, a few of which include:

EMA

SMA

WMA

HMA

RMA

DMA

LSMA

VAMA

TMA

MF

Using this indicator will make entries more simple because crossovers and crossovers can more easily be detected, either manually or using alerts. These multiple Moving Averages allow for a smoothed out price trend, and the filtering of irregular and odd short-term price fluctuations. Due to the ample count of price trends that are widely used, it is difficult to view the market through the eyes of all types of investors/traders. This indicator manages to counter exactly that, you will be able to see all existing trends and enter/exit positions accordingly. This indicator can be used with all chart types and works well with many other indicators. It allows for complete customization and offers easy-to-understand settings which can be designated to a certain individual. You can modify every single factor of the MAs which allows for an even more personalized and adapted Indicator that reflects your trading/ investing inquiries. Most importantly, it looks cool.

A few of the technical settings you can change are:

Moving Average Count (Select how many do you want to be displayed.)

Moving Average Type (EMA, SMA, WMA, etc.)

Source (close, open, high, low)

Separate MA Length (The length of each Moving Average, its lookback. How many previous candles should it be based on? Choose each Moving Average's lookback length.)

You can also change the style settings of the indicators like:

Progressive opacity percentage (By how much will the next MAs fill affect the other? 1st: 50%, 3rd: 30%, 4th: 20%, 5th: 10%)

Bullish Candle Color

Bearish Candle Color

This indicator is unique because it can be used for all strategies and all trading styles, for example, day trading or long-term investing, really anything if used correctly. The reason it can be used in so many instances is a result of the detailed and in-depth settings tab. This allows the indicator to be used and to be useful in various situations and allows you to dominate the market. You can either increase the MA length difference by progressively small amounts for day trading and create bigger gaps in the MA length difference for swing trading or long-term investing. Integrated alerts also enhance your efficiency while using this indicator because you can choose to be notified at the crossovers and crossunders of a pair of Moving Averages.

The technical portion of the indicator creates and plots the chosen amount or count of Moving Averages as specified in the settings tab. Then it fills each MA using the selected color and opacity. Afterward, it adapts the moving Averages to use the inputted data from the settings tab and uses it to plot them accordingly.

Relative VolatilityRelative volatility highlights large changes in price. This was designed to be used with my relative volume indicator so that traders can see the effect of volume on price action. It is also a good tool to analyse breakout patterns to identify best entry points and waves.

Above shows relative volatility and relative volume working together.

DMI With Crosses (MyNewTrade)Directional Movement Indicator:

+DI and -DI

I changed the color of the bar bars according to the crossed of +DI and -DI . It helps us to have an idea of whether the trend is continuing or not.

+DI crossover to -DI barcolor is Aqua, if not bar color is Red.

It also helps us to find the lowest and highest points of the graph according to the positions of Adx +DI and -DI .

It gives warnings at the lowest and highest points, which helps us to detect the direction of the trend.

Volatility - Sacred GeometryThis indicator is designed to pick up changes in volatility before it happens. It also shows current volatility, as price action drops the blue lines contract. The script uses the blue lines to locate spikes in volatility.

Example of dump revealing itself with plenty of notice.

Here large changes in price action are shown when the white lines spike. Traders can get a heads up on any pump or dump a few candles before it happens.

This example shows a low volatility channel vs high volatility channel. The blue lines expand as price range increases.

Trends can be discovered by studying the patterns.

* This indicator does not use sacred geometry, I just called it that because it looks like it. *

If anyone is interested in developing this indicator any further please get in contact.

Candle Percent Volatility by AllenlkThis indicator gives you the percentage movement of each candle. Measurements are taken between the candle High point and Low point, and also between the Open and Close and calculated in percent %. From there it smooths out the data with a moving average. This gives you an idea of how much volatility is within each candle given the time resolution of the chart.

I like to use this information as a way to turn off a strategy, or select a proper time resolution for a strategy. If each candle has less than 2.5% Volatility most strategies will typically buy and sell rapidly at prices that are too close together, potentially losing money. During those times it seems best to either temporarily turn off the strategy, change the time resolution or switch to another strategy.

Big Move Finder Outlier ZoneA way to find if price made a big move in a user input given amount of time ago. If it made a move more than the given percent amount, a colored zone will be placed until a given amount of length finishes taking place, and then it will stop coloring the zone. This helps filter out or find stocks that are making or have made too big a price move or were too volatile in the past.

DisplayPriceMoveThresholds-by-STTAEnglish

Name: DisplayPriceMoveThresholds-by-STTA

- This study shows symbols in chart where a defined price movement percent threshold between a configurabele range of current bar and historic bar is exceeded.

- This information can be used to backtest possible PUT and CALL strike distances for option trading.

- User can configure if rising or falling or both price movements shall be displayed.

- This study can be used with all symbols and all time periods.

- A Extended functionality can be selected, where all price movements will be displayed in chart

German

- Dieser Indikator zeigt im Chart Symbole an, wenn der Preis bestimmte konfigurierbare Prozent-Schwellen zwischen zwei Kerzen mit konfigurierbarem Abstand überschreitet.

- Diese Information kann beim Optionshandel nützlich sein, wenn passende Strike Abstände gewählt werden sollen.

- Der Benutzer kann konfigurieren, ob steigende, fallende oder beide Preisrichtungen ausgewertet werden sollen.

- Dieser Indikator kann für alle Symbole und Zeitperioden verwendet werden

- Eine erweiterte Funktion kann ausgewählt werden, wo alle Preisbewegungen mit Schwellen als zusätzlicher Linienchart gezeichnet wird.

Inputs

- displayed triangle symbols above or below candle in chart window

Settings/Parameter

- Resolution: defines the resolution for calculation

- Source: defines bar value as open, close, high, low

- Direction: specifies price direction

-- UP: evaluates only rising price movements

-- DOWN: evaluates only falling price movements

-- BOTH: evaluates rising and falling price movements

-- ALL: evaluates rising and falling price movements; additionally plots all percentage values and thresholds as linegraph in chart

- Up Threshold in %: Float value of rising price movement threshold in percent: Min Value:0.0

- Down Threshold in %: Float value of falling price movement threshold in percent: Max Value:0.0

Outputs

- Up Threshold Exceeded: triangle symbol in chart above bar

- Down Threshold Exceeded: triangle symbol in chart below bar

- ALL Output:

-- plot of all percentage values as linegraph in chart when Direction ALL is selected

-- Line Up Threshold: plot of Up Threshold horizontal line in chart when Direction ALL is selected

-- Line Down Threshold: plot of Down Threshold horizontal line in chart when Direction ALL is selected

If you are interested to obtain access to this indicator, please send me a message via Tradingview or Signature contact data below this description

Solltest Du Interesse für einen Zugriff auf diesen Indikator haben, sende mir bitte eine Nachricht über Tradingview oder meine Signatur Kontaktdaten unter dieser Beschreibung

ADX Histogram with DI linesInspired by the user scarf from Tradingview. In contrast with that other indicator, this one instead of a simple moving average (SMA) for the ADX calculations, uses a running moving average (RMA) or also known as Wilder's Average. I like having a histogram for the DI lines over just having lines alone because it makes it easier to see. In addition I made it so that values less than 5 for the DI lines are colored lightly to note that the movement was less significant(might not matter but some might care about it, atleast I do). The ADX has a color fainting effect too, and when it goes above the threshold then it becomes black to note that it is trending, as the indicator suggests.

The advantages with these additions and changes are that it shows a more traditional moving average like the original author Wellers Wilder suggested and you can see the crossings and directional movement changes easier from seeing the colors on the histogram easier than you would by looking at the DI lines alone. The disadvantages are you won't be able to tell when the ADX line is above both DI lines and when the ADX then makes a decrease from there(which can sometimes show a reversal), but personally it doesn't matter too much to me and perhaps to those who care more about seeing the direction than having to focus on all those 3 lines crossing all over the place.

Commercial Movement Index-BuschiEnglish

Inspired by the book "The Commitments of Traders Bible" by Stephen Briese, this indicator is a follow-up of my already published "Commercial Index-Buschi".

Here, the Commercial Index isn't shown in values from 0 to 100, but in how far the value changed from a given timeframe (default Movement Reference: 6 weeks). Therefore it ranges from 100 (bullish move from the Commercials during the last weeks) to -100 (bearish move).

Deutsch

Inspiriert durch das Buch "The Commitments of Traders Bible" by Stephen Briese, ist dieser Indikator eine Weiterentwicklung meines bereits veröffentlichten Skriptes "Commercial Index-Buschi".

Hier wird der Commercial Index nicht in Werten von 0 bis 100 angezeigt, sondern in wieweit er sich innerhalb eines vorgegebenen Zeitfensters (Standard: Movement Reference: 6 Wochen) verändert hat. Daher schwankt er zwischen 100 (bullishe Bewegung der Commercials innerhalb der letzten Wochen) und -100 (bearishe Bewegung).

Daily High Low MovementIndicates the daily high and low drawn by green and red lines. Fill blocks indicate the average value movement relevant to the previous day. Green fills indicate that the value is moving higher than the previous day and red meaning lower.

NYSE:BA

Combo Backtest 123 Reversal and ADXR This is combo strategies for get

a cumulative signal. Result signal will return 1 if two strategies

is long, -1 if all strategies is short and 0 if signals of strategies is not equal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Secon strategy

The Average Directional Movement Index Rating (ADXR) measures the strength

of the Average Directional Movement Index (ADX). It's calculated by taking

the average of the current ADX and the ADX from one time period before

(time periods can vary, but the most typical period used is 14 days).

Like the ADX, the ADXR ranges from values of 0 to 100 and reflects strengthening

and weakening trends. However, because it represents an average of ADX, values

don't fluctuate as dramatically and some analysts believe the indicator helps

better display trends in volatile markets.

WARNING:

- For purpose educate only

- This script to change bars colors.

Combo Strategy 123 Reversal and ADXR This is combo strategies for get

a cumulative signal. Result signal will return 1 if two strategies

is long, -1 if all strategies is short and 0 if signals of strategies is not equal.

First strategy

This System was created from the Book "How I Tripled My Money In The

Futures Market" by Ulf Jensen, Page 183. This is reverse type of strategies.

The strategy buys at market, if close price is higher than the previous close

during 2 days and the meaning of 9-days Stochastic Slow Oscillator is lower than 50.

The strategy sells at market, if close price is lower than the previous close price

during 2 days and the meaning of 9-days Stochastic Fast Oscillator is higher than 50.

Secon strategy

The Average Directional Movement Index Rating (ADXR) measures the strength

of the Average Directional Movement Index (ADX). It's calculated by taking

the average of the current ADX and the ADX from one time period before

(time periods can vary, but the most typical period used is 14 days).

Like the ADX, the ADXR ranges from values of 0 to 100 and reflects strengthening

and weakening trends. However, because it represents an average of ADX, values

don't fluctuate as dramatically and some analysts believe the indicator helps

better display trends in volatile markets.

WARNING:

- For purpose educate only

- This script to change bars colors.

Multi-period Simple Moving Average trenderA plot of 6 SMA's grouped by 3's for short and long views of trading patterns.

Average Directional Movement Index Rating Strategy The Average Directional Movement Index Rating (ADXR) measures the strength

of the Average Directional Movement Index (ADX). It's calculated by taking

the average of the current ADX and the ADX from one time period before

(time periods can vary, but the most typical period used is 14 days).

Like the ADX, the ADXR ranges from values of 0 to 100 and reflects strengthening

and weakening trends. However, because it represents an average of ADX, values

don't fluctuate as dramatically and some analysts believe the indicator helps

better display trends in volatile markets.

WARNING:

- This script to change bars colors.

CMYK MOVEMENT / FORCE ◊ Introduction

Price Movement / Force

A script that uses Volume and price movement to indicate Bullish/Bearish momentum, like a hindsight MACD.

◊ Origin

This is a part of Project XIAM.

◊ Theoretical Approach

Philosophy γ :: consequential

◊ Usage

Early Indication of Bullish/Bearish momentum, before price reversal.

CLEANSIGNAL can be used as input source, for more reliable results.

Currently BTC◊USD ETH◊USD XRP◊USD Are available in my scripts.

Otherwise the ticker's volume is used as input.

My own indicators will be updated soon, to include source selection in their settings.

◊ Features

BULL / BEAR Phase to open orders. ( HINT : combine with RSI ? )

EXIT sweep : to find appropriate exit moments, to close opened orders.

Sweep is muffled if Phase continues.

Sweep Finalize send final EXIT signal.

◊ Community

Wanna share your findings ? or need help resolving a problem ?

CMYK :: discord.gg

AUTOVIEW :: discordapp.com

TRADINGVIEW UNOFFICIAL :: discord.gg